Memes are Back

Apparently, trading by individual investors is still going strong. Although it seems that most have moved on from their dreams of trading full time, some have rekindled their passion for that Holy Grail of day traders, meme stocks.

Tupperware (TUP) and Rite-Aid (RAD) are the latest unlikely names that have suddenly become meme stock superstars. Before it went bankrupt, Yellow (YELL) was also in the latest mix. As is the case with many memes, both companies involved this time are almost dead or running on fumes. Frankly, I thought Tupperware was more of a household name from the 50s and 60s, like Kleenex, than an actual product or company (I remember my mother thinking about throwing a “Tupperware Party” as a possible side hustle). And as for Rite-Aid, the one where I live gives off a distinct “Soviet Union-in-the 80s” vibe, complete with empty shelves, depressing florescent lighting, and indifferent staff.

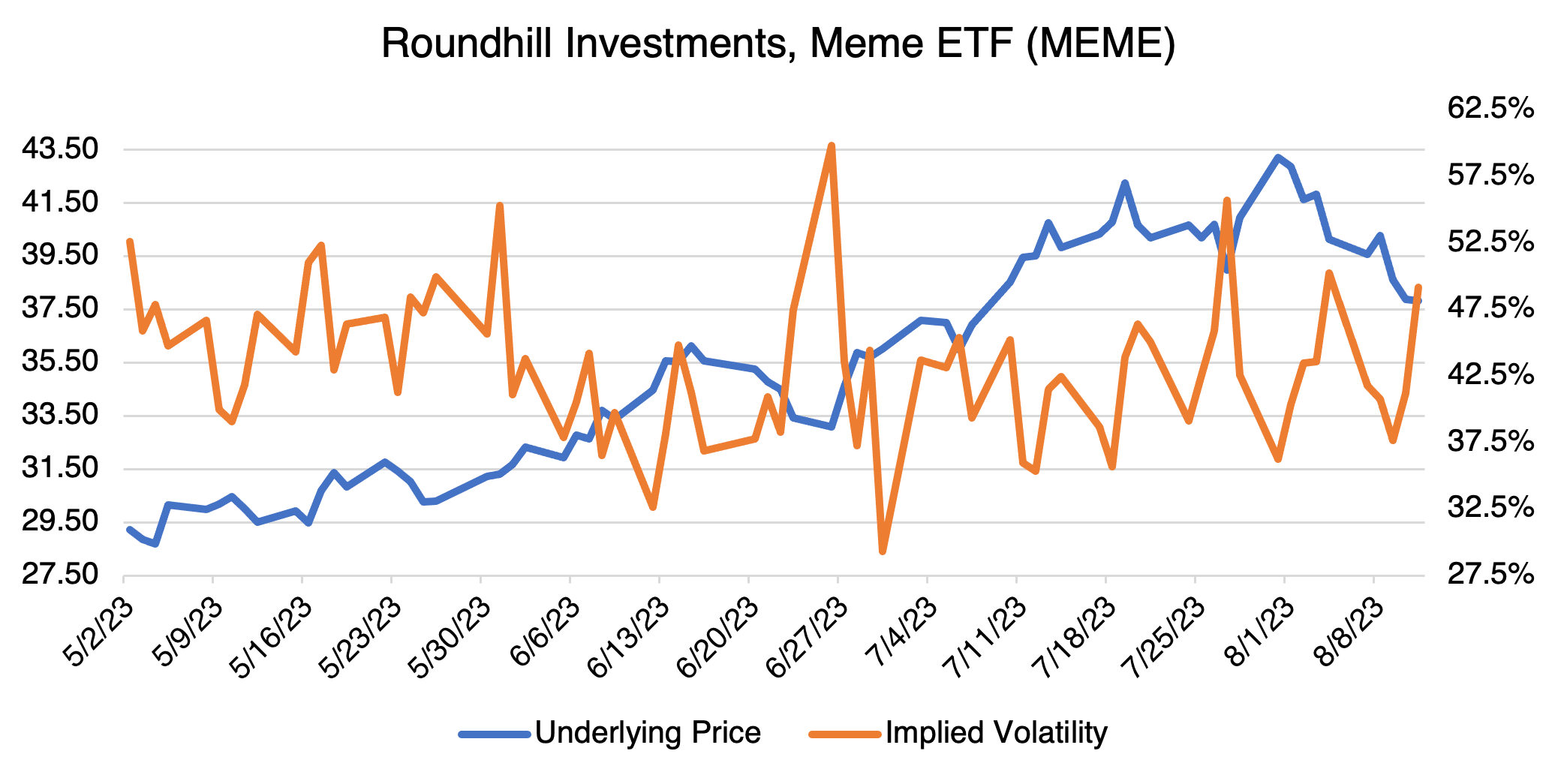

Rite-Aid and Tupperware are considered meme stocks, although that exact definition is kind of hazy. Most are beaten down companies with seemingly hopeless prospects that are suddenly “discovered” on social media. Other characteristics can include high short interest (the number of shares that have been sold short over the total available for trading, or “float”) or increased social media activity. They usually have good name recognition and business models that are easily understood. Not all are in immediate trouble. For example, an ETF that tracks a variety of meme stocks, MEME, includes such mainstream names as IBM, Mattel, and Delta. In that regard, MEME is probably less “memey” than it seems(chart below), and is doing quite well this year with an almost 48% return YTD.

In the case of classic meme stocks (e.g., AMC, GME, BBBY), their fundamentals are less important than their volatility and momentum, as investors rush in to make a quick score before attention shifts elsewhere. If the trade does happen to work out, traders receive double or even triple digit returns and get to brag to their friends and family. If the trade fails, then everyone is quick to forget and chalks it up to bad luck, bad advice, or inscrutable third parties (i.e., the evil hedge funds).

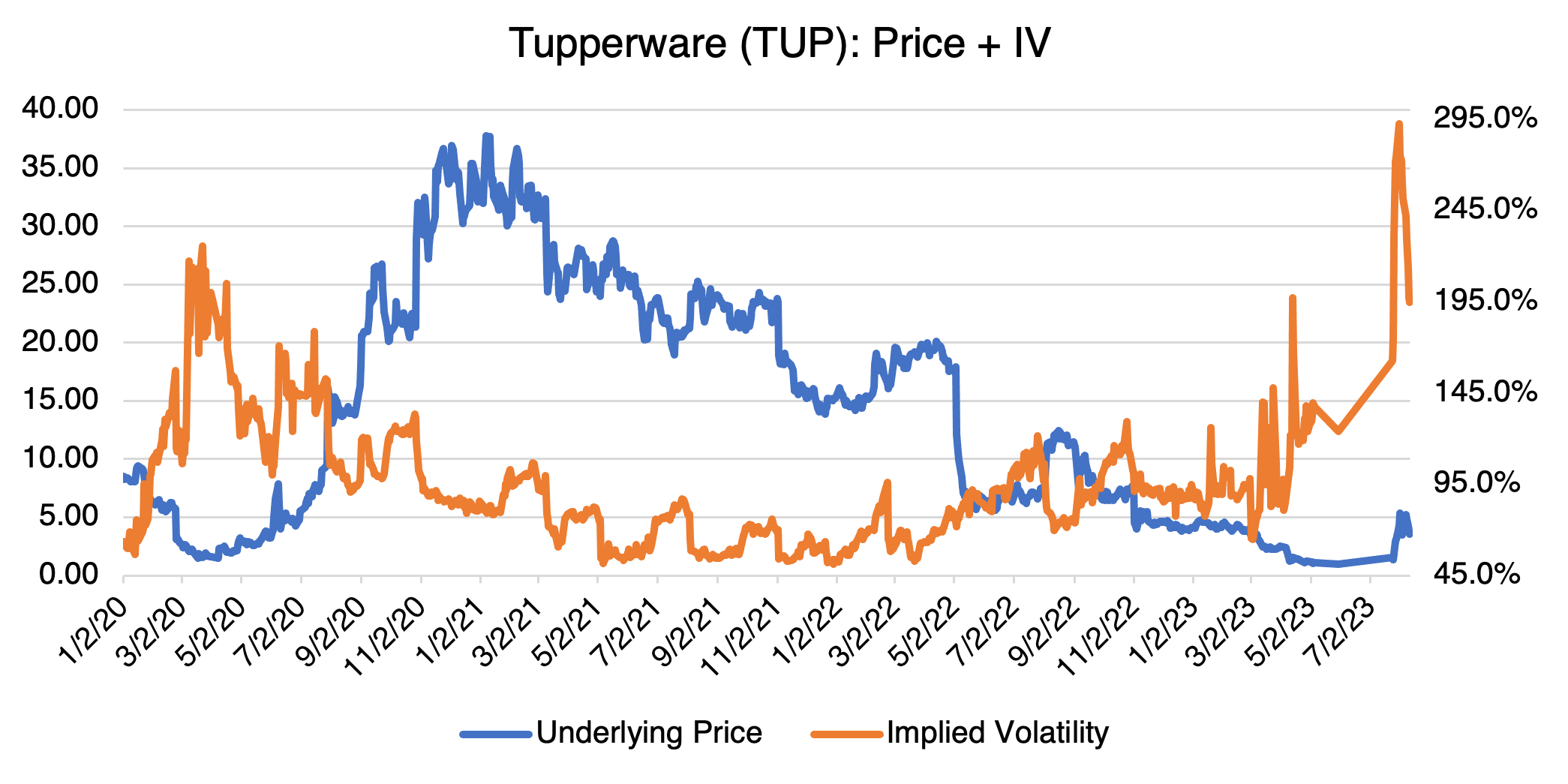

Take Rite-Aid and Tupperware. Both stocks were happily sliding into oblivion until they were transformed into the latest memes. Rite-Aid is swimming uphill with expensive long term debt, decaying fixed assets, legal issues, and $1.5 billion in accounts payable. Tupperware faces a similarly bleak future, announcing last April that “there is substantial doubt about its ability to continue as a going concern.” No wonder. TUP suffers from unremarkable products, an outdated selling method, and increased competition. Both RAD and TUP share the same depressing story: companies that failed to adapt to increased competition and life in the 21st century.

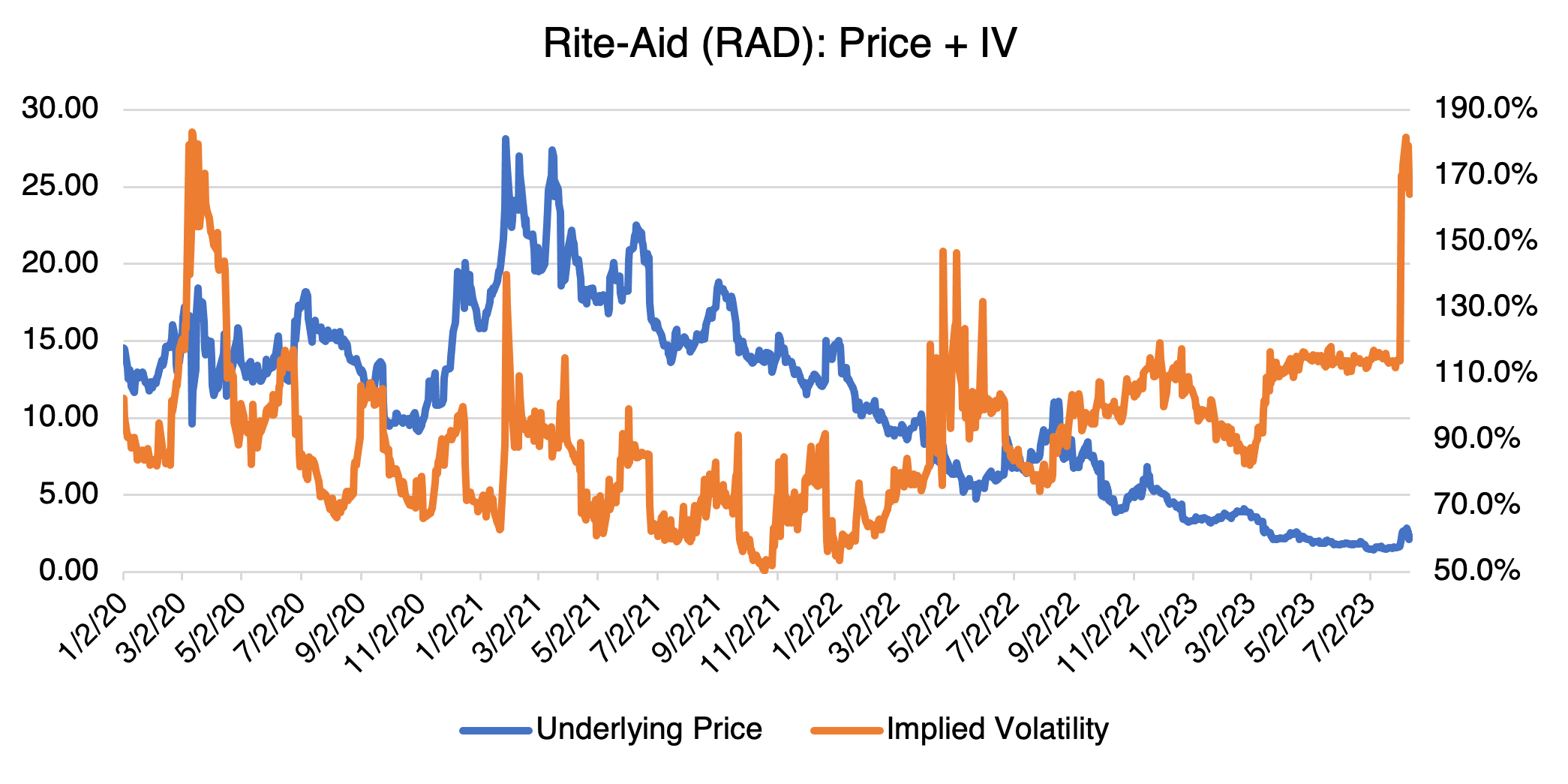

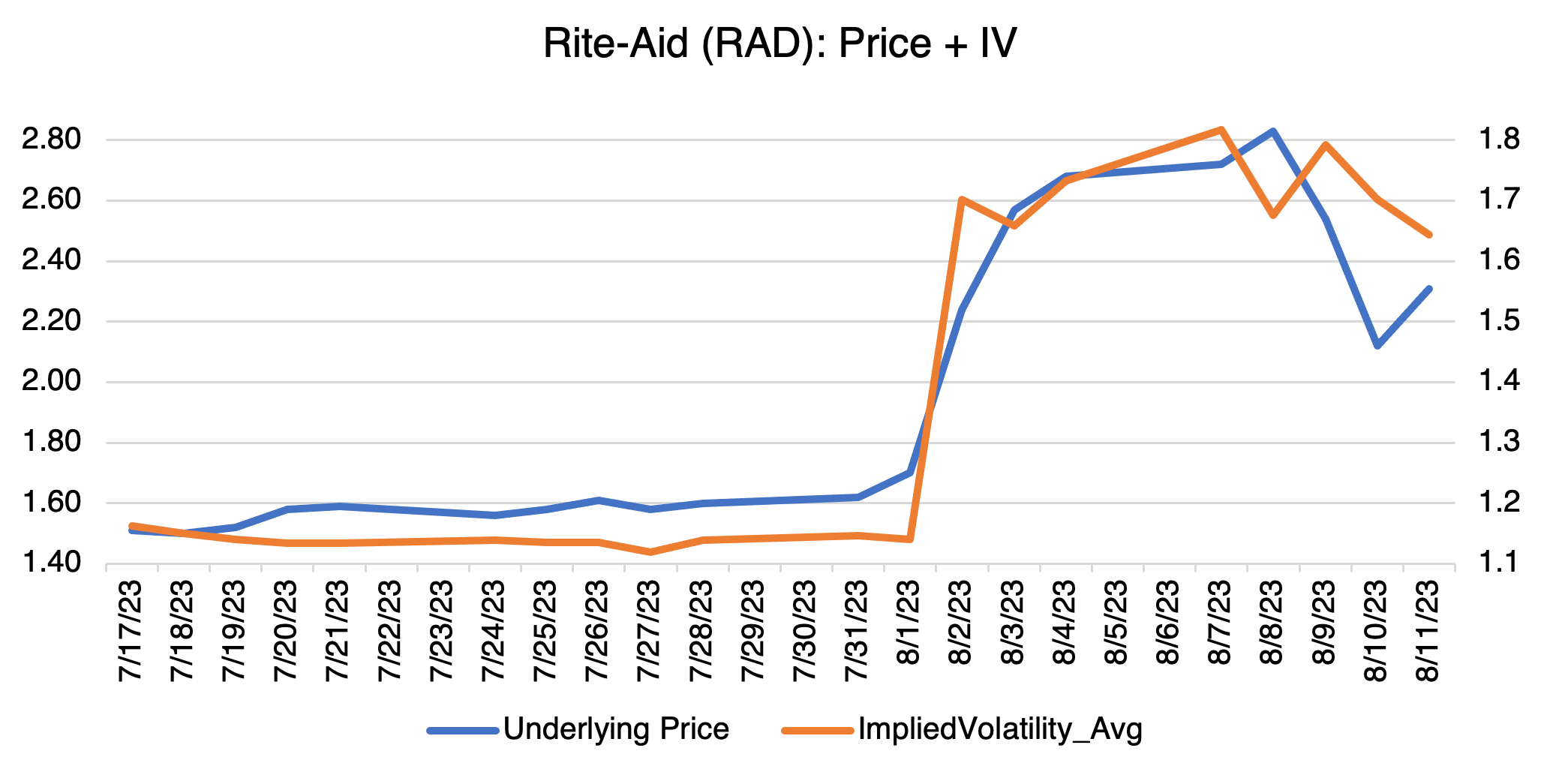

No one would seriously argue that their fundamentals aren’t apocalyptically bad. So why have they rallied? Because in the Meme Stock Playbook, fundamentals don’t really matter when you’re trying to precipitate a short squeeze. The thinking is simple: run the stock up high enough and the shorts will eventually panic, causing a volcanic rally. The strategy isn’t exactly new and is possible in any market that allows short selling. Modern examples are Volkswagen (2008), Herbalife (2012), and of course, GameStop (2012). Traders are hoping for the same thing for RAD and TUP, encouraged by short interest ratios of 23.7% and 30.5%, respectively. So far, it hasn’t really worked; both stocks have declined since the original bump, taking their ridiculously high implied volatilities with them (see long and short term charts below).

Meme stock traders often use “cheap” deep out-of-the-money options as their instrument of choice. With low dollar value and explosive upside potential, they are tailor made for this purpose. But, as I’ve pointed out numerous times in previous blogs, caveat emptor: the options may be cheap on an absolute dollar basis, but certainly not when you take into account their implied volatility, and by extension, their probability of success. That’s not to say that you can’t make money on stocks like these, just that the odds will be stacked against you.

Again, implied volatility is not just a technical concept for option geeks. In the case of RAD and TUP, in both cases IV almost doubled as the stocks unexpectedly rallied. That’s great if you’re long out-of-the-money calls, as they will roughly double in price from the volatility effect alone. But the opposite can also be true — IV will shrink if the rally sputters or takes its time to develop. That’s what these stocks are seeing now, with both RAD and TUP implied volatility starting to come off. The explosive rally has failed to occur, and their volatilities are reflecting that fact. With their prices failing to rally as well, that’s a double whammy to anyone holding long options. Something to keep in mind if you’re going to play the meme stock game.

Trading meme stocks like RAD and TUP is fine as long if you’ve a) designated part of your portfolio for short-term, super spec trades, with strict limits, b) plan on losing all or most of the investment, and c) don’t let the memes take over your online and real life. In other words, don’t go nuts and don’t bet the kids’ college fund. Just like sports betting, it can be kind of fun and exciting. But, don’t take your eyes off the prize — finding stocks that take advantage of long term technological change. That’s how you build generational wealth. More on that next week.