When Dollars Just Aren’t Good Enough!

If you need any further proof that gold fever is moving into the mainstream, legislators in several states are trying to make it easier to buy things with gold. Not by letting you use ingots at the cash register, but rather by linking your gold to electronic payments platforms and relieving the capital gains tax on investments in precious metals.

I wouldn’t depend on using gold as anything other than an investment just yet. Other than the uphill fight to change existing laws, there is also the issue of regulating the money supply, which is under the exclusive purview of the Federal Reserve. If people were suddenly allowed to use gold as legal tender (as well as cryptocurrencies) for any and all purposes, essentially adding a new component to the money supply, I’m sure the Fed would have something to say about it.

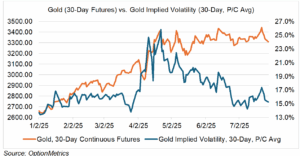

In any case, gold fever has abated, at least for now. It has been moving more or less sideways since it made new highs at the height of the tariff panic in early April. In addition, its implied volatility has decreased to the low 15% region. Crypto, memes, and high-flying stocks have stolen its luster.

Engage Max Froth!

If you’re bored with the Mag 7, gold, and crypto, there’s something else to keep you busy. It seems that meme stocks are back, only this time the market has moved on from GameStop (GME) and AMC (AMC) to Kohl’s (KSS), Krispy Kreme (DNUT), GoPro (GPRO), Opendoor Technologies (OPEN), and Rocket (RKT), amongst others. Many commentators are seizing upon this as yet more evidence that the market is overextended, and possibly even forming a bubble.

Before everyone gets too excited at the prospect of being on the right side of a fund-destroying short squeeze, Garrett DeSimone, head quant at OptionMetrics, points out:

“Market makers appear well-positioned to provide liquidity in the latest rallies of Kohl’s (KSS) and Rocket (RKT), as reflected by implied lending rates. After the initial hype, borrowing costs have snapped back to moderate levels around 10% annualized. This stands in stark contrast to GameStop’s (GME) January 2021 run, when lending costs soared to nearly 80% annualized, making the stock virtually impossible to borrow. Overall, this suggests that the potential for an extreme short squeeze is likely limited.”

Apparently, recreating the meme stock glory days of 2021 will be harder than expected.