Apocalypse Now?

This week, the tone of the markets took on a decidedly apocalyptic tone. Inflation, war, interest rates, Covid, stagflation…the list goes on and on. Interesting that everybody seemed to be a lot happier with the market over the last two years when Covid was raging and supermarkets resembled those of the Soviet Union, circa 1988. Regardless, let’s round up the dismal numbers from the first four months of the year:

| Asset | YTD Change (%) |

|---|---|

| Nasdaq | -21.2% |

| S & P 500 | -13.8% |

| Dow | -9.4% |

| US 10 Yr. | 134 bps |

| Inflation | 150 bps |

| GDP, Q1 (advance) | -1.4% |

| S & P GSCI | 35.5% |

Source: Dow Jones

Yes, the numbers look bad, but allow me to supply a few observations.

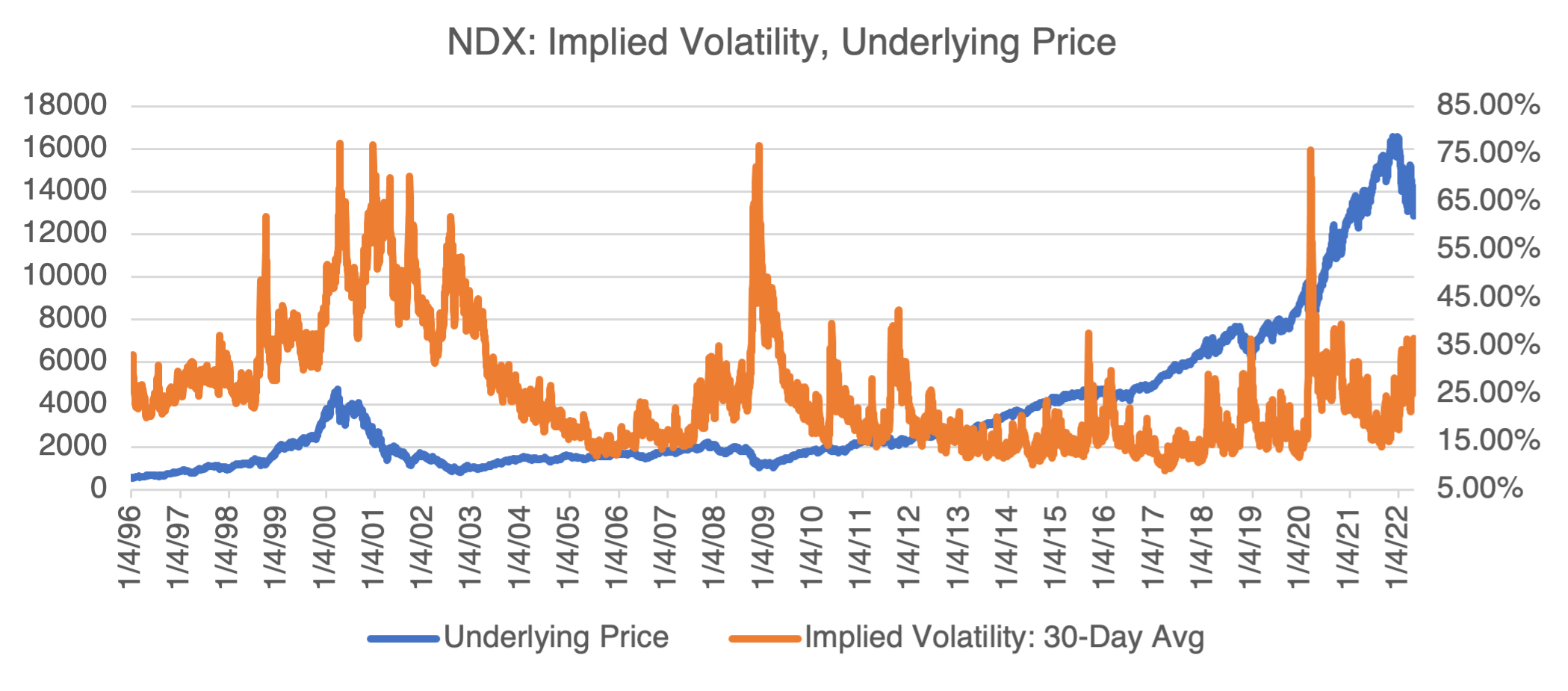

Observation #1: as I wrote a few blogs back, it’s important for options traders to distinguish between implied volatility (IV) and perceived volatility. When you read phrases like “stomach-churning volatility,“ it doesn’t necessarily mean that implied volatility is at record levels. Take the NDX, the Nasdaq 100 index. Despite all the reports of carnage in the tech sector, the IV of the index closed at 36.6% last Friday, certainly high and in its top quintile, but not yet in crisis-mode territory.

(Source: OptionMetrics)

Observation #2: There is an old risk management aphorism that goes something like this: “Predict Disaster and be Hailed as a Prophet.“ In other words, bad news gets clicks and sells papers. For example, “Worst 4 months in 80 years!“ or this cheery vision from a well-known site that has been nothing but bearish since 2008:

(Source: ZeroHedge)

It’s important to realize that anyone, especially in social media, can be a market commentator, regardless of qualifications or track record. Their object is not necessarily to provide trenchant analysis, but to attract the most clicks. My advice is to take whatever they say with a massive grain of salt. Also, please realize that a lot of the people who are now super bears have been super bears since 2008. They proudly point out when they were right (which is infrequent, btw), but usually, conveniently, forget that most of the time they were swimming upstream. And even if they were right, paper trading is easy – it’s only when you’re losing actual money — your money — that losses really matter. If the analyst has been predicting the rebirth of the Great Depression or has been stuck in one mode of thinking for some time, you should move on to more constructive and objective analyses. Don’t waste your time.

The fact is that there is always something going on in the markets to worry about, no matter which direction you are leaning. A quote from the movie Men in Black says it best:

“There’s always an Arquillian Battle Cruiser, or a Corillian Death Ray, or an intergalactic plague that is about to wipe out all life on this miserable little planet, and the only way these people can get on with their happy lives is that they do not know about it!“

Observation #3: Comparisons to past periods are interesting, but sometimes I doubt how useful they really are. I know, these are fighting words to every technical analyst out there, but things do change structurally, and the market is no exception. Personally, I have never seen one rigorous, independent, and peer-reviewed study that proves that price patterns repeat, or that technical indicators are indeed more effective than just random chance. Supporters tend to point out the instances where their analysis “worked,“ but tend to forget or ignore when it didn’t. I get it, traders like to hang their hat on something, anything, in a chaotic system, but it’s important to realize what’s real and what you would like to be real. Just because the indicator is exotic or arcane or supposedly used by “insiders,“ doesn’t make it more predictive or instructive than anything else out there.

Ukraine, Month Two+

The war in Ukraine continues to slog on with no end in sight, lending a tone of impending dread to the markets. Don’t count on this to end anytime soon.

One sad related note. Putin has been increasingly framing the war as a contest between Mother Russia and the West, with western institutions (NATO) and culture threatening to overrun the Russian state. In other words, and just as in the Cold War, the bogeyman is seen to be knocking on their door, just as the Mongols did in the 13th century, the French did during the Napoleonic wars, and the Germans did during WW2. In this upside-down universe, the war in Ukraine has been turned into a Russian war of survival. And wars of survival require sacrifice, something the Russians are very good at. Although the figures are subject to conjecture, most agree that Russian casualties are currently approaching 20 thousand. Compare that to the estimated 32 million the USSR lost in WW2 (20 million directly and 12 million that Stalin murdered). Let’s put that figure in perspective. 32 million is over 22,000 dead per day, or about 915 per hour, for the entire four and a half years the Russians were at war. Or put another way, it’s the entire population of New York and New Jersey.

Given that, it’s wishful thinking at best to think that Russia will call it quits due to battlefield losses. Don’t count on it. As one analyst put it, “Putin doesn’t have a reverse gear.“

Archegos: Nuts!

I wrote about the Archegos saga a few times when it broke last March, here and here. In summary, it’s yet another tale of hedge fund and prime broker greed and incompetence and is emblematic of so many ills that have long plagued Wall Street. If you haven’t read about it, you really should.

I can’t add much to the facts of the case, which have been well-covered elsewhere. Needless to say, Bill Hwang, the Archegos Mastermind, is probably going to jail, which is exactly where he belongs. The “Why Bill Hwang Did It“ game is kind of fun to play but will never be resolved. More interesting is the lawsuit that was filed by the Employees Retirement System of the City of Providence, a pension fund, against the Credit Suisse Group AG, former Chairman Urs Rohner, and 19 other directors and executives. The complaint alleges that “… that CS’s board did not provide the resources, people, technology, systems, and controls needed to comprehend the overall risk the bank was taking on, much less manage that risk…“. I’m glad to see that someone is finally going after the CS Board after presiding over not only Archegos, but a string of other client related losses at Greensill Capital, Malachite Capital, Luckin Coffee, and I’m sure others that have not been well-publicized. Credit Suisse has been at the center of more than their fair share of scandals. I’m no fan of The Guardian, but here’s a good summary of what CS has been up to since 1986.