Nominations May Not Tell the Tale

This is my last election-related blog, promise!

It’s been two weeks since Donald Trump won the presidency again, and he’s wasted no time selecting cabinet nominees. As is his habit, the picks have been surprising, unconventional, unpredictable, and, in some cases, controversial. Certain sectors, such as defense, pharmaceuticals, energy, and crypto, have been buffeted by the ramifications of the president-elect’s selections. Let’s try to separate out short-term noise from realistic long-term effects.

A note of warning to begin. Investment strategies based on what the government has done, might do, or hasn’t done can be very treacherous. Why? Because the government is unlike any investor and can operate under some unique rules.

First, the US government has an endless supply of money and a long time horizon, both much greater than that of any investor. It doesn’t have the hard discipline of a daily P/L to force liquidation or a change in investment strategy. That’s because the government doesn’t have to make money; its goals can be socially necessary or politically motivated. Second, the government can be fickle, and its support can change overnight as political fortunes wax and wane.

And third, the government can pick the wrong horse spectacularly and still survive. Case in point: Intel (INTC), down over 45% over the last year, despite more than $20 billion in government support from the 2022 Chips Act and endless cheerleading from the Biden administration. Compare that to Nvidia (NVDA), up over 175% over the same period, or even SPY, up over 29%.

With that in mind, let’s review the four sectors that have been most affected by the new policies and regulations that may come along.

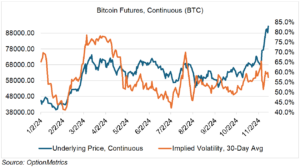

First up, crypto and Bitcoin (futures ticker: BTC). Trump’s support of the crypto industry is well known and was featured in his campaign. His election, as well as the impending departure of regulators and representatives highly critical of the industry, has led supporters to believe that a new Golden Age of Crypto is about to begin. Since election day, bitcoin is up over 33% and over 105% year to date.

Interestingly, bitcoin’s implied volatility has not increased in sync with its price. Instead, it has decreased 8.1 percentage points, or 12.4% since election day. BTC rallies are usually accompanied by increased implied volatility, not decreased. Apparently, and despite the fact that the practical use case for crypto as a medium of exchange or alternative national currency is still debatable, investors are convinced that this time is different. We shall see.

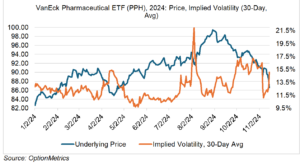

Second, Pharmaceuticals. Who would have thought that a conservative, pro-business president-elect would nominate someone to head the Department of Health and Human Services whose views are usually associated with the far left. RFK, Jr.’s controversial views on vaccines and weight loss drugs, as well as his criticisms of the pharmaceutical and agribusiness industries in general, are obviously bearish in the short term for drug companies. Understandably, investors have been running scared. The VanEck Pharmaceutical ETF (PPH) has declined 3.3% since the nomination, and its implied volatility has increased a full 3 percentage points, or 25% (see below).

Before selling the sector, investors should keep two things in mind. First, many of RFK Jr.’s views do not sit well with the Republican establishment; his confirmation is anything but a sure bet. Second, the wide-ranging changes he envisions will be difficult to implement in a bureaucracy composed of over 83,000 employees operating out of 13 divisions and subject to some of the most extensive and well-funded lobbying efforts ever mounted. Turning a super tanker takes time and a lot of experience.

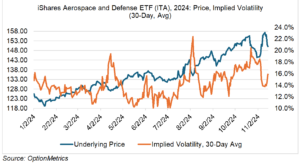

Which brings us to the third sector influenced by the new administration, defense. The $841.4 billion defense budget (greater than that of the next nine countries combined) is an obvious target for cost cutters. Considering that the U.S. defense spending is about 40% of the worldwide total, that’s bearish, or at least in the short term.

However, there are several long-term factors at play that should support defense stocks. Although US defense spending is high in absolute dollar terms, it is not when measured as a percentage of US GDP. In fact, at under 3%, it is the lowest it’s been since 1999 (it was about 40% at the end of WW2!). In addition, there are still several conflicts (the Mideast, Ukraine, and potentially Taiwan) that are still very active and may involve the U.S. And finally, cutting defense spending is great in theory but unpopular among congressmen and regions that have districts dependent on it. Cutting defense spending sounds great, but not when it’s going to cost you your seat in congress.

Soon after the election, the iShares U.S. Aerospace and Defense ETF rallied 7.4%, outpacing the SPX, but soon began declining after the administration’s cost-cutting intentions became clear. As the uncertainty overhanging the sector increased, it’s implied volatility followed suit, increasing 2.1 percentage points, or 15.3%, since its post-election low. As the market eventually realizes that meaningful cuts are a ways off or difficult to enact, the sector will probably revert back to its long-term trend.

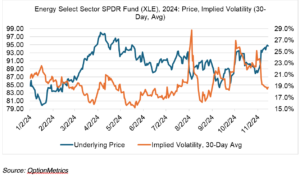

The last sector we will review, energy, presents the clearest case. The President elect’s nominees to head the Department of the Interior and Energy both hail from the oil and gas industry and are decidedly in the “drill, baby, drill” category. Not much to see here—the nominees and incoming policies are clearly bullish for the fossil fuel business.

Since election day, the Energy Select Sector SPDR Fund (XLE) has increased 5%. The market seems to be very certain that it will be clear sailing ahead from a regulatory and policy standpoint, leading to less uncertainty of what the future may bring. Over the same period, XLE implied volatility has decreased 3.9 percentage points, or 17.3% (see below).