The VIX: Ho Hum?

Last week, in Nvidia: Scary Stuff, I hinted that Nvidia’s S&P dominance might be related to the VIX. You might have noticed that the VIX has been boring (there’s no better word for it) and declining, slowly, since roughly 2023. Geopolitical tensions, surprising economic indicators, new highs, AI – nothing seems to get the VIX all that excited:

Source: OptionMetrics

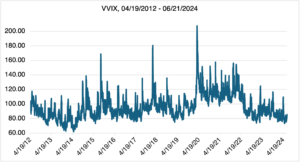

The VVIX, or the index that measures the volatility of the VIX (i.e., the vol of vol), has also been trending lower:

Source: OptionMetrics

The VVIX, or the index that measures the volatility of the VIX (i.e., the vol of vol), has also been trending lower:

Source: OptionMetrics

By any metric, the VIX is one sleepy market! Is there any reason to suspect that it might be getting ready to wake up? Nvidia and its tech cousins may hold the key to the answer.

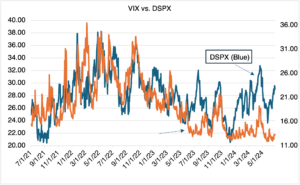

As Nvidia and the tech sector have rallied this year and easily outperformed the broad market, their performance in relation to other stocks in the index has expanded, or diverged. “Divergence” (very basically) measures the difference between an index’s return (in this case, the SPX) to that of its individual components. It may be viewed using the S&P 500 Dispersion Index (DSPX). Currently, because of the tech sector’s dominance (NVDA is up almost 155% ytd), divergence is historically high (see below). At the same time, implied volatility, as measured by the VIX, remains in the doldrums. Will this continue? Eventually, the spread between the two will narrow, either because divergence decreases or the VIX increases. Since betting on continued divergence has been a popular (and very crowded trade) on Wall Street for some time, it could get interesting when it finally reverses. In the meantime, however, ever increasing divergence is not budging the VIX.

Source: OptionMetrics

Out of the Money, And I Mean Really Out of the Money!

Here’s something that conspiracy theorists could really sink their teeth into. Last week, August futures options in silver and copper saw buying in deep out-of-the-money calls and puts. By itself, that’s not so strange. What was strange were the strikes: in silver, currently trading around $29.55, several thousand $75 calls and $12.75 puts were traded; in copper, currently around $4.41, 5300 $14 calls and $0.25 puts went across. Both occurred in the August contract, which has 58 days left until expiration.

I’m not sure the motivation here. If the object is to make a giant return from a super low investment (the “junk calls” strategy), you could also do that by selecting calls or puts much less out of the money that cost basically the same and have a much higher probability of success (but still very low). Maybe a meme stock trader read too much about how wild commodities can be and decided to give them a shot. Who knows — it’s hard to make the inherently irrational rational.

Practically speaking, I can’t imagine of an event that could take place in the next 58 days that could cause silver and copper to go so hyperkinetic that the strikes go in-the-money, or even close. But, for the sake of argument, let’s just say that such an event, however unlikely, did occur, and the options went in-the-money, or close to it. Does the buyer of these options really think that everything in the world will be just like before and that other markets and regulators will just go about their business while silver and copper either almost triple in price or crater into oblivion? No, obviously some event occurred that is so earth-shaking, so cataclysmic, and so unexpected that normal life will have transformed into something we can’t even imagine. But, good news — they will have their profits (assuming the clearing houses and banks are open and functioning) to barter for food! Be careful what you wish for!

And with that, I wish you all a Happy July 4th!