UnitedHealthcare Fizz?

The biggest news story last week wasn’t about Syria, South Korea, Trump’s nominees, or inflation. No, it was about the execution-style killing of the CEO of UnitedHealthcare, Brian Thompson. It was something right out of Law & Order, and it managed to capture the attention of most of the country. Healthcare insurers are not the most loved companies in the World, much less their senior management, and the alleged killer’s motive played right into the overwhelmingly negative opinion of the industry. In the fallout, their stocks came under pressure: since the shooting early last Wednesday, and as of the close last Monday, UnitedHealthcare (UNH) and CVS (CVS) have come off 7.3% and 4.8%, respectively.

If I had been long UnitedHealthcare going into last week, and had to make a list of things that I thought I could cost me money, the sudden execution-style killing of the CEO would not have made the list. At the same time, weird stuff happens all the time (and more frequently than we care to admit), and that’s just one of the inherent risks of trading. It’s not that bad, however: unexpected, low probability events always produce the largest gains or losses, as well as trading opportunities that don’t come around that often. They can also cause a sudden shift in focus, as long standing issues that were previously dormant – in this case, the hard-nosed consumer practices of the healthcare industry – can be suddenly thrust into the limelight.

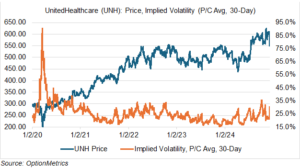

If you are trading healthcare options, all this has obvious implications. From an options point of view, future uncertainty is implied volatility’s best friend. It seems that the public furor symbolized by the alleged killer’s motives caught the insurance industry by surprise, and when there’s lots of noise, confrontational congressional hearings and proposed new regulations invariably follow. Whether anything will actually come of all this is beside the point: future uncertainty has increased, and implied volatility followed in the short run, especially for UNH (see chart below):

As you can see, UNH’s IV jumped to 30.5% by Monday’s close, a full 9.2 percentage points higher than just last Wednesday. Although that may seem high, keep in mind that since 1996, UNH implied volatility has averaged 29.8% and has remained fairly stable since 2021, despite the almost 57% rally since then. Second, social media has a notoriously short attention span. Now that the killer has been caught, it’s just a matter of time before everyone moves on to something else. And third, and perhaps most important, private healthcare is an entrenched and massive industry with a fleet of lobbyists, lawyers, and politicians on their side. Of the l0 largest revenue companies in the US, two (UnitedHealthcare and CVS) were numbers 4 and 6, respectively (FY 2023). Change or new regulations won’t occur overnight, and if it does, will move at a glacial pace.

All this leads me to believe that the current furor should fade, UNH and their brethren should recover, and their implied volatility should recede. Temporary jumps in implied volatility are now more possible, but should be limited and short term. In other words, nothing to see here, keep walking.