Supercharged ETFs

Single stock ETFs have come into vogue.

What is a single-stock ETF, exactly? As is obvious from the name, it’s an ETF that is based on a single stock, but whose performance — and here’s the key — has been supercharged in one direction or the other. For example, Nvidia (NVDA) has several single stock ETFs with performance and risk characteristics that can suit just about any market view. Super bullish? Then the GraniteShares 2X Long NVDA Daily ETF (NVDL), may be for you, providing twice the return of NVDA stock itself. Less adventurous? Then NVDS, with just 1.25X leverage, may be the ticket. Super bearish? We’ve got you covered: NVDQ, which is 2X inversely levered, should appeal to the most ardent NVDA bears (are there any left?).

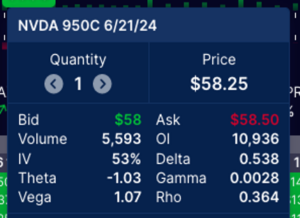

If you’re feeling lucky and want even more juice, then there are options available on single stock ETFs. Like all options, they are valued using the implied volatility of the underlying, in this case the ETF itself. Notice that the implied volatility (IV) of the ETF will follow its leverage, i.e., the ETF IV should be about the IV of the stock multiplied by the ETF leverage ratio. For example, if the IV of NVDA is trading 53%, then the IV of NVDL with 2X leverage should be about 2X higher, or about 106%. Notice I say “about” — in this case, NVDL is trading 104% (see below). The ratio between the two IVs can vary from the multiple, sometimes significantly, for a variety of inscrutable reasons. Regardless, not only is the underlying return profile highly levered, but so are the options’ implied volatilities. If you are getting the impression that the more levered variety of single stock ETFs are not for the faint of heart, you are right.

Source: OptionStrat

A cautionary note to the DIY crowd: of course, you could create the same or similar performance characteristics by combining one or more off-the-shelf derivatives and save the ETF fees (which are deducted from the fund’s NAV). After all, that’s what the ETF providers are doing. But the do-it-yourself option involves taking the time to figure out the exact combination of products that will produce the same return profile, executing all of them more or less simultaneously, constantly rebalancing and maintaining leverage as the market moves, and an ongoing stream of commissions and bid/offer spreads. In other words, it takes a lot of time, effort, and expertise. Trust me, let someone else do it for you.

Let’s Bet on Everything!

A related observation on single stock ETFs. You might have heard that a few weeks ago, the Commodity Futures Trading Commission (i.e., the CFTC, the regulatory body that oversees futures products and markets), proposed new regulations aimed at controlling (some say banning) event contracts, i.e., derivatives tied to elections, sports, award shows, and just about anything. Such contracts have been around for a long time but have been trading since 2021 on an organized exchange, Kalshi, which describes itself as “the first regulated exchange where you can buy and sell contracts on the outcome of events. Contract prices reflect the view of traders as to the chances of the event happening. Each contract is worth $1 if you’re right.”

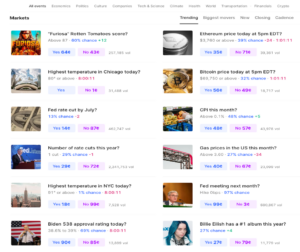

Below is a pretty representative screen shot from Kalshi’s site. As you can see, the variety of bets is almost endless and it’s very easy to spend hours looking at them all.

Source: Kalshi

If you’re wondering why regulators allows highly levered single stock ETFs, 0DTE options, crypto tokens, and online sports betting, but want to highly regulate, or even ban, event contracts, you’re not alone. In this case, the majority of the CFTC commissioners were concerned that political event contracts (i.e., betting on election results) could be abused or manipulated and thereby affect election results. Personally, I’m not sure how that could happen, exactly, but I get their drift. Regardless of the specifics, the real argument that regulators must face is whether event contracts serve any legitimate risk management function, or are really just gambling contracts spruced up to resemble futures. The line between gambling and investing seems to be getting thinner and thinner. More on this next week.