DeepSeek and Reality (And Not the Artificial Kind)

I’ve often written that the largest shocks to the market are those that come out of right field. Unexpected, they challenge accepted narratives and can change long standing fundamentals overnight.

Last Monday, we got just such a shock: with the sudden emergence of DeepSeek, the possibility of cheap AI suddenly turned the market upside down. Maybe you don’t have to invest hundreds of billions to get workable AI? And maybe US big tech isn’t as dominant as we thought?

And just like that, DeepSeek unraveled the AI trade that has dominated the market’s thinking since the introduction of ChatGPT in late-2022. Nvidia, who was kind of overstaying its welcome anyway, plunged 17%, taking the NASDAQ down with it by 3%. Even the AI-related trades, such as power producers and their favorite fuel, natural gas, came off hard. Similarly, uranium, which was supposed to power all those mini nuclear reactors powering all those data centers, dropped 7% (although it’s been declining since mid-2024).

Although some of DeepSeek’s claims have been questioned (a $5.6 million development budget seems questionable, to say the least), that doesn’t really matter. What does matter is that the conventional wisdom surrounding AI – massive development budgets, endless demand for electricity, and US dominance – has been challenged, convincingly. Although the AI market recovered somewhat over the course of the week, thorny questions still remain.

Was this the inevitable disappointment that sometimes follows overly optimistic expectations? Or was this really a “Sputnik Moment” as some have suggested, and represents a truly historic turning point?

As in most things, the truth is somewhere in between. AI will undoubtedly turn out to be a significant technological advance, with immediate productivity and efficiency gains in logistics, healthcare, finance, defense, and robotics. The long term implications of combining AI with quantum computing will be hard to fathom. But, it’s very hard to say what will happen between now and then. When commentators say things like “AI is the last invention humans will ever create,” “AI is the most significant discovery since electricity,” or “AI is going to change the world as we know it,” all of that is highly speculative and has very rarely been true of any previous invention. I remember similar claims being advanced about augmented and virtual reality, 3-D printing, personal transportation devices (e.g., the Segway), and others. None turned out to be significant (yet?), but all were accompanied by considerable “this is going to change the world” hype.

Whether you’re skeptical of the promise of AI or not, the fact remains that AI will remain a salient feature of the markets for some time. From an options point of view, the DeepSeek affair has revealed some interesting things about the implied volatility of two firms that have benefited the most from AI, Nvidia (NVDA) and Constellation Energy (CEG).

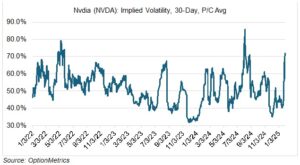

Historically, vol crush (the tendency for implied volatility to increase before earnings announcements and then decrease afterwards) dominated the trend of Nvidia’s implied volatility (see chart below). Last Monday was an exception: the DeepSeek announcement drove its IV up from 42% to 67%, a full 25 percentage points higher. That’s quite a move in one day, and reflects the massive amount of uncertainty that is now present. I suspect NVDA’s IV will decline over the next few weeks if the stock recovers or just moves sideways.

Constellation Energy (CEG) (see chart below), a national power producer and trader, was also a DeepSeek victim, declining an unhealthy 21%; it had been up previously 55% YTD. CEG’s implied volatilty increased to 65.7% from 52.2%, a full 13.5 percentage points higher. Unlike that of NVDA, its implied volatilty has been increasing since it started rallying from $223.71 at the end of last year to peak at $347.44 (a new all-time high) on 01/24, the day before the DeepSeek announcement.

What does CEG’s IV vs. price movement indicate? That the market was getting increasingly uncertain and anxious regarding CEG’s rapidly increasing stock price. Sometimes, you can use implied volatilty to help determine the market’s sentiment regarding an individual stock. It’s certainly not foolproof, but another factor to consider.

Is Technological Change Increasing?

The hyperbole accompanying AI and DeepSeek got me thinking about the generally accepted notion that the rate of technological change is increasing, especially over the last few decades. Here’s what Google AI has to say about it:

“Yes, according to current trends, technological change is significantly increasing, with the pace of advancement accelerating compared to historical rates; this is evident in the rapid development of fields like artificial intelligence, robotics, and the Internet of Things, leading to transformative impacts across various industries and aspects of life.”

But is this really true, or is it just another example of recency? Think about it. Someone born in 1880 and who died in 1960 saw the advent of electricity, widespread indoor plumbing, automobiles, airplanes, nuclear energy, antibiotics, skyscrapers, air conditioning, radio and movies, refrigeration, household appliances, the transistor and integrated circuits, and digital computing. And, that’s not to mention two world wars, a deep and long-lasting worldwide depression, and the transformation of the US from a largely agrarian society into a global superpower. By way of illustration, imagine if that same person went to sleep in 1880 and woke up 80 years later in 1960. They would be at a loss to recognize or operate most things and would be completely bewildered.

Compare that to someone born in 1960 who is still living today. This person witnessed the widespread adoption of computers, consumer-friendly software, cel phones and smartphones, the internet, and frequent and universal air travel. With the exception of the internet, all the others existed in one form or another before 1960. Advances since then have been more a matter of refinement and increased productivity and convenience than actual invention. Conduct the same thought experiment as previously: imagine if this person went to sleep in 1960 and woke up today. With the exception of smartphones, the internet, and personal computers, they would recognize almost everything. Sure, things would look different and they would be unaccustomed to the controls, but they would know what they do and would quickly figure out how to operate them. That’s in marked contrast to the 1880 to 1960 period, in which the person wouldn’t even know what these things were, much less how to make them work.

Given this comparison, maybe our parents, grandparents, and great grandparents witnessed more technological change than we have. Keep that in mind when proponents of AI say things like “AI is the most significant discovery since electricity!” Perspective always matters.