2023

To begin, a healthy, happy, and prosperous new year to one and all! I’m going to start the new year by looking back at some stocks I covered in 2022 and see if we can learn anything from them.

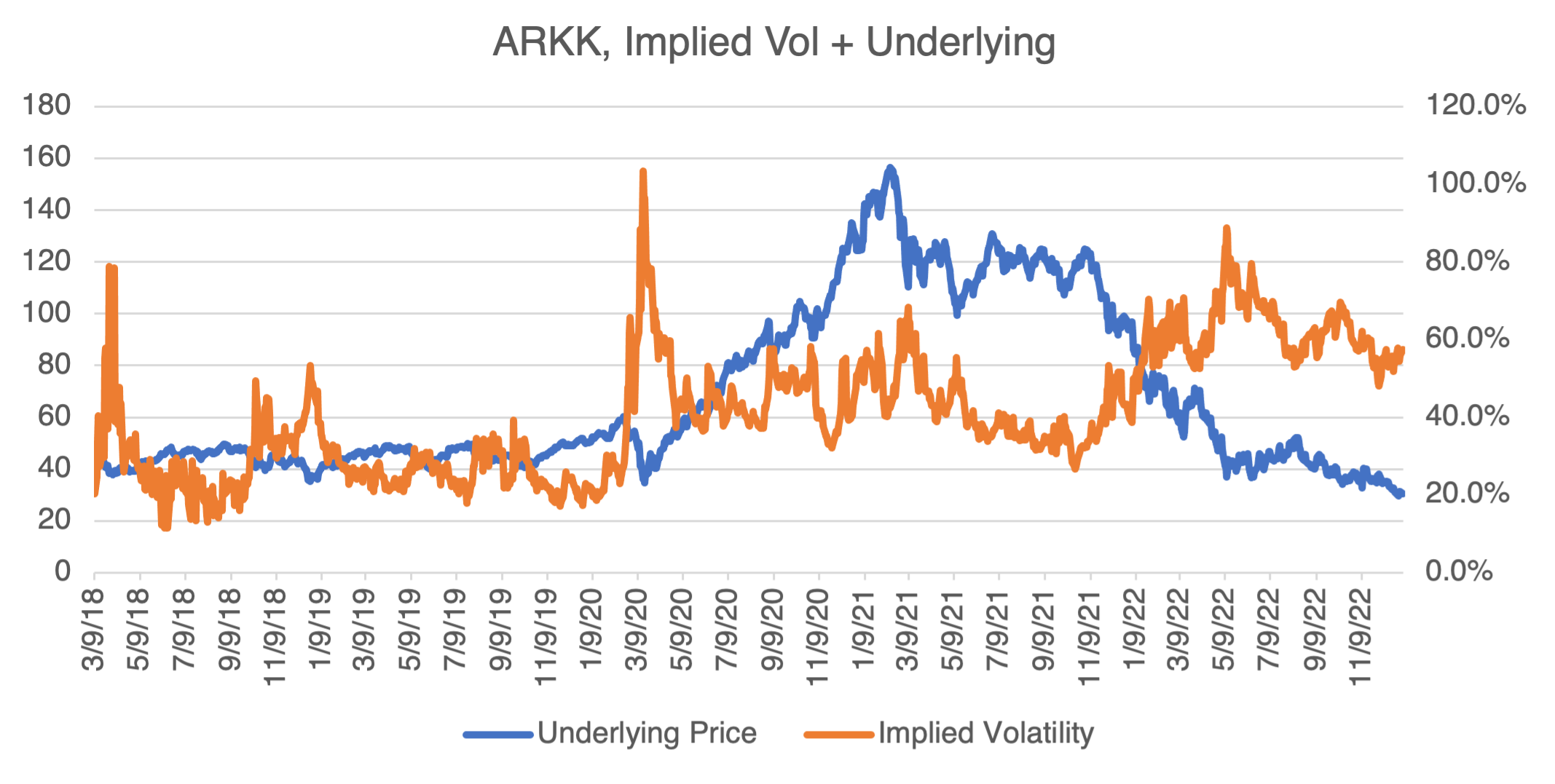

Tech Wreck ’22 has not been kind to Cathy Wood’s ARK Innovation Fund (ARKK). As I wrote last June (ARK Just Ain’t What It Used to Be), “After a blazing 2020, 2021 returned a worrisome and negative 23.4%, that in a year in which the S & P returned a positive 27%. So far, 2022 has been a disaster, with ARKK down 55.1% ytd.” Well, it hasn’t gotten any better since then — the ETF was down almost 68% for 2022. At its peak, ARKK commanded over $28 billion in assets; now it’s down to about $6 billion. You usually don’t see ARKK mentioned as a Pandemic Darling, but you should.

Now what? Well, if you invest in ARKK, you’re investing in Cathy Wood’s financial vision and slavish devotion to growth stocks. Despite the rotation away from growth stocks that started in 2021, ARKK’s composition and trading strategy has not really changed. Like many traders who double down, the logic goes something like this: “If you liked it at $10 bucks, you’re gonna love it at $5 bucks! One of the characteristics of long term successful traders is that they are flexible and not married to any strategy or position. As the market changes, they change. Failure to do will result in an inconsistent “boom or bust” return profile, just like ARKK.

If you’re intent on playing ARKK from either the short or long side with options, implied volatility is currently trading in the mid-50% region and will tend to increase as ARKK declines (increased uncertainty) and stay steady to decline as it increases (decreased uncertainty).

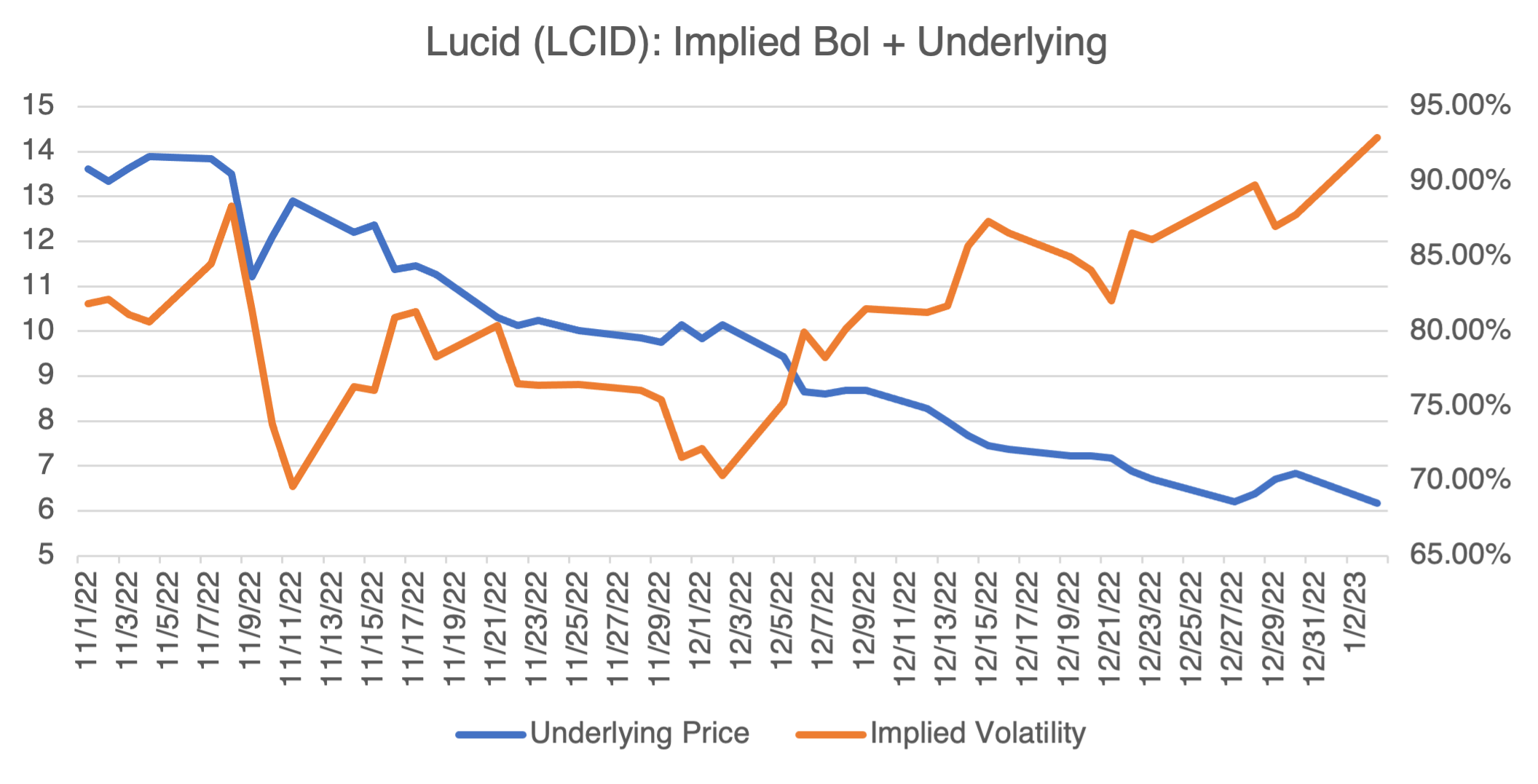

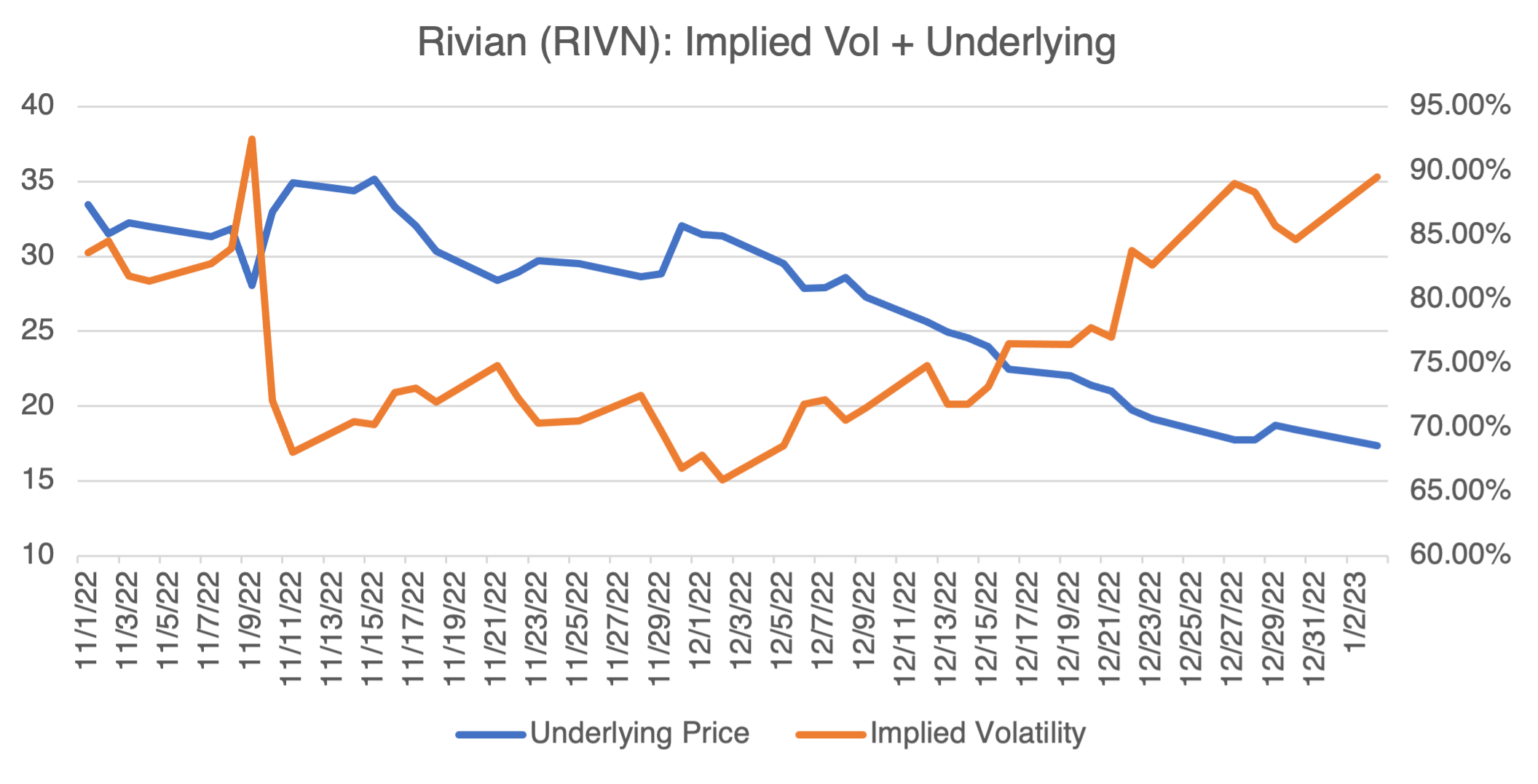

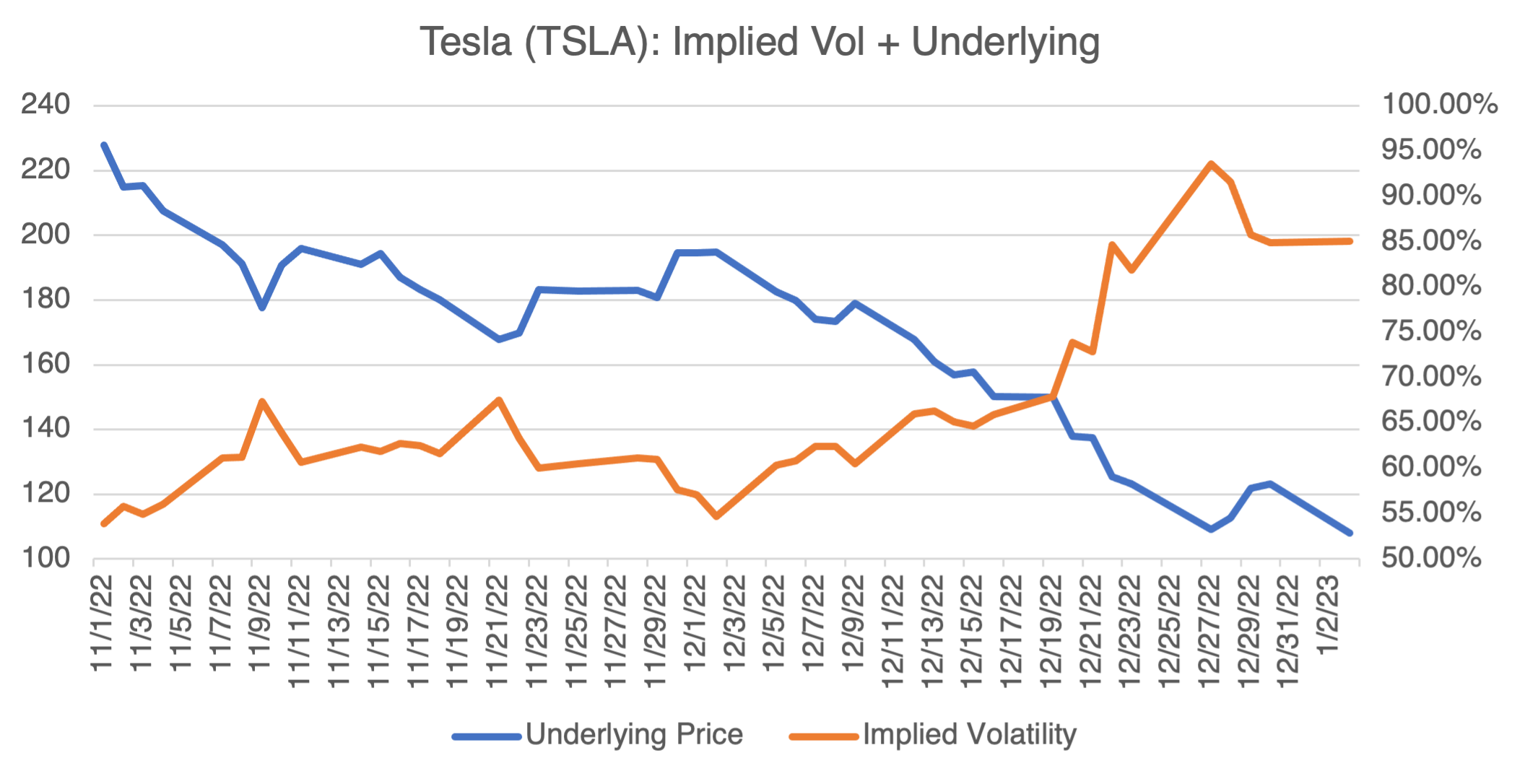

One of Ms. Wood’s favorites has always been Tesla, whose precipitous slide has taken down its various wannabe rivals, such as Rivian, Lucid, and Lordstown. In my roundup of small EV producers last November (More Teslas?), I noted that bringing a new car model to market, much less one with brand new technology, is extremely capital intensive and operationally difficult, even for established auto makers. As I wrote, “__The success or failure of the EV startups featured below will hinge on their ability to manage their cash balances and attract new capital while production is ramping up and revenue isn’t coming in.” Tesla’s troubles are certainly not helping matters.

If you’re trading options on TSLA or any of the EV startups, they are displaying a common phenomenon: volatility increases as the underlying decreases. This is not a minor effect and crucial to understand if you want to be successful trading options. Since the price slide of end-November, implied volatility has shot up 39 percentage point for Tesla, 24 for Rivian, and 23 for Lucid. If you think a recovery in these stocks is imminent, beware: the upward trend in implied volatility will reverse as prices increase, significantly decreasing option valuations.

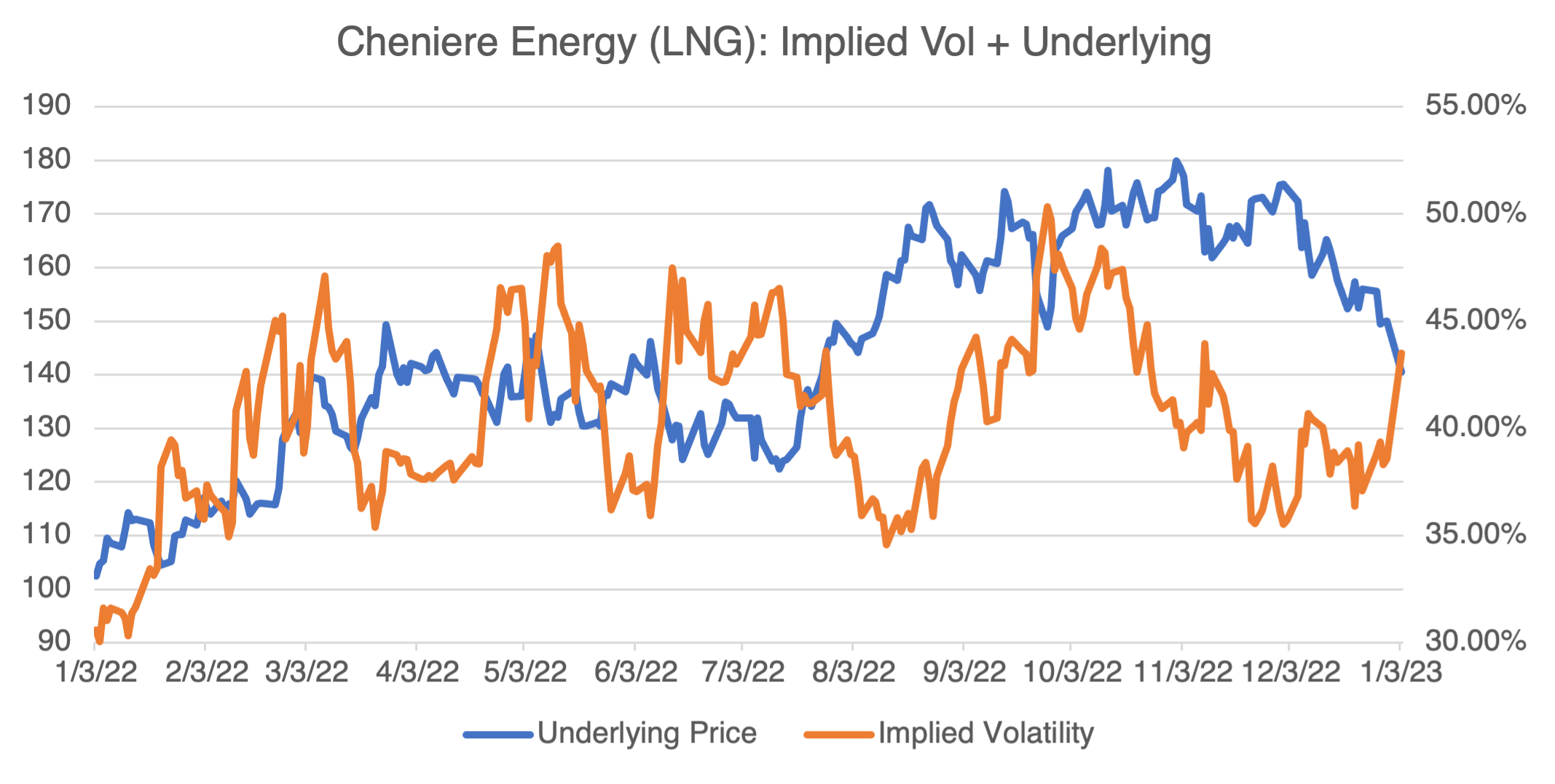

In December, I wrote about Cheniere Energy and some different option strategies to take advantage of the changing international situation in natural gas and LNG (Visual Greeks and LNG) and (Straddlers Beware):

1) If you believe that the mild European winter has relieved their energy crisis, then it follows that LNG might break out to the downside of its $148.95 (09/26/22) – $179.86 (11/01/22) range that’s been in place since last summer. In that case, uncertainty regarding the stock’s future price direction will likely also increase, driving implied volatility higher. If both of those events occur, then there’s no reason to get too fancy — a simple put will suffice. We reviewed this strategy and its related greeks last week.

2) Since LNG has been in a trading range since last summer, you may conclude that it will either stay within the range or finally break out. In that case, straddle or strangle strategies may be appropriate.

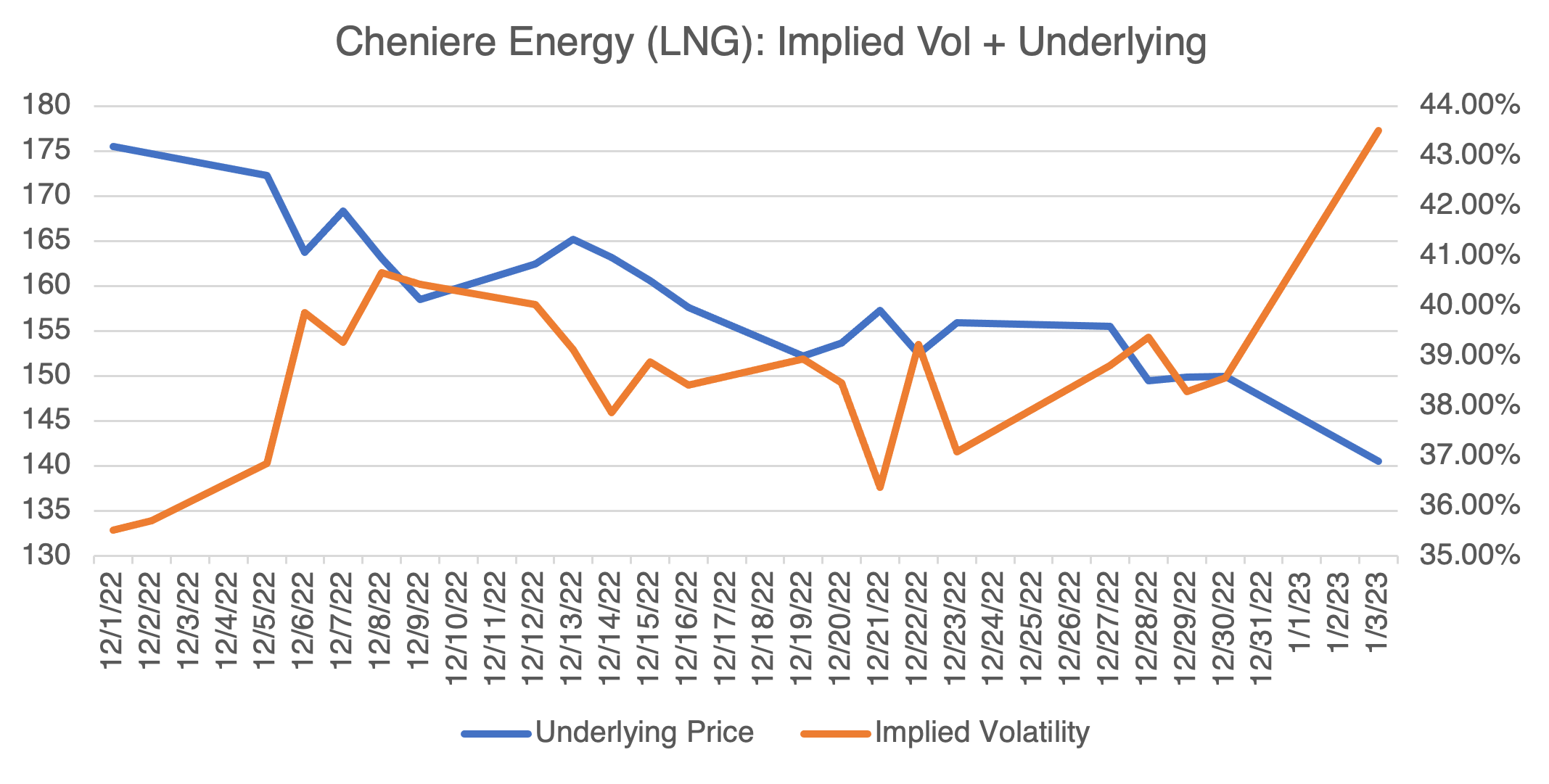

Since then, and on the back of lower natural gas prices, Cheniere has indeed broken out to the downside, taking out the low of $148.95 from last September 23. Consequently, implied volatility has jumped about 5 vol percentage points, up to about 43.5%.

Price and vol since November 1:

How did the three strategies I analyzed last time work out?

1) Jan ’23 $150 put @ $4.75.

2) March ’23 $155 straddle @ $23.55

3) March ’23 $145 put/ $180 call strangle @ $10.60.

The results are very instructive, and I’ll go over them next blog! If you can’t wait, try building them in our options profit calculator to see how they turned out.