Event Options, Avaya!

Last July, I wrote about the CME’s latest wunderprodukt, Event Options. At the time, the exchange was seeking approval from the CFTC to launch. It was granted, and last Monday, September 19th, was the first day of trading.

For those of you who missed my first article on the subject, Event Options are actually run of the mill binary options, an exotic option type that’s been around for some time. As I wrote at the time, if you’re used to sports betting, Event Options should be easy to understand. They are essentially “yes” or “no” (hence, “binary”) bets on specific events occurring. Unlike normal options, the payout is fixed in advance and cannot vary, no matter what price results at expiration.

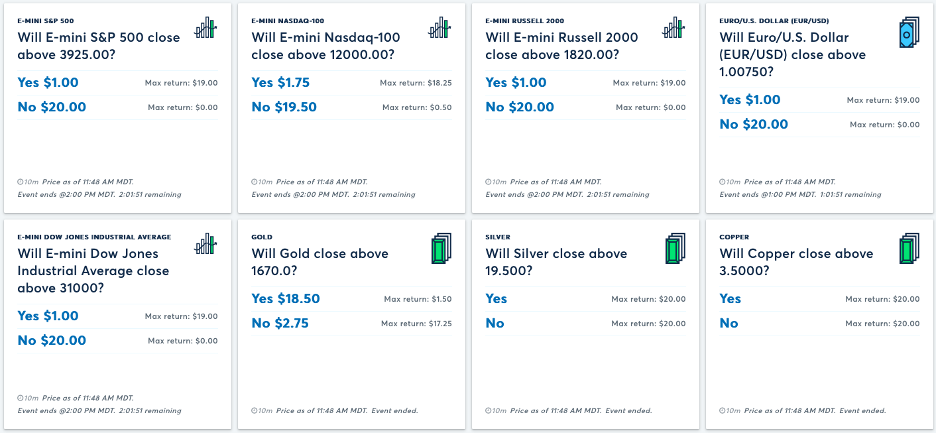

The CME product is available in a variety of asset classes (equity, energy, metals, and FX). The max payout for any option is $20.00/contract; max payment is anywhere between $0.25 and $19.75. Expiration is daily. Below are some actual trades, direct from the CME site:

(Source: CME)

Since the outcomes can only be one of two results, pricing is intuitive. Since the expiration is at the daily close, they will reduce in value as the day progresses and as the settlement becomes easier to predict. Conversely, they will increase in value as daily volatility increases since any event becomes more likely.

A few words of warning. First, there is no guarantee that the contract will prove a success. Second, volume will be thin to non-existent in the early days of the contract. Most new contracts fail. Of course, pricing will reflect this. Still, if you’re in the mood for some cheap thrills in the World of Options, this might be your ticket.

Avaya

It seems like every few months, a new super meme stock comes around that dominates social media for a few days or weeks and then disappears as fast it appeared. The latest is Avaya (AVYA), a software provider for corporate phone networks and call centers.

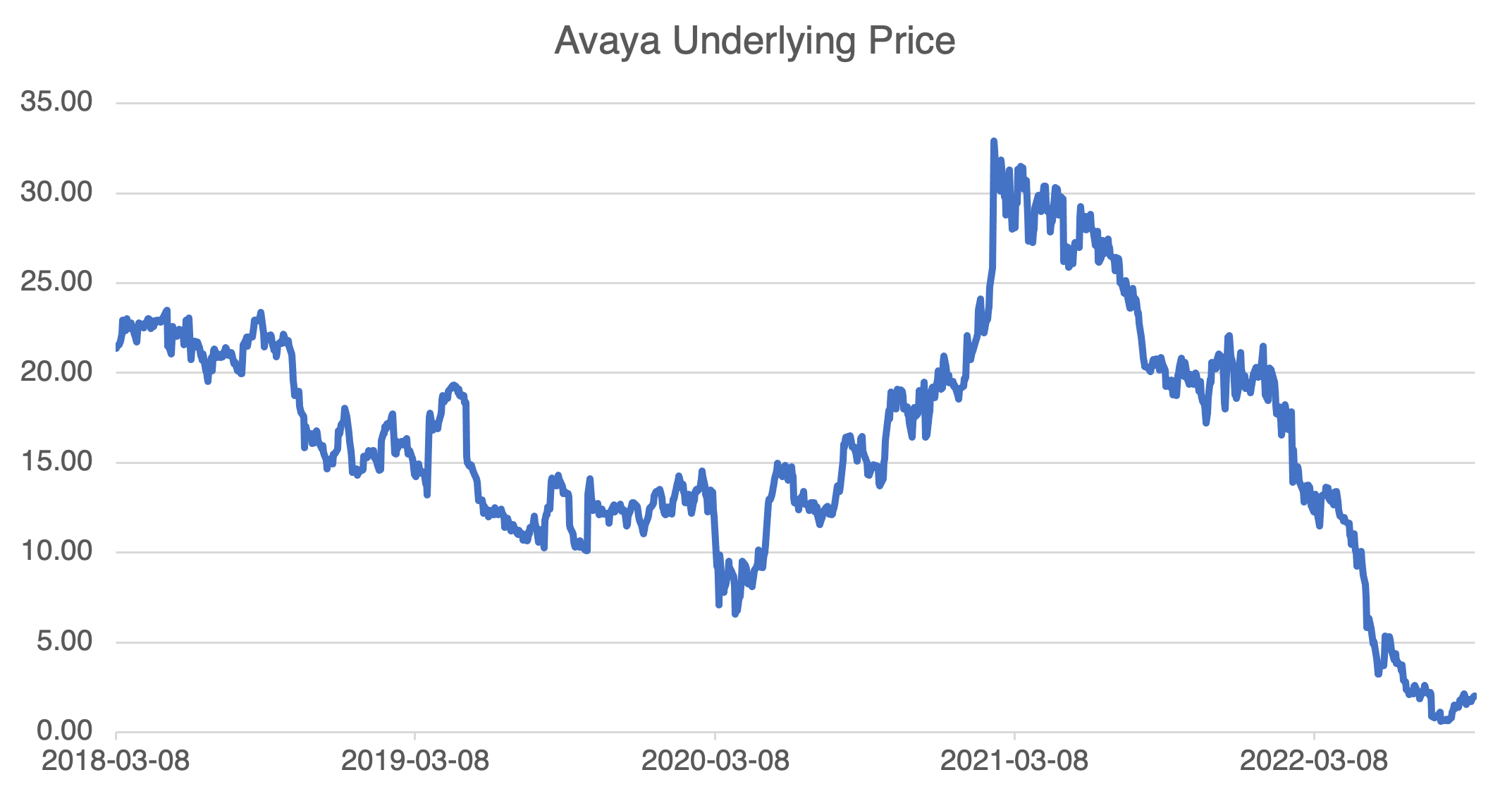

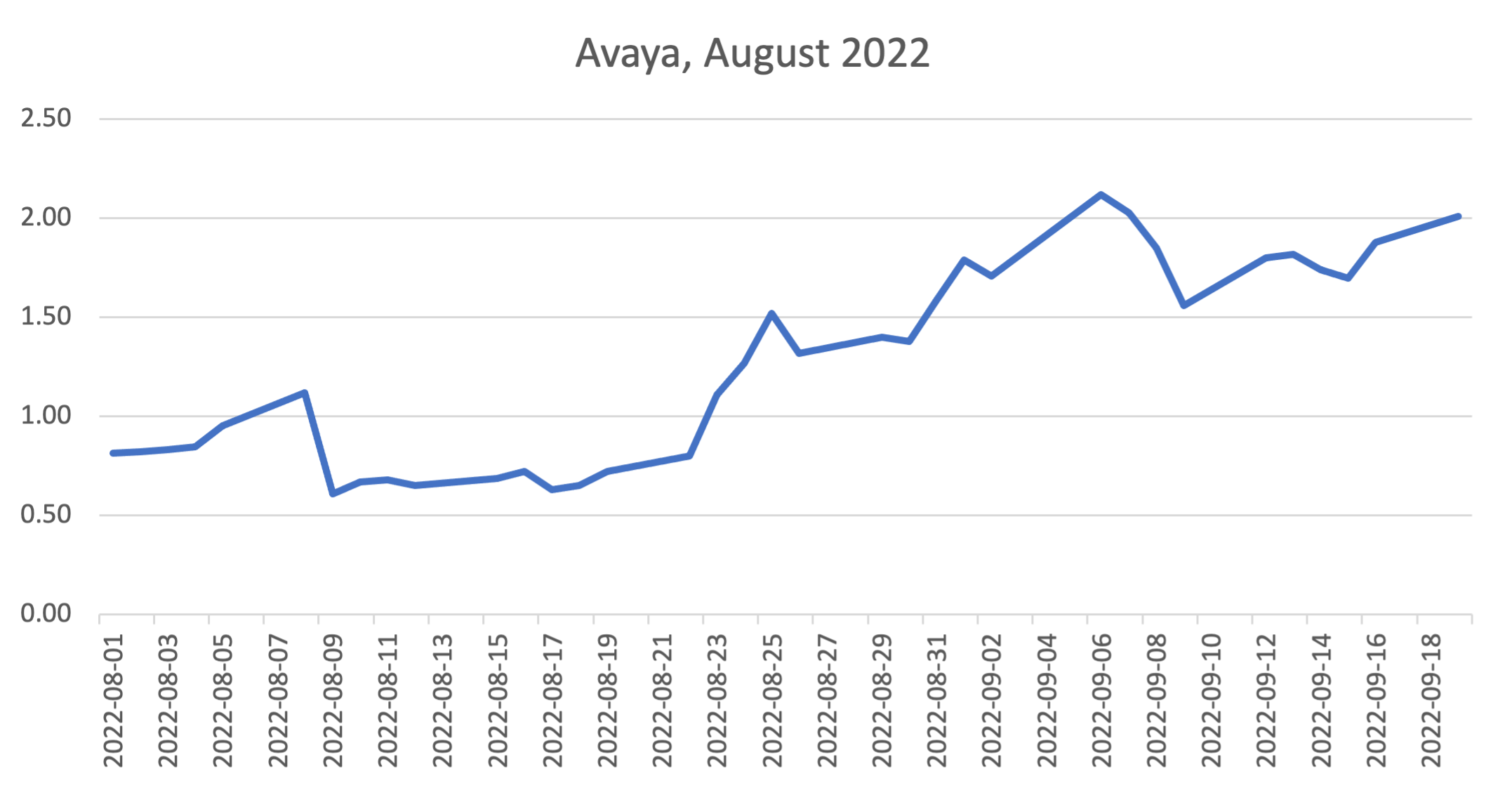

As you can see below, the rally hasn’t been all that impressive in relation to its long term chart. However, it has tripled in price since the beginning of August, spurred on by the purchase of a 15.4% stake by Theo King, a cloud software entrepreneur. Apollo Management and other institutional investors lined up against the company after it badly missed some revenue targets soon after issuing new debt. It appears to be headed to bankruptcy court. However, this being a meme stock, the situation quickly devolved into the usual Twitter and Reddit fight of lone, heroic retail investors against big bad Wall St. funds.

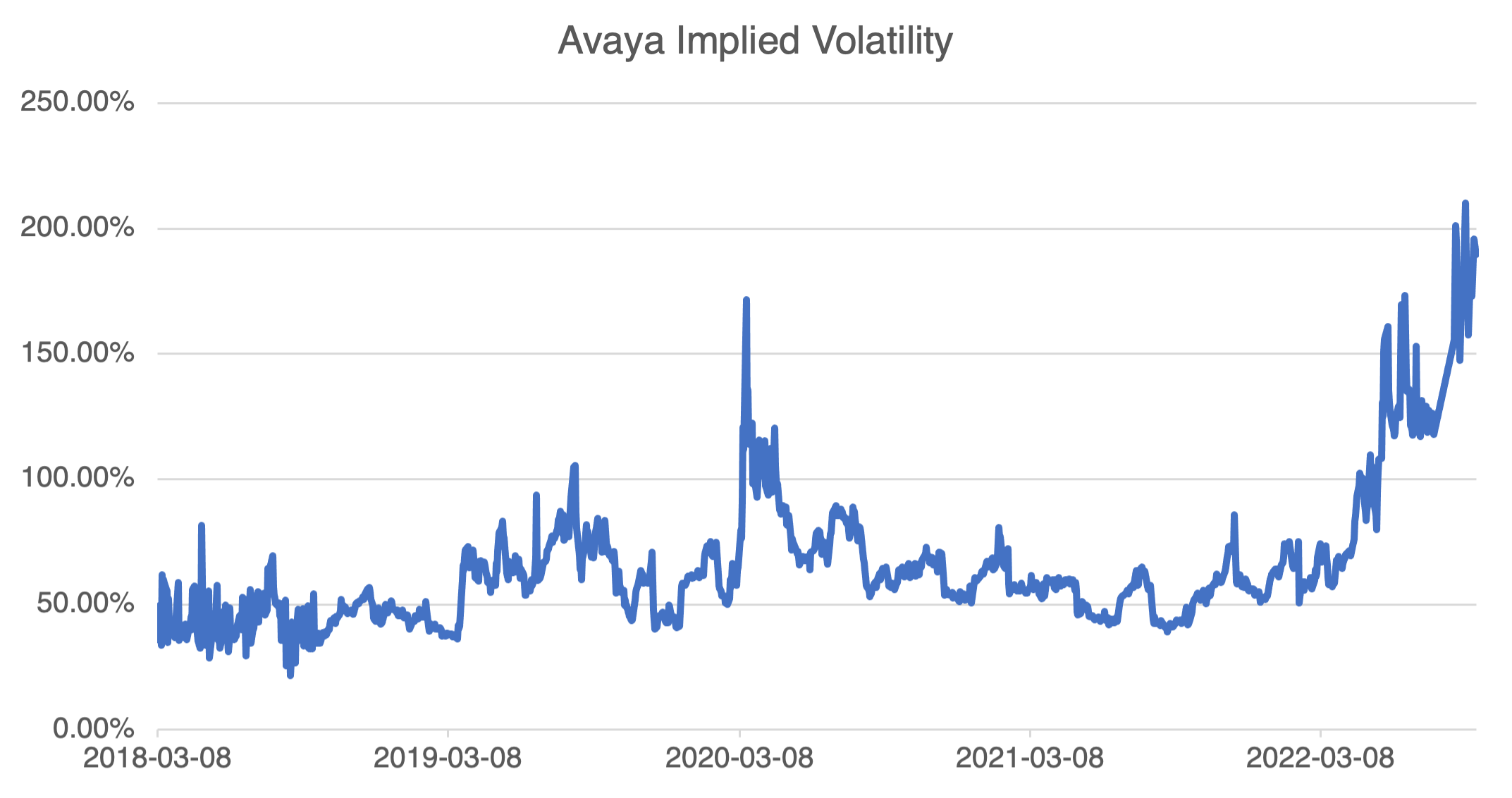

Much more impressive than AVYA’s price action has been its implied volatility, which rocketed over 100% and is currently over 200% at the money. As with all meme stock like moves, that puts it higher than that of the most volatile commodities, such as natural gas.

What does this mean in practice if you’re trading options? It means that if you are long, you are really speculating on two different factors: price and volatility. In this case, the two are very intertwined and if the rally fizzles out (which it will do if the crowd moves on), implied volatility will also fall to more “normal” levels. Since its extremely elevated, you will then have two things against you.

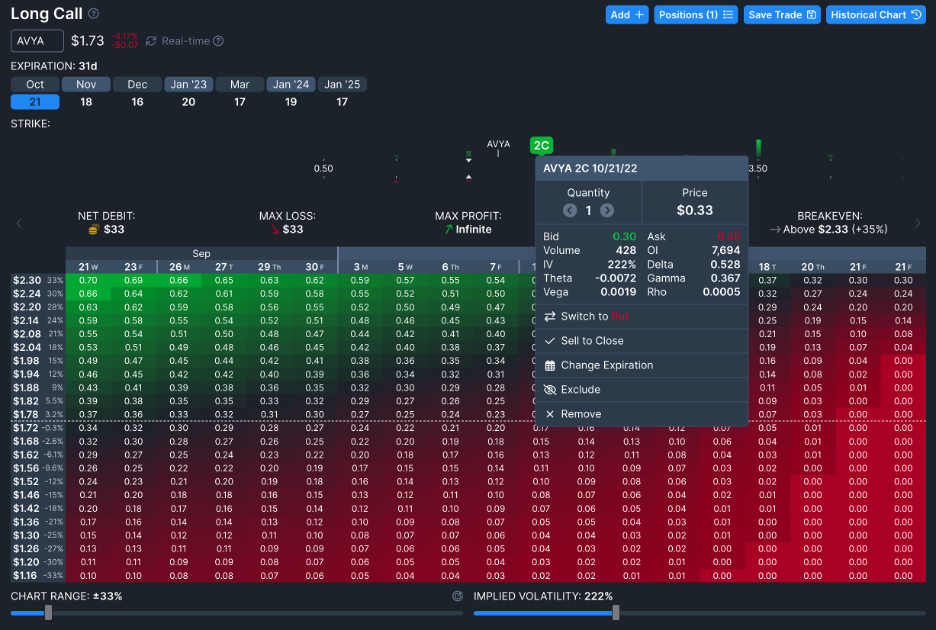

Consider the two tables below from OptionStrat. Each shows an AVYA $2.00 call, 10/21 expiration. One is at 239% IV, the other at 100%.

As you can see, the call value, originally roughly $0.33 with the stock at $1.73, decreased to $0.12 at 100% at the same underlying price. Although that move seems extreme, it’s not improbable if the social media mob loses interest (as they tend to do). As I’ve been writing for the last six months, implied volatility is important!