Crude and Gold and Uncertain Futures

Last week, I wrote about geopolitical tensions and how they have been consistently part of the crude oil market since the beginning of the war in the Mideast on October 7, or even from the start of the war in Ukraine over two years ago, despite their varying intensity, or in some cases, validity (“If it bleeds, it leads”).

Last weekend’s attack on Israel by Iran, and the prospect that the war could extend regionally and to new combatants, obviously strengthened the argument that geopolitical fundamentals are underpinning the crude market and made them a more valid and immediate reason to cite for crude’s ascendency. There has always been a chance that the war would expand, but now the odds have shifted considerably. The crude market is now hypersensitive to new geopolitical developments, both to the upside (new aggression, widening the war) and downside (nothing new occurs). Although the situation has abated somewhat, the Geopolitical Risk Index jumped from a relatively normal 155.6 last Friday to 238.4 on Monday.

Whether last weekend’s events lead to new aggression or not, the crude market, which is directly affected due to possible supply disruptions, and gold, which is the classic safe haven, will be supported by the prospect. Both markets will be on edge until the situation between Israel and Iran resolves itself, however imperfectly. Borrowing the old notion of the “Fed Put,” there is a “war put” beneath the market as long as the Mideast remains in a state of heightened tensions. How much the crude market is being supported is anyone’s guess, but around $10.00 seems to be a good estimate. Of course, that could instantly disappear if a comprehensive cease fire is somehow (and now improbably) negotiated, or supply is increased. Gold, which has been making new all-time highs since last October, is in the same boat.

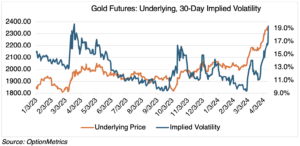

How would an options trader view all this? Let’s take a look at the implied volatility in both crude and gold to see how it may react to both upside and downside pressure. Even if you don’t trade commodity options, it will be instructive. First, Brent crude futures:

In general, crude oil implied volatility moves inversely to its price (the correlation since 2005 is -0.40). You can see this clearly in its price action since February1: Brent has rallied almost 15%, while its implied volatility has decreased from 31.3% to 27.6%. However, this relationship might break down if hostilities increase — option traders will react to the increased uncertainty by bidding up crude’s implied volatility. The opposite may also be true: if nothing happens militarily, and tensions subside, then implied volatility will decrease. That is, to an extent. If the unlikely occurs, and a cease fire is announced, or supply is increased, prices could begin to fall rapidly. Implied volatility will then revert to its usual relationship and increase sharply. Predicting implied volatility is always a matter of guessing uncertainty.

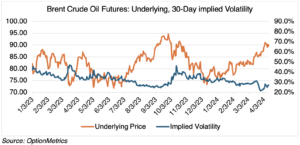

You can see this clearly in gold (chart below). In general, gold’s implied volatility trades at relatively low levels (in comparison to other commodities) and without much change from day to day. However, since gold started making new all-time highs in early March, its implied volatility has uncharacteristically shot up, increasing from 11.2% on March 1 to 19.4% currently. Why? Uncertainty, the chance that gold’s steep rally will accelerate, or for that matter, fizzle — is hard to predict and producing anxiety among options traders. There is also some mystery at work here. Geopolitical tensions and central bank purchases are usually cited as the basis behind the rally. But, these have been present for some time — there’s nothing new here, so why the sudden acceleration since early March? Again, it’s uncertain, and that leads to higher implied volatility every time.