Event Options: Viva Las Vegas!

Every exchange has a bunch of people whose sole job is to think up new products and drum up new volume. Some of the new products actually make it off the drawing board and are made available to trade. Most are variants on successful contracts with changes to location or maturity and don’t merit much notice. Most fail. Futures and options contracts have been around since the 18th century, so there’s not much new under the sun.

I thought of this when reading about a relatively minor announcement last June from the CME heralding their introduction of Event Options on September 19th (pending CFTC approval). The CME has been trying to attract retail investors for some time, and this is their latest salvo.

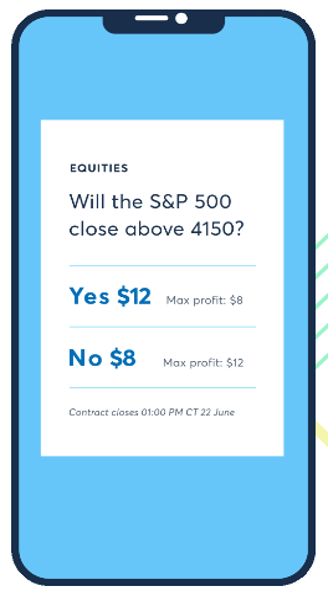

If you’re familiar with sports betting, you will be very comfortable with Event Options. Here’s how they work. Each day, the CME will offer daily expiring, cash-settled options on futures contracts on 10 different energy, equity, FX, and metals contracts. There is a twist, however. These options are a simple “yes” or “no” proposition, with a fixed and predetermined profit/loss. For example, consider the trade below supplied by the CME:

(Source: https://www.cmegroup.com/activetrader/event-contracts.html)

In this case, the question is whether the S&P 500 will close over 4150 (the strike). The maximum profit or loss is set beforehand at $20.00. If you bet “yes,” it will cost you $12.00; if you bet “no,” it will cost you $12.00. If the index settles above 4150, you will make $8.00 ($20.00 – $12.00), regardless of how high the S&P closes. For the downside bet (“no”), the opposite is true, but you will make $12.00 ($20.00 – $8.00). Multiple strikes will be available. Each day, and for each product offered, a new series of Event Options will be offered. According to the CME, these will be small size contracts geared for retail investors and priced between 0.25 and $19.75/contract.

Stripping off the marketing promotion and rebranding, Event Options are nothing more than binary options, an exotic option that’s been traded among institutions since the early-70s but became available to retail investors in 2008. Just like Event Options, binary options pay out a fixed and predetermined amount depending on whether a certain event occurs, a simple “yes” or “no” proposition. Curiously, the SEC approved binary options, widely considered an exotic financial instrument, in 2008 in an effort to spur retail participation after the financial crisis. In the US, binary options are available primarily on the North American Derivatives Exchange (NADEX), which specializes not only in binaries, but other exotic options as well. Like all niche products, interest in binaries has come and gone over the years, but I imagine that the CME’s efforts will draw renewed attention to them.

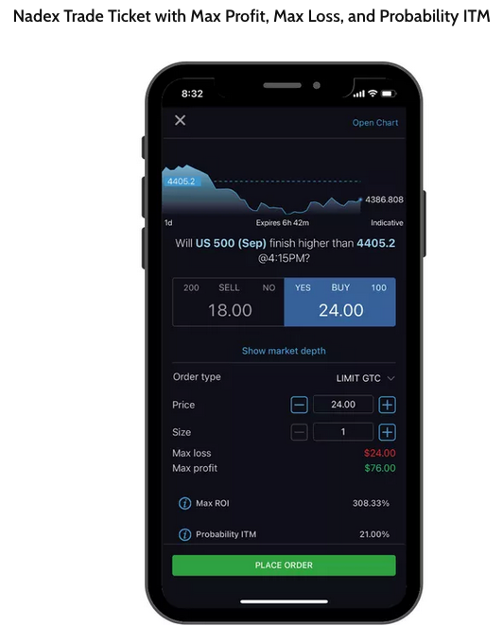

Whether they are called Event Options or binary options, their simplicity, small size, and known risk makes them very attractive to retail investors. Both the CME and NADEX have geared their marketing accordingly — witness the cute smart phone displays, (below, from NADEX), upbeat videos, and lack of technical language in their marketing materials.

(Source: nadex.com)

As you can imagine, this provides the perfect environment to take advantage of naive retail investors looking for a simple product to play the markets. Indeed, binary options have been banned for retail sale in the UK, the EU, Australia, and Israel, and for good reason. In Australia, it was reported that between 74 and 77% of all customers lost money while trading binary options. The frauds committed run the gamut, but mostly center on refusal to reimburse or credit customer funds, identify theft, and manipulation of binary option payouts and prices through the use of trading software. Classy stuff! In fairness, these frauds did not occur on organized, established exchanges but on shady, unregulated internet-based trading platforms, or through unregistered broker dealers. Obviously, the CME and NADEX do not suffer from these problems.

Given their reputation and given that the markets aren’t exactly stable right now, the CME’s timing is not ideal. Even if approved, I doubt that any of the top mainstream brokers will be offering them to their retail clients (that is, unless they are a success!). That’s not to say that I think the contracts will be a failure. Exactly the opposite — these contracts tap into two trends that have been developing over the last decade or so: the “sportsification” of financial markets and retail’s increasing participation in options. Las Vegas has moved to Wall St., and it’s right at home.