Tesla, My Two Cents

This week, I’m going to start by writing about one of the most covered stocks in the history of man, Tesla. Being an options guy, I don’t have much to add on its fundamental situation. I will say this, however: if you’re in the market for an EV, Tesla is no longer the only game in town. Mercedes, Volvo, Audi, and Lucid all now offer high-end EVs that are fresh, cool, and fast, in contrast to Tesla that hasn’t come out with a new model in a few years. Putting it in MBA speak, their “first mover advantage” has been significantly eroded, and Tesla is going to have to fight for every sale, just like any other car company. That’s not to say that TSLA can’t recover, but that it will be an uphill fight.

If you are new to option trading, OptionStrat has an options profit calculator tool that shows the predicted profit/loss of any options strategy. It is easy to use and a great tool for option traders.

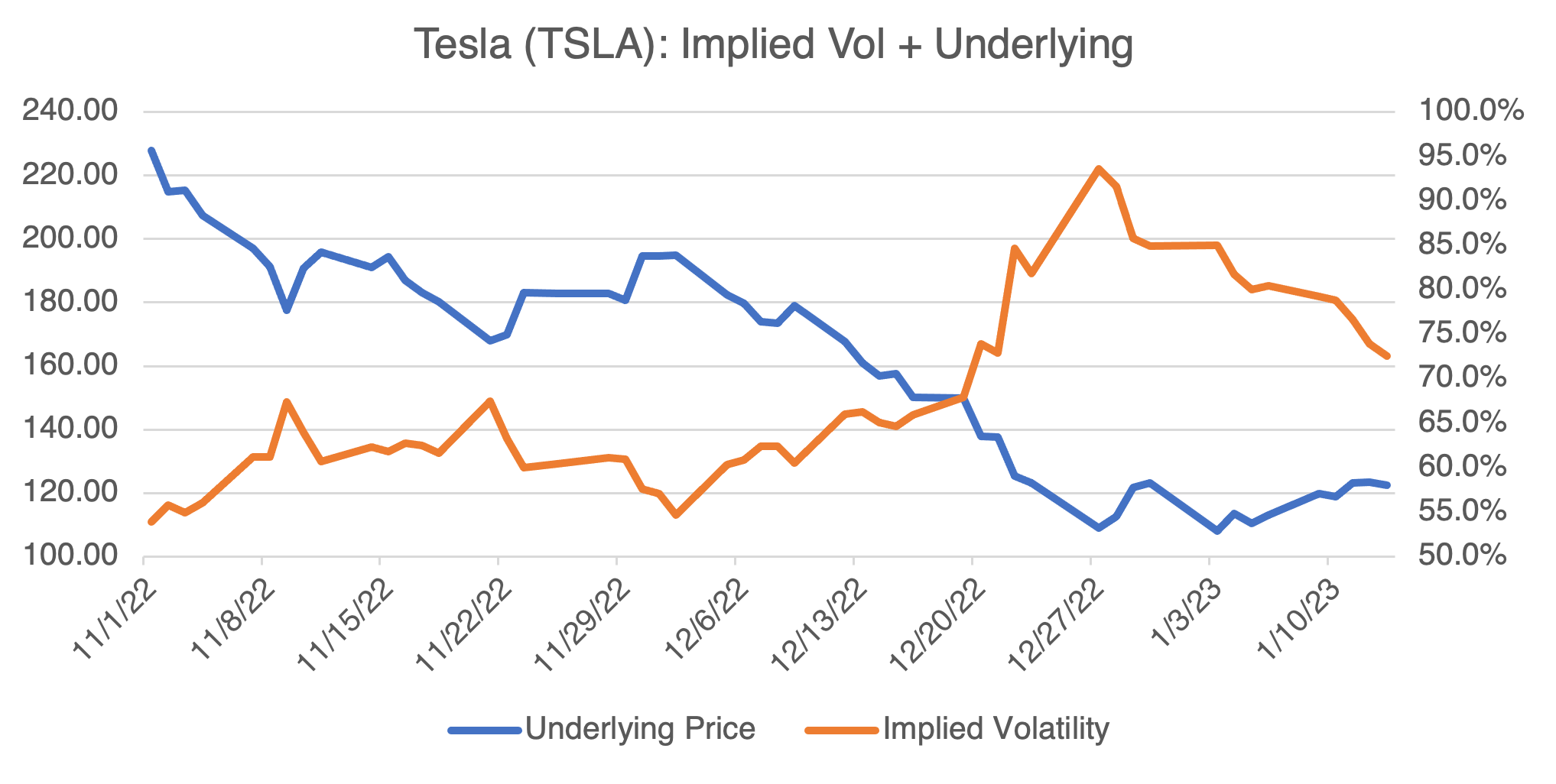

As I wrote a few weeks ago, TSLA displays a characteristic common to many stocks: the tendency of its implied volatility to increase as prices decrease. Tesla’s near-term action displays this clearly:

This has implications if you think Tesla is due for a recovery rally, since implied volatility will decrease along with option valuations. Strategies that are volatility neutral or take advantage of short volatility are available, but the results are sometimes unintuitive or even counterintuitive (welcome to options trading!). Simulating positions and strategies at various prices, volatility levels, and times to expiration will reveal what you should know before executing a strategy. We’ll review some of the possible Tesla strategies next blog. For now, you can always use our options profit calculator to test them out.

Hydrogen Hype, 2023 Version

Hydrogen has been touted on and off as the Next Big Thing in Energy for the last few decades. George Bush mentioned it in his State of the Union Address 20 years ago, way back in 2003. To put that into perspective, iPhones and iPads didn’t exist, Facebook had just started (its original name was FaceMash, no kidding), and the Dow ended the year at 10,415. The prospect of producing energy with water as the only byproduct has made it a long-time dream of energy intensive industries and climate advocates.

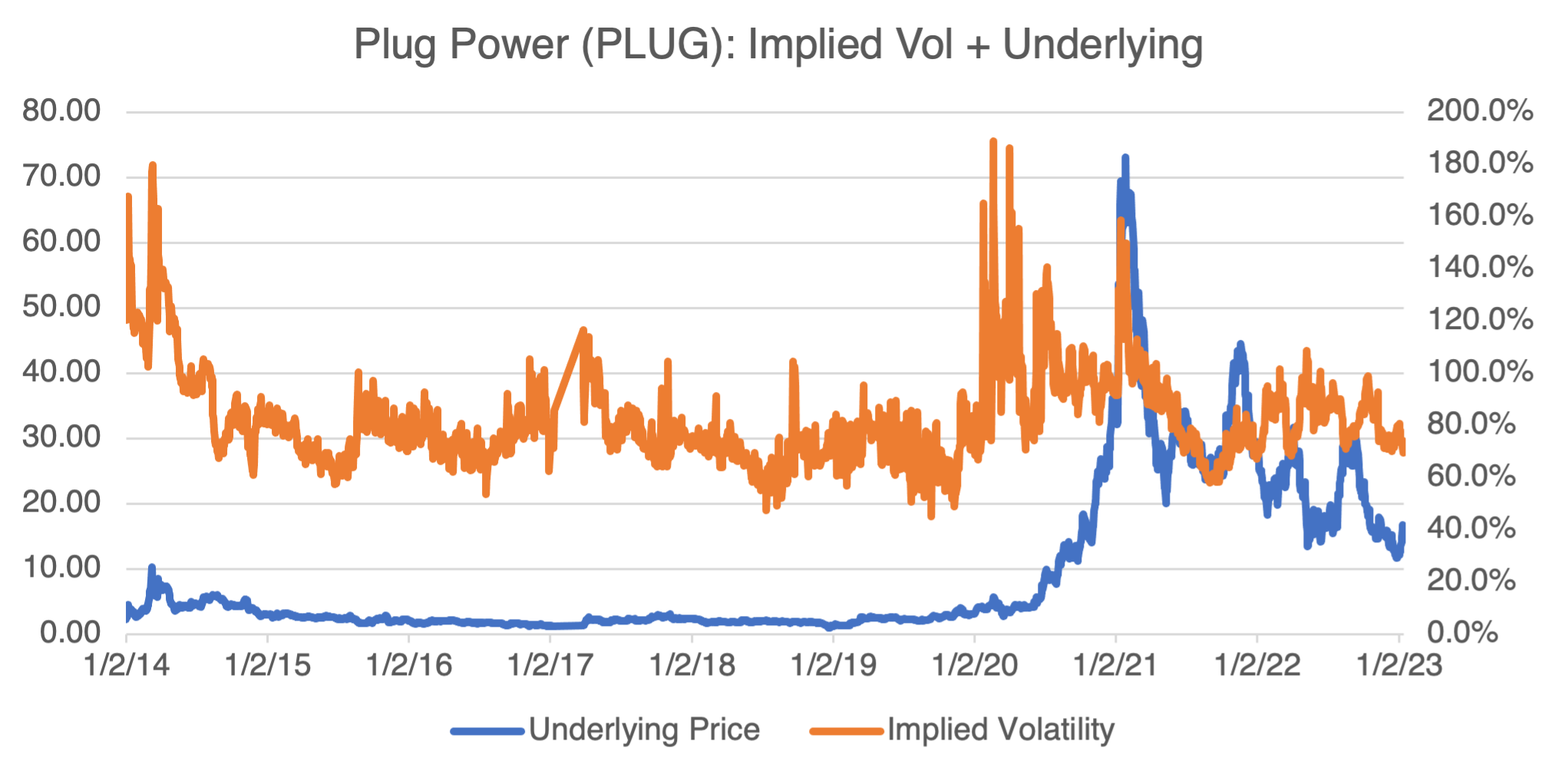

Plug Power (PLUG) was founded in 1997 to take advantage of the coming new world by selling fuel cells. It went public in 1999, hailed as one of the new breeds of companies that would permanently change the energy industry. It’s been on several wild rides since. Wild Ride #1 began in late 1998 when its stock price rocketed from $160 to almost $1500 in just a few months. After reality set in and after years of unprofitability, the stock fell below $1.00 in 2013. The company languished until 2020, when it started making “green” hydrogen (as opposed to “grey” hydrogen, which is made from natural gas) in addition to fuel cells. Wild Ride #2 began, and new investor money flowed in. Plug was once again an investor darling, its stock rising from $3.24 at the beginning of 2020 to $73.18 a little over a year later.

Wild Ride #2 completed, Plug made headlines on something as mundane as accounting disclosures. In short, they made a deal with Amazon to sell fuel cells for forklifts. As part of the deal, they also issued warrants to Amazon that gave them the right to purchase shares at a set price (i.e., a call). Plug’s shares then promptly rallied, driving the calls they issued to deep in-the-money. That’s great, except for one thing: accounting rules mandate that the cost of issuing the stock must be deducted from revenue. Since the cost was higher than Plug’s revenue, they were in the interesting position of having to report negative revenue. And if that wasn’t enough to turn off investors, they then reported that accounting errors made over several years would force a restatement of their financial results. To add insult to injury, the CEO had sold stock before the accounting errors were disclosed, prompting a shareholder lawsuit and further inflaming the situation. Plug had shot itself in the foot and was again out of favor.

By Summer 2022, Plug was trading in the teens, down almost 80% from its 2020 highs. It was at this point, and after some serious lobbying, that Washington came to its rescue in the form of the Inflation Reduction Act, which contained a generous hydrogen tax credit.

Where does all this leave Plug? Is it time for Wild Ride #3? Well, after almost 23 years, they are almost right back to where they started, pushing a new uneconomic technology on the back of the transition to green energy. The only difference is that the government is supporting them this time. Investor money is flowing into the sector, with over 100 privately funded hydrogen startups in 2022 alone. Plug’s long history makes it an industry leader and the obvious choice if you believe the hydrogen story. Although the global market for hydrogen is projected to skyrocket by 2050, projections such as these are notoriously fickle (read: wildly inaccurate) and government subsidies and mandates can disappear as Washington’s priorities change. In other words, you have to be a true hydrogen believer to invest in Plug.

Due to the uncertainty surrounding Plug, its implied volatility is relatively high and is currently trading in the 75 to 95 percent region. That’s a hefty price to pay for a faddish growth stock in an unproven sector. If you accept the investment thesis, however, then the underlying might be a better place to go.

Recommendation Corner

When people find out that I’ve spent my career in trading, they often ask me if I have a favorite book on the subject. The book I usually recommend isn’t about trading per se, but about the history of Wall Street and some of the characters involved. The Scarlet Woman of Wall Street by John Steele Gordon (great name!) is the book on the subject. For those of you who don’t know, the Scarlet Woman was the nickname of the Erie Railroad, Cornelius Vanderbilt, Daniel Drew, Jay Gould, Jim Fisk, Leonard Jerome (that is, father of Jenny Jerome, Winston Churchill’s mother!) all figure prominently, shamelessly manipulating railway stocks, judges, and politicians while laying the foundations of Wall Street. Today’s titans of Wall St. have nothing on these guys.