Crude Oil: Volcano or a Dud?

After months of geopolitical tensions building up in the Mideast, last week the oil market finally decided to notice that there is a war going on that could directly threaten supply. Of course, that’s been true for a year, but this time the market seems to be taking it more seriously. Crude oil, which is a good surrogate for tensions in the region, has rallied 13% since the end of September. Obviously, it has been reacting to last week’s missile barrage and the expansion of the war beyond Gaza.

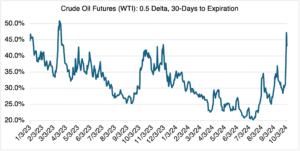

Reflecting the market’s latest round of war anxiety, crude oil’s implied volatility has increased from 30.2% to 43.1% since the end of September, an increase of 11.8 vol points. During the outbreak of the war a year ago on October 7, 2023, its implied volatility jumped a similar amount before it leveled off about two weeks later.

Source: OptionMetrics

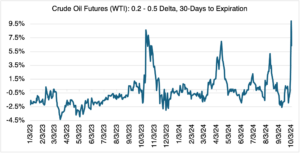

As important, the at-the-money to out-of-the-money implied volatility spread (0.20 – 0.50 delta) has also blown out since the beginning of October. The chart below displays the spread, holding expiration constant at 30 days. The last time the spread expanded to this degree was at the beginning of the war. Typically, the spread increases as out-of-the-money buying pressure increases. In this case, the $90 call seems to be the bullish fan favorite.

Source: OptionMetrics

Apparently, the oil market is taking the latest round of geopolitical events very seriously, at least as seriously as when the war first broke out a year ago.

A word of caution, however: the connection between crude oil prices and regional war anxiety is fickle and will eventually require confirmation that its supply fears are real. If that doesn’t happen, or no new developments occur, then the bullish impetus will be reduced. Markets have a short attention span, and crude oil is no exception — its reaction in terms of price and implied volatility to “more of the same” without any significant supply disruption will tend to become less and less. To date, the war has not resulted in any supply disruptions of note, despite the worst forecasts. That’s one of the reasons why the OTM – ATM spread spikes but then can’t seem to hold on to its gains for more than a few days.

But of course, that was before the Israelis adopted a more aggressive stance towards Iran and its surrogates. In the current circumstances, and given the possibility of an explosive upside, the upside/downside of short volatility positions is not favorable (understatement). Frankly, it’s the type of “what were you thinking?” trade that could get you fired if it doesn’t work out.

One surprising note about the war in the Mideast. The iShares MSCI Israel ETF (EIS) has rallied 29.8% in the year since 10/07/2023:

Source: OptionMetrics

Note that the SPX returned 32.3% over the same period. Needless to say, an almost 30% annual return is impressive for a country at war with no conclusion in sight and with enemies knocking at its gates. Apparently, investors have not been too worried about Israel’s prospects, war or not. That could change if the war accelerates: in the short term, the index is off about 3% since end-September.