Gold Is in the Air

Markets can be very strange, and high returns can cause traders to do some crazy stuff. That is, at first glance – sometimes they turn out not to be so crazy after all. Case in point: what’s been going on in gold and silver lately.

If you haven’t noticed, April gold futures made a new high of $2968.50 on February 11 and seem to be flirting with the $3000 mark. Although new all-time highs in the metal are certainly interesting and noteworthy, the rally in gold has been going on since late 2022. What is interesting is the effect that President Trump’s potential tariffs are having on the gold markets. Notice that I use “markets,” plural; there are numerous gold markets, the largest being in New York and London. And is as so often the case with different locations, prices don’t necessarily match up.

Due to the tariffs, or more accurately the fear of them, physical gold (i.e., actual gold bars) in NY is trading about $20 higher than in London. Bank dealers in London normally lend their gold inventory and sell NY futures to hedge the price risk. With NY futures higher than in London, losses on their hedge are larger than normal. Instead of closing the hedge and realizing the losses, they could be partially mitigated by making delivery with cheaper London gold. If you’re a bank with access to physical London gold, and the means to transport it, that’s a viable plan. And while you’re at it, you can take advantage of the $20 spread by selling NY futures and shipping even more gold from London to make delivery on them.

But like most things, it’s not that simple. First, you have to get a hold of the gold that you have stored in vaults under the Bank of England. Since other people will be doing the same, it will take a few days to get it out. Then, you have to refine it or trade it to the standard for delivery 100-ounce Comex bar size, much smaller than the 400-ounce London standard. And finally, you have to get the physical bars to New York. And how exactly do you ship gold bars? The same way you do with people – you fly them, commercially. “Are you checking a bag?” suddenly has a new meaning.

Silver prices have also diverged between London and New York, and have led to similar London/New York shipments. Although silver is normally shipped via ship, the profits from the divergence are so large that air freight can be justified.

All of this has led to massive shipments of gold and silver making their way across the pond to New York, as well as record deliveries on the Comex. In the broader sense, it’s underlined some of the stranger factors you sometimes have to consider when trading physically settled commodities. They don’t happen that often, but when they do, they can be very strange indeed.

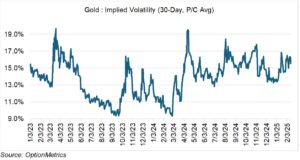

Since the gold market has been experiencing new highs, tariff potential, and locational price disparities, gold’s implied volatilty should be increasing. And it is: before all of the locational differences occurred, it was trading in the high 13%, low 14% region; now, it’s over 16% (chart below). For traders accustomed to other commodities whose volatilty can move into the triple digits, that doesn’t sound like much. But keep in mind that since 2023 and the beginning of the latest rally, gold’s implied volatility has rarely traded over 17%. Gold seems volatile because it’s making new highs and getting a lot of attention from the financial press, but in reality it’s a relatively sedate commodity.

Something to Worry About

I often write that the risks that usually cause the largest moves in price and implied volatilty are those that are completely unexpected and come out of nowhere. It’s tempting to call all of these events Black Swans, but that’s not really accurate. Black Swan events are so rare that no one even considers their possibility, and when they do occur, they have a catastrophic impact. After the fact, they are explained away as eminently predictable. 09/11 is a great example – few saw it coming, but everybody was unanimous that they should have.

What am I worried about? It’s not tariffs, inflation, trade wars, political upheaval, or anything currently in the news. It’s Taiwan, and the possibility that China will force reunification through military action or realistic and convincing threats. Although the market seems to be ignoring this issue (old news), it’s a very real risk that should not be ignored and could have massive implications for your portfolio.

How the current administration will react to a forceful seizure of Taiwan is anyone’s guess. If push comes to shove, the various scenarios that could play out range from acquiescence to all out military confrontation. No one really knows, and that’s part of the risk that could suddenly develop.

What we do know is that wars, or even negotiations to avoid them, are rarely predictable. Maybe the Taiwan issue will be solved diplomatically, eventually. Or maybe the Chinese will realize that it is not in their best interest to seize Taiwan and will more or less just accept the status quo. Or maybe not. The fact remains that there is no bullish scenario stemming from China taking Taiwan by force, or even threatening convincingly to do so, and no market or asset class will be spared in the short run.

My intent here is not to play boogey man, which is all too frequent in today’s social media dominated environment. Rather, it’s to point out the massive risk overhanging the market that is largely ignored, but that all investors should acknowledge.

Hedging catastrophic risk can be a frustrating and expensive exercise, because the hedges rarely work out. In this case, a long VIX position is the most obvious long term candidate. Think of it like fire insurance – you don’t like paying the premiums, but at the same time, you don’t want your house to burn down.