Crude Oil Isn’t That Volatile; Q1 Options Volume Was Incredible

Crude Oil: It’s Been A LOT More Volatile!

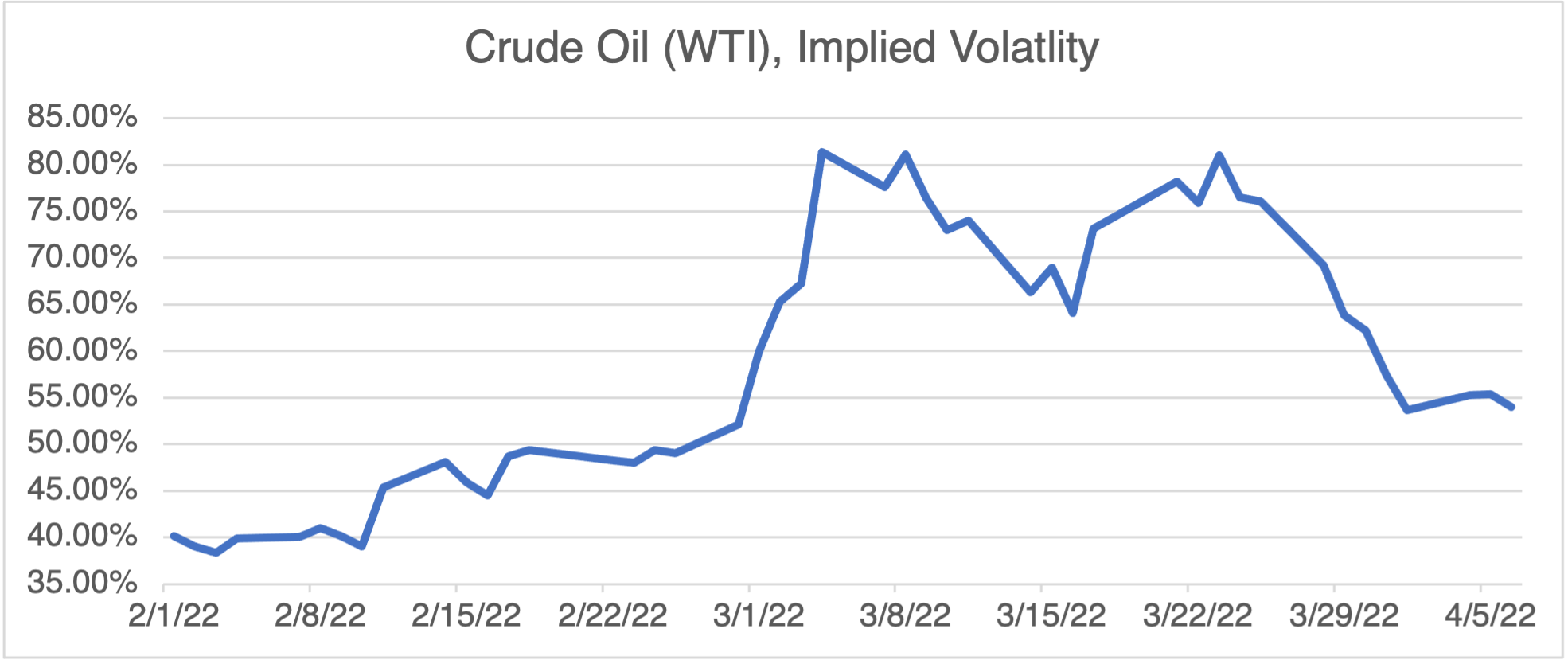

According to almost everything you read, crude oil is very, very volatile. The evidence is everywhere: prices at the gas pump are super high, the war in Ukraine and sanctions have disrupted supplies, and fossil fuel production is the main target of ESG warriors. So, volatility is high, right? Well, not really! Take a look at this chart since the beginning of February:

(Source: OptionMetrics)

As you can see, not only is crude oil volatility nowhere near post-war highs, but it’s been declining since the war began. Although it’s higher than the average since 2005 (35.4%), not even the recent high of 81.4% could hold a candle to the all-time high of 198.2% hit during 2020.

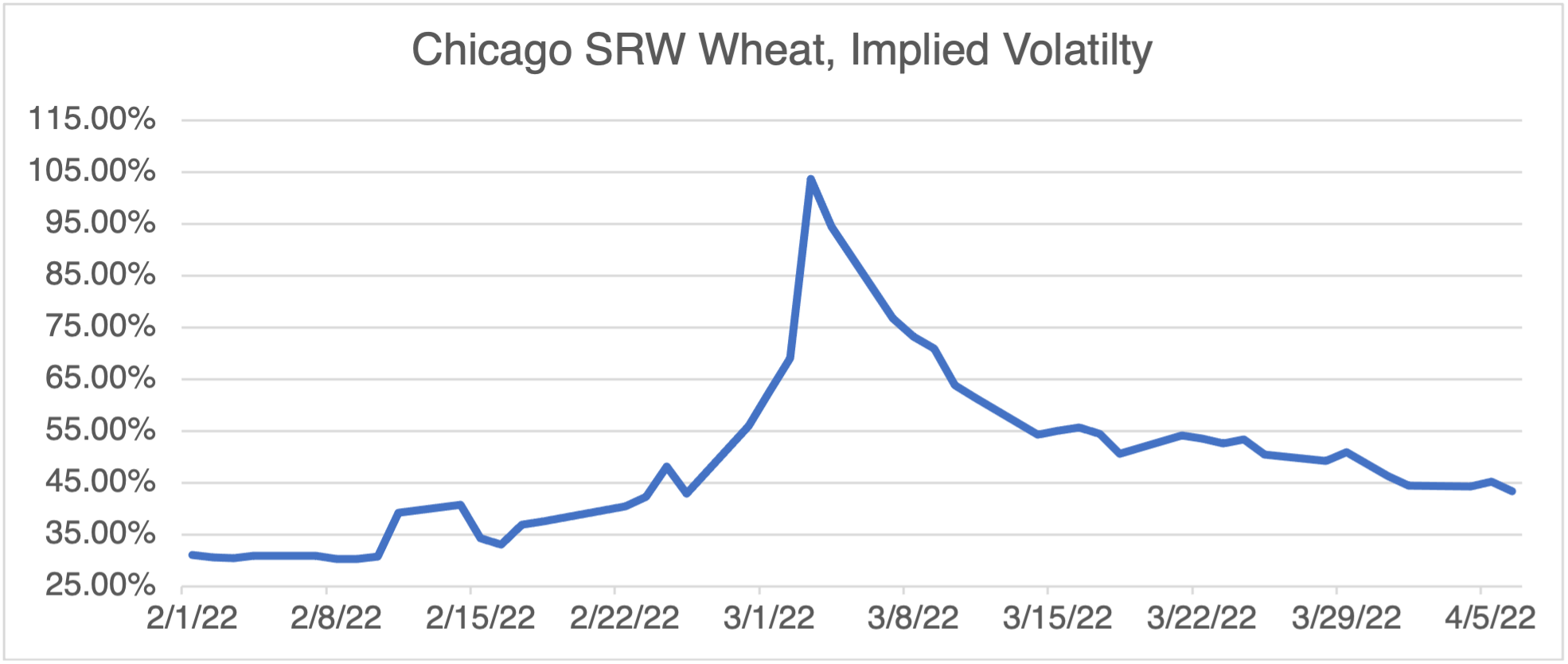

And it’s not just crude oil — implied volatilities have been declining in other commodities as well, notably wheat:

(Source: OptionMetrics)

Why? Isn’t the war still going on? Markets, like people, can be childish and tend to bore easily. For implied volatility to increase, the market will need new and unexpected news that drives price uncertainty. Failing that, and with a stalemate in Ukraine, expect volatility to sag, slowly.

The message here: don’t confuse your impressions of price action, especially when derived from the press or social media, with actual implied volatility – they are two different things!

Volume Talks – the Q1 Option Volume Numbers Are In And They Are Impressive!

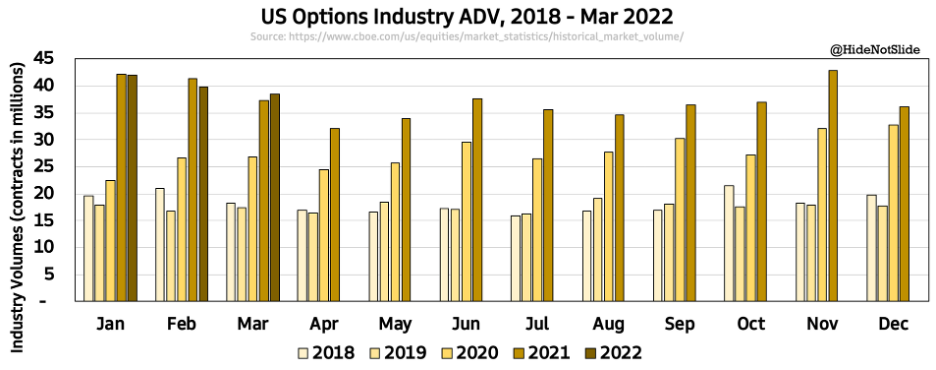

First quarter exchange volumes are out and there are some interesting developments.

First, equity option volumes continue to grow, despite the alleged disappearance of retail traders, and is a little less than double 2018 – 2020 levels.

(Source: frontmonth.substack.com)

Second, it seems that the war did not provide a significant volume boost for options trading versus 2021. The first quarter of 2021 saw volume that was significantly above Q1 2020 – it would have been hard to improve on that performance. It will be interesting to see if volume can equal that of 2021, or even exceed it, for the rest of the year.

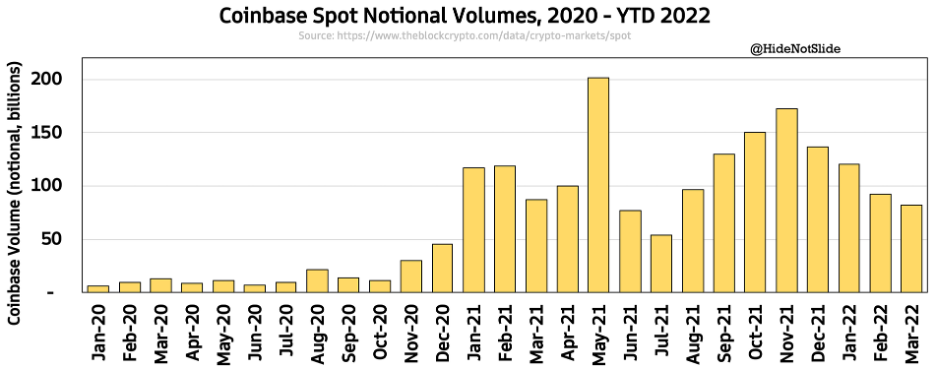

Third, and despite the hype and almost perfect conditions for crypto trading (war, inflation, and sanctions), crypto volume has been declining since last November, and has been going more or less sideways since the beginning of 2021 :

(Source: frontmonth.substack.com)

Has retail moved to greener pastures or does crypto need some significant upside price action to revive? As I wrote in my last blog, if it doesn’t go up in this environment, when will it?