Cruises are Back!

Last December, I wrote about cruise lines and how they were almost destroyed by Covid (Let’s Take a Cruise). The outlook at the beginning of the pandemic was pretty bleak. As I noted, “I can’t think of another group of stocks harder hit by Covid than cruise line operators…the big three lines [Carnival, Norwegian Cruise Lines, and Royal Caribbean] lost nearly $900 million each month during the pandemic. Carnival, the worlds’ largest cruise operator, reported a 99.5% year-over-year decline in Q3 2020 revenues…” That’s a lot of money.

Well, Covid almost killed them, but not quite. In fact, not even close. Pent-up travel demand after Covid, along with discounts and promotions offered last year, has resulted in oversold cruises with 100% occupancy rates. Ships are crowded now, with long lines for popular amenities and overwhelmed staff. And there’s something else going on: cruises are no longer dominated by retirees, but are increasingly the vacation of choice for millennials. Cruise lines have caught on to this trend, and have changed their advertising, vacation packages, and on-board activities accordingly. A broadening demographic is a positive in an industry traditionally saddled with an aging clientele.

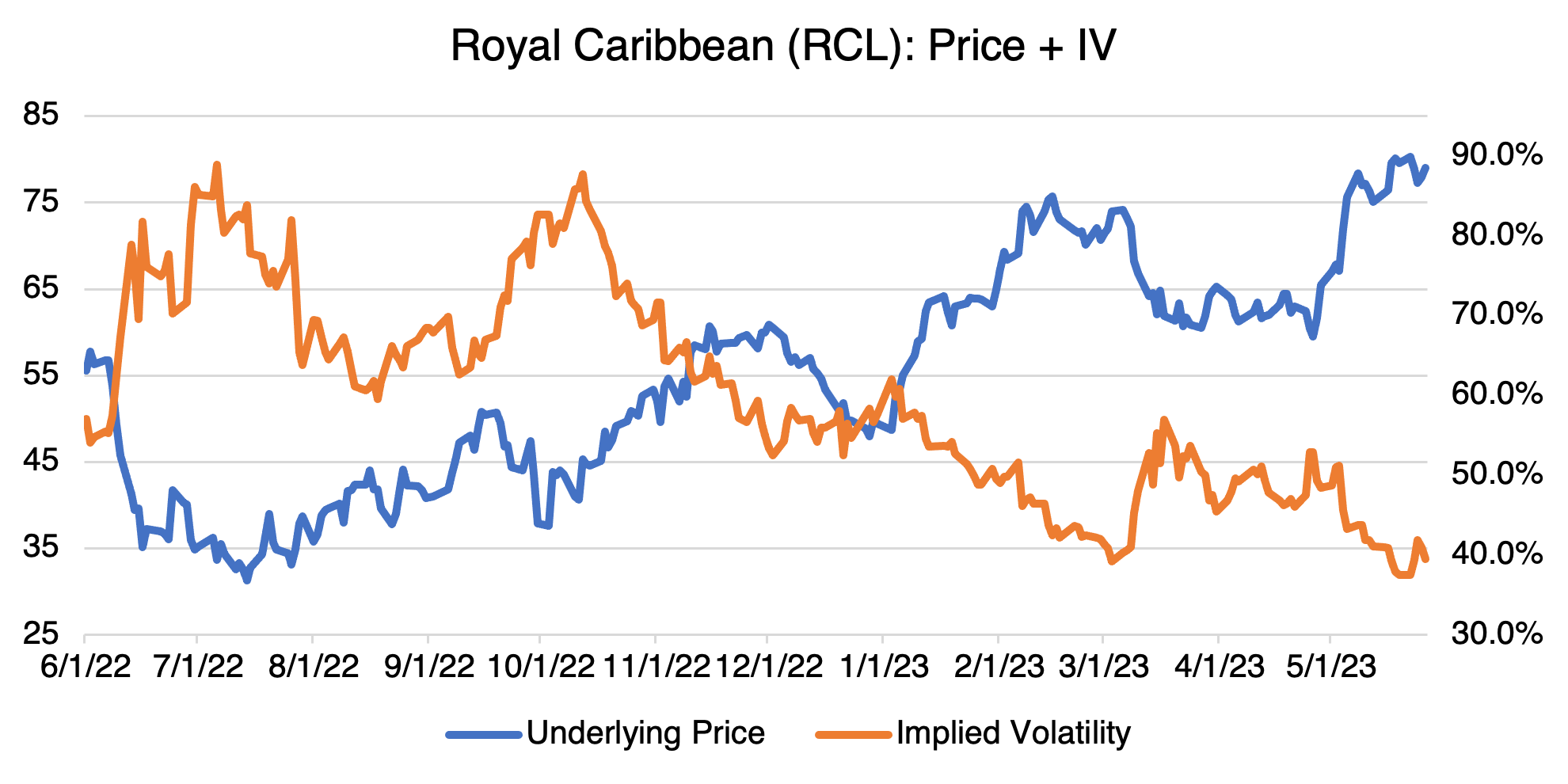

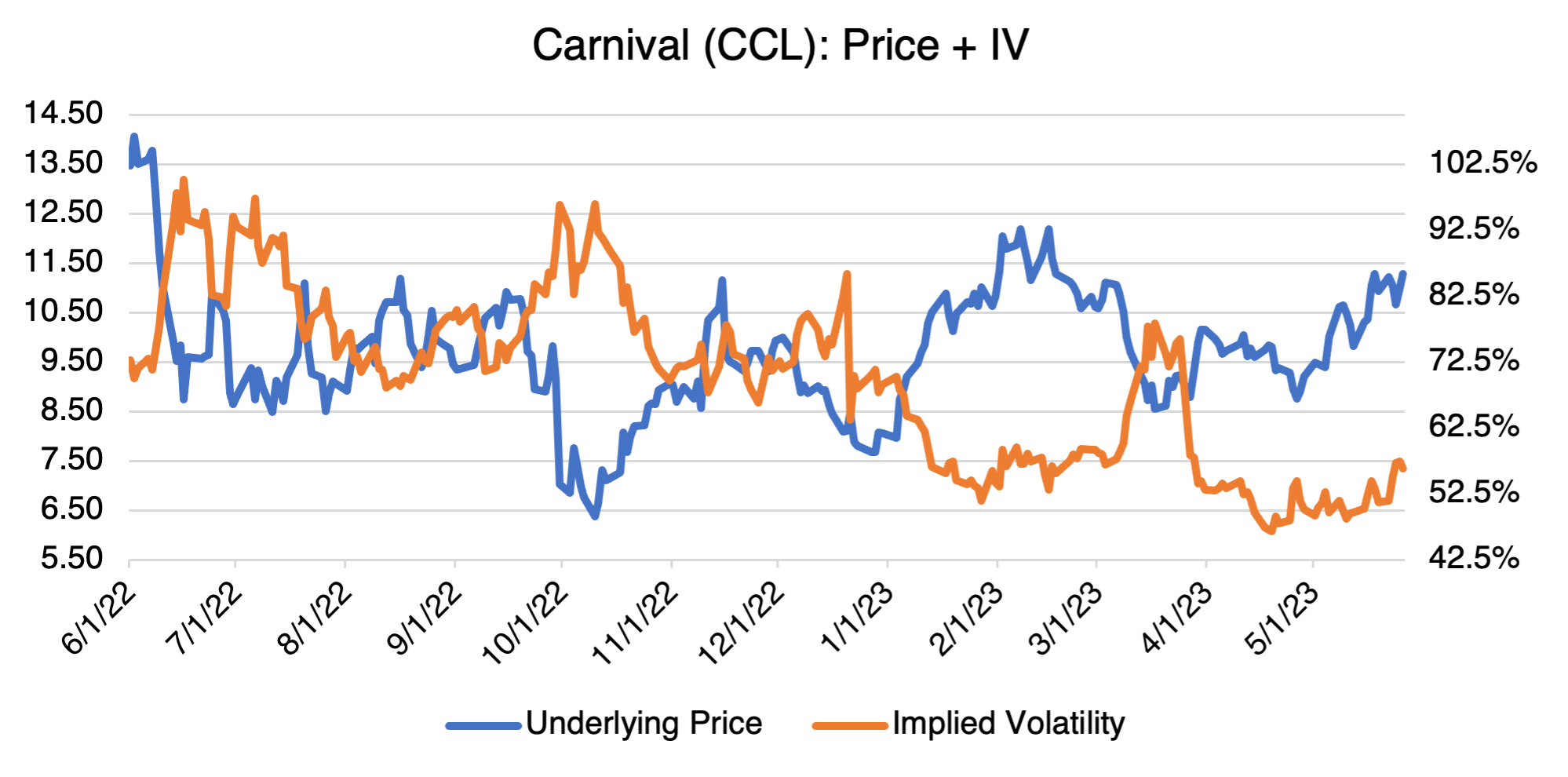

When I first reviewed cruise line stocks at the end of last year, I suggested that if you’re into long term plays for stocks that have been beaten down through no fault of their own, then cruise lines might be just the thing. Below are Royal Caribbean (RCL) and Carnival (CCL), two candidates if you buy into the long term cruise line story.

Something to keep in mind in constructing an options position around RCL or CCL: like many other stock options, implied volatility tends to move inversely to price. That is, as prices increase, implied volatility tends to decrease, and vice versa. You can see this most vividly in RCL since May. If you don’t plan your strategy taking this into account, you might have implied volatility working against you as the stock increases. This is not a technical detail. Taking the RCL July 21 $80 call as an example, you can see below that it’s vega (i.e. how much the premium will change for each 1% change in volatility) is 0.118 at its current implied volatility level of 41%.

If RCL rallies, and volatility comes in 5 points, for example, then your premium will be fighting against a 0.59 negative volatility effect. Taking this into account, your bullish strategy should then be neutral to short implied volatility, such as a call spread. You can use OptionStrat to fine tune your position to achieve this.