Dr. Doom

Beyond Meat

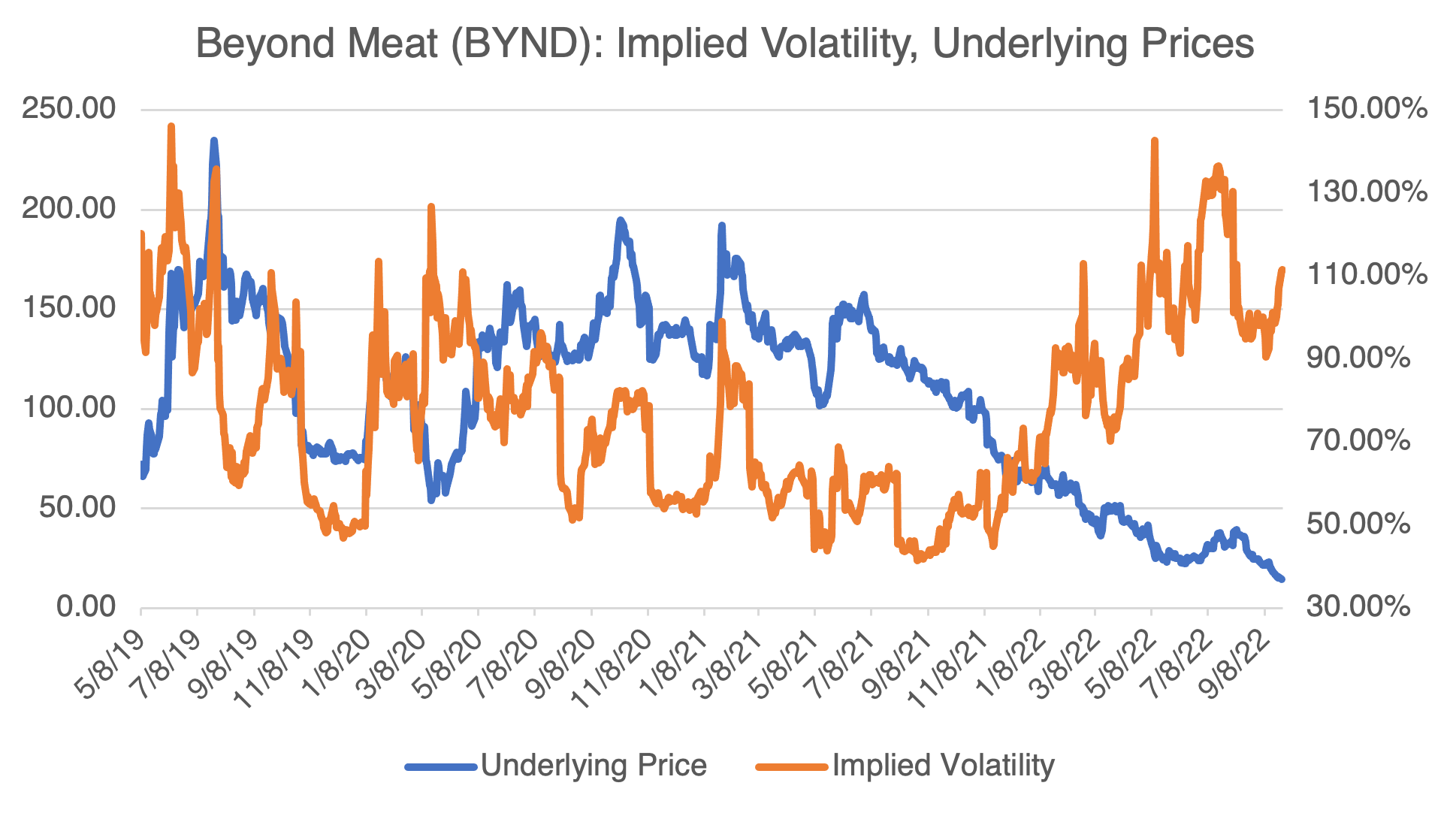

I hadn’t looked at it for some time, but it was pointed out to me that Beyond Meat (BYND) is down over 76% YTD and is currently trading in the $15 region with implied volatility over 110%. Keep in mind that this was a stock trading almost $200 in 2020, at the height of the plant-based meat craze.

Engineered meat has less than 1% of total market share for meat products in the US. Coupled with the failure of McDonalds’ product (the McPlant burger — great name!), investors are skeptical that the product will ever broaden its appeal outside of the vegetarian market.

The stock also conforms nicely to one of my informal rules of stock picking — the more celebrity endorsements, the worse it’s outlook. Kim, Leonardo, Snoop, and Bill can afford to lose money on stuff like this and move on to their next kick. Most can’t.

The best part of this story is that the COO was recently fired for allegedly biting a man’s face. Yes, biting someone’s face, full-on zombie style. Upon his appointment, Beyond Meat founder and CEO Ethan Brown said Ramsey had “a proven track record of impressive operational excellence in the protein industry.” The irony is overwhelming.

Crypto

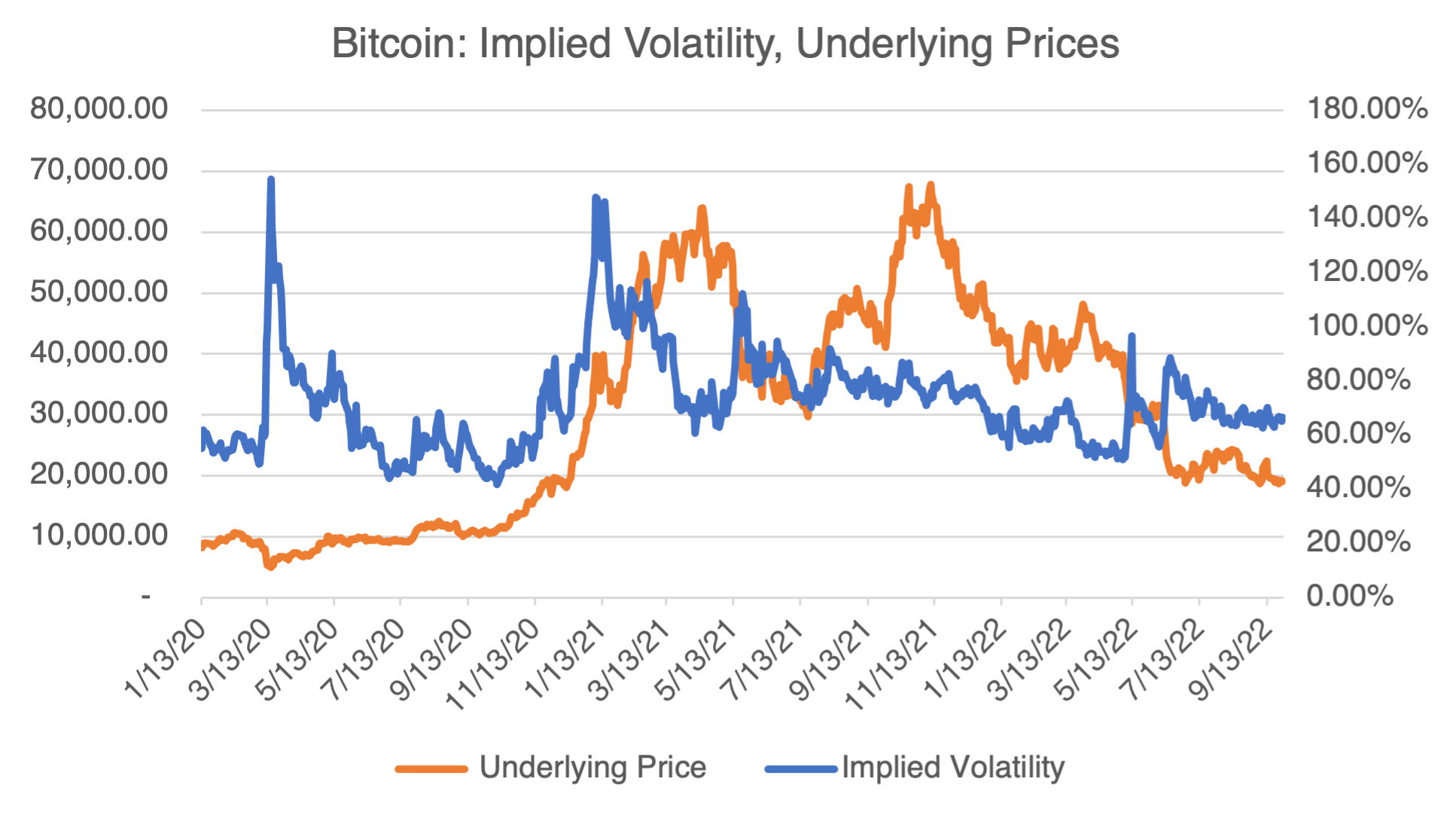

With the dollar’s ascent due to below parity with the Euro and almost to parity with the British Pound (!!!), one would think that bitcoin would finally be getting out of its own way. It hasn’t and is now languishing in the $19K region. At the same time, its implied volatility remains in the mid-60s. Since it tends to increase as prices decrease, if you’re bearish on Bitcoin, an options strategy might get a significant volatility kick.

As I’ve written before, current conditions — war, inflation, currency debasement — should have led to the Golden Age of Crypto. Instead, it crashed and burned, revealing itself as a pure spec play and hedge to nothing. That’s important — if you’re going to trade crypto, be realistic about the fundamentals (if any) that are driving it.

Dr. Doom’s Stopped Clock

Last week, it was reported that Nouriel Roubini, NYU professor and Famous Economist, is predicting a major recession/depression. Again…and for the millionth time. Like many famous Wall St. pundits, his reputation is based on one very prescient call. In Professor Roubini’s case, he called the 2008 crash. Since then, however, he’s been kind of cold, to say the least, and has been consistently the wrong way around during the greatest US equity rally in history. Predicting disaster and steep bear markets is his gig, and it never seems to change. Of course, eventually he will be right (the “stopped clock is right twice a day” aphorism), but that’s not much help. Purveyors of doom porn make compelling reading and viewing, but track record is everything in investing, and these guys just don’t have one. Read with caution!