The Magnificent Seven: The Remake

Just a little over two months ago, the Magnificent Seven (minus Tesla) were at the top of the world and, possibly, a baby bubble. When it became apparent that the economy and inflation were a bit hotter than expected, and that interest rates might not be coming down as fast as expected, the market’s attention was diverted and the Mag Seven suddenly became susceptible to the laws of gravity. Much to the chagrin of casual investors, markets don’t go straight up or down, and especially not when you want them to.

Momentum investing (in a nutshell, buy what’s going up, sell what’s going down) can work, but ultimately, financial results call the shots, and that means paying attention to earnings announcements, no matter how deadly dull. This is a big week for such announcements — more than 30% of S&P 500 companies are reporting earnings.

Interestingly, implied volatility is at the center of a very consistent options strategy to take advantage of the uncertainty and importance ascribed to each reporting announcement. The usual pattern is for implied volatility to increase in the weeks before the announcement (increased uncertainty), and then to decline sharply afterwards (decreased uncertainty), the so-called “vol crush.” Essentially, the volatility version of “Buy the rumor, sell the news.”

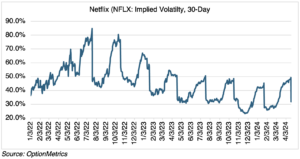

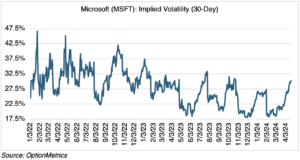

You can see this pattern clearly in Netflix (NFLX), which reported last week, and Microsoft (MSFT), which is due to report after the close this Thursday, 04/25:

As you can see above, vol crush is a regularly repeating feature of the market. Although Netflix’s latest results were perceived as negative (underlying down 9% the day after), its implied volatility plummeted as well, dropping from 49.3% to 31.8%. After Q4 results were released in late January, the drop in implied volatility was even more impressive — 45.2% to 27.6% in one trading day. Uncertainty drives implied volatility, and when results are finally revealed, it is temporarily no longer a factor.

Microsoft follows the same pattern. Currently, MSFT’s implied volatility has increased to 30.3% (Friday’s close) from 18.5% on March 1, anticipating this Thursday’s (04/25) Q1 earnings release. As you can see below, this type of increase before announcements is not unprecedented (and actually more normal than not).

For certain stocks with regular and well-anticipated earnings announcements, the “vol crush” is a consistent pattern that option traders should take into account when devising strategies. As I have noted often, understanding and recognizing the factors that influence implied volatility is what separates professional options traders from amateurs.

This not just a “geeky, quant thing” (as someone once put it to me). Its effect on premium, especially during periods of vol crush or expansion, is significant. Consider what happened to Netflix before and after its January earnings release. As I noted above, implied went from 45.2% to 27.6% in one trading day, a drop of 17.60 vol points, or 38.9%. Implied volatility is directly proportional to premium, i.e., NFLX premiums will consequently decline by roughly that percentage (key word being “roughly” — strike and maturity may alter the result somewhat). That’s enough to offset the effect of many price change that might occur. In other words, if you are on the wrong side of implied volatility during the period before or after an earnings announcement, you could be in the interesting situation of having correctly predicted the market but didn’t make any money (or a lot less than you thought). Frustrating, to say the least.

Let’s use one more example, Microsoft. Using OptionStrat, we can estimate the effect of vol crush implied volatility shifts. Currently, MSFT’s implied volatility is trading 30.3%. Let’s say that it declines to 25% after the earnings announcement this coming Thursday, a decline of 17.5%. A simple, plain vanilla MSFT at-the-money $400 call, May 17 expiration, starts out at $13.93 on April 23, with the underlying at $401.

Now let’s say that volatility decreases to 25% (see table below) after MSFT’s earnings announcement on Thursday. Assuming that the underlying stays at $401, the $400 call then declines to $11.09, a decline of $2.84, or 20.4%. [Of course, the assumption that the underlying will stay the same is unrealistic, but it was necessary to isolate the effect of the decline in implied volatility.]

Ignoring implied volatility can be costly!