European Issues

Europe has a full-fledged energy crisis on its hands. Consequently, liquified natural gas prices are soaring and have increased over 7 times from a year ago. This makes a compelling case for Cheniere Energy (LNG), the world’s second largest LNG producer. Despite making new highs this month, LNG implied volatility has actually decreased, making its options relatively inexpensive. OptionStrat has a new time to expiration slider feature that you should explore. Imagine living in a place where you can’t heat or cool your house, or even turn the lights on? Or one in which rolling blackouts are a way of life. If you had to guess, you would probably bet that it was some country riven by war or economic distress. And you would be wrong. Believe it or not, it’s a foretaste of what may be in store for Europe during the upcoming winter. Europe — that bastion of civilization, social welfare, and green energy, has a full-fledged energy crisis on its hands. In response, authorities are considering the possibility of rationing supplies between consumers and industry if the situation gets any worse. Needless to say, that’s not exactly bullish for Europe’s economy.

I’m not going to dwell on how the Europeans got themselves into this situation in the first place. Suffice it to say that depending on Russia and Vladimir Putin to supply 40% of your natural gas needs while at the same time shutting down a lot of your conventional power generation didn’t turn out to be the greatest idea in the world. It reminds me of the famous line from Animal House: “You f-ed up. You trusted us.”

How high are energy prices in Europe? Higher than most Americans could imagine. Natural gas futures are about $9.00 MMbtu in the US; in Europe, they are trading about $66 MMbtu, over 7 times higher. Similarly, baseload power in the eastern US is about $106 mwh; in France, it’s currently about $430 mwh, 4 times higher. And that’s for September — it doesn’t take much imagination to guess what could happen if the winter supply situation gets even worse. Imagine getting an electric bill that’s about 5 times higher than you’re used to (or can afford), while hanging out in a dark and cold house, and you can see what a real energy crisis looks like.

What does this have to do with options? As a result of all their supply issues, Europe is trying to get as much natural gas for the winter as they can lay their hands on. That means importing liquified natural gas (LNG) that can be delivered via ship to specialized import facilities. The problem is that Europe is now competing with Asian customers, also buying for the upcoming winter. The net result is that the LNG market is tight, and prices are rising fast.

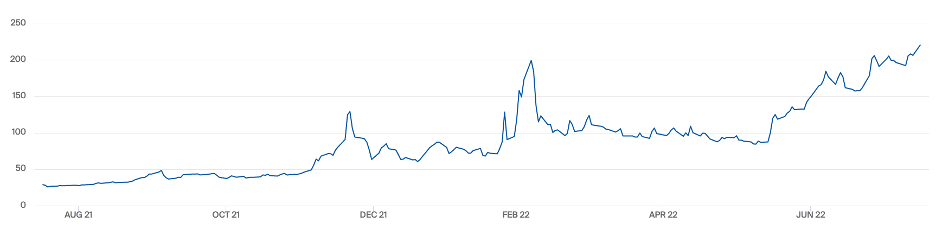

(Source: ICE)

To put this chart in perspective, last August 16th, 2021, it closed at 29.05; currently, it’s trading about 220. That’s over 7 1/2 times greater than just a year ago. Even for a historically volatile commodity, that’s quite a move!

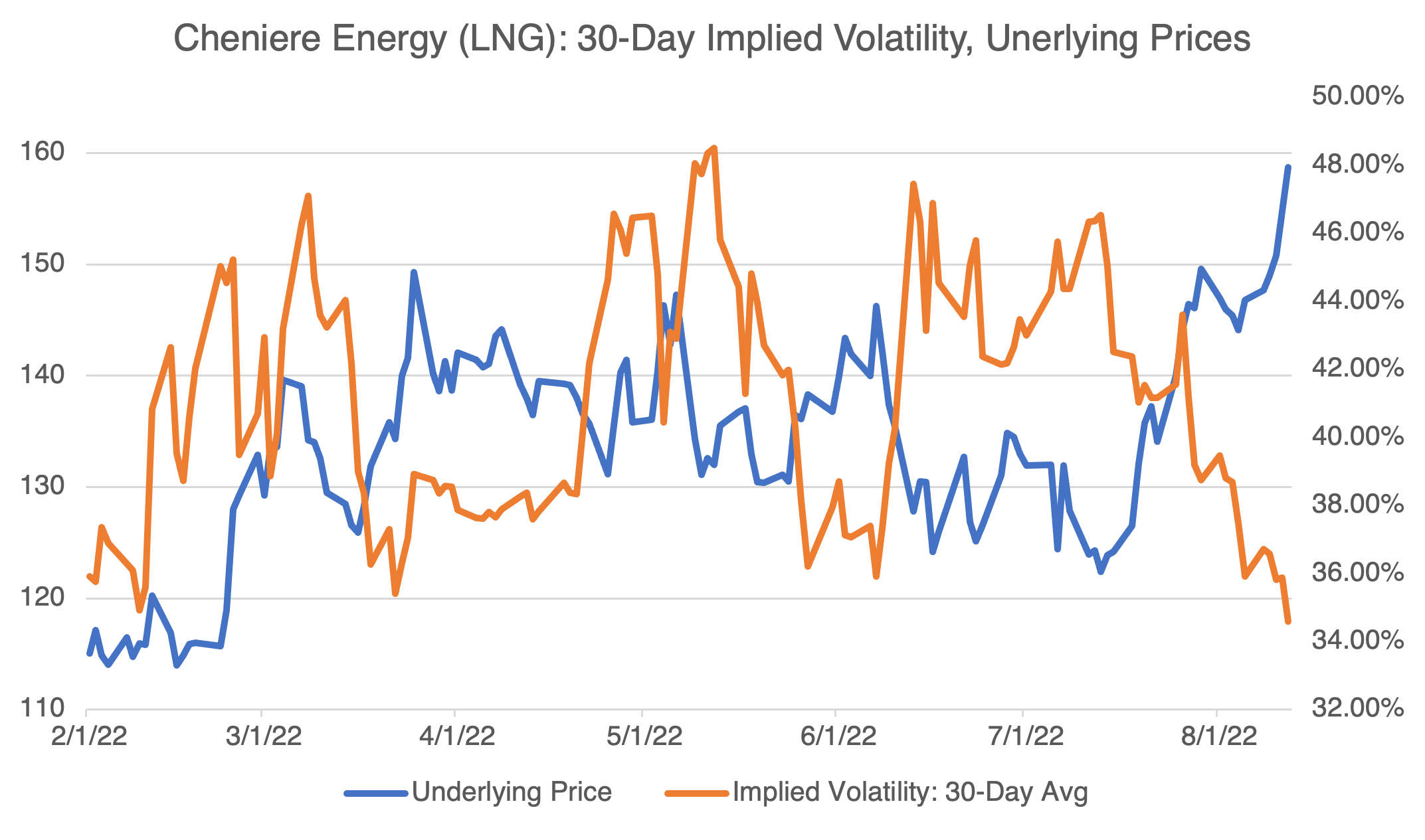

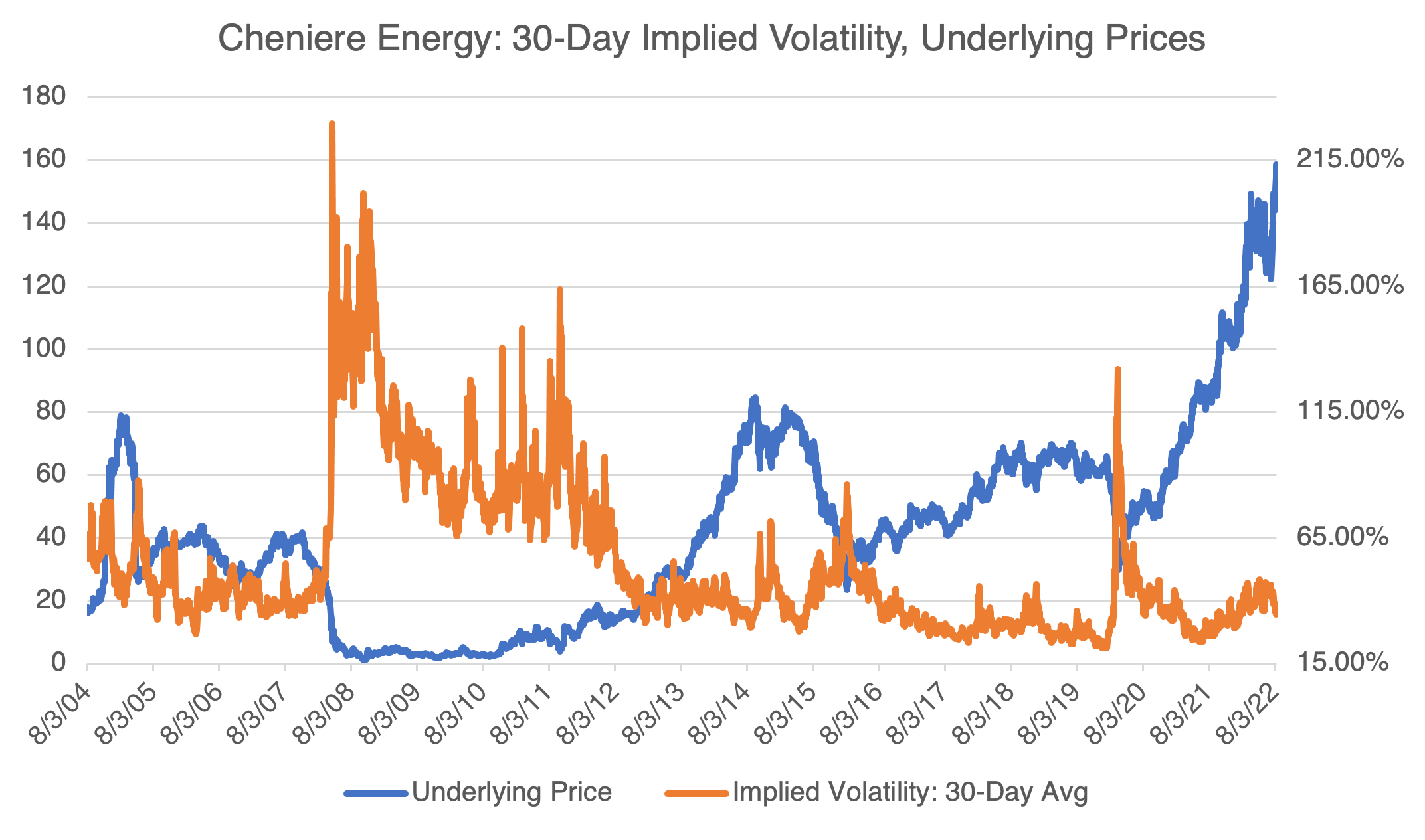

Most US investors don’t want to trade European natural gas futures for a variety of very good reasons. That’s where Cheniere Energy (LNG), the largest producer of LNG in the US and the second largest globally, comes in. I’ve written about the company before because of its interesting price and volatility action as a result of the Ukrainian war. As you can see from its most recent price and volatility action (below), LNG started its assent on when the war started last February.

Its implied volatility, however, has not followed suit. Like many stocks and commodities, its implied volatility generally moves inversely proportional to its price (i.e., opposite). The result is that, after finally making news highs, LNG’s implied volatility plummeted almost 10% from 44% to 34%. This makes its options relatively inexpensive compared to their pricing a few weeks ago. If you think that the European energy crisis can only intensify, LNG’s options could be the way to go.