LNG: Disconnected?

To begin, an important clarification on an observation I made in my last blog. As I wrote, “…interestingly, five out of the top ten biggest daily VIX spikes occurred on Monday.” What I really meant was that, historically, five out of the top ten biggest daily VIX spikes occurred on Mondays, a very different, and much more interesting, point.

This week, we return to an old friend, liquified natural gas and the largest producer in the US, Cheniere Energy. When we wrote about them last February (LNG Uncertainty), the Biden Administration (remember them?) had recently frozen permits for new and pending LNG export projects. As I wrote, “…this is largely a political process and injects a whole new level of uncertainty into US LNG production, exports, and domestic natural gas prices.”

Although the freeze continues, its future is uncertain and dependent on the results of the upcoming election and the energy policies of the new administration. LNG is also susceptible to geopolitical tensions due to the fact that it may be shipped internationally. This was demonstrated in 2022 after the start of the war in Ukraine. Most traders outside of energy circles (and for that matter, politicians) don’t remember that a full-fledged European energy crisis almost occurred that autumn. The war in Ukraine had started during that February; US and European sanctions resulted. The Russians then responded by curtailing the flow of natural gas to Europe. Since at the time Europe was dependent on Russia for approximately 45% of their natural gas supply, this led to projections of widespread and painful energy shortages, as well as rocketing US and European natural gas prices.

Importing liquified natural gas was one of the measures the Europeans undertook to fill the projected supply deficit. Consequently, LNG producers, which were rallying before the war due to higher natural gas prices, were the direct beneficiaries. Cheniere rocketed to a new all-time high of $182.15 by the end of November 2022.

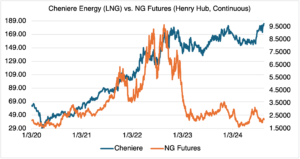

In addition to domestic and international political pressures, LNG prices are also affected by the commodity from which it is made, regular natural gas. However, despite the fact that natural gas prices were below $2.00 at the beginning of this month and producers are shutting in wells, Cheniere has roughly held on to its gains (see below) and recently made new all-time highs.

Source: OptionMetrics

Why? Most of Cheniere’s production (greater than 90%) is covered by long-term offtake contracts, insulating them from price declines and generating predictable revenue. As with any company beholden to commodity prices, long term and favorable input and output agreements are crucial for financial stability. Otherwise, the company’s results will be tied directly to their trading and hedging ability and possibly subject to extreme variability – you will be investing in a liquified natural gas trading room, not a production company.

Another factor supporting the stock is that Cheniere management has been aggressively pursuing buyback programs when the stock dips. For the first six months of 2024, LNG bought back $1.7 billion of stock; $4 billion more is authorized through 2027. As a result, management is providing investors with an informal “put” below the market.

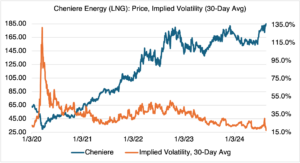

The ”put” could be one of the reasons that LNG’s implied volatility has been declining steadily (see below). Note that Cheniere’s implied volatility and price generally move inversely to one another. Since the stock has been making new highs lately, its implied volatility is at historic lows and trading in the high teens. Since LNG has been increasing since mid-2020, steadily increasing prices are the usual state of affairs. If the stock makes new highs, expect its implied volatility to move even lower. Conversely, if LNG cannot hold on to its gains, implied volatility may test its most recent highs of roughly 30%.

Source: OptionMetrics