The Great Rotation: Maybe Not?

Politics seems to be everybody’s main occupation and obsession lately, so I thought I would open with an interesting fact that I found on Substack from Boyer Research, a provider of equity market research and commentary:

An investor who put $10,000 in the S&P 500 in 1961 and held only when Republicans were president would have made $102,293 by the end of last year, versus $500,476 for Democrats. One who stayed in the index no matter which party held the White House made $5,119,510.

I guess you can safely ignore the “which party is better for the market, Republicans or Democrats?” question. Of course, the conclusion is subject to numerous caveats, but you get the idea.

**********

Recently, the mainstream financial press declared the tech rally dead. Personally, whenever I see a headline such as in Monday’s WSJ blaring “A Stock-Market Rotation of Historic Proportions Is Taking Shape,” I instantly start getting skeptical. “Historic” moves often turn out to be temporary responses to long term, one way trends; the longer and more pronounced the original trend, the larger and more violent the pullback. The move is usually unexpected, outsized, and might even dramatically break some daily or weekly records, but is not necessarily indicative of a significant turning point – it could be just normal variation in an established trend that is bound to snap back every now and then, testing the true believers.

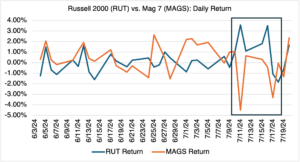

Currently, is there any robust evidence for the “Great Rotation?” Below, I charted the daily return of RUT (Russell 2000) and MAGS (Magnificent Seven). Plainly, MAGS has outperformed RUT up until about mid-July, at which time the trend reversed (see highlighted rectangle in chart below). Price action on July 11th was particularly divergent: RUT increased 3.6% while MAGS decreased 4.5%. July 16th was similar, with RUT increasing 3.5% and MAGS decreasing 0.44%. The divergent direction on both days led to a lot of very dramatic headlines. Other trading days since then have also displayed RUT outperformance, but not to such a degree.

Source: OptionMetrics

All this leads to the following question: is the “historic” rotation back to small caps just based on two rather extreme trading days? This could be a classic case of recency bias, the tendency to overweight the significance of recent events. At this point, it seems that the evidence isn’t compelling enough to conclude that the current rotation, or whatever it is, is anything more than a short term reaction. Magnificent Seven outperformance has been a feature of the market for at least a year, and it will take more than a few days of data to conclude that this is no longer the case. Maybe the latest round of tech earnings (TSLA and GOOGL announced yesterday; NVDA’s turn is on August 28) will tell the tale, but as of now, announcing the arrival of the Great Rotation seems premature.

**********

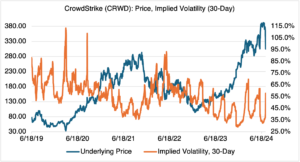

Finally, in the Jeopardy category entitled “Buy Low, Sell High,” there is CrowdStrike (CRWD), the cybersecurity software company that last week caused the exact event that they are supposed to prevent. The market’s first reaction, an 11% selloff (see chart below) on Friday, followed by another 13.5% on Monday morning, was understandable given the severity and duration of the problem. Before the incident, CRWD was a Wall St. favorite and had a rich valuation to prove it, trading at over 20 times projected revenue, the highest amongst its competitors. It’s now coming back down to Earth (currently < 15X projected revenue) and will probably have some tough times ahead as management tries to reassure their current and prospective customer base.

Source: OptionMetrics

If you can keep a cool head and focus on the strength of the underlying business, company disasters often turn out to be a long term buying opportunity. I stress “long term,” however — sometimes it can take months, or even years, for the disaster or scandal to wear off (Boeing). Stocks like these can be a bargain if you can live with the fact that a) you will most likely not buy the low, and b) will have to wait awhile before the stock recovers. In other words, you’re going to have to live through some pain before you can realize any gain.

“Buy low and sell high” is great advice, but it’s easier said than done. After all, how many people were loading up on stocks in 2008 – 2010, or after the dot.com bust, or after any downturn in which it seems that the entire world is melting down? In retrospect, most say they would have (but didn’t), and go on to promise themselves that they will load up if the opportunity ever arises again. But trust me, they don’t – but should.