Interesting Stuff: Twitter, Peloton, and MOVE Contracts

Twitter: More to Come?

To begin, I won’t comment or recap what’s been going on between Twitter and Elon Musk – it’s been well-covered in the press, and I don’t have much to add to the ongoing, and increasingly complex, saga. Suffice it to say that Elon Musk wants to buy Twitter (I think) and he runs the greatest one-man PR shop in history. Regardless, I do know something about options pricing and volatility and can comment on that just in case you want to trade Twitter options. See below:

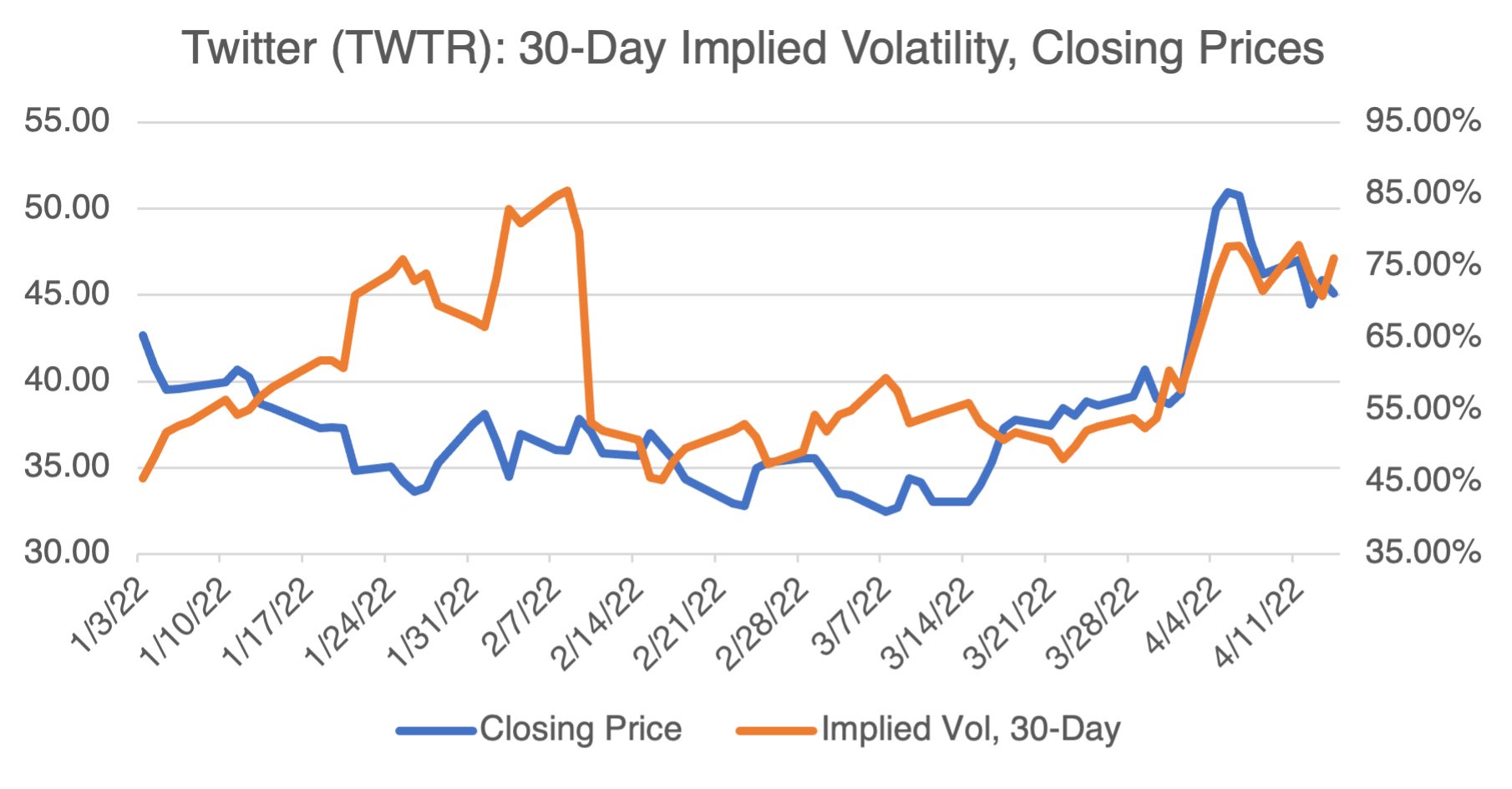

(Source: OptionMetrics)

Current implied volatility of about 76% is elevated, obviously, and about 25 percentage points higher than when Elon Musk fired his first salvo in late March. Note that it has been roughly following the trend of underlying prices since then. Are TWTR options expensive from a volatility standpoint? If you look at the long-term chart, maybe not.

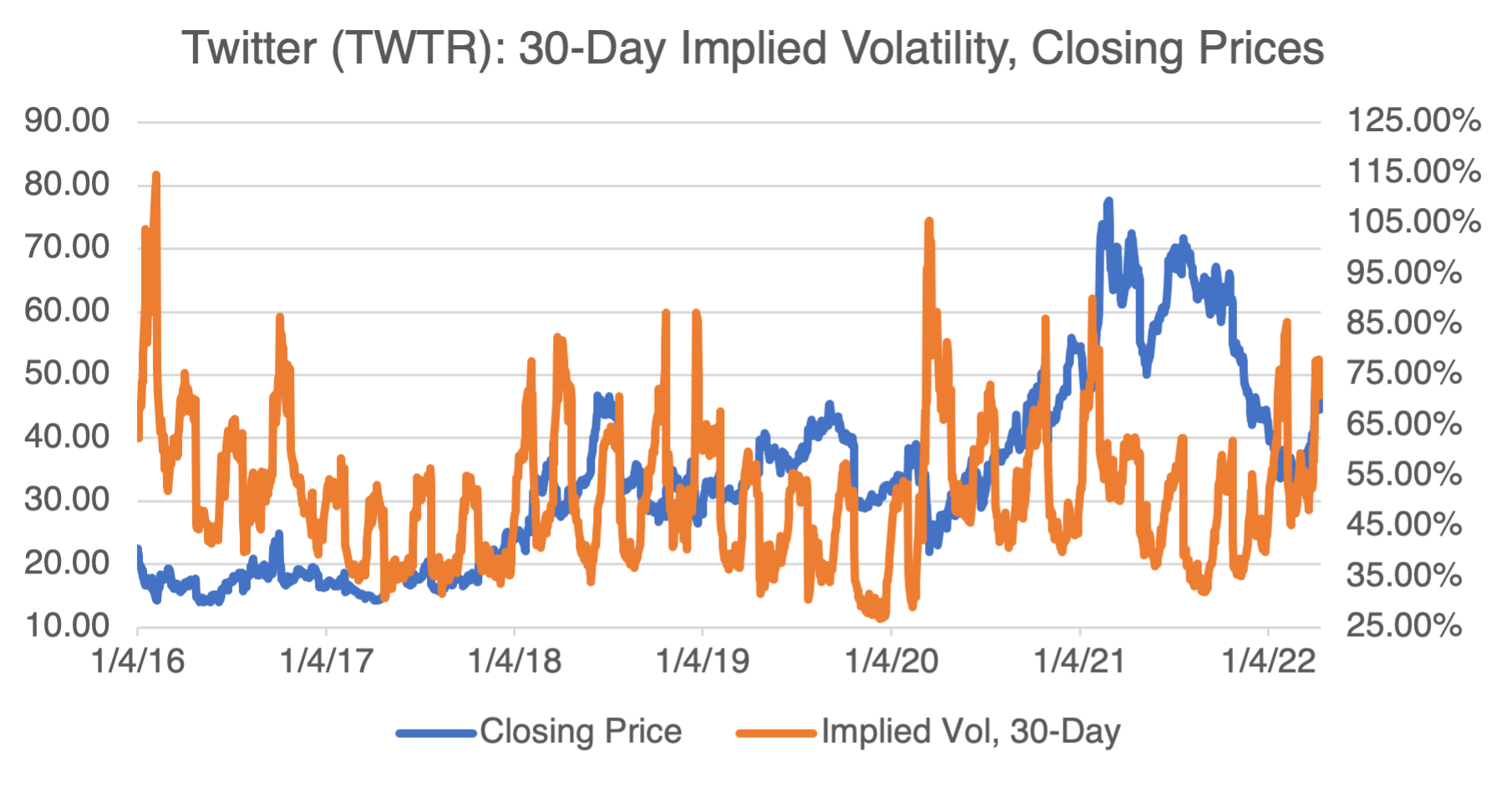

(Source: OptionMetrics)

Since 2016, implied volatility has been over 75% on numerous occasions and has even gone into commodity-like triple digits on occasion. As long as the TWTR/Musk saga continues, price uncertainty will underpin implied volatility. Of course, and as in everything he touches, any investment strategy will be at the mercy of Elon Musk’s peripatetic personality and social media presence.

Peloton: Hmm.

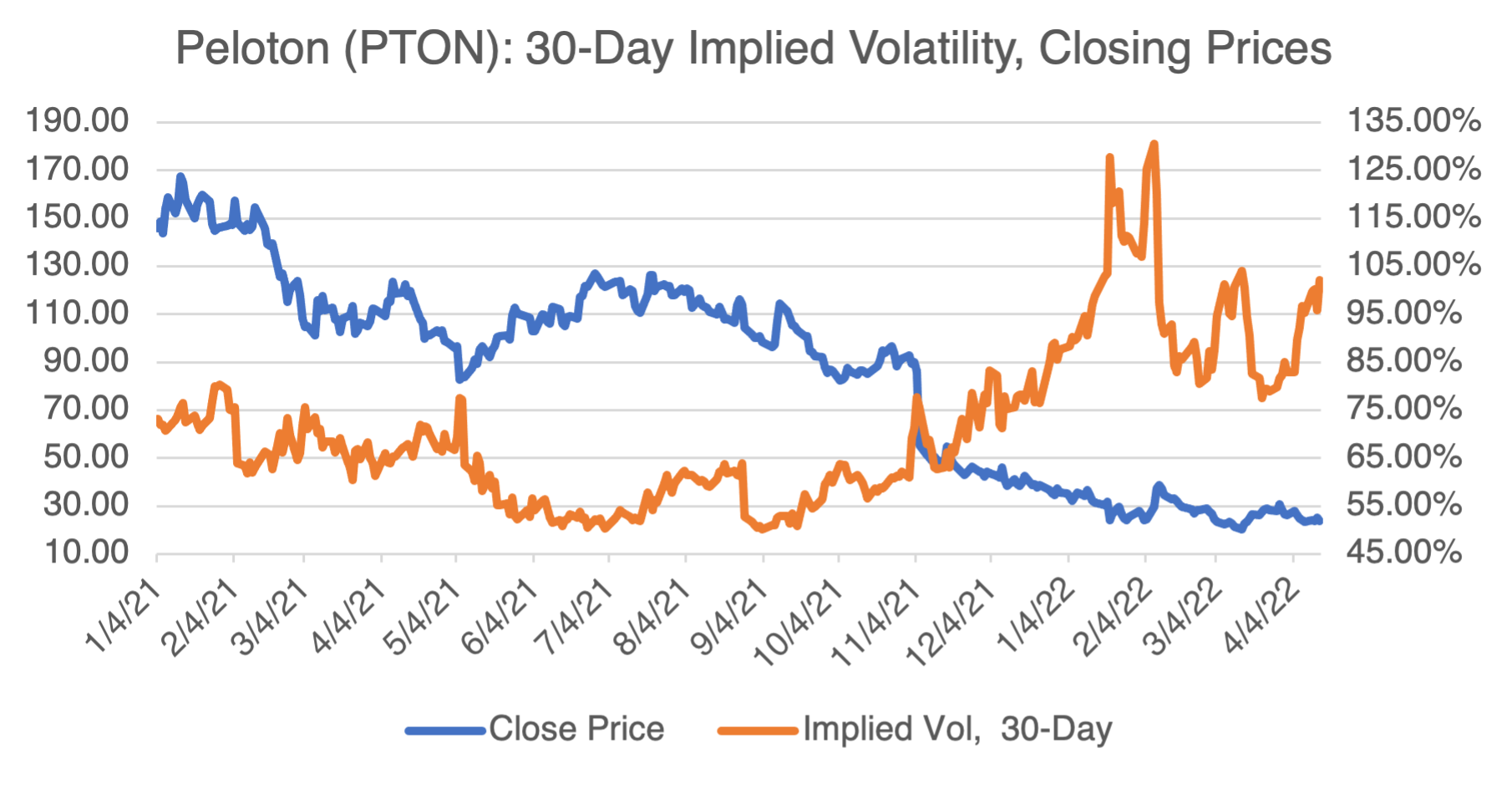

(Source: OptionMetrics)

After hiding out for a few months after defenestrating their former CEO and Founder, Peloton emerged on April 14th by raising subscription prices and lowering the price of the machine (I guess they figure they will make it up on the back end, or something). And then, on April 15th, Eric Carter of the NYT wrote an article entitled Breaking Up With Peloton. In it, various Peloton users describe how and why they became ex-users. At the same time, in-person gyms are experiencing sharply higher memberships from their Covid lows. None of this is good news for Peloton.

At this point, it’s unclear whether the company will stabilize or face a fire sale. In either case, Peloton options are subject to considerable uncertainty that tends to underpin its implied volatility. Currently, with implied volatility reaching the low triple digits, the options are relatively expensive. Any options-related strategy should take that into account.

FTX MOVE Contracts

In doing research on crypto currencies for the last several blogs I’ve written, I came across an interesting product offered on the FTX. For those of you unfamiliar with FTX, it is a very well-advertised cryptocurrency exchange that, among other products, offers crypto futures, swaps, and options. One of their products is an interesting derivative that they call MOVE contracts. As they describe it, “MOVE contracts represent the absolute value of the amount a product moves in a period of time. So, if a daily BTC moves $125 from the beginning to end of a day, the BTC-MOVE contract will expire to $125 whether BTC went up or down.” In this case, the amount the product moves is defined as from one close to another. In common gambling terms, it’s basically an over/under on price change. As you know from previous blogs, I’m skeptical about the future of crypto, but this is an interesting product.