Don’t Trust ‘Em!

It’s hard to be a copper or gold trader lately. As I wrote a few weeks ago (Copper, the New Steel), copper has been buffeted by tariff news since early February. Massive and historic inflows of the metal into the US in anticipation of the impending tariffs resulted, as well as prices that peaked at almost 46% higher year-to-date. True to form, the 50% proposed tariffs was changed at the last moment before the August 1 deadline to exclude raw and refined copper, causing a 22.3% decline, the largest one-day drop in the history of copper trading.

Despite this turmoil, no one in the administration seems to have learned that details are important, especially when commodity tariffs are involved. Last Friday, it was gold’s turn to get whipsawed. As part of a months-long attempt to clarify existing tariffs, the Customs Border Protection Agency stipulated last week that cast 1 kg and 100 troy oz gold bars imported from the country would indeed be subject to Switzerland’s new 39% import tariff. Since this is the standard size bar traded on the Comex, and it was widely expected that bullion would be exempt, the news was greeted with some shock. Of course, this caused the gold market to make new all-time highs. But then, the administration indicated that it would be issuing an executive order “clarifying misinformation” about gold tariffs. Right on cue, the President wrote on Monday afternoon that there would be no tariffs on gold, and gold promptly dropped 2.6%.

Frankly, it seems that the President should have gotten all this straight beforehand. Regardless, it does point out the obvious fact that the Administration’s tariff policies are fickle, and relying on them to make investment decisions can be hazardous, to say the least.

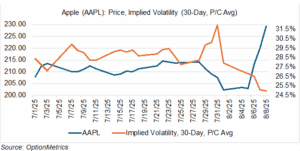

Take the current case of Apple (AAPL). The stock rose 13.3% last week, mostly on the back of Tim Cook’s successful meeting with President Trump.

After announcing that it would invest $100 billion on US companies and suppliers over the next four years, the Apple CEO seems to have made peace with the President, and may have even earned his company an exemption from future chip tariffs. Just last month, Apple warned of tariff costs in the billions, so this was welcome news. However, this could change, and based on history, probably will, so I wouldn’t put too much investment weight on the exemption. Ask any copper or gold trader.

How Rich are Today’s AI Superstars?

It’s been reported lately that certain AI pay packages are reaching into the stratosphere, the $250 million-over-four-years type stratosphere. That got me thinking – how do they compare with what was paid out in the early days of other brand new technologies with seemingly unlimited potential? It’s difficult to come up with one, but the very early days of movies, with its potential to change society, may provide a good comparison.

What did the early stars make in relation to today’s AI boomers? The most popular early stars were getting about $1 million/year in the era immediately after World War 1. To put that in perspective, in 1920 the average income was about $3,300/year and the average house $6,300; the top stars were therefore making over 300 times more than the average person. Some of them were making significant incomes even before federal income taxes were instituted in 1913. No wonder many of them spent like there was no tomorrow!

Compare that to today. Currently, the average income is about $66,000. An AI superstar who manages to score a $250 million pay package over four years ($62.5 million/year) is making almost 950 times more than the average income level, over three times greater than the best paid silent stars were in 1920.

Of course, comparing prices across time is more complicated than it seems and is very dependent on which relative value methodology is employed (if you’re really interested in this, Measuring Worth (https://www.measuringworth.com/) is the source). Regardless of method, I think it’s safe to say that the richest and most famous stars of early Hollywood earned much less than today’s AI superstars. I’m not sure if that means anything about the current state of the AI market, but it’s interesting nevertheless.