Nvidia’s Big Day, Again

Nvidia (NVDA) is scheduled to release Q4 earnings this Wednesday after the markets close. Nvidia has been on the defensive since early last November and the sudden appearance of DeepSeek earlier in the year highlighted increasing doubts about its sky-high valuation. This makes Wednesday’s earnings release particularly important and presents significant price risk after the announcement.

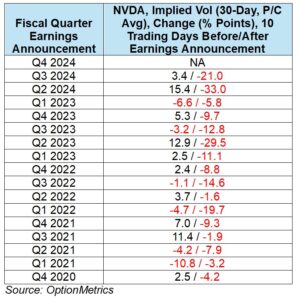

I’ve written several times about the behavior of implied volatility before and after earnings announcements, the so-called “vol crush” pattern in which implied volatility increases beforehand and then decreases afterward as uncertainty about the outcome diminishes. The pattern is particularly consistent in the case of Nvidia:

As you can see in red above, in 100% of the announcements since 2020, NVDA implied volatility declined, in most cases significantly, after the fact. 16 announcements, 16 declines. Not that many options trades are that consistent, or yield such spectacular results. [Two other AI stocks, Palantir (PLTR) and Advanced Micro Devices (AMD) show similar patterns. For more on this, see my blog at OptionMetrics, Vol Crush: Dependable and Consistent]

One could argue that vol crush is simply a result of earnings coming in favorably or generally within estimates, or at least supporting the prevailing trend. In that case, implied volatility should increase before the announcement as uncertainty builds, but then decrease afterwards as the prevailing trend is confirmed. For Nvidia, that has been the case since it took off in 2020. Whether the pattern will continue in the face of a disappointing announcement, or a market more skeptical to AI, remains to be seen (and possibly as early as this Thursday). Regardless, to date the results of the NVDA vol crush trade have been very impressive, to say the least. Let’s look at some other examples.

Taxi!

Self-driving cars have been perpetually on the horizon for about a decade now, but never seem to really catch fire. Sure, there are some early adopters and Tesla owners who pay for the full self-driving feature, but the vast majority of us aren’t comfortable with a computer driving our car. That might change soon, and the market is taking notice.

For many people, Robotaxis, i.e., driverless taxis, are their first introduction to autonomous vehicles (AVs). Google’s Waymo, which completed 150,000 trips last year, is currently leading the way, offering fully autonomous rides in Los Angeles, San Francisco, and Phoenix. It’s just like a regular rideshare, only there’s no driver in the car. Step into the future!

Uber has experimented with AVs, but believes that widespread adoption is a ways off. Other than technological issues, there are a myriad of state-by-state regulations that must be navigated. There are also safety issues – AVs must have a safety record that far surpasses normal vehicles.

That doesn’t mean, however, that Uber can afford to ignore the threat that AVs pose to their driver-based business model. Rather than develop their own system, Uber’s strategy is to partner with AV developers, offering them distribution in exchange for their technology. Essentially, they are farming out the AV technology to specialists, affirming that Uber’s competitive advantage is matching cars with passengers, not the cars themselves. As a mentor once told me “Do what you’re good at!”

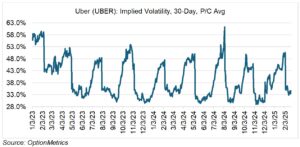

Above is Uber’s implied volatility since 2023. Notice two things: a) it’s been trending lower, and is at the bottom end or its long-term range, and b) as discussed above regarding Nvidia, the consistent vol crush pattern accompanying each earnings announcement. Even if you don’t believe in the AV story, or have doubts about Uber’s fundamentals, you can still play the Uber vol crush strategy.

Uber’s main competition on the AV horizon is, as usual, Tesla, which announced that the first of their AV taxis (“robotaxis) should hit the road in Austin in June. That’s probably optimistic. The twist here is that in the meantime they are also introducing their own ride-sharing app (Elon Musk claims it is the “Airbnb of ride-sharing) through the Tesla Network. In other words, and unlike Uber, Tesla is going it alone to get customers. That seems like a steeper climb than Uber’s approach, and a somewhat different business than what Tesla is accustomed to. Add in the distraction from Musk’s full-time job with the current administration, and I’m skeptical that he can make it work.

As in the case with Uber, even if you agree that Tesla’s robotaxi initiative will not live up to expectations, or have troubles with their other businesses, vol crush is still a consistent TSLA strategy (see below):