PTON Anyone?

Yes, I know I’ve written about Peloton a lot. Unlike most stocks, it seems that something new happens every week that changes my view of its long-term prospects. Who would have predicted that two years ago, at the height of the pandemic, and with PTON trading over $160, that it would now be trading under $9 bucks (it closed at a new low at the end of September at $6.93) and we would be writing about its possible demise.

What’s new? Last week, they announced an additional 500 layoffs, or 12% of the remaining workforce (they’ve already laid off more than 4,000 employees). According to the CEO, Barry McCarthy, the “…bulk of our restructuring work is complete.” And then, ominously, he pointed out that “There comes a point in time when we’ve either been successful or we have not,” and then said that that point would be in about six months. Trying to head off a mass panic by its employees and the market, he was then forced to issue a clarification, writing “There is no ticking clock on our performance and even if there was [sic], the business is performing well and making steady progress toward our year-end goal of break-even cash flow.” Which is true and which is false? Personally, I wouldn’t bet against his first, 6-month timeline. What happens if the company is still underperforming when the clock runs out? Who knows, but I suspect a steady stream of investment bankers wearing their “A-Game” ties have been calling over the last few months, all armed with restructuring plans and potential buyers.

I do not have a crystal ball and don’t know whether the CEO’s recovery plan will work or not. No one does, including the CEO. However…we do know that the stock is down about 95% from its 2020 highs, they still make a good product, and still have a loyal, albeit stagnant, fan base. They are in the position they are now in due to mismanagement and overestimating the effects of the pandemic, not from selling a bad product. However, the object of the exercise is to make money, and that’s been a dream for some time — its annual loss for the fiscal year is $2.8 billion, so far. And finally, the CEO faces the herculean task of changing PTON from an aspirational brand to one with a broader demographic and expanded userbase. That is probably his greatest challenge.

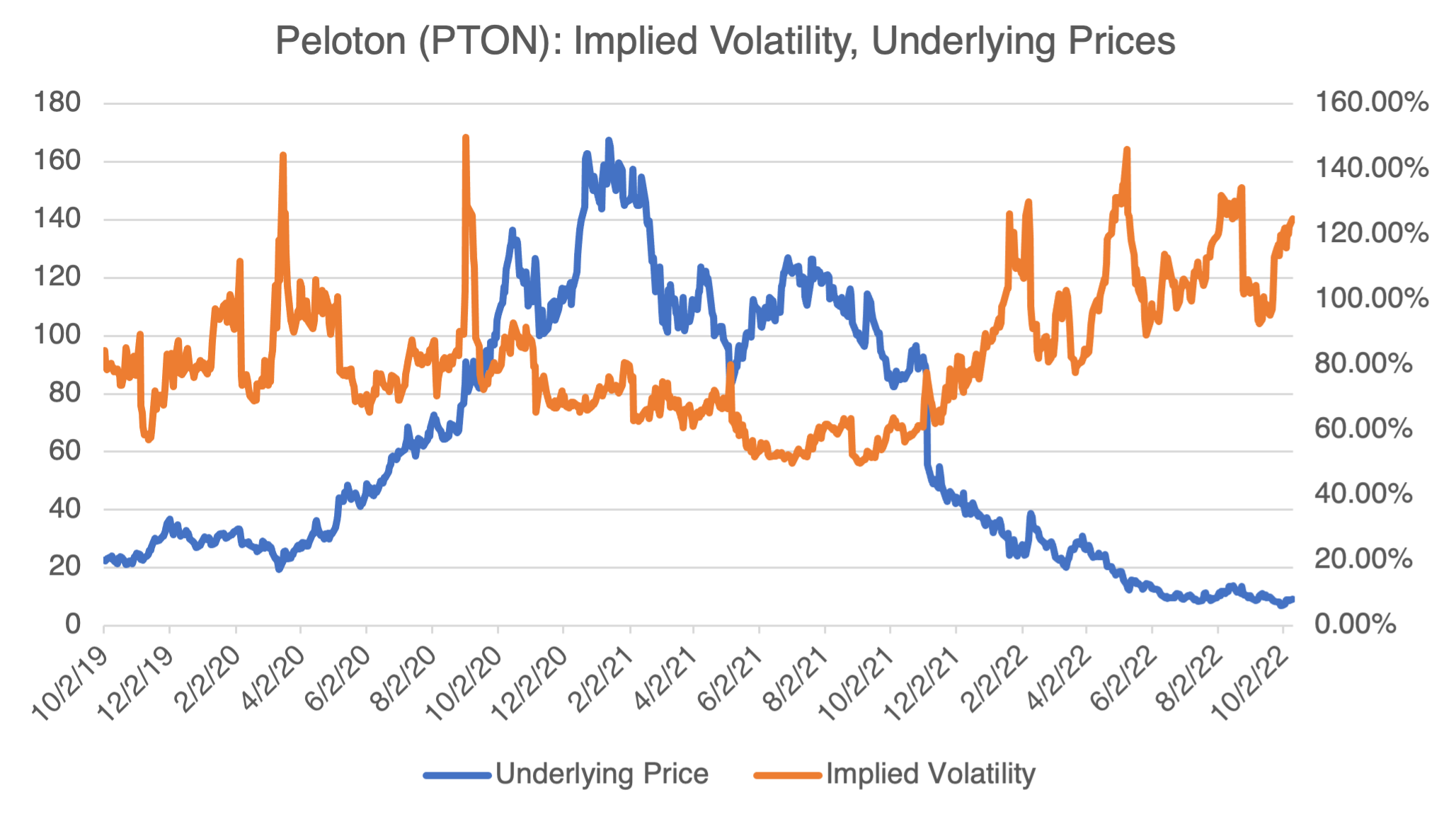

Needless to say, when it comes to PTON, the uncertainty meter has been pegged to “10” for some time. Usually, that indicates a perfect opportunity to use options if you have an investment opinion. As you would imagine, its implied volatility is high, even for PTON, and is trading at almost 130%, the highest it’s ever been. Some of this has to do with the effect of price direction, since implied volatility tends to increase as the underlying decreases. However, the primary driver is that it seems like its 50/50 that the company will either survive or be sold at lower levels. The good news is that, if you’re considering selling options, OTM strikes have abnormal value. However, volatility will continue to spike, especially if the downward trend and uncertainty continues. Short volatility positions should be considered only on a spread basis.

DoorDash For the Long Term

When the market sells off hard, even good stocks get sucked down.

In this case, and for restaurant delivery services in particular, it might be justified. As anyone that has ever used an online delivery service to order food, their services are essentially the same (they remind me of OfficeMax and Office Depot — no one could ever tell them apart). Whether it be Grubhub, Uber Eats, Postmates, or any of the other million competitors, brand loyalty is nonexistent. Grubhub’s former CEO even used the word “promiscuous” to describe customers (interesting word choice). The only differentiating items are therefore price and perks, whether the app works and is easy to use, giveaways, and which app has your favorite restaurants. The basic service is a commodity, and it’s tough to increase commodity margins. That leaves all the delivery services struggling to find a competitive advantage in an industry offering a very uniform product. Market share then becomes the primary consideration in stock selection.

DoorDash (DASH) might be a perfect example of all this. To give you a sense of its decline, it was a $245 stock in November 2021, but is now trading in the low to mid- $40’s, down over 70% ytd. Clearly, the market has fallen out of love with DASH, and the latest California proposal to reclassify gig workers as employees rather than contractors certainly didn’t help. Although that’s an industry wide problem and not specific to DoorDash, it’s still not good for the stock. On the other hand, DASH is still the market leader in delivery, with a whopping 59% market share of monthly sales, more than twice its nearest competitor, Uber Eats, at 24%. If you believe in the long-term viability of online restaurant delivery, then DASH might fit the bill.

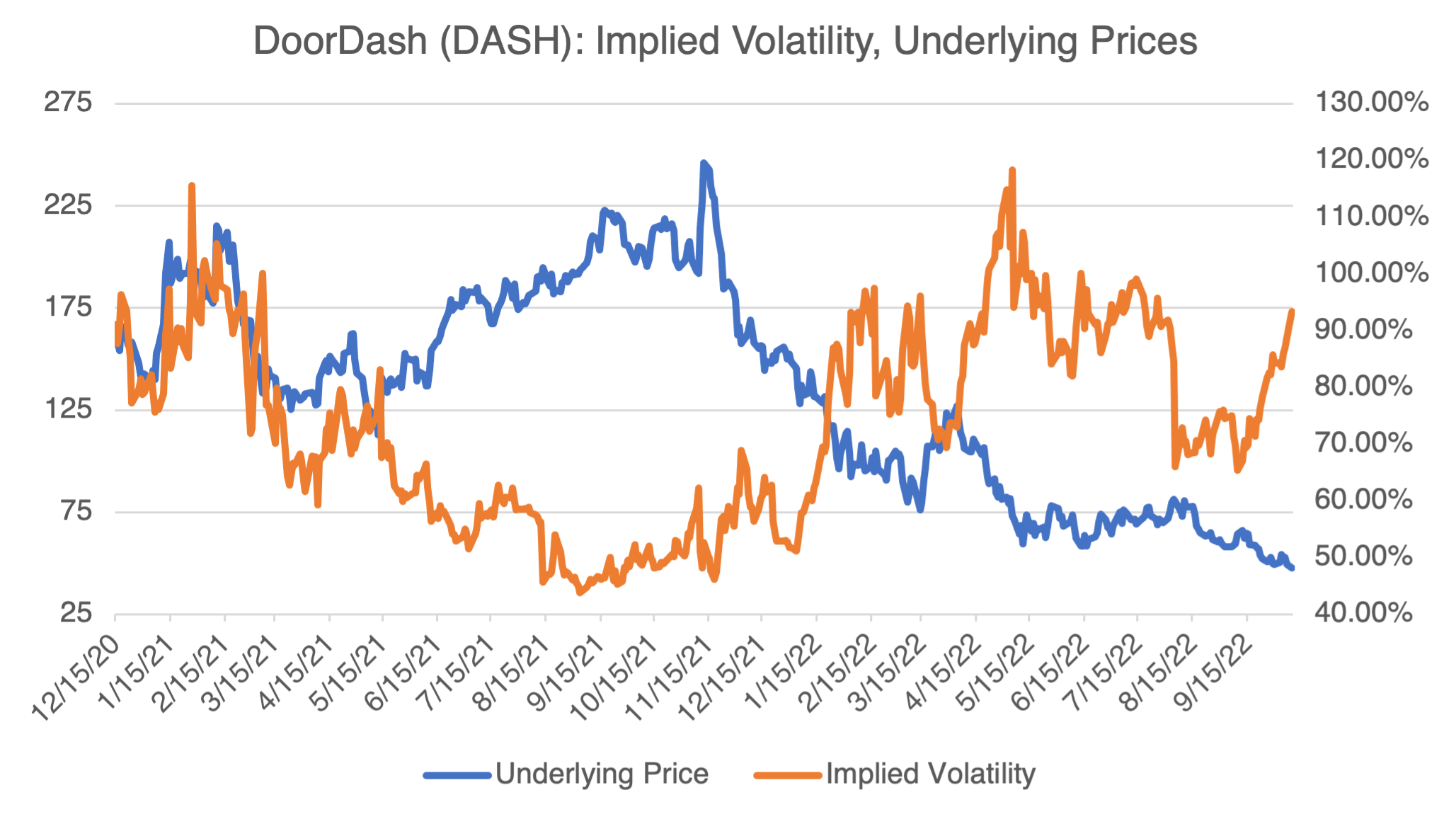

As with Peloton, uncertainty rules, and this is reflected in DASH options trading near 100% implied volatility, almost 35% points higher than a month ago. And like PTON, volatility will only increase as prices continue to decline, and decrease to move sideways as prices recover. Again, option spread positions are called for to shield against significant volatility movement.