Europe. Bring a Good Coat, Maybe!

The gathering storm in Europe is even more serious than when I last wrote about it a few weeks ago. EC energy ministers are getting together this Friday to discuss various measures to lower natural gas and power prices while maintaining adequate supplies. Good luck — supply and demand can be a real bitch! Price caps, new market designs, suspending the exchanges, government subsidies — they’re all on the table. When politicians start talking about evil speculators manipulating markets, you know that intervention or some short term “fix” is coming. Given the choice between a cold populace facing 4-digit utility bills in the dark and pissed off traders, politicians will go for the former every time.

Europe is facing several economic crises at the same time — soaring energy prices, inflation, a sharply higher dollar, and supply chain disruptions — some emanating from the lingering effects of the pandemic, but most from the Ukrainian war. I suspect that given a little luck and mild winter weather, they will skate by. But there’s another alternative that isn’t getting a lot of attention, namely a ceasefire. Here’s the idea: the war isn’t going exactly as planned for Putin and maybe he’s decided to use his energy hammer to get favorable cease fire terms. Something like, “I’ll give you your energy back and you can go back to normal, but you have to look the other way when we permanently occupy parts of Ukraine. We can both declare partial victory and move on. Deal?” For the Europeans, they get to extract themselves from an energy crisis that is infinitely worse than they thought when they first signed on to oppose the war. I suspect for most people there, the Ukrainian war is, as Neville Chamberlain put it in 1939, “a quarrel in a faraway land between people of which we know nothing.” In other words, now that we’re cold and broke, it’s time to cut a deal. For Putin, he also gets to extract himself from a sticky situation with no end in sight and all his friends get to have their yachts back. Of course, this assumes that he’s rational and getting unbiased information — both debatable. He might just be really into higher energy prices and nationalistic pride and is in no big hurry. Who knows?

Unexpected, out of the blue news affects the markets to the greatest extent. Traders can adapt to what they know and can read about. It’s the “unknown unknowns” — sudden war, pandemics, any significant change — that cause the most violent moves. When they do happen, it’s amazing what can happen in a very short time. The current press line on the Ukrainian war is that it’s a back-and-forth slog with no end in sight. But what if — just if — a cease fire came out of nowhere? Or if it comes out that the Russians and Europeans were secretly meeting to hammer one out and they were pretty far along? Energy prices would plummet, inflation wouldn’t be an issue anymore (in the short term), the dollar would spike down, and worldwide equity markets would rally hard. Yes, it’s a long shot, but it’s the stuff that serious returns are made of, especially when options are employed.

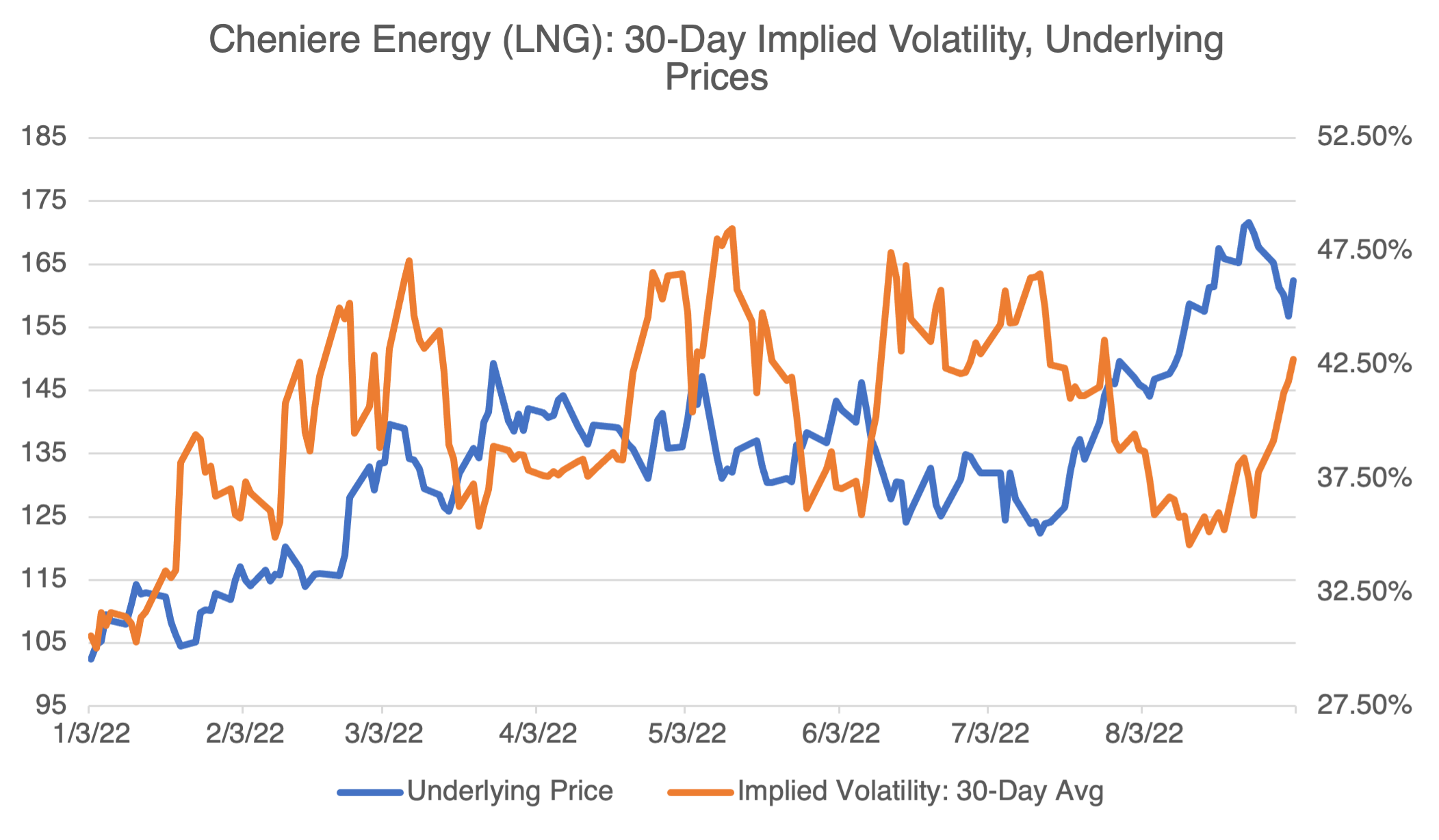

I wrote about Cheniere Energy (LNG), the world’s second largest producer of liquified natural gas, a few weeks back. As long as Europe needs gas, and it needs it bad, LNG should hold up. The problem is that at current price levels, it needs a steady stream of bearish energy news to make new highs. At the same time, it could be very vulnerable to any loosening of the energy situation in Europe. Its implied volatility has increased lately as the mainstream press has become more focused on the woes of Europe. I’m usually not a giant fan of medium to long term straddles or strangles, but LNG could be a good case for one.

(Source: OptionMetrics)