Ceasefire Ruminations

March 8, 2022 - By Brett Friedman, OptionStrat Contributor

- I’ve been writing about uncertainly and its effect on implied volatility over the last several weeks.

- You can’t get much more uncertain than how the Russian/Ukraine situation will ultimately turn out.

- One of the basic rules of predicting price and volatility is that out of the blue events – war, pandemic, natural disasters – have the largest effects.

- Similarly, events outside of the mainstream consensus have a similar effect. The market is then caught one way and has to change direction in a hurry. That’s usually when you get the biggest moves in price and implied volatility. They’re not exactly Black Swan events, but baby Black Swans.

- What does this have to do with today’s insane market? The general consensus (as far as I can tell) is that the Ukrainian war will not end anytime soon and may even turn into an endless Russian quagmire, like Afghanistan or Syria.

- Most experts and assorted commentators do not view a negotiated cease fire as probable in the short term. It goes without saying that their track record lately (and always, for that matter) hasn’t been that great. Who knows, Putin might be looking for a way out without losing too much face, live to fight another day and all that. I’m not saying that it will happen, or that it’s even that likely, but an unexpected ceasefire does present a perfect setup to profit from an extreme market shock scenario.

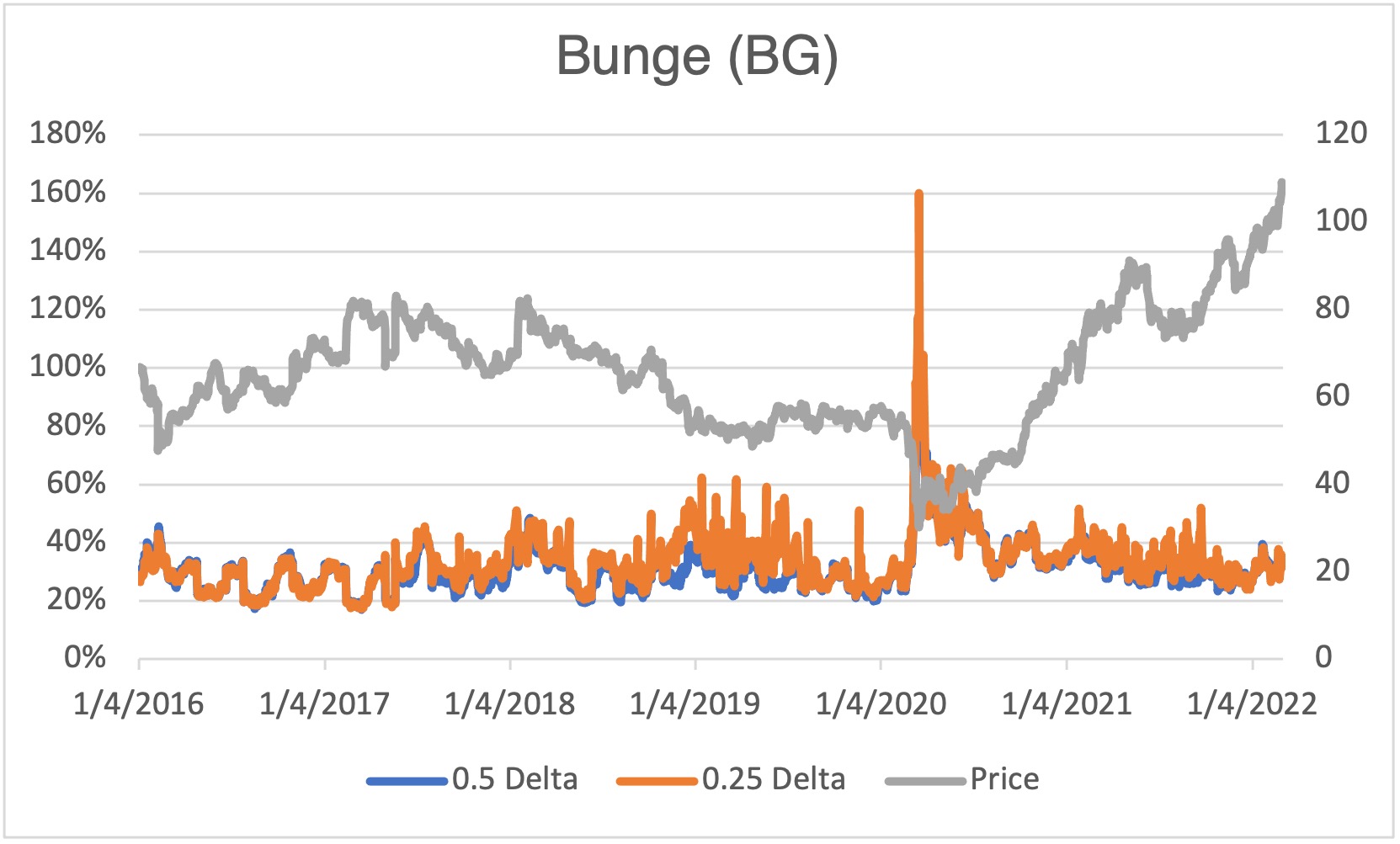

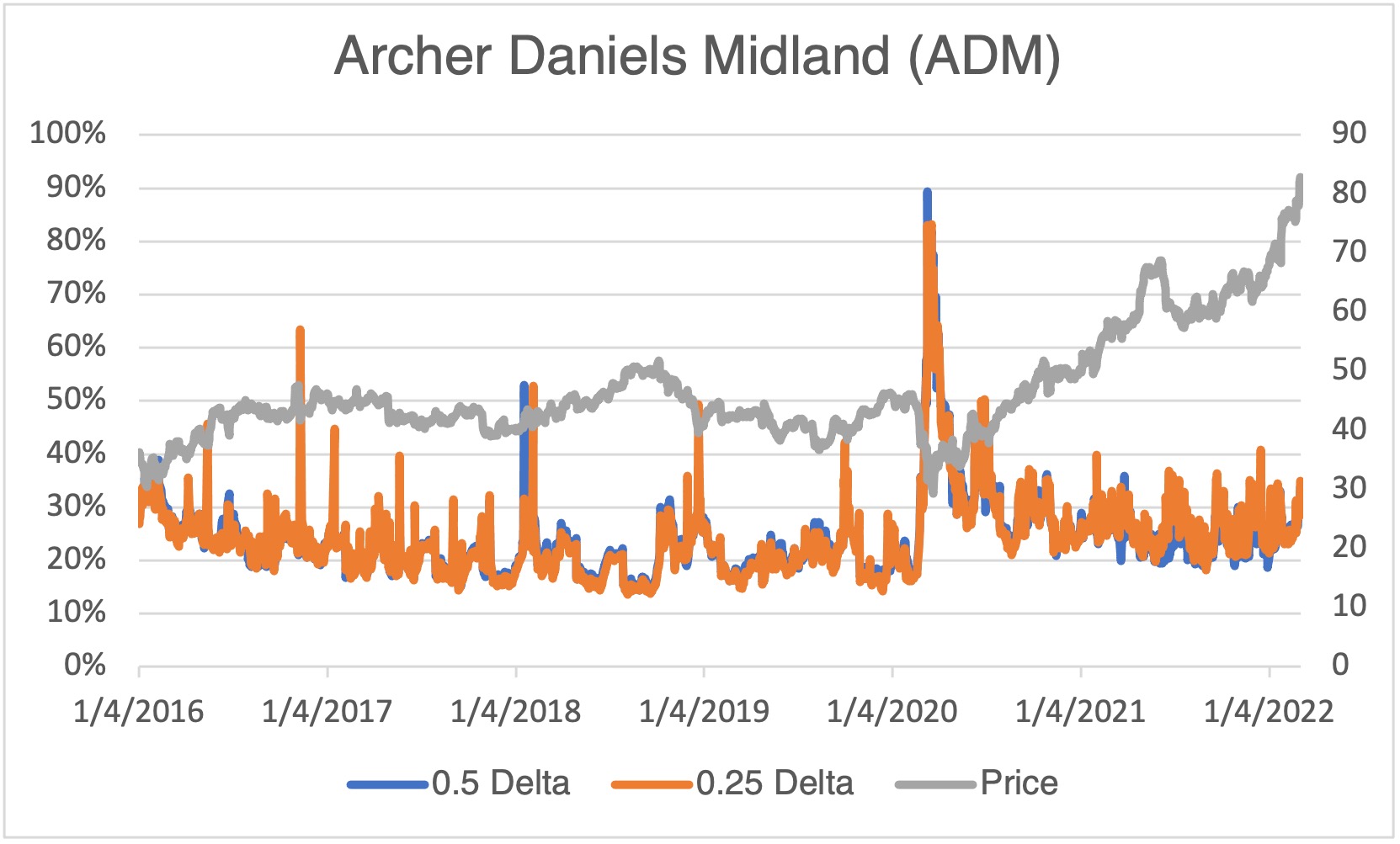

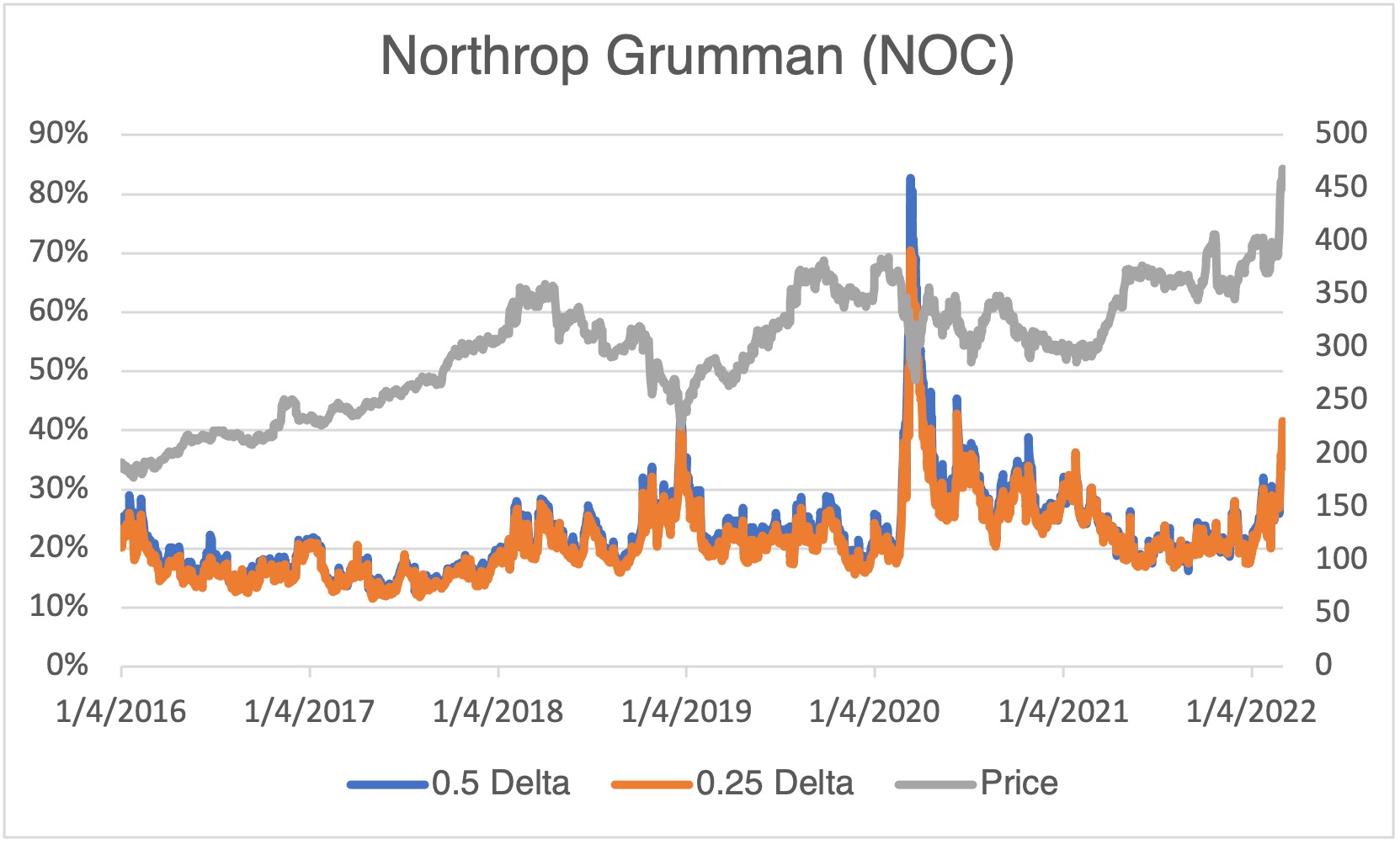

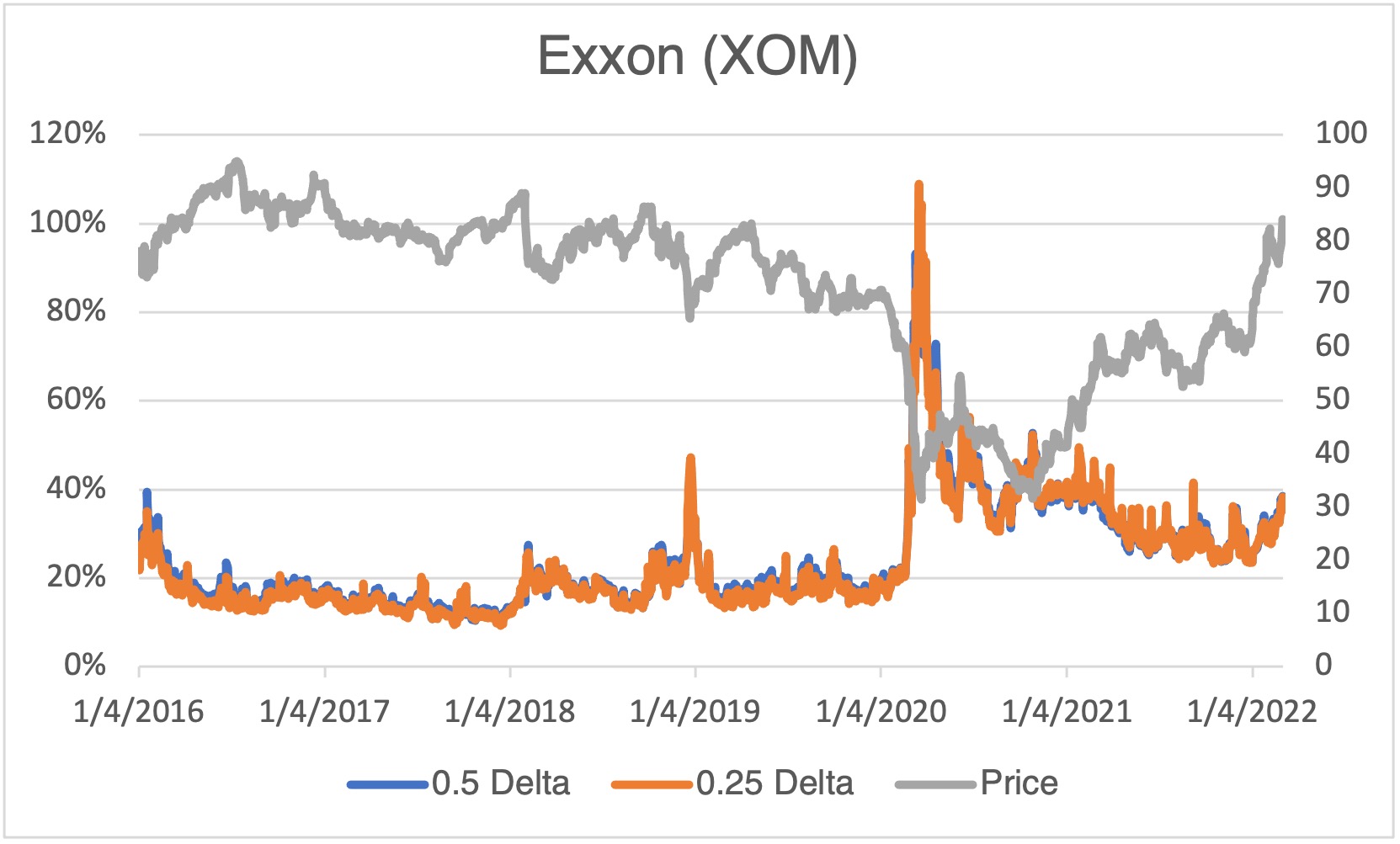

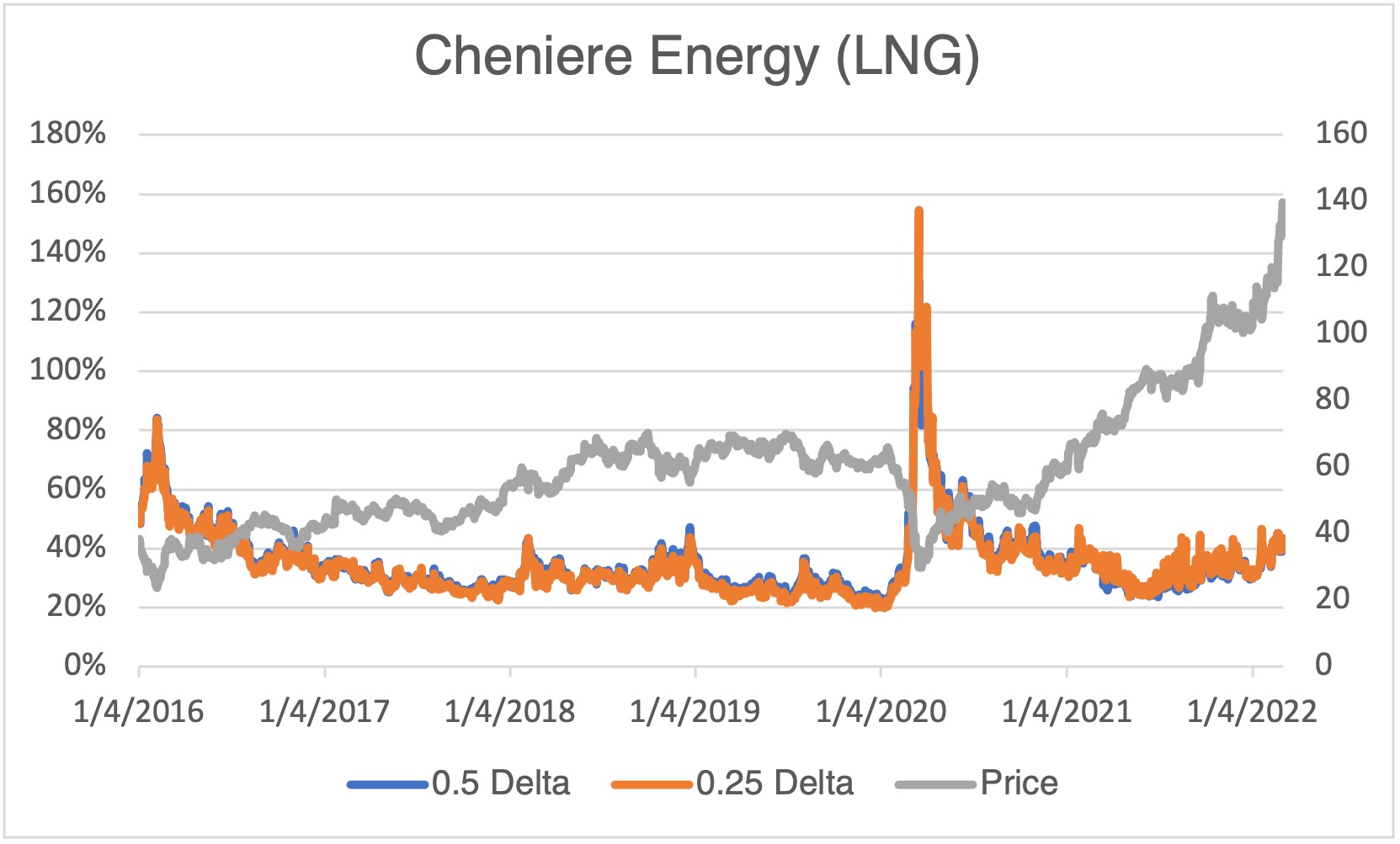

- Sectors that have benefited from the war (energy, agriculture, defense) could then see a sharp sell off as the war underpinning is pulled away. On the other hand, the rest of the market could rally as war worries are relieved.

- One special note on defense stocks. Whatever happens, one of the by-products of the war will be a renewed focus on defense, weaponry, and overall security. So, a cease fire could produce a short-term sell off in the sector but not in the medium to long-term.

- Since the ceasefire scenario is highly speculative, options strategies present an attractive vehicle if the consensus is wrong (which it will be) and mayhem results.

- Below are some selected stocks that could get caught in a short-term vacuum if a ceasefire somehow materializes: