Safe Havens?

On Monday afternoon, I had this week’s blog, an update to last week’s piece about crude oil, almost completed. And then the truce was announced, and it was back to the drawing board. Crises seem to be happening more often, but getting shorter. I’m honestly not sure whether that’s good or bad!

When the Israelis started bombing Iran a mere two weeks ago, it would have been a very hard sell to convince crude traders that oil would soon be making new short-term lows as a result of the war. Most, including me, were looking at the exact opposite, a possible explosion over $100. That didn’t happen, and unless the truce completely blows up, it’s not going to in the near future. At the same time, if there is one thing that the last two weeks demonstrated, it’s that things can change very rapidly, and especially if the President is involved. Low probability events might not be as unlikely as everyone thinks.

One thing that is not going to go away anytime soon: geopolitical risk, and the financial turmoil that usually accompanies it. Previous blogs have highlighted that the Economic Policy Uncertainty Index is at all-time highs, even higher than during the Great Depression. In light of this, the need for safe havens is greater than ever. Uncertainty is king.

Gold is most often described as the King of Safe Havens. More recently, bitcoin (“electronic gold”) has also been said to be a hedge against geopolitical turmoil.

Are either claims true?

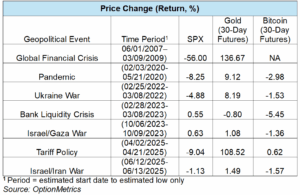

To find out, we conducted a simple analysis of gold and bitcoin returns relative to the SPX during several recent geopolitical and financial crises, starting with the most severe, the financial crisis of 2007-2009 (see table below):

As you can see, gold is in fact a good hedge against the SPX during periods of extreme crisis. In fact, it outperformed to the upside during the periods analyzed above. Note that this describes its hedge effectiveness during geopolitical or financial crises, not against inflation. That’s related, but a topic for future analysis. Also please note that hedge effectiveness is a long-term concept; on a daily basis, there could be days in which the hedge goes in the same direction as the other asset.

As for bitcoin (and sorry for all you superfans out there), it did not act as an effective hedge during the periods reviewed. As a matter of fact, it mostly correlated positively with the SPX, i.e., both the SPX and bitcoin moved in the same direction. Perhaps another crypto asset would do better, but it’s doubtful. Bitcoin is many things, but it’s not a good crisis hedge.

Great Market Acronyms, Version 3.0

TESS: Trump Enjoys Surgical Strikes. Due to recent events, it seems that TACO might have to be retired (at least for now). TESS is the updated version, but I suspect it will also have a short shelf life.