Let’s Take a Cruise

I read an article a few days ago about a giant rogue wave that hit a cruise ship, just like in the Poseidon Adventure! If this happened in March 2020, right at the beginning of Covid, it would have been the perfect metaphor for the near destruction of the cruise line industry. I can’t think of another group of stocks harder hit by Covid than cruise line operators. Imagine being stuck on a crowded cruise ship during a pandemic and you can see why.

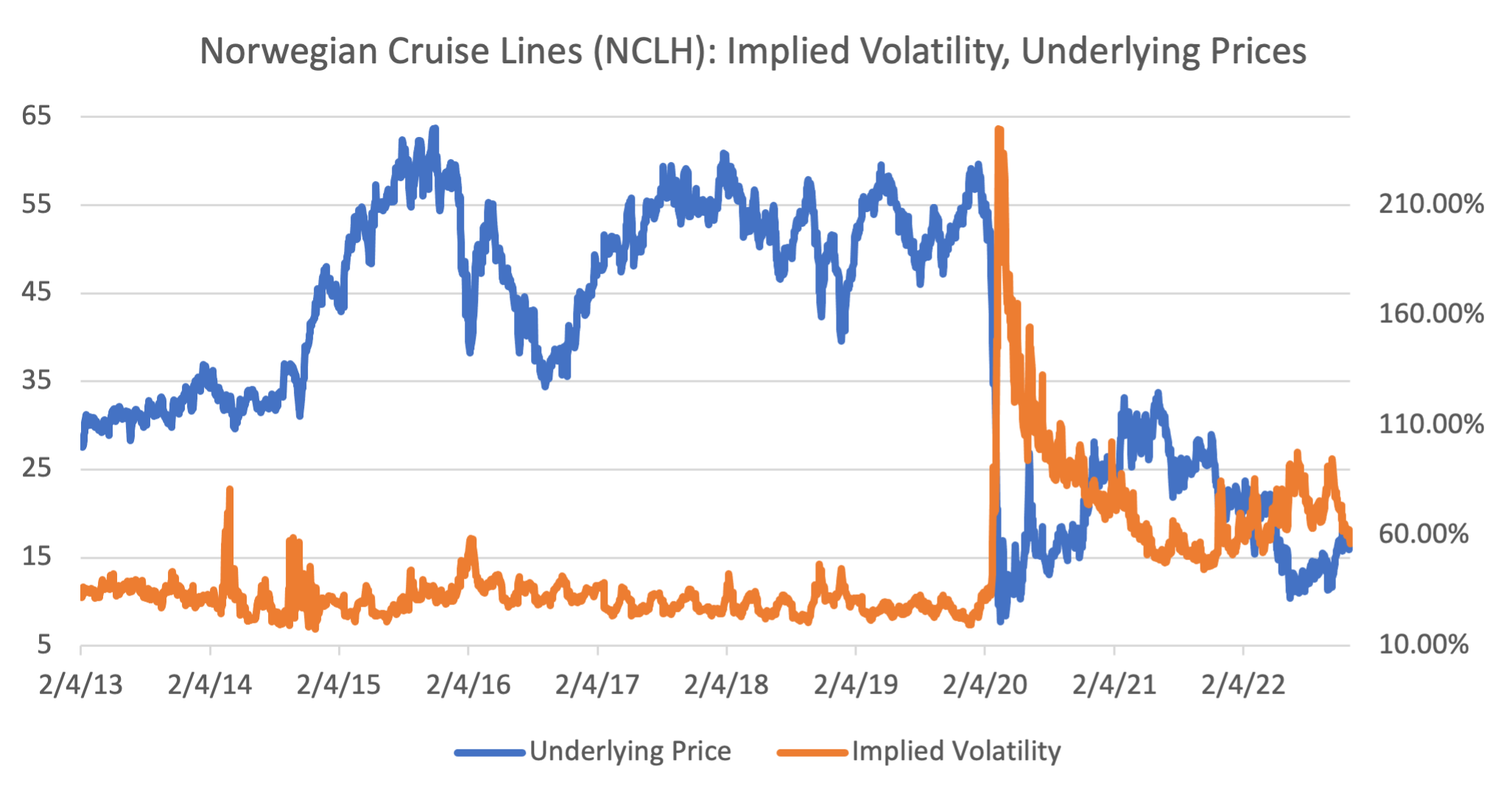

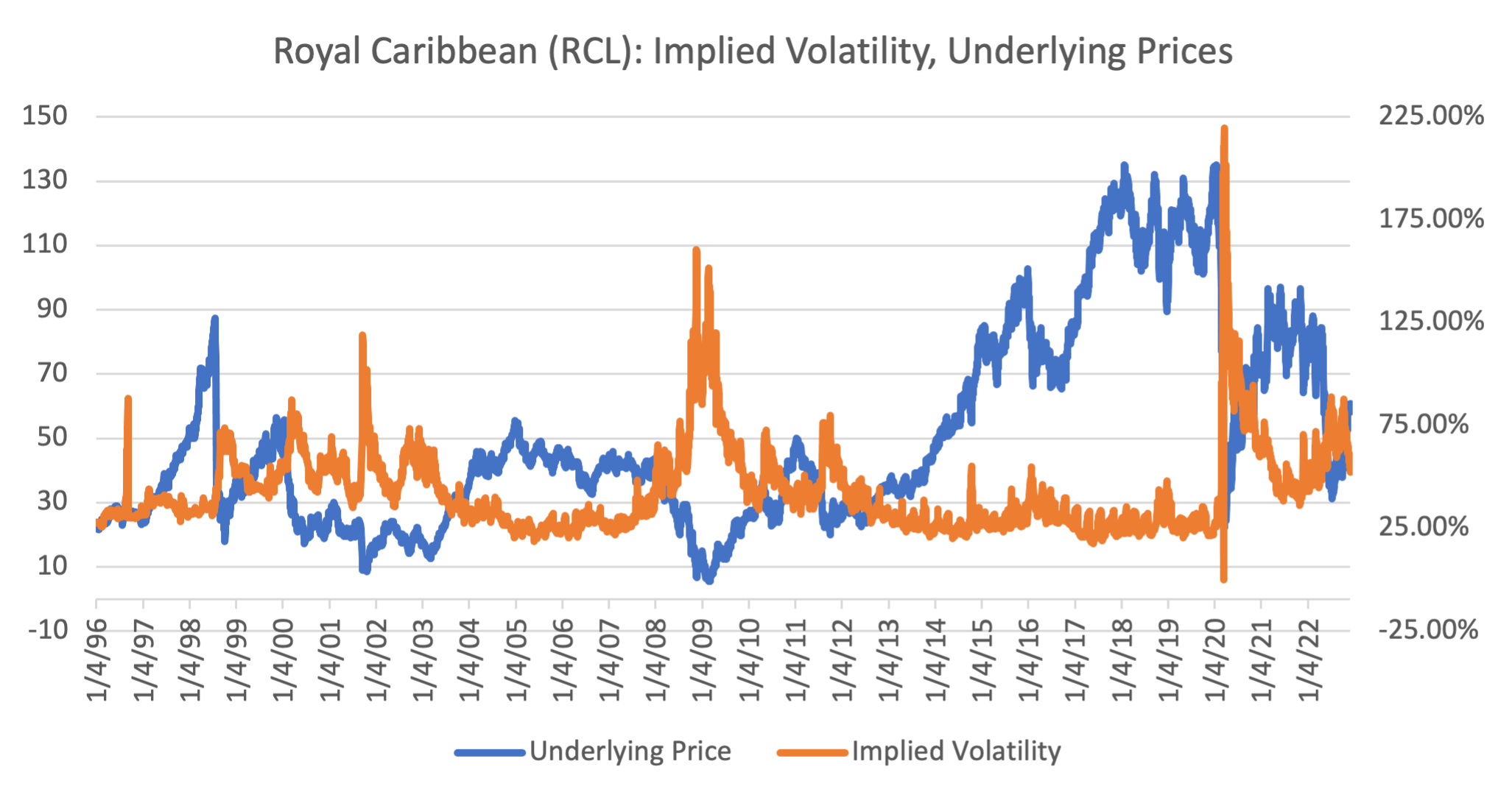

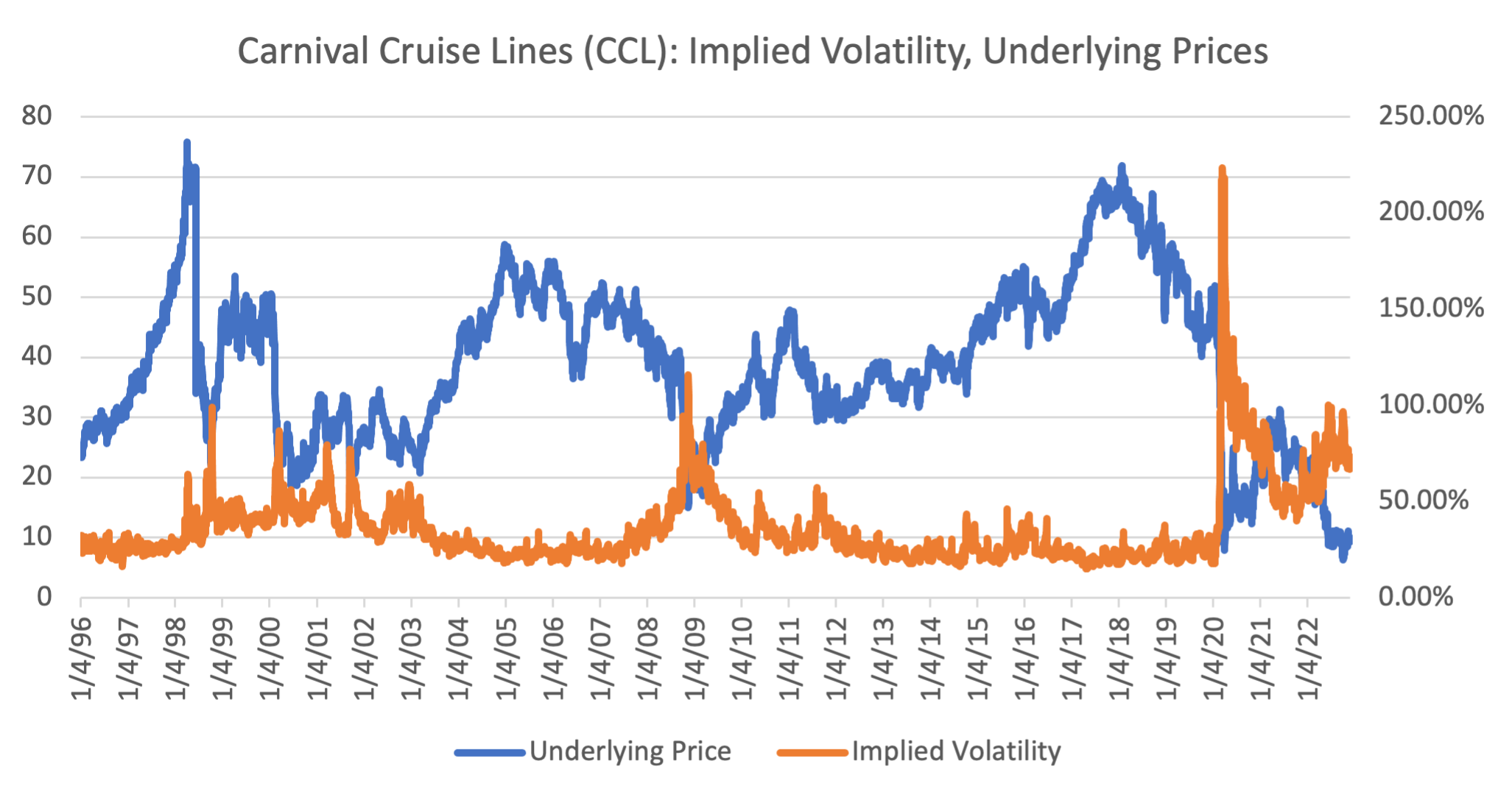

Just to point out the degree to which the cruise lines were almost destroyed by Covid, the big three line lost nearly $900 million each month during the pandemic. Indisputably, that’s a lot of money! Carnival, the worlds’ largest cruise operator, reported a 99.5% year-over-year decline in Q3 2020 revenues, from $6.5 billion to a paltry $31 million. With ships locked in port and burning cash, cruise lines took on debt, determined to make it through Covid. The outlook was grim, and bankruptcy seemed around the corner. Stock prices of the big three cruise operators, Carnival (CCL), Royal Caribbean (RCL), and Norwegian Cruise Lines (NCLH), plunged but bottomed out quickly at the height of the pandemic in March and April of 2020.

But that was then, and this is now, and Covid is no longer the boogey man it once was. Covid highflyers have all plunged in value since peak-pandemic, some still searching for a bottom. Can the opposite be true for those stocks that got annihilated by Covid? In the case of cruise lines, the answer might be a tentative yes.

Despite the ongoing pandemic in 2021, cruise lines recovered somewhat (see charts below) on the belief that it would soon be over. Investors got their wish in 2022, but then started worrying about a recession and interest rates. Since taking on debt to survive, cruise lines are more susceptible to interest rates increases than they used to be. Consequently, as interest rates rose, cruise lines were hammered, again, and are back to near their lows.

If you’re looking for bright spots, they exist. As you would expect, the end of the pandemic released built-up demand for travel services, cruises included. Bookings are coming back and are now above 2019 levels. Some analysts are forecasting 2023 bookings at 30% greater than 2019 levels. Apparently, cruise passengers are loyal, repeat customers. At the very beginning of Covid, faced with incredible uncertainty, 45% of passengers booked on cancelled cruises opted for a credit instead of a refund. And finally, as of last March, the CDC removed all risk advisories regarding cruise ships.

From an options point of view, the three major lines provide some interesting opportunities. All three show an interesting trait: their implied volatilities have been relatively stable, regardless of movements in the underlying, since the 2008 financial crisis and prior to Covid. Since the near death of the industry, implied volatilities for all three have increased considerably, touching over 100% for NCLH and CCL. As the uncertainty regarding their ultimate fate has decreased, their implied volatilities have decreased accordingly. It follows that if prices recover, uncertainty, and implied volatility, should be further reduced. Strategically, this means that options strategies designed to take advantage of increasing prices will be fighting against decreasing implied volatility. If you’re using options to trade these stocks, position with that in mind.

Annoying!

Sam Brinkman-Fried’s Apology Tour ’22. Seriously, enough already! As my first trading boss said after I defended a losing trade, “but they took the money anyway, right?” Unfortunately, the answer is always yes.

Unusual Options Activity

Remember to check out our options flow tool which shows unusual options activity in real-time. UOA consists of real trades made by other traders and institutions, giving you insight into what the “smart money” is up to!