Copper, the New Steel

The recent rally in copper was a reminder that tariffs and uncertain trade policy can still be significant market drivers, despite traders’ rather blasé attitude toward both (“headline fatigue” strikes again!). The imposition of tariffs on imported copper was expected, just not as high as 50%. That drove the metal up 13% in the front-month futures contract, an all-time high and reportedly the largest daily increase since 1968. Copper is now up over 40% year-to-date, behind only palladium (43.4%) and platinum (61.6%) for the largest commodity price increase so far this year.

Copper is often dubbed “the new steel,” and is a critical component in construction, electronic products, defense, and transportation. To date, approximately 50% of domestic US domestic consumption is imported, mostly from Canada and Peru in the form of refined copper. China, cited by the administration as effectively controlling the market, does indeed account for about 45% of global refinery production, but only 1% of total US imports.

Given all the imports, the new copper tariffs are meant to spur domestic production and refining capacity and address national security concerns. It’s going to be an uphill fight; copper production doesn’t just expand at the flip of a switch. Building and permitting a copper smelter can take more than five years. Mining the metal is even worse; it takes an average of 29 years for a new copper mine to begin production. That’s too long for most investors.

Copper tariffs of 50% are obviously inflationary, the extent of which will be dependent on the ability to increase domestic production (doubtful, in the short-term) and the extent to which price increases are passed on to consumers (probable). The potential damage to the economy is probably greater than any benefit.

Whether the 50% tariff will be modified is anyone’s guess. To date, President Trump follows “real estate politik,” i.e., he negotiates like a real estate developer by starting out ridiculously high, gaining concessions, and then compromising. It’s a familiar, well-worn tactic, but no one knows for sure whether 50% is a bluff or the real thing. Hence, the copper market’s freak out.

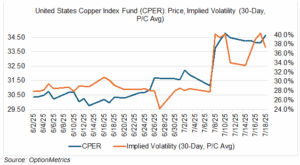

Personally, I suspect that it is a negotiating tactic, just as was the case in previous tariff negotiations (TACO may apply). If that’s the case, then copper has overreacted. Despite that, some amount of tariff (albeit less than 50%) is most likely, and will act to support the market. What you are left with is a market that is cautiously bullish and awaiting the situation to become clearer. New highs are possible, albeit at slower speed than when the tariff was first announced. Although it seems counterintuitive, volatility could decrease under such circumstances, unless the market manages to make new highs or new information becomes available. CPER implied volatility shot to over 40% on the day the tariffs were announced, a gain of 12.5 percentage points. Since then, it’s gone mostly sideways.

How to trade copper? Copper futures are the most direct vehicle, but various ETFs also exist for the pure metal, mining stocks, and combinations of both. Leveraged copper ETFs are also available. The United States Copper Index Fund (CPER) is composed of copper futures and is the purest play on price alone (see chart below).