Is A Bitcoin Bubble Forming?

Many people are asking me lately whether bitcoin is turning into a bubble. For a variety of reasons, most of which center around prospects for a much friendlier regulatory environment, BTC futures have rallied more or less nonstop since November 5, with spot reaching a high of $107,429 on December 16 (the January futures contract peaked out at $110,155 that day). On a spot basis, BTC is up almost 143% year-to-date and 55% since election day; MicroStrategy (MSTR), the bitcoin proxy stock, is up 496% YTD.

Any market that rallies that much in such a short period invariably leads to speculation that a bubble is forming. Is this the case for bitcoin? Short answer, and based on what I am seeing in the BTC futures options market: although the market is certainly frothy, it doesn’t seem like a full-fledged bubble just yet. It might turn into one, but right now it looks more like a very aggressive bull market, or a meme stock in its heyday, than a classic bubble.

Why? If you trade options, there are a few telltale signs that point in that direction:

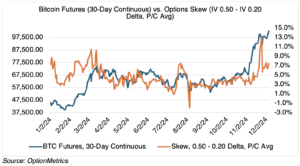

- Increasing implied volatility and out-of-the-money (OTM) to at-the-money (ATM) volatility skew; increased implied volatility. As traders rush to buy “cheap” options (in absolute dollar, not implied volatility, terms), they tend to bid up OTM strikes, increasing the volatility spread to ATM options. If the spread grows to abnormal levels, it is sometimes indicative of an overbought, or in the case of a bubble, frantic market. As you can see in the chart below, the spread has been increasing (as of 12/16, it was 6.25 percentage points), but is not yet at abnormal levels.In addition, 30-Day average BTC implied volatility has averaged about 65% since 11/05, and has remained relatively stable. If traders were uneasy about the future trend of BTC, or if daily prices swings were greater and therefore difficult for market makers to hedge (as would be the case in a bubble), then implied volatility would be increasing. So far, this has not been the case.

- Sharply backwardated or flattened contango futures curves. Futures curves in which the nearest contracts are more expensive than the deferred are known as “backwardated” (the opposite is “contango”). Each curve exhibits certain behavior during a bubble, as traders tend to bid up the most nearby contracts. As a result, backwardated futures curves tend to become steeper and contango curves become flatter.BTC, which has been in contango since bitcoin futures were first introduced in late 2017, has not displayed either of these effects. During the most recent rally since election day, BTC’s deferred months have significantly outperformed the nearby contracts (see chart below). This could indicate that traders are comfortable with the risk of the deferred contracts and believe that the current rally will be sustained and last into 2025. This would not be the case if BTC were forming a bubble, because in general they are short-lived and confined to the front end of the forward curve.

- Unusually high volume and open interest. It’s no surprise that BTC futures have been attracting sharply increased volume and open interest since election day. One interesting point here: the Micro BTC contract has consistently attracted more interest than the regular contract, with its open interest jumping over 3.7X since before election day (it just surpassed 100,000). Open interest in the full-sized contract has remained relatively stable. Since the Micro BTC contract is for small investors, apparently bitcoin futures contracts are attracting more retail than institutional business. Although the increase in volume and open interest has not yet reached extreme levels, the increased presence of retail investors is telling.

There are also some non-options related factors that could indicate that a bubble is forming. Bubbles are usually accompanied by various unusual financial schemes to get retail investors involved. Almost always, they are highly levered and hold the promise of quick double or triple-digit returns. MicroStrategy (MSTR), the various highly levered bitcoin related ETFs, and extreme forecasts and statements (“it’s like Manhattan real estate,” “we’re never going to sell”) all come to mind. Assertions that conventional financial metrics do not apply to the investment, or that the investment is only meant for the few that can truly understand it, are other common traits of bubble-like markets.

In all of the factors I have described above, there is evidence that the market may indeed be frothy, but not necessarily on the way to a full-fledged bubble. What would it take for me to change my mind? Mostly, sharply elevated OTM to ATM skews, extreme movement in the shape of the futures curve, blowout volume and open interest, and extreme, double digit daily price swings. So far, none of these have occurred to the extent that would indicate that BTC is forming a bubble.