The Market is Weird?

“We should be adding here, not cutting!” “The market is acting weird. I’ve never seen this before!” “The market will turn around soon. I just need more time” “You just don’t understand this position” “The...

“We should be adding here, not cutting!” “The market is acting weird. I’ve never seen this before!” “The market will turn around soon. I just need more time” “You just don’t understand this position” “The...

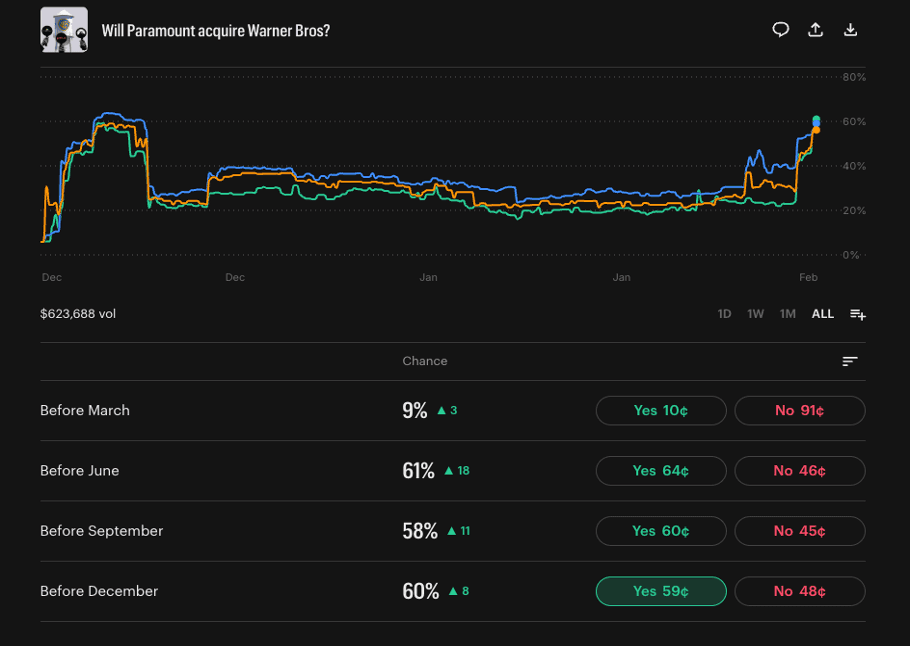

One of the most significant events in financial markets over the last several years has been the rise of prediction markets. Markets that trade bets on the outcome of various events have existed in one...

Bubble speculation is one of the markets’ favorite pastimes, but for most the definition remains elusive. A useful guide to technological bubbles has been provided by author Alasdair Nairn in his book Engines That Move...

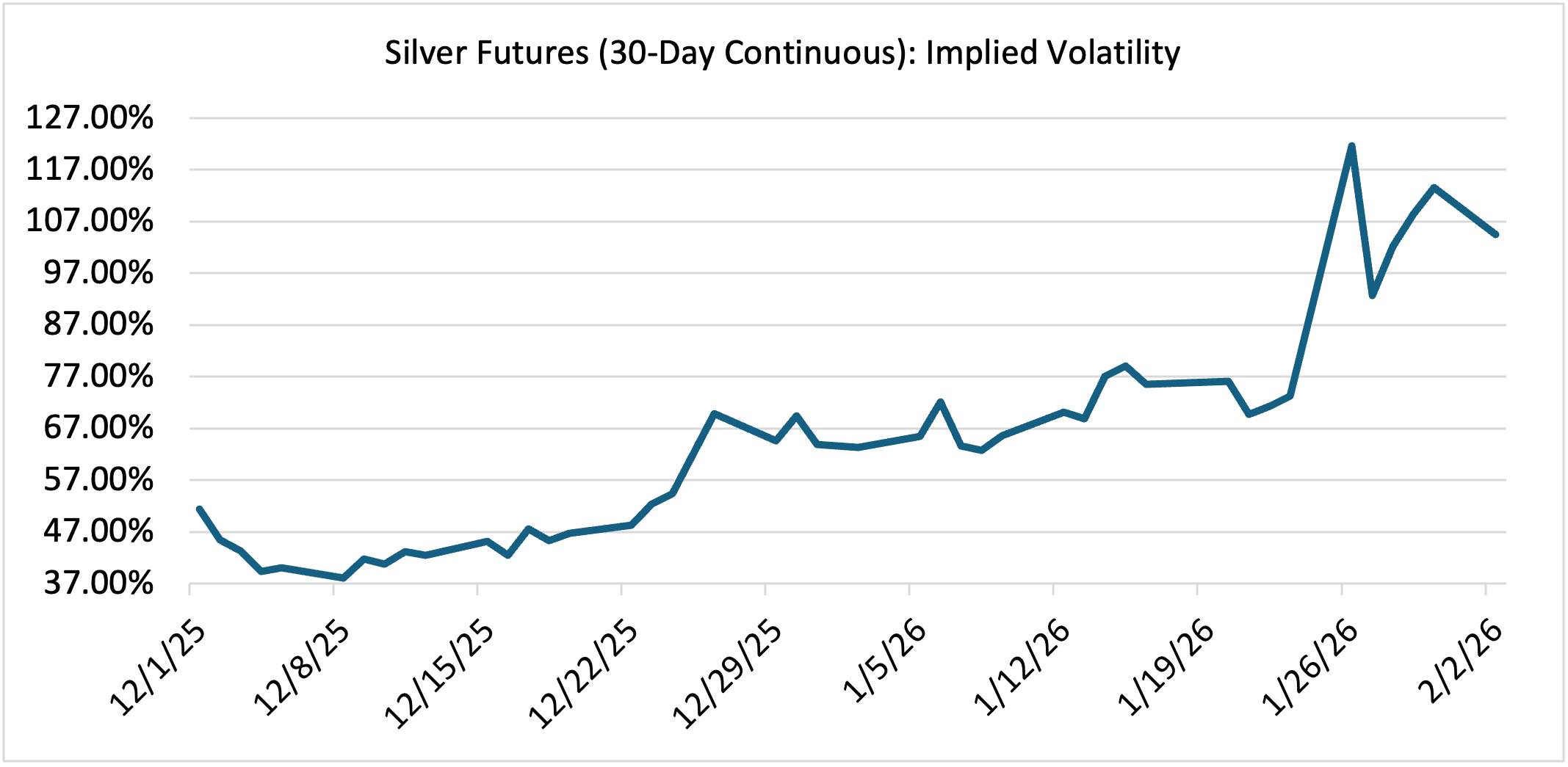

Precious metals finally called it quits last Friday. Silver drove off a cliff and shed 25.6%, gold 13.4 %, platinum 16.8%, and palladium 15.73%. And yes, those are daily changes, not monthly or yearly. Friday...

According to many market and political observers, last week witnessed the latest iteration in the Trump TACO trade. For those of you who may have been trapped in a cave last year, TACO stands for...

There must have been something in the water towards the end of the year. Venezuela moved center stage in the geopolitical uncertainty contest, silver got incredibly volatile with multiple trading days swinging +/- 7%, and...

Economic and geopolitical uncertainty, the main theme of 2025, seems to be accelerating into the new year. Two events this week may add fuel to the fire: the Supreme Court ruling on tariffs, and the...

First, a very Happy New Year to all my readers! It’s 2026, and what better topic to begin the year than the endless conversation about financial bubbles, in this case silver. The metal registered the...

Private assets, sometimes called “alternative investments,” are investments that do not trade on a public exchange and do not neatly fall into any traditional asset class. A short list would include real estate, hedge funds, private...

One of the most important developments of 2025 has been the increased popularity of prediction markets. Originally concentrated on sports betting, they moved into politics, entertainment, and financial bets. If you want to bet on something, one of the platforms will accommodate you. During the 2024 presidential...

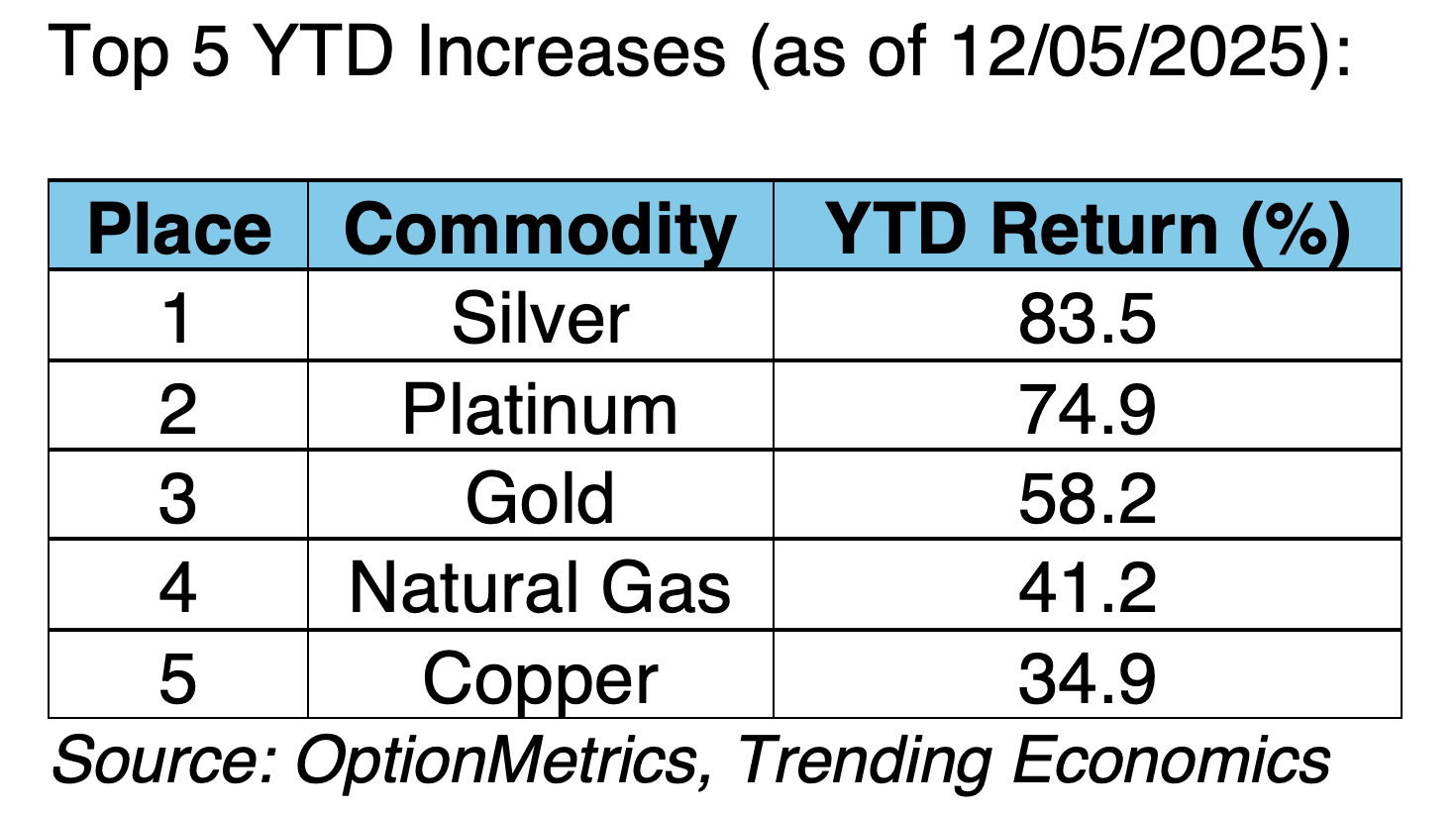

The year is almost over, and it’s time to examine the top five winners and losers in commodities and what they may portend for 2026. On the winning side (although I guess that really depends...

Unbelievably, it’s December and we are approaching the end of the year. Almost always, traders now start talking about the so-called Santa Rally. As I’ve noted in the past, investors love patterns, rules, and metrics...

At the end of last month, I wrote a blog entitled “A Bad Strategy for Strategy?” that was really about the perils of leveraged ETFs (although I did use two ETFs related to Strategy (MSFT)...

If you search for “Is the market in a bubble?” or “Is the market overvalued,” you will see various pop ups breathlessly indicating that it is “in dangerous territory” and liable for a serious correction....

Like everything else, Wall Street is susceptible to fads and fashion. When I started trading foreign exchange as my first real trading job, a certain short-term metric of the US money supply, M1, was all...

Last week, Nvidia’s market capitalization passed over $5 trillion. $205.76 was needed, and NVDA broke through without a sweat. At roughly the same time, Apple’s valuation topped $4 trillion, and Microsoft was close to doing...

Last September, I wrote about leveraged ETFs (Leveraged ETFs: Reward Isn’t Free!) and why they might yield some surprising results. I concluded that “Equity markets haven’t seen a prolonged bear market since 2022, and I...

At the end of the year, when finance editors sit down to determine the stories of the year, the rise of precious metals will undoubtedly be a candidate. As of Monday’s close in NY, gold...

As I’ve written numerous times, the greatest market shocks come from the unexpected, a jolt from left field. Sometimes the shock goes against a commonly held belief or trend, and other times it’s something entirely...

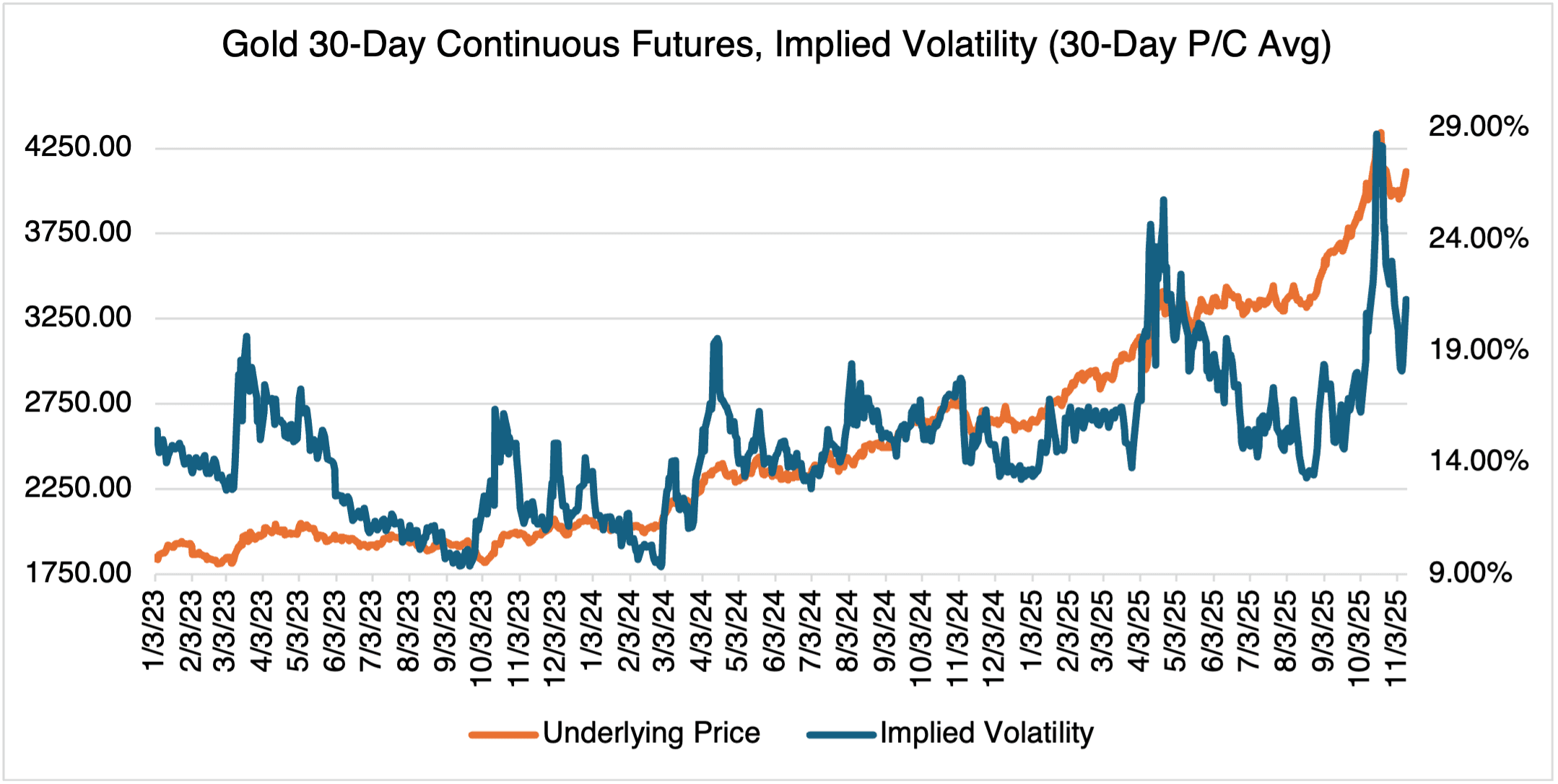

In mid-September, I was interviewed on the Futures Rundown, a YouTube podcast that specializes in futures trading (link here). The interview was entitled “Is Gold in a Bubble?’.” At the time, I concluded that it...

If you haven’t noticed by now, Wall Street is a perpetual motion machine for new financial products. Exchanges, brokerage firms, and banks are always hard at work trying to figures out the latest iteration or...

I’ve been meaning to write about this for some time, but other more pressing and timely topics intervened. Three professors at Purdue and CUNY, wrote a paper entitled “Wisdom or Whims? Decoding the Language of...

This week, I’m going to update two unrelated topics I wrote about previously, bitcoin treasury companies and quantum computing. First up, bitcoin treasury companies, or financial innovation at its best. I’ve written about these previously,...

It seems that investors are growing more impatient and want high returns as fast as possible. It’s therefore not surprising that high-flying IPOs with the potential for eye-watering short-term returns are back in fashion. Earlier...

Last week, I was interviewed by Mike Khouw of CNBC who has his own channel on YouTube (Open Interest). Most of it was about my latest blog on VIX futures and what they may be...

Once upon a time, the Republican party stood for free markets, limited government, a strong defense, and a laisse faire approach to the economy. Whether the party really held to those beliefs is a matter...

Can you predict future price movement based on the time of the year or political events? From reading the financial press, it would seem you can. There are a few trading strategies tied to the...

It’s hard to be a copper or gold trader lately. As I wrote a few weeks ago (Copper, the New Steel), copper has been buffeted by tariff news since early February. Massive and historic inflows...

Lately, there has been a lot of attention paid to the spread between small and large-cap stocks. Specifically, the spread between them, as represented here by SPY (SPDR S&P 500 ETF) minus IWM (iShares Russell...

If you need any further proof that gold fever is moving into the mainstream, legislators in several states are trying to make it easier to buy things with gold. Not by letting you use ingots...

The recent rally in copper was a reminder that tariffs and uncertain trade policy can still be significant market drivers, despite traders’ rather blasé attitude toward both (“headline fatigue” strikes again!). The imposition of tariffs...

If you own a home, then you’re familiar with the person who shows up at the front door trying to sell you solar panels. Where I live, it’s almost a weekly occurrence. Which got me...

European defense stocks are all the rage. After it became apparent that the President would pursue a more independent and unilateral foreign policy, Europeans reacted by committing to spend €800 million as part of a...

Now that everybody has put their guns away, we can finally go back to “regular” trading. It’s nice not to have to check the news every 10 minutes! I’ve written about gold a few times,...

On Monday afternoon, I had this week’s blog, an update to last week’s piece about crude oil, almost completed. And then the truce was announced, and it was back to the drawing board. Crises seem...

Although I am usually opposed to buying deep out-of-the-money calls (“lottery tickets”), the war between Iran and Israel might be presenting just such an opportunity. Despite hints that it was imminent, the war was a...

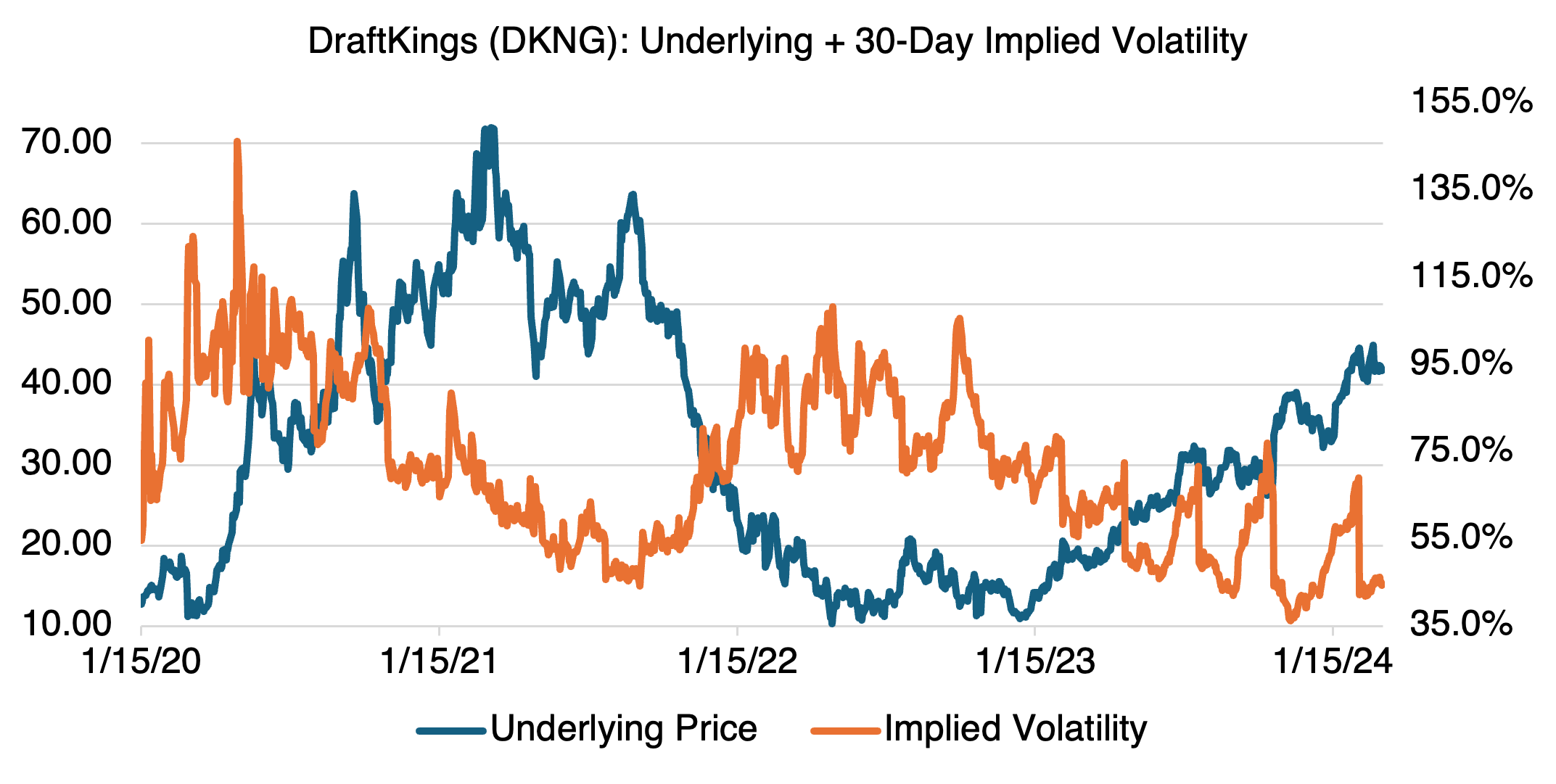

Two weeks ago, in the blog entitled Tesla’s Robo Bet, I wrote that “…problems with the robotaxi rollout or some other unexpected setback to the business in general, may cause volatilty to shoot back up.”...

Robotaxis and self-driving cars are new technologies that always seem to be five years away. A few years back, with the introduction of Tesla’s self-driving mode, it seemed like they were finally here and that...

On April 28th, the Iberian Peninsula went dark, with millions of customers without power for most of the day and night. If you’ve ever lived through an extended blackout, you know what goes on: no...

Some popularly watched stocks issued their earnings reports last week, and I thought I would look into whether they experienced vol crush before and after the fact. I reviewed 10 stocks: AXON, FTNT, KTOS, MELI,...

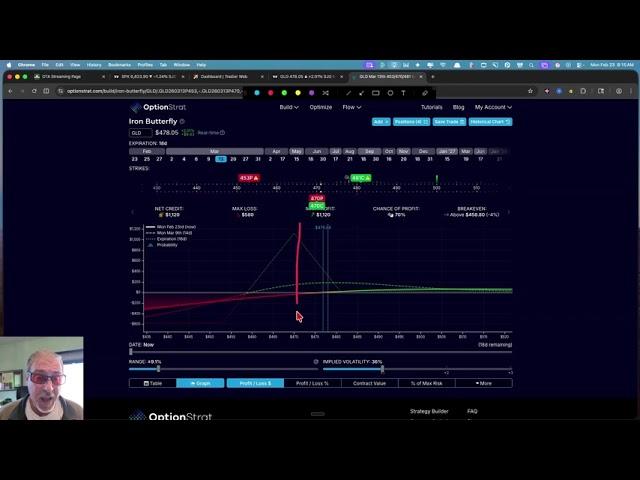

With the most recent financial panic receding into history, volatility is returning to more normal levels. This can present opportunities if you believe that the core reason for the panic still exists, but has temporarily...

People not directly involved in finance tend to tell me two things during sharp sell-offs. First, they mention how they liquidated nearly everything months before, and second, how they bought something that is now taking...

I was going to write about tariffs and economic policy uncertainty – yet again — this week, but decided that my readers might welcome a break. If you want to read about them, you won’t...

I finished writing my previous blog, Apocalypse Now, just last Tuesday morning. It was about the relatively esoteric topic of VIX futures backwardation, and how it might portend continued instability and was definitely not the...

Last week, I wrote that the shape of the VIX futures curve was backwardated, i.e., the shorter expiration contracts were trading over the more deferred. As I pointed out, this has only occurred about 19%...

If you’ve ever bought the VIX because things seem to be unraveling fast, you know it can be a frustrating experience. Just when it seems like the index is going to make a significant move...

I hate to write about vol crush yet again (the latest, here), but the response from some readers was that it was the simple and obvious result of earnings announcements that were in-line with expectations...

What do Tesla and crypto have in common? Both now have a significant political element to them, which either gives (bitcoin), or takes (Tesla), depending on what or who is on the current administration’s naughty...

I’ve written about opportunities in liquified natural gas (LNG) several times, but before the new Trump administration took over. Since then, two recent developments have changed their outlook. First, US energy policy has swung decidedly...

Regardless of your political affiliation, almost everyone would agree that President Trump is an industrial strength disruptor. With disruption comes uncertainty, and uncertainty is the lifeblood of implied volatility. Recently, I came across the Economic...

Regardless of your political affiliation, almost everyone would agree that President Trump is an industrial strength disruptor. With disruption comes uncertainty, and uncertainty is the lifeblood of implied volatility. Recently, I came across the Economic...

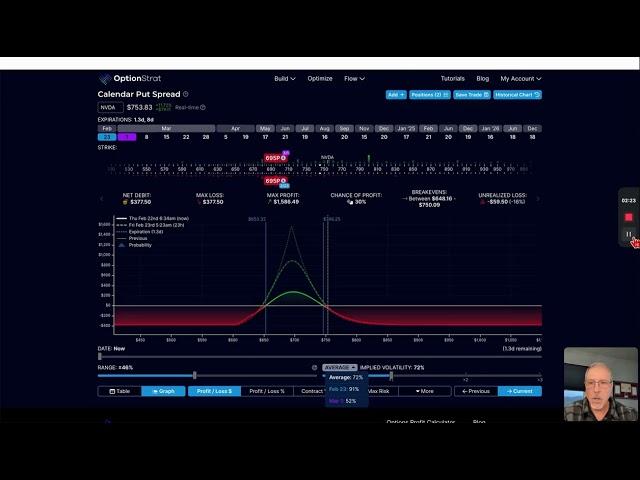

Nvidia (NVDA) is scheduled to release Q4 earnings this Wednesday after the markets close. Nvidia has been on the defensive since early last November and the sudden appearance of DeepSeek earlier in the year highlighted...

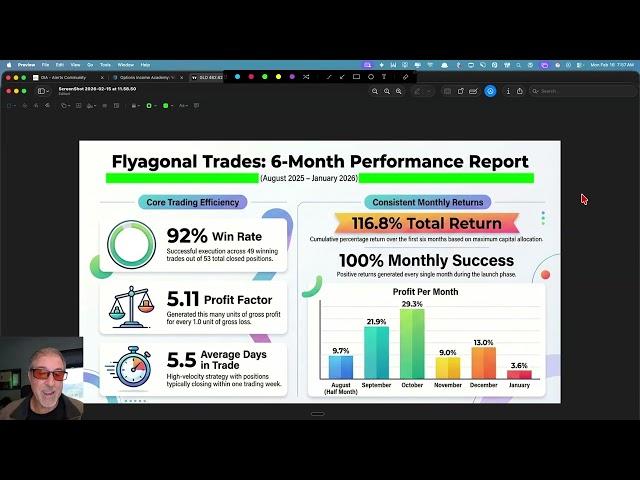

Markets can be very strange, and high returns can cause traders to do some crazy stuff. That is, at first glance – sometimes they turn out not to be so crazy after all. Case in...

I first wrote about MicroStrategy last November (Bitcoin Shenanigans). Since the company announced its Q4 earnings call early this month, I thought it would be a good time for an update. For the last remaining...

I’ve often written that the largest shocks to the market are those that come out of right field. Unexpected, they challenge accepted narratives and can change long standing fundamentals overnight. Last Monday, we got just...

How Does An Options Market Maker Manage Their Book? Pretend that you are an options market maker, i.e., at any time you are ready to buy or sell options on demand. You maintain liquidity, manage...

As of last Monday, we now have a new chief executive, and some have wondered whether the radical changes that the current administration has promised, as well as President Trump’s penchant for off-the-cuff or out...

I’m often asked about when is the best time of the year to invest in stocks, specifically the SPY ETF. To answer the question, I looked into monthly SPY returns from 1996 to 2024 to...

There was a show on in the late 80’s called Quantum Leap in which a scientist gets caught in an experiment that causes him to be “trapped in time.” The result is that he can...

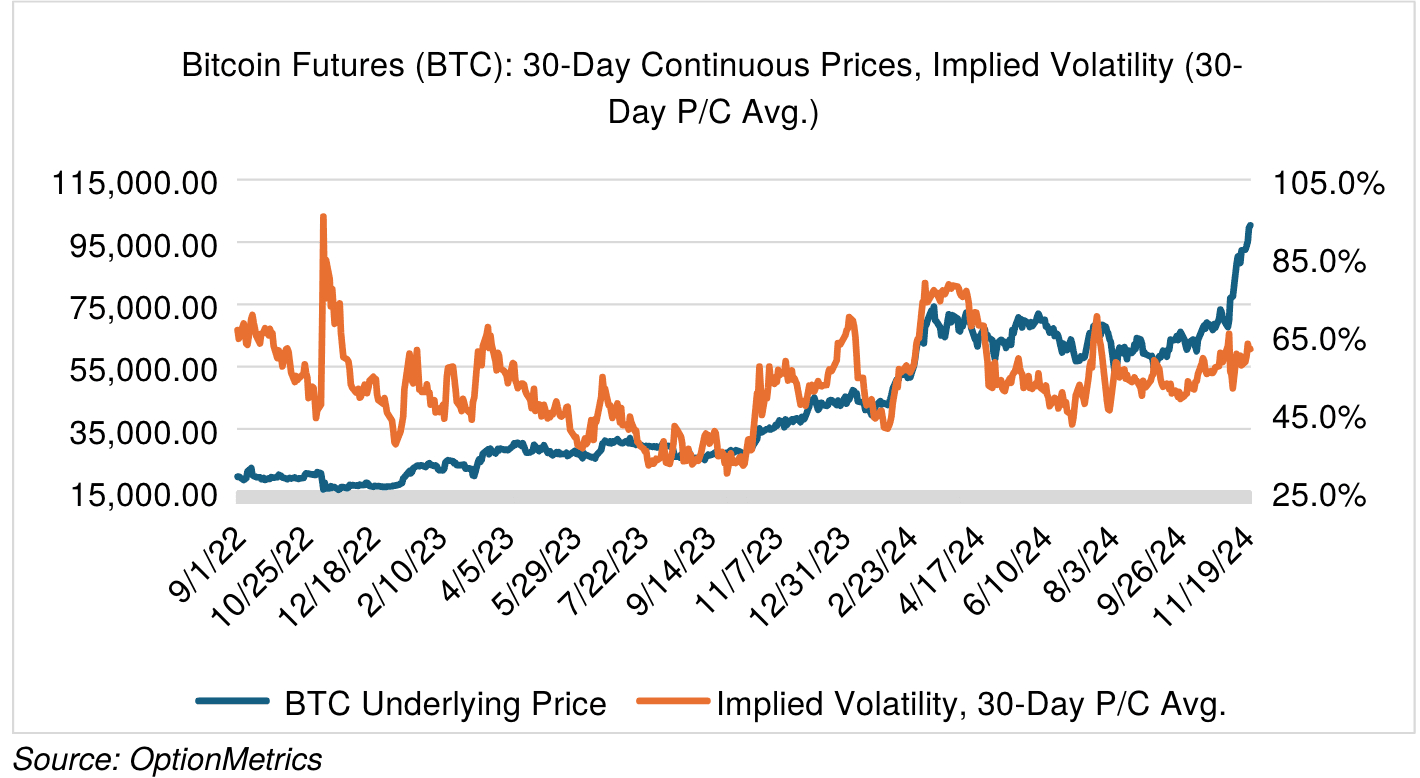

Many people are asking me lately whether bitcoin is turning into a bubble. For a variety of reasons, most of which center around prospects for a much friendlier regulatory environment, BTC futures have rallied more...

The biggest news story last week wasn’t about Syria, South Korea, Trump’s nominees, or inflation. No, it was about the execution-style killing of the CEO of UnitedHealthcare, Brian Thompson. It was something right out of...

I’ve written about vol crush a few times and how it’s one of the most consistent and reliable options trades around. For those of you unfamiliar with the term, vol crush is the tendency of...

Bitcoin has been one of the clear winners of the new administration. BTC is up almost 41% since election day (see below) and looks poised to test the $100K barrier. Commentators point out that a...

This is my last election-related blog, promise! It’s been two weeks since Donald Trump won the presidency again, and he’s wasted no time selecting cabinet nominees. As is his habit, the picks have been surprising,...

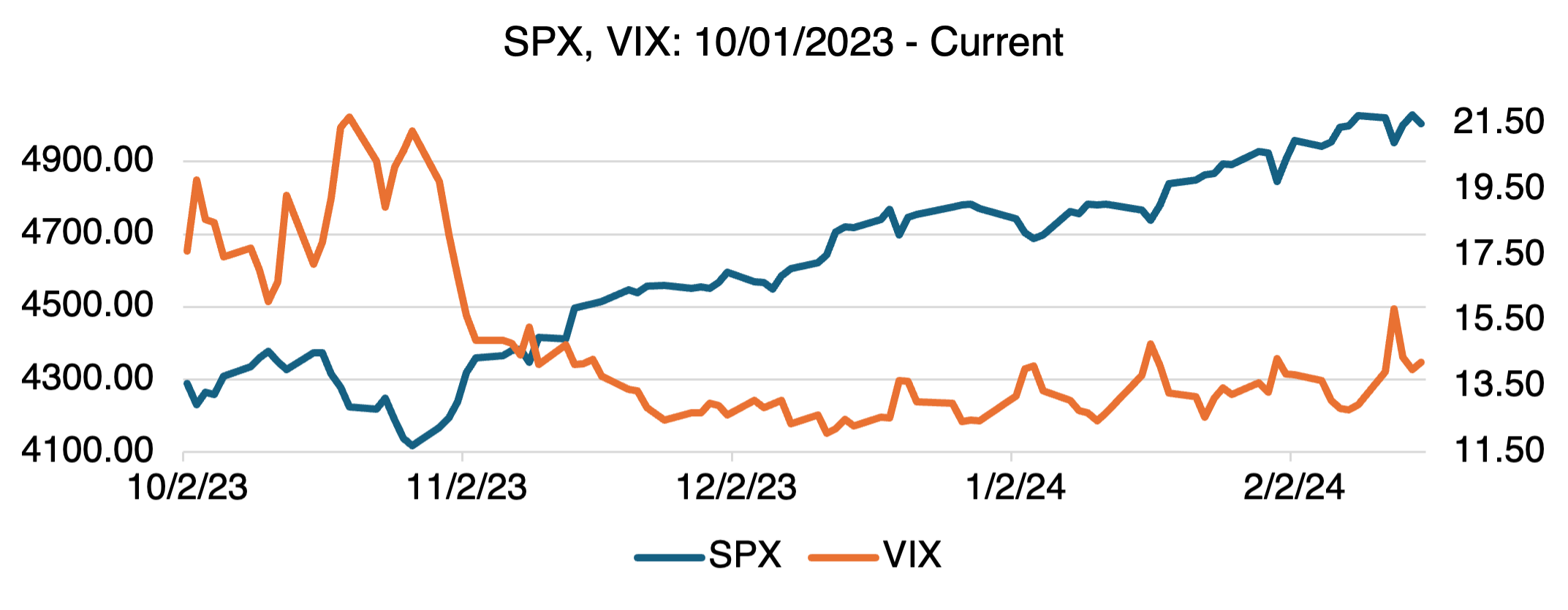

As you probably know, the VIX is popularly understood as the markets’ fear or uncertainty index. Given the heated rhetoric surrounding the election and all the predictions of doom and gloom, I thought it would...

Last week, I wrote about the effect of presidential elections on the equity markets (hint: the effect is minimal). Now the election is finally upon us, and the polls still show a dead heat, +/-...

The Presidential election is less than two weeks away, and market pundits are busy focusing on what the results may mean for the markets. Since electing a new president is a big event, it seems...

Over the course of my long career on Wall Street, almost every hedge fund or trading division I’ve worked for or advised asserted that they were “risk averse.” Of course, that’s what they said, but...

After months of geopolitical tensions building up in the Mideast, last week the oil market finally decided to notice that there is a war going on that could directly threaten supply. Of course, that’s been...

One of my recurring investment rules is never to confuse good intentions with good investments. I know it’s satisfying to put your money where your mouth is, or invest out of principle, but it’s almost...

Despite the attention on the upcoming presidential election and the new markets and platforms that have sprung up to bet on the result, one of the most direct indicators that can be used to speculate...

I’ve written about Nvidia vol crush a few times now. To recap, vol crush is implied volatility increasing before earnings announcements and then crashing soon afterwards. For stocks that are in the news and well-followed,...

0DTE Expanding, Again The inexorable rise of 0DTE options continues. Responding to ever-increasing volumes and expiration dates, exchanges, brokerages, and trading firms are now discussing expanding the 0DTE universe beyond just indexes to include individual...

I didn’t plan on writing about Nvidia this week, but the market forced the issue. Since NVDA is still one of the main bellwethers for the market, I thought I would review how its latest...

This coming Wednesday, Nvidia (NVDA) is scheduled to release their Q2 financial results. Obviously, it’s a big day for the company and an even bigger day for the market. NVDA has been at the center...

To begin, an important clarification on an observation I made in my last blog. As I wrote, “…interestingly, five out of the top ten biggest daily VIX spikes occurred on Monday.” What I really meant...

Last Monday, August 5th, was one of those days that traders will remember for the rest of their careers. Everyone talks about the possibility of sudden downside blowouts, but in reality they are exceedingly rare....

I open with the famous quote from The Thing in the Fantastic Four. After what’s been going on in the markets, the reason is obvious. It seems that investors finally realized what they suspected all...

Most investors don’t know this: commodities have been in a slow speed bear market since last June. The Bloomberg Commodity Index (BCOM) fell under 100 on July 15th and has been headed down since. The Goldman...

Politics seems to be everybody’s main occupation and obsession lately, so I thought I would open with an interesting fact that I found on Substack from Boyer Research, a provider of equity market research and...

Since Nvidia and its AI cohorts started their seemingly unstoppable rally about a year and a half ago, there has been a steady undercurrent of those suggesting that their rally was about to end, cataclysmically...

Last week was a busy news week due to President Biden’s continued travails, but if you’re an energy investor, some important news came out that may have been escaped your notice. It wasn’t earth-shattering, but...

Last week, in Nvidia: Scary Stuff, I hinted that Nvidia’s S&P dominance might be related to the VIX. You might have noticed that the VIX has been boring (there’s no better word for it) and...

After a few months of going sideways, and the market’s attention elsewhere, Nvidia took off again in late May after announcing yet another quarter of fantastic results. As of last Wednesday, Nvidia briefly become the...

Last January, I wrote about one of the more esoteric investments out there, uranium (Uranium is Glowing). The element is in the midst of a resurgence due to the growing consensus in some quarters that...

Yes, another article about GameStop (GME), the blogger gift that just keeps on giving. As of Monday’s close, it seems like everyone involved with the stock has finally woken up with a wicked hangover. Friday’s...

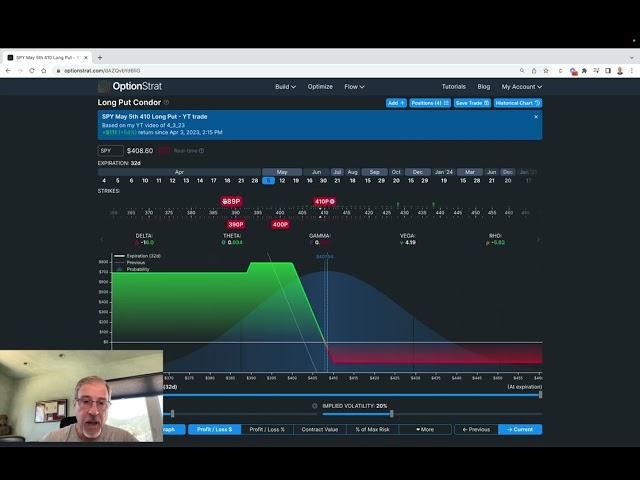

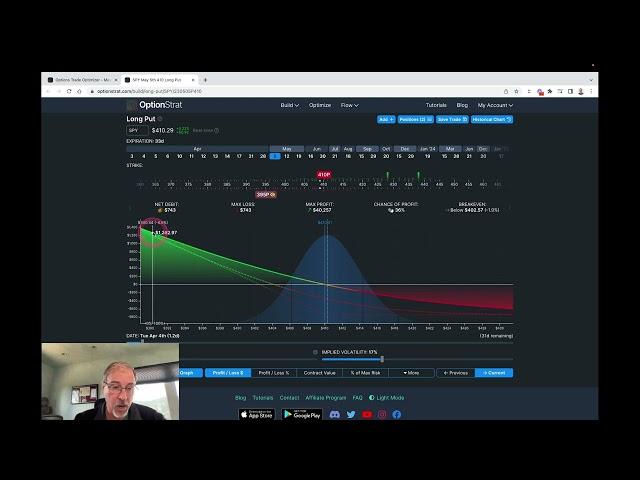

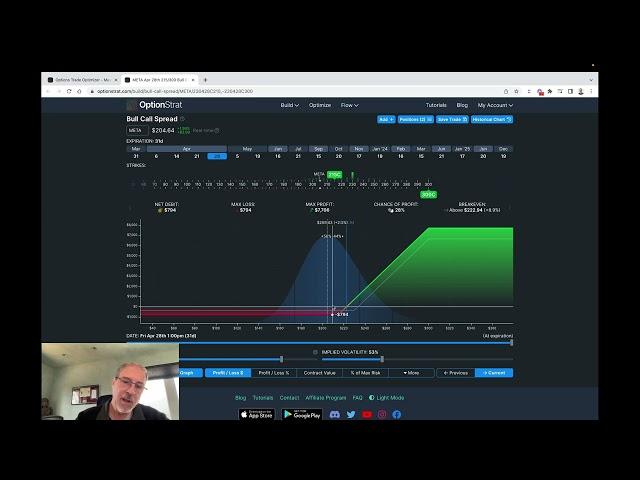

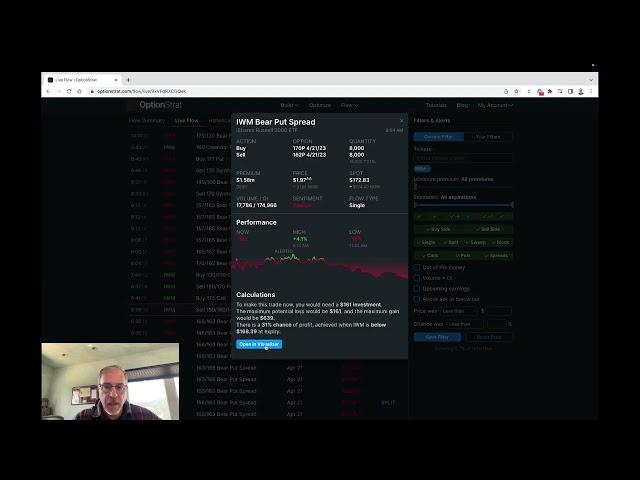

Hey traders, We’re excited to share some important improvements to the OptionStrat flow platform. OptionStrat flow consolidates large and unusual trades into the actual strategies that traders and institutions are making. With this week’s updates,...

I wrote about GameStop (GameStop. Again, Really?) just two weeks ago when it first reemerged as the king of meme stocks. Like most people, I thought that all the excitement would go away within a...

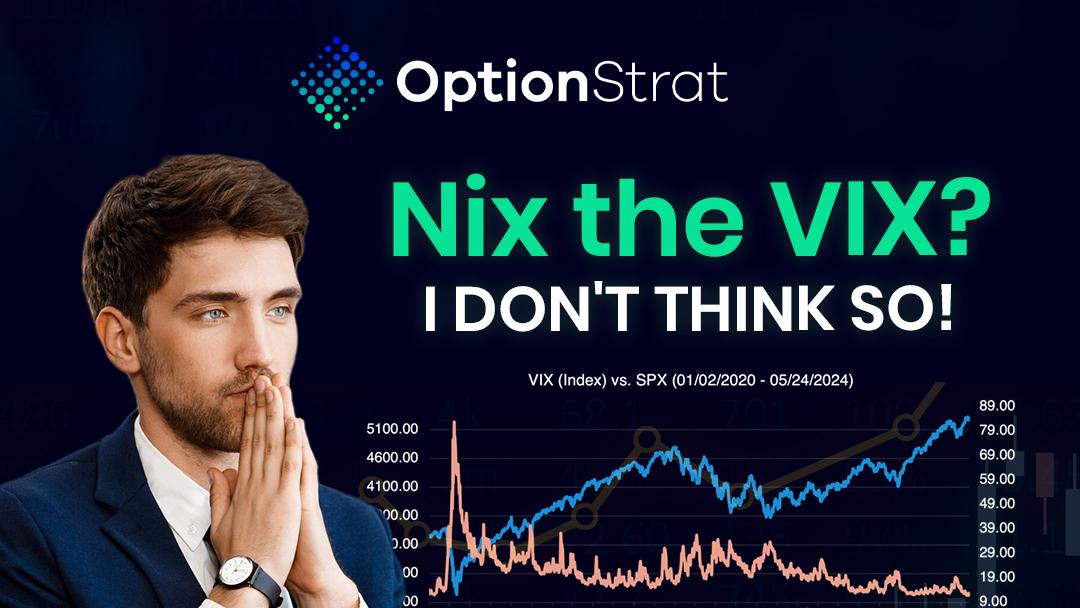

A colleague of mine sent me an article from 1999 entitled “Ken Fisher on Nixing the VIX.” At the time, the VIX index was only 5 years old, and it would be another 5 years...

Single stock ETFs have come into vogue. What is a single-stock ETF, exactly? As is obvious from the name, it’s an ETF that is based on a single stock, but whose performance — and here’s...

I couldn’t resist writing about the latest action in GameStop, AMC, et al. You may remember that a lot of seemingly normal people took up stock trading (it looks easy!) during the pandemic to pass...

In a few articles going back as early as February 2022, I discussed the ongoing travails of Peloton (PTON). Why of the tens of thousands of securities available did I choose to write about Peloton,...

Last week, I wrote about “vol crush,” or the tendency of implied volatility to increase before earnings announcements and then to decline rapidly immediately afterwards (The Magnificent Seven: The Remake). I used Microsoft (MSFT) as...

Just a little over two months ago, the Magnificent Seven (minus Tesla) were at the top of the world and, possibly, a baby bubble. When it became apparent that the economy and inflation were a...

Last week, I wrote about geopolitical tensions and how they have been consistently part of the crude oil market since the beginning of the war in the Mideast on October 7, or even from the...

Crude oil is back. Having rallied almost 20% so far this year, Brent is hovering around $90 and is up over 16% year-to-date. Shooting above the psychologically important $100+ level may even be in the...

Last September, I wrote a blog entitled Green Risk, in which I detailed some of the disappointments that green investors have faced. My point was not to question their desire to limit carbon emissions, but...

Once a quarter, the market experiences the so-called Triple Witching Day, or the simultaneous expiration on the same day of stock options, stock index futures, and stock index options. The last one was on March...

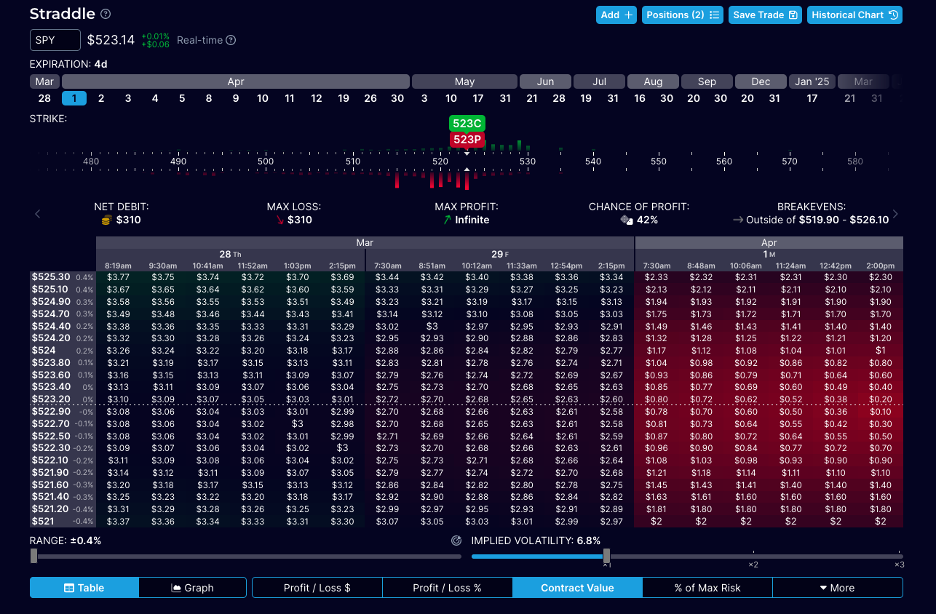

Lately, some trader friends of mine have been asking me about short-dated options and whether they should trade them or not. When I answer, “it depends,” they aren’t’ happy — they want a simple yes...

From what’s been going on lately in Bitcoin and Gold, one would think that the world is on the edge of Armageddon. After languishing for most of 2022 and ’23, Bitcoin is up, as of...

The lofty heights surrounding artificial intelligence leads one to wonder whether it will eventually suffer the same fate as another sector that has had its day in the sun, electric vehicles. In my neighborhood, you...

Nvidia was a Wall Street mega darling even before its incredible results were announced last Wednesday night. Since then, it has been anointed The Greatest Stock of All Time. Press coverage has been universally positive...

I’m asked frequently why the VIX doesn’t seem to rally all that often or all that much. I tackled this question last October in a blog entitled The VIX: Hope Springs Eternal! but thought it was time...

Not a day goes by lately that you don’t hear about the performance of the Magnificent Seven. Nvidia (NVDA), Meta (META), Amazon (AMZN) and Microsoft (MSFT) are up an astonishing 49.8%, 35.2%, 16.4%, and 13.4%...

I’ve written several times about Liquified Natural Gas (LNG) and the world’s second largest producer, Cheniere Energy (ticker = LNG, conveniently and confusingly). In a nutshell, LNG is natural gas that has been refrigerated into...

It was 176 years ago last Wednesday that gold was discovered at Sutter’s Mill in California. Despite the fact that it gets very little notice, the discovery triggered the gold rush, western migration, and had...

I’m talking about Spirit Airlines (SAVE), and just couldn’t resist the pun. As you probably know if you follow the airline sector, Jet Blue’s proposed $3.8 billion merger with super low cost Spirit was blocked...

Yes, uranium. If you’re looking for an esoteric investment play that will dazzle your friends, this just might be the thing! In wrote about uranium last September (Uranium?) and concluded “__With increasing demand and uncertainties hanging...

It’s every flyers worst nightmare: a part of the plane blows off in flight and leaves a gaping hole in the fuselage. Open, blue skies and the wind rushing through the cabin is not exactly...

To begin, allow me to wish you and yours a happy, healthy, and prosperous 2024! In my last blog, last year, I noted that it has become an almost unanimous opinion among many investors that...

One story that came out last week but did not gain a lot of attention was the release of the “Doomsday Book” by the NY Fed. Although it sounds like something right out of Harry...

On December 4, two law professors, Robert J. Jackson, Jr of NYU and Joshua Mitts of Columbia, issued a pre-print study (i.e., not peer reviewed) entitled Trading on Terror? In the Introduction, the authors write: On October...

A recent market development that should be getting more attention is the seemingly endless slide of the VIX. For those of you who aren’t familiar with it, the VIX is an index that measures the...

Most Americans don’t know it, but Europe had a full blown energy crisis during the Fall and Winter of 2022. I wrote about it in August of that year (European Issues) and several times since, focusing on...

As is its habit, Bitcoin is back in the news lately. Bitcoin futures have been rallying, almost without a break, since the beginning of the year. As of this writing, it’s up a whopping 122%...

Looking around after boarding a plane recently, I had to ask: does anyone wear real pants anymore? Not that I’m nostalgic for the era when people got all dressed up to fly, but the answer...

It’s important in investing not to let preconceived notions get in the way of real world economics and financial results. A great example of this is what I wrote about last week, the problems suddenly...

If you’ve been trading options for the last few years, then undoubtedly you’ve read all about the explosive growth of 0DTE options and have probably even traded them for yourself. For the uninitiated, “0DTE” stands...

This week, an update on two completely unrelated blogs I wrote previously, More Teslas?, 11/21/2022, and Orange You Smart, 03/08/2023. Both tales feature one of the most immutable forces in economics, supply and demand, and in addition might...

I had intended to write this week’s blog about 0DTE options and their effect on the market. Sadly, the war in the Middle East is now center stage. As I wrote at the beginning of...

Hello Traders! Today we are launching some significant and highly-requested upgrades to OptionStrat! We have been working hard to deliver this update based on your invaluable feedback and suggestions. Futures Support: You asked, we delivered! We’re...

If you follow the VIX (which you should if you trade options), you know that it hasn’t been that exciting lately. As I’ve heard many traders and investors say, “it doesn’t seem to move anymore,...

In July, I wrote about sustainable aviation fuel, or SAF (Overpriced SAF?). It’s not the most exciting topic in the world, but it does display one possible hazard of investing in the green revolution, or...

It just caught the attention of the non-energy markets and popular press that crude oil has been rallying since last June. In general, if crude has a shot at breaking $100, and its accompanied by...

For those of you who have moved on from conventional and dirty fossil fuels, uranium might be of interest. Uranium is the primary source of nuclear power, and although certainly more controversial than wind or...

I’m on vacation this week, but thought I would write a short note anyway. For new traders, it’s very tempting to think that someone has figured out the market and can predict it’s every twist...

One of the longest-lasting effects of Covid is the way people buy things. Unwilling to leave the house, people naturally pivoted to fulfilling their needs online, accelerating a trend that had already started in the...

Last week, I ended my blog (Memes are Back) by noting that that is was ok to trade the latest meme stocks, but “…don’t take your eyes off the prize — finding stocks that take...

Apparently, trading by individual investors is still going strong. Although it seems that most have moved on from their dreams of trading full time, some have rekindled their passion for that Holy Grail of day...

Here’s a crazy statistic: researchers estimate that 1 in 10 Americans lease storage space. Some report that it’s even higher, at 20%. Whichever number you believe, that’s a lot of people, somewhere between 33 and...

Last week, I flew for the first time in several months. As a consultant, I used to fly about once a week, and often internationally. As a former super frequent flyer, I remembered what I...

I went to McDonald’s (MCD) last weekend for the first time in a few years and it was a different place than I remember. First off, there were no employees to greet and take orders...

One of the most underappreciated and mundane inventions of the 21st century is air conditioning. Although it rarely makes it to anyone’s Top 10 Inventions list, A/C was essential to the development of skyscrapers (upper...

When asked how he went bankrupt, Hemmingway famously replied, “Two ways. Gradually, then suddenly.” I remembered this over the weekend while keeping track of the mutiny/rebellion/uprising/coup/protest (or whatever it was) that was going on in...

My son, who has a real day job but trades stocks on the side, pointed out to me the other day that WeWork was trading at $0.23 cents. Frankly, I didn’t even know that WeWork (WE)...

Although most people take them for granted, large commercial airliners are pretty incredible machines. Take the Airbus A380, the largest commercial aircraft in the world. At about 240 feet long and almost 80 feet high,...

I wrote about cruise lines last December and at the end of May (Cruises are Back!), the gist being that they were beaten down by Covid but might be a good long-term play. Pent up post-Covid...

For those looking, the waste disposal industry has been getting a lot of attention lately. Why the sudden interest? Because collecting garbage is no longer about just taking out the trash, but about two of...

Last December, I wrote about cruise lines and how they were almost destroyed by Covid (Let’s Take a Cruise). The outlook at the beginning of the pandemic was pretty bleak. As I noted, “I can’t...

I’m not a diet person, but I couldn’t help noticing that some relatively new weight loss drugs have been getting a lot of attention from entertainment and social media types. The drugs, Wegovy and Ozempic,...

Last week, I wrote about the intensifying debt ceiling crisis (Something Real to Worry About, No Kidding!) and that the equity markets don’t seem to be taking it too seriously. Since then, and with time...

Last February, I wrote about the debt ceiling in Something to Worry About. In it, I noted that “…as we get closer to June or financial insolvency, the greater the effect will be. A high impact/low...

We’re excited to announce the launch of our new branding for OptionStrat! At OptionStrat, we strive to make options investing easier and more accessible for everyone, regardless of experience level. Our new branding reflects this...

I’ve written about the recent gold rally a few times now (Crudely Speaking) and (Gold Bugs and the Debt Boogeyman). The precious metal, and its digital cousin, Bitcoin, benefited from the SVB crisis, which confirmed...

It’s been a long time since an OPEC meeting completely surprised the oil markets. There are just too many people associated with the organization, as well as too much money at stake, to keep anything...

People tend to think that whichever disaster they lived through personally was either the worst and most earth-shattering in history or a close contender. Hence, the usual clickbait headlines proclaiming “The worst [insert specific natural...

Most of you are probably sick of reading about the banking crisis by now. I know I am. Let’s discuss something more interesting, or at least more fun: how to make money on sports betting...

I would be remiss if I didn’t comment on the latest event roiling financial markets, the sudden death of Silicon Valley Bank, the near death of Credit Suisse, and the derisking affecting markets worldwide. I’m...

Believe it or not, Orange You Smart was a TV ad campaign from the early 80’s promoting Florida citrus. I thought of it the other day while buying some very expensive orange juice, the kind that induces sudden sticker...

This week, let’s review some companies that succumbed to dreaming instead of managing. I’ve reviewed Rivian (RIVN) and Beyond Meat (BYND) before, but Salesforce (CRM) now joins the club. Although BYND and CRM are in...

A few blogs ago, I recommended watching the new Madoff documentary on Netflix. By now, most of you know the story, but it does bring to light some details relevant to investing and options trading...

I mentioned a few weeks ago that Bitcoin was starting to show some life after its near-death experience during the crypto meltdown (Surprise! Crypto Might be Back!). At the time, I hesitantly wrote that bitcoin...

Peloton (PTON), that avatar of Things-Upper-Middle-Class-People-Did-During-Covid, is back (well, might be back). I wrote about Peloton frequently last year because it so well encapsulated the boom-and-bust cycle of many companies that thought Covid would go on forever....

Traders generally fall into one of four categories on Wall St: equity, bonds, foreign exchange, or commodities. Sure, there is some crossover, but that’s about it. I’m a commodity guy and have been for most...

Last week, I wrote about everybody’s favorite, Tesla. Since I’m an options guy, I was quick to admit that I had no special insight on the stock’s fundamentals. However, being a recent EV shopper, I...

This week, I’m going to start by writing about one of the most covered stocks in the history of man, Tesla. Being an options guy, I don’t have much to add on its fundamental situation....

I wrote about Cathy Wood’s ARK Innovation Fund earlier in the month (2023). Coincidentally, a long-time friend of mine, Richard Gluck, author of the Market Cyclist Substack blog (The Market Cyclist), mentioned it as well...

To begin, a healthy, happy, and prosperous new year to one and all! I’m going to start the new year by looking back at some stocks I covered in 2022 and see if we can...

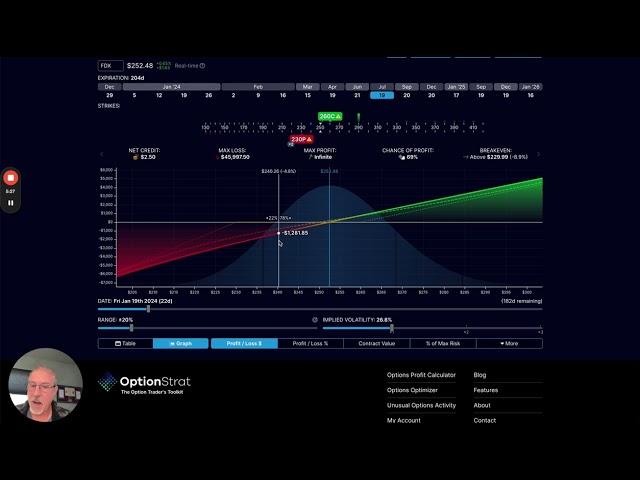

Last week, I demonstrated the Visual Greeks feature of OptionStrat using Cheniere Energy (LNG) as an example. The visual greeks feature is a new addition to our options profit calculator that makes it easy to...

When I first started trading options, valuation and analytical support were extremely limited. I had nothing even approaching the usefulness of OptionStrat. Let’s take just one feature, Visual Greeks, and how it can help analyze...

The War Won’t Stop It seems that most people have forgotten that there’s still a war in the Ukraine and it continues to influence energy prices. As Americans, we’re far removed from the fighting and...

I read an article a few days ago about a giant rogue wave that hit a cruise ship, just like in the Poseidon Adventure! If this happened in March 2020, right at the beginning of...

Perhaps the biggest financial story of 2022 has been the implosion of the crypto market. FTX and Sam Brinkman-Fried have dominated the news over the last few weeks, and rightly so — it’s a great...

This week, I’m going to concentrate on electric vehicle manufacturers other than Tesla. Rivian, Lucid, Fisker, Nikola, and Lordstown, if not exactly household names, have all been hard at work trying to carve out a niche...

I often write about individual stocks that I think are interesting, mispriced, or in the news. Sometimes, they just have cool names that merit investigation (e.g., Rocket Lab). In all cases, I include a chart...

I’m not crazy about unanimous opinions, especially when it comes to stocks. Usually, the situation isn’t as bad (or as good) as the consensus indicates. Recently, Meta and Snapchat both took it below the waterline...

This week, I’m keeping up my review of futuristic, disruptive stocks whose business models or products were a figment of someone’s imagination just a few years ago. One stock that certainly qualifies (and has a...

I think anybody that has ever been stuck in traffic has thought how cool it would be to own your own personal flying machine. Just like George Jetson, you could fly above it all, zipping...

Yes, I know I’ve written about Peloton a lot. Unlike most stocks, it seems that something new happens every week that changes my view of its long-term prospects. Who would have predicted that two years...

If you follow juicy Wall St. scandals, as I do, Credit Suisse’s latest nosedive shouldn’t have come as a surprise. CS has been at the center of some of the most irresponsible behavior over the...

Beyond Meat I hadn’t looked at it for some time, but it was pointed out to me that Beyond Meat (BYND) is down over 76% YTD and is currently trading in the $15 region with...

Last July, I wrote about the CME’s latest wunderprodukt, Event Options. At the time, the exchange was seeking approval from the CFTC to launch. It was granted, and last Monday, September 19th, was the first...

Despite Ukraine’s recent gains, a military solution to the conflict is unlikely. Both sides will eventually seek negotiations. For Putin, for survival; for Ukraine, under Western pressure. Regardless of the outcome of the war, Europe’s...

The gathering storm in Europe is even more serious than when I last wrote about it a few weeks ago. EC energy ministers are getting together this Friday to discuss various measures to lower natural...

Two meme stocks in the news, AMC and Bed, Bath, and Beyond, are trading at triple digit implied volatility levels , those usually associated with the most volatile, supply-constrained commodities. Their options are priced accordingly (i.e., super...

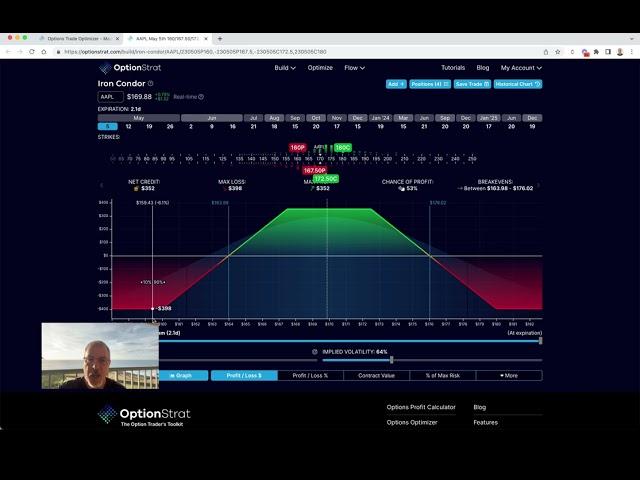

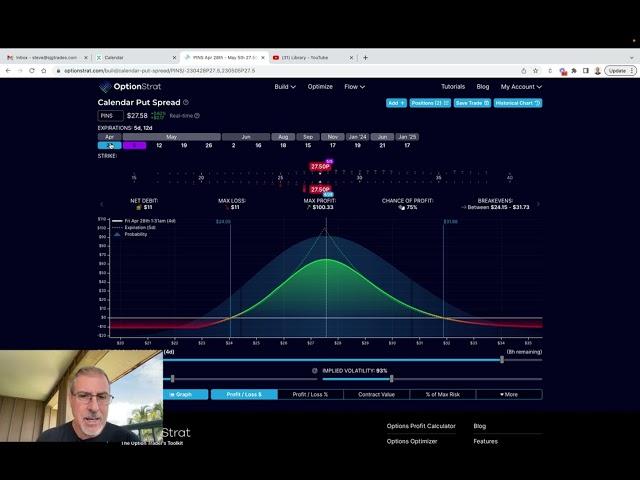

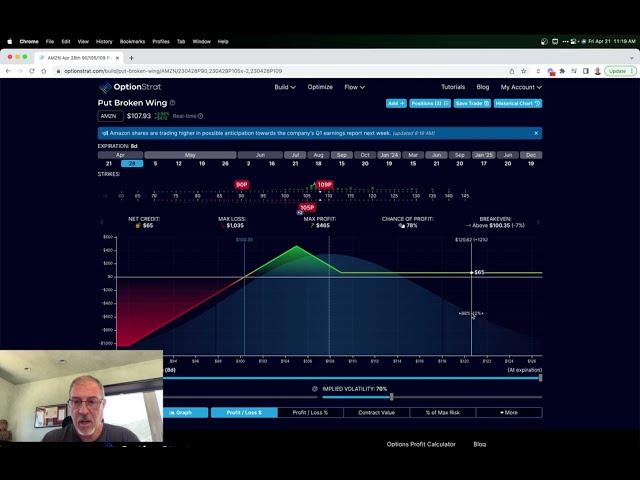

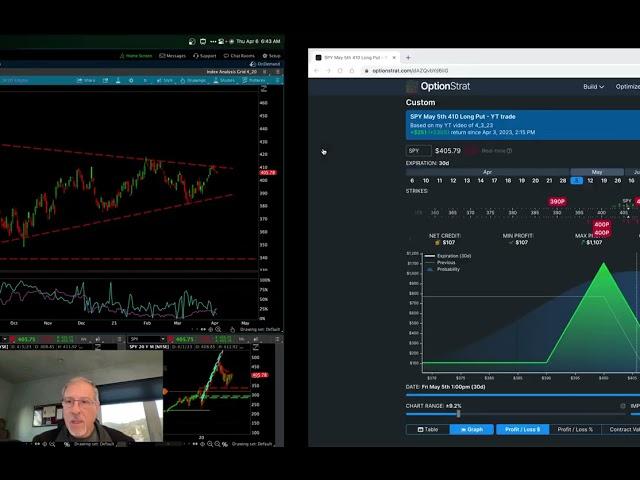

Our options profit calculator tool is used by traders around the globe to visualize the potential profit and loss of option strategies over time. Many traders tell us it’s the first step they do before...

Europe has a full-fledged energy crisis on its hands. Consequently, liquified natural gas prices are soaring and have increased over 7 times from a year ago. This makes a compelling case for Cheniere Energy (LNG),...

The European energy situation is driving up natural gas to prices not seen since 2005 and 2008. Consequently, certain natural gas related stock options could be excellent opportunities when viewed in relation to their implied...

Numerous studies have come to the same conclusion: you can’t time the market. You might be able to every now and then, but it’s extremely rare to beat the market consistently and in the long...

At one point in my career, I was the risk manager for an absolute return hedge fund. For those of you who aren’t hip to cool kid hedge fund lingo, an absolute return hedge fund...

This week, I thought I would check in on some stocks that I have reported on previously, as well as one newcomer. I warn you now, it’s a depressing bunch, but if you like buying...

It’s unanimous: inflation is going nuts and is the highest it’s been since the 70’s! Most people can’t relate to this since they weren’t even alive in the 70s (the average age in the US...

Every exchange has a bunch of people whose sole job is to think up new products and drum up new volume. Some of the new products actually make it off the drawing board and are...

The Dollar As I wrote last week, the dollar continues to be the king of the FX forest and has soared to roughly 20-year highs against the Euro and Japanese Yen. Less heralded is the...

Auto-updating quotes are now available to all premium subscribers! (Free users will still receive 15 minute delayed quotes which must be manually refreshed) Currently the auto-updating quotes are only available for the options profit calculator portion of...

With all the news about inflation and gas prices and various other depressing news, the incredibly high value of the dollar has largely flown under the radar. Unless you trade foreign exchange, hedge a company’s...

Some of my previous blogs focused on the so-called Covid Darlings, the stocks that benefited from Covid, but are now subject to extreme selling pressure. I have also featured several stocks that benefited from the...

Cathie Wood’s ARK Innovation ETF skyrocketed to mass popularity when it delivered a solid 35.7% return in 2019 and then followed up with an eyepopping 156.6% in 2020. She is now firmly enshrined as a...

Last week, I attended a derivatives conference in Las Vegas (Quants in Vegas, an interesting combination). Like all conferences, it was a chance to see and be seen and to check out what everybody else...

As you know, lately I have been writing about cryptocurrencies and how they have not been acting as advertised (to say the least). Each week has brought new revelations, culminating last week in crypto’s first...

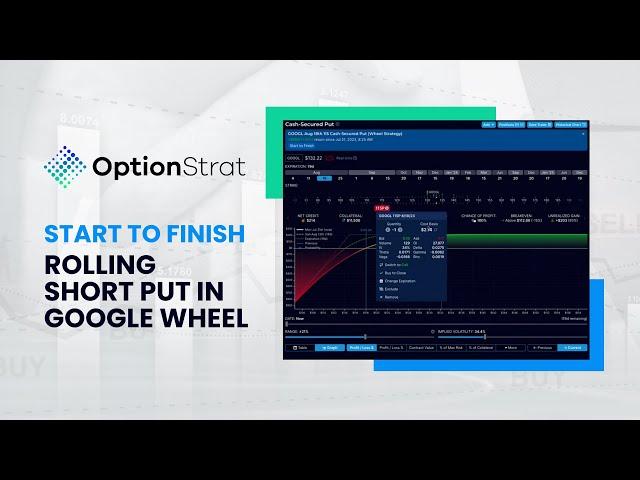

What is “The Wheel”? The Wheel Strategy is a popular options trading strategy for generating consistent passive income. While OptionStrat has over 50 pre-built strategy available to use with our options profit calculator, you may...

Last weekend, a horse aptly named Rich Strike won the Kentucky Derby. Believe it or not, he was an 80-1 long shot. I don’t know much about horse racing (actually, nothing), but I do know...

This week, the tone of the markets took on a decidedly apocalyptic tone. Inflation, war, interest rates, Covid, stagflation…the list goes on and on. Interesting that everybody seemed to be a lot happier with the...

Apparently, a federal judge in Florida has decided for all of us that the pandemic is officially over. Glad to know it, but as anyone that has been following Covid-related stocks (see PayPal, Meta, Moderna,...

Twitter: More to Come? To begin, I won’t comment or recap what’s been going on between Twitter and Elon Musk – it’s been well-covered in the press, and I don’t have much to add to...

Crude Oil: It’s Been A LOT More Volatile! According to almost everything you read, crude oil is very, very volatile. The evidence is everywhere: prices at the gas pump are super high, the war in...

Ukraine, Again As I write this, the War in Ukraine continues to rage on with no end in sight. Despite early hopes of a Ukrainian “victory” leading to a forced ceasefire, Putin and Russia (are...

Volatility Roundup As we noted at the start of last week, the bull market was starting to feel like prom night at 3am. For traders new and old, last week was a wild ride with...

It’s always interesting when markets refuse to follow conventional wisdom. For example, in March 2020 amidst the scary beginnings of Covid, you couldn’t find too many people who were bullish equity and real estate. Gloom and doom...

More about Nickel Last week, we discussed the crazy goings on in the nickel market and why retail investors should take note. As I wrote, Tsingshan Holdings, the world’s largest producer of nickel and founded...

Imagine that one day you’re trading away in a pretty quiet stock and all of sudden it goes up 66% one day and then doubles the next over the course of 18 minutes. Also imagine...

I’ve been writing about uncertainly and its effect on implied volatility over the last several weeks. You can’t get much more uncertain than how the Russian/Ukraine situation will ultimately turn out. One of the basic...

Before I get into last week’s options analysis, I think it best to quote an old friend of mine from the markets: I am not a geopolitical analyst and I have not become one since...

As we have written over the last several weeks, the Russia/Ukraine situation may produce some opportunities in options trading that don’t come along too often. Luckily, and despite the best efforts of various sociopathic and monomaniacal world...

Today we are launching a series of improvements to our options profit calculator product known as the strategy builder. These changes focus on making it easier to manage strategies throughout their lifetime. Here’s the quick...

Week Ending: 02/11/2022 After a week or so off, the Russian/Ukraine faceoff is back on the front page and above the fold. Despite the renewed frenzy in the press, there’s not much new information. The...

Weekly Volatility Roundup Week Ending: 02/04/2022 Dare I say it? Volatility actually decreased last week! Of course, some stocks looked like they were knocking on the Gates of Hell (Read: Facebook, last Monday), but that only tended...

Volatility Roundup The bull market party has been going on since roughly 2009 (and who would have predicted that at the very bottom of the financial crisis?) but is obviously getting a little decrepit. Anxiety...

Last blog (2023), I said I would review the short term results of the Cheniere Energy (LNG) options strategies I discussed previously (Visual Greeks and LNG) and (Straddlers Beware). Summarizing, Cheniere Energy is the world’s...

New index data We are expanding our platform to include data from some major stock market indices and their options: SPX: S&P 500 Index VIX: Cboe Volatility Index XSP: Mini S&P 500 Index (Similar to SPY at 1/10th...

As an addition to the premium chance of profit feature, premium users can now view an overlay of the stock’s probability distribution when using the graph view in our options profit calculator. The probability distribution...

OptionStrat’s saved trade system has been revamped! Over the past few weeks we have added some highly requested features to give the saved trade system a makeover. Instead of being a simple list of saved...

We are launching an exciting new feature for OptionStrat today: Historical price charts! You can now view the past price history for any strategy by clicking the historical price button on the strategy builder screen....

The launch of OptionStrat Flow is finally here! Our powerful new unusual options activity scanner is now out of beta and ready to take your trading to the next level. Our proprietary algorithm is the...

We are happy to announce that our live data plan is now available! Live data will apply to both the options profit calculator (aka strategy builder) and options optimizer tools. Stock and option quotes are...

When trading options, it’s important to understand the characteristics of your options strategy. An options profit calculator like OptionStrat is used to find the potential profit and loss at various prices, as well as show...

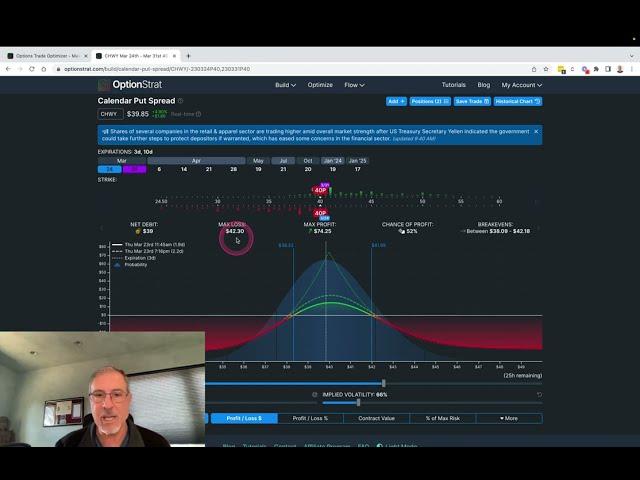

Since day one OptionStrat has had support for multi-expiration strategies such as calendar and diagonal spreads, and today we are launching an update to enhance the multi-expiration features. Now it is possible to add an...

OptionStrat is now available as an app for mobile devices! Now you can use OptionStrat on the go alongside your other mobile trading apps. All of the features available on the desktop version, including our options...

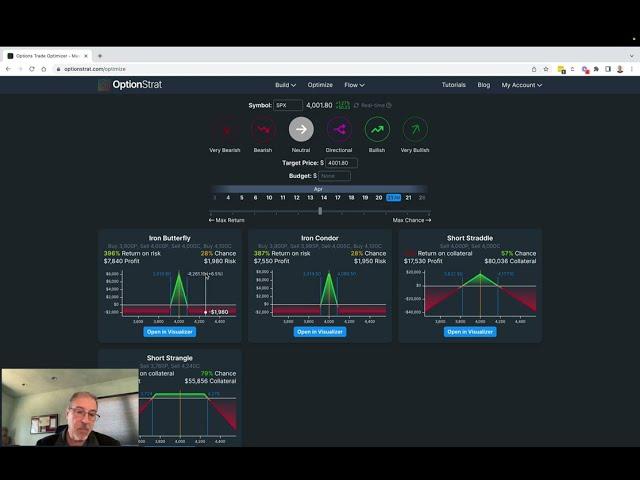

Today we are releasing the new options optimizer tool for public testing. The options optimizer makes it easy to search through thousands of potential trades and focus on the ones that matter: the strategies with maximum return,...

As of today OptionStrat is now available to the public! Thank you to the pre-beta testers who helped provide valuable feedback. OptionStrat is a tool for creating and visualizing option trades on U.S. stocks. It...

You may have heard of “IV crush” before, or maybe experienced it first-hand when you got the direction of a stock correct but your options still lost value after earnings. Implied volatility, or IV, is...

OptionStrat is capable of showing future profit and loss calculations on positions that are already established. To input a trade that you have already opened, select the type of trade from the strategy menu (for...