The VIX. Inscrutable As Ever!

Last Monday, August 5th, was one of those days that traders will remember for the rest of their careers. Everyone talks about the possibility of sudden downside blowouts, but in reality they are exceedingly rare. That’s not to say that crashes never happen; they do, and that’s part of the game. Everyone lands on Boardwalk eventually.

When they do occur, the reactions can be “interesting.” Last week, former Treasury Secretary Lawrence Summers urged the SEC to investigate one of the most shocking aspects of August 5th, the early morning, 5-hour surge in the VIX index to a high of 65.73, a 42.34 jump from the previous close of 23.39 and the largest intraday move in the VIX ever recorded (interestingly, five out of the top ten biggest daily VIX spikes occurred on Monday). According to Mr. Summers, the move might have been “somewhat artificial” due to issues of liquidity, index settlement procedures, and lack of confirmation in the VIX futures markets.

I’ve written about the VIX numerous times, mostly in response to the somewhat cranky “VIX is broken” narrative. Ironically, I was responding to the argument that the VIX was too unresponsive to market events. Now it seems that many traders are embracing the opposite notion, that the index was too responsive, and must therefore be somehow broken in the other direction. Some people are never happy.

The crux of the latest argument has to do with how the VIX index is derived. Since the VIX is calculated using the midpoint of bid/offer spreads for each applicable strike, wide bid/offers lead to an increase in the index. In early morning, pre-market trading, liquidity is often limited and bid/offers are therefore very susceptible to widening due to abnormal order flow or unexpected events. In this case, the 10%+ drop in the Nikkei 225 was an unexpected event, to say the least. As the argument goes, extremely wide bid/offers, perhaps widened out artificially by those attempting to profit from short covering, led to the stratospheric increase, not necessarily investor panic or anxiety.

As further proof of this, some commentators point out that VIX futures (NOT the index itself) did not increase nearly as much during the early morning hours. At its widest point during premarket trading, the gap between the index and futures was 32 points; by the end of the day, it was down to 8 points. Since futures are not calculated but traded by real people, many consider them a more realistic gauge of investor sentiment.

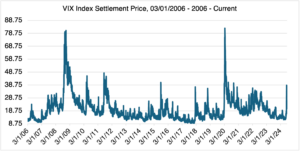

The last argument is the speed at which the index decreased after the initial near vertical move (see below):

Source: OptionMetrics

This is a weak argument, as all equity indexes recovered sharply the day after the crash. After settling at 38.57 on Monday, it fell almost 11 points to close at 27.71 on Tuesday, but there was no immediate follow through other than heightened anxiety that another crash could possibly occur. That’s not enough to justify Monday’s elevated settlement. Historically, it is only during extended periods of uncertainty and anxiety, such as during the recession of 2008 – 2009 or the 2020 pandemic (see below), that produce consistently high VIX readings. So far, the events of August 5th have been confined to a single trading day and have not been the harbinger of anything more serious.

Source: OptionMetrics

To the current crop of VIX doubters, I would point out that it’s easy to say now that the index was overvalued at its peak. But I think that ignores the situation that confronted many traders on Sunday night as a full-fledged crash seemed to be unfolding. Of course, limited liquidity factored into the index’s rise; it always does when unexpected events hit the market. And, of course, short covering dispersion traders forced the VIX higher and widened out bid/offer spreads. Wide bid/offer spreads occur during extreme moves; it’s how the market makers try to protect themselves, not necessarily evidence that the index is being miscalculated or something nefarious is afoot. Indeed, if the market hadn’t recovered after Monday, I doubt anyone would be doubting that the VIX index was overvalued. Rather, they would probably be arguing that VIX futures were undervalued and mispriced and that the index was correctly valued. 20/20 hindsight never fails to be accurate.

Finally, liquidity and and settlement issues were always present in the VIX to some degree; they are risks endemic to the index, or to any index for that matter. When you trade the VIX, you are tacitly accepting that. That’s not to say that the issues are invalid, but knowing the rules of the game – and understanding their ramifications before you trade — is important.