Implementing the Wheel Strategy with our Options Profit Calculator

What is “The Wheel”?

The Wheel Strategy is a popular options trading strategy for generating consistent passive income. While OptionStrat has over 50 pre-built strategy available to use with our options profit calculator, you may be wondering where this strategy is…

The Wheel is actually a combination of two option selling strategies which are performed again and again over time, alternating between each. It involves selling covered calls and cash-secured puts over a long term time-frame, and can be an alternative to a traditional “buy and hold” stock investing strategy. It is an income based strategy for making small but hopefully consistent returns, which is quite the opposite of gambling on long calls and puts.

The methodology is simple:

- Select a stock to perform this strategy on. If you already own it, skip to step 3. It is important that you choose a stock that you wouldn’t mind owning over the long term. If you already own the stock, it should be one that you wouldn’t mind selling (for example, if you have held a stock for years and have achieved a reasonable gain and are now ready to sell).

- Sell cash-secured puts on a stock you want to own (or wouldn’t mind owning).

- You will earn income (a net credit) for each CSP that you sell. Eventually you may be assigned and will be forced to buy 100 shares of the stock at the strike price.

- The “cash-secured” part means that you need enough cash or collateral to buy 100 shares at the strike price, regardless of if you are assigned or not.

- Now that you have 100 shares, sell a covered call on the stock.

- Again, you will earn income for each covered call. If assigned, you will be forced to sell your 100 shares at the strike price.

This cycle simply repeats for as long as you’d like to continue the strategy. If you already own 100 shares of a stock, you can simply jump in at step 3 (selling covered calls). Essentially, you are getting paid to open and close positions in the stock. Note that while the strategy switches every time you are assigned, the goal is not necessarily to be assigned. Ideally, you keep collecting premium and allowing the option to expire worthless (or buying to close for a profit). However, this is a point of debate among traders of the strategy. On the contrary, if you are truly bullish about a stock, you shouldn’t mind owning it, and assignment may be in your best interest.

One important thing to note: This strategy involves the same risks as trying to time the market when buying and selling stock. If you are assigned on the put (forced to buy the shares), you may do so at an unfavorable strike price, or the stock may fall soon after you purchase them. Likewise, if you are forced to sell your shares (when the call is assigned), you may have to sell them at an unfavorable price. (Imagine if your strike is $200 but the stock moved up to $300! You’d be selling way below the market rate) Like the buy and hold strategy, you need to be okay with owning the stock long-term. In case you have to buy 100 shares at an unfavorable price or time, you may need to hold for months or years for the stock to go up again (assuming it ever does). Of course, you could sell covered calls for income in the meantime (the third step of the wheel), but you probably wouldn’t want to get assigned and sell your shares at a loss.

Example

Scenario 1: You want to own stock XYZ

When you identify a stock that you want to own (or at least, that you wouldn’t mind owning), you can start the wheel by selling a cash-secured put. If the stock goes below the chosen strike price, you will be assigned and will have to buy 100 shares at that price. Because of this, you can get a juicier premium by selling puts that are likely to be assigned. However, if assigned, you run the risk that the stock continues to drop. Since you truly want to own this stock, buying in at a good price shouldn’t be a problem, you just have to be okay with not getting the “best” price since it may continue to go lower.

Since you are selling a put, time works for you, not against you! Gone are the days of rapidly losing value as time passes. Instead, you will profit as time passes and the put gets closer to being worthless. Since you sold the put, you want it to be worthless or near worthless so that you can either avoid assignment, or close it for a profit. Getting assigned is also okay, but as I mentioned before, the primary goal is to make income without being assigned. When choosing an expiration, a date 30 to 45 days out works best as time decay is accelerating, but premiums are still high enough.

So, if stock XYZ is trading at $100, you will now need to choose which strike to sell. This part depends on how much risk you want to take (and again, getting assigned may be a “risk” or it may not be, depending on how eager you are to own the stock). Here are some hypothetical strikes and prices for puts expiring in 32 days on XYZ.

| Strike | Premium | Chance of Assignment |

|---|---|---|

| 100 | $648 | 50% |

| 95 | $448 | 36% |

| 90 | $298 | 25% |

| 85 | $192 | 16% |

| 80 | $121 | 9% |

| 75 | $74 | 5% |

| 70 | $46 | 2% |

As you can see, strikes that are closer to the current price ($100) will pay more, since you are taking on additional risk. It is commonly recommended among traders of this strategy to choose a strike with a delta of around 0.30, and a 30% chance of assignment or lower (giving you a 70% chance that the put will be out of the money and you will simply collect the full premium).

In this case, you could take a moderate approach and sell the 90 put (or maybe 92.5, if it exists) for a profit of around $300 per month.

At some point, you will likely be assigned and will be forced to buy 100 shares at that strike price. XYZ could move down to $93, forcing you to buy at $95 if you had sold the 95 put. Because you are buying above the market price, you will have an unrealized loss of $200 ($2 x 100). However, you may have gone multiple months without taking assignment, allowing you to rake in premium to offset this loss.

Now that you own 100 shares, you can move onto the second phase, selling covered calls.

Scenario 2: You own stock XYZ

Alternatively, if you already own 100 shares of a stock, you would start here. Perhaps you purchased 100 or more shares years ago and they have accumulated a decent profit and you are willing (but not rushing) to sell. The same effects of time decay apply, so we still want to select a call about 30 to 45 days away with a similar chance of assignment.

In this scenario, you do the reverse: Sell covered calls until you are assigned. If the stock moves above your strike price, you will be forced to sell your shares at that strike.

| Strike | Premium | Chance of Assignment |

|---|---|---|

| 100 | $795 | 50% |

| 105 | $550 | 42% |

| 110 | $365 | 32% |

| 115 | $223 | 24% |

| 120 | $146 | 17% |

| 125 | $89 | 12% |

| 130 | $56 | 8% |

Just like selling puts, selling calls that are further out-of-the-money will yield smaller premiums, as you wouldn’t be taking on much risk by selling far OTM calls that are unlikely to be assigned. If you are ready to sell your stock, you could be more aggressive and sell the 105 or 110 call, knowing that you will likely soon be assigned. Otherwise, you could have a greater chance of keeping your stock by selling the 120 or 125 call, in exchange for receiving much less income.

Pros

- The credit you make from selling covered calls can be thought of as reducing your cost-basis. If you spent $20k on 100 shares a while back, every time you sell a covered call for a $200 credit, you are reducing the cost of the stock by making your money back.

- If the stock trends upwards, you can collect income and benefit from the stock appreciation. (Assuming you are in the covered call phase and own the stock)

- Unlike owning a stock where your gains are not “real” until you sell, it can feel good to lock in an actual cash credit after completing each step.

- There is relatively low risk in this strategy compared to others. You can’t easily lose 100% of your investment like you can when a long option expires worthless. The stock could go to $0, but the chances are much smaller.

Cons

- During the covered call phase, you own 100 shares of the stock. If the stock drops significantly, you may find yourself with a large unrealized loss. However, this is the same risk that you would be taking by owning a stock anyways.

- It isn’t a very exciting strategy. Options traders may be expecting quick and large returns, but this strategy requires patience.

- You will need a large account size, depending on the stock you choose, as you need to be capable of buying 100 shares per put you sell. You don’t want your entire account to be dedicated to a single strategy or stock, so to be safe your account should really be much larger than that.

Tips

- If you choose a stock with a high implied volatility, you will receive higher premiums in exchange for taking on more risk. A stock with high IV has a high chance of wild swings that could cause you to be assigned. Again, this could be a good thing if you want it and a bad thing if you don’t. When using the wheel strategy, it is preferable to select a solid “boring” stock that doesn’t have many wild swings.

- If the call or put has gone down in value (meaning you have earned some of the credit, but not the full credit yet), you can always close it early. If the option has increased in value (likely because it is going in-the-money), you can still close it out early but you will lock in a large loss. It may be better to roll it or just take the assignment.

- To expand on the last point, you can close the option early and “roll out” to a further expiration date to allow for more time. You can also “roll up” or “roll down” to a different strike. This will lock in the profit or loss on the existing option but allow you to change the strategy going forward.

- American options can be assigned at any time, not just at expiration. In practice, this rarely happens, as it usually doesn’t make sense for the option owner to exercise their option early. The most common case is that a dividend is coming up, and the call buyer decides to exercise early so they can buy the stock and take advantage of the dividend. To warn about this scenario, OptionStrat premium members will see an icon on the profit calculator when an ex-dividend date is approaching.

Modeling it in OptionStrat

It’s helpful to keep track of each trade as you perform the steps in this strategy. Our options profit calculator tool can help you model each step, and also keep track of the overall success of your strategy.

To start modeling this strategy in OptionStrat, select the “Cash-Secured Put” or “Covered Call” calculators on the build menu at the top of the site.

Modeling the Put

Unlike other strategies on the site, you won’t need to pay attention to the table or graph much, as this strategy isn’t dependent on the future value of the option (unless you are trying to close out early). The important things to look at will be:

- The Net Credit: This is how much premium (income) you will earn for selling the put.

- The Collateral: This is how much cash you need in order to afford 100 shares of the stock.

- Note that the “Chance of Profit” is not the chance of assignment. To find the chance of assignment, hover over the chart and check the percentage chance of the stock being below your strike price. (This feature is only available for premium members)

The max loss for this strategy will be high, but that is only because the stock can go to $0, which is a risk that you would take with simply owning the stock anyways.

To experiment with finding the appropriate option, check the various expirations around 30-45 days away and move the strike slider around to see how the premium changes with various strikes.

Modeling the Call

Similarly, you can find the premiums for selling a call through the covered call calculator. There is no collateral shown here because the call is covered and doesn’t require any margin.

Note that by default, the calculations on the screen include the 100 shares. If you want to exclude the effects of the stock price on your shares, click on the equity portion and select “Exclude”:

Tracking Trades

Once the call or put expires, you will either be assigned, or it will expire worthless. You can track each expiration in OptionStrat to see the total profit that you have earned over the lifetime of the strategy.

First, start by saving your initial call or put by clicking the “Save” button. You will need a free account to save the trade for later use. Once saved, you can find the trade and re-open it from the saved trades page.

Upon expiration, we automatically close the option at the price it expired at. However, you will want to edit this automatic behavior to either buy or sell the stock if assigned. (Since we aren’t connected to your broker, we are unable to know if you were assigned or if you closed out early)

If you were assigned on your call, you can click the equity portion of the trade and click “Sell to Close”. Make sure to enter the strike price so the closing price is correct.

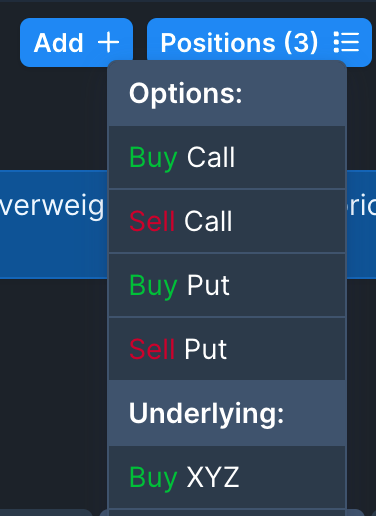

If you were assigned on your put, click the Add menu and click “Buy XYZ” to add 100 shares to your strategy.

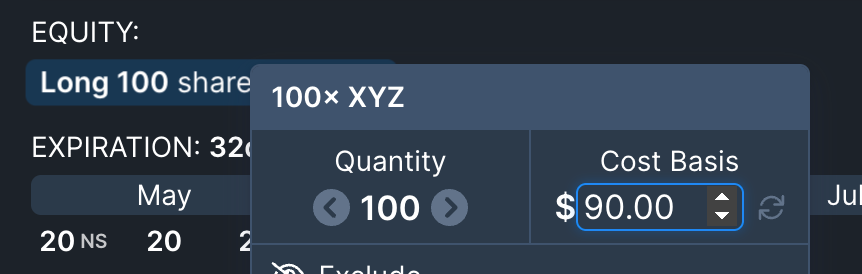

Then, click the stock and click the price to edit it. By default, it will use the current market price of the stock. Enter the strike price of your put so that the entry price of your shares is correct.

As you repeat this process, you will be able to view all your open and closed trades from the Positions menu at the top. (To avoid cluttering the interface, we only show the most recently closed option in the strike selection area. The other trades will be in the positions area)

Conclusion

Many traders turn to the wheel after unsuccessfully trying to “win big” at buying options. Being a day trader is harder than it looks, and the wheel strategy provides a methodical method for making steady gains. If you have the capital required, consider giving it a try.