Flying Stocks!

I think anybody that has ever been stuck in traffic has thought how cool it would be to own your own personal flying machine. Just like George Jetson, you could fly above it all, zipping to your destination quickly and quietly. Like many inventions that were forecast in the 50s and 60s, some of them are finally coming to pass, and air taxis are one of them. To that end, a few firms are busy developing eVTOL (electric vertical take-off and landing) vehicles that are the first step in satisfying your most ardent Jetson fantasies. Although they are all still in prototype phase, and have unresolved problems, some of the companies that make these vehicles are public and ready to trade. Let’s focus on one of them, Joby Aviation (JOBY).

Joby is developing commercial passenger eVTOL aircraft that could compete favorably (i.e., faster, quieter, zero emissions) with helicopters and other existing aviation alternatives. In early October, JOBY secured a partnership with Delta to obtain an eVTOL fleet to ferry passengers from their homes to the airport, starting in NY and LA. Delta gave them $60mm upfront, with the promise of $200mm in total if certain milestones are met. They are going to need the money — developing a new breed of aircraft is very expensive and time consuming, especially if you factor in regulatory approvals. Although the product is certainly disruptive and all that, the company will likely burn vast amounts of cash and have no sales for some time. JOBY has gone through $360mm over the last four quarters and is projected to need another $1.2 billion over the next 31/2 years. Analysts do not expect significant sales until 2025. There is also the specter of competition from several other eVTOL startups.

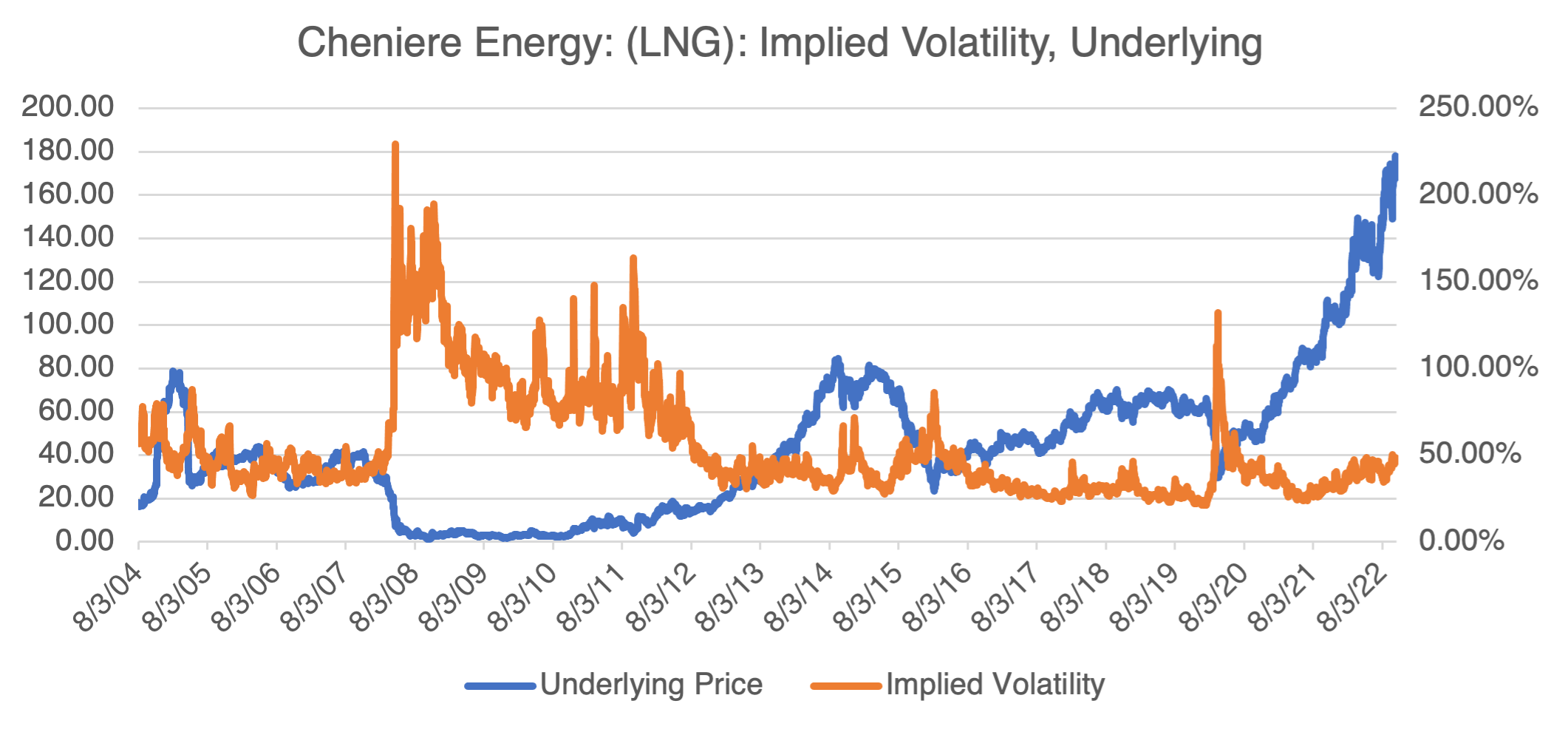

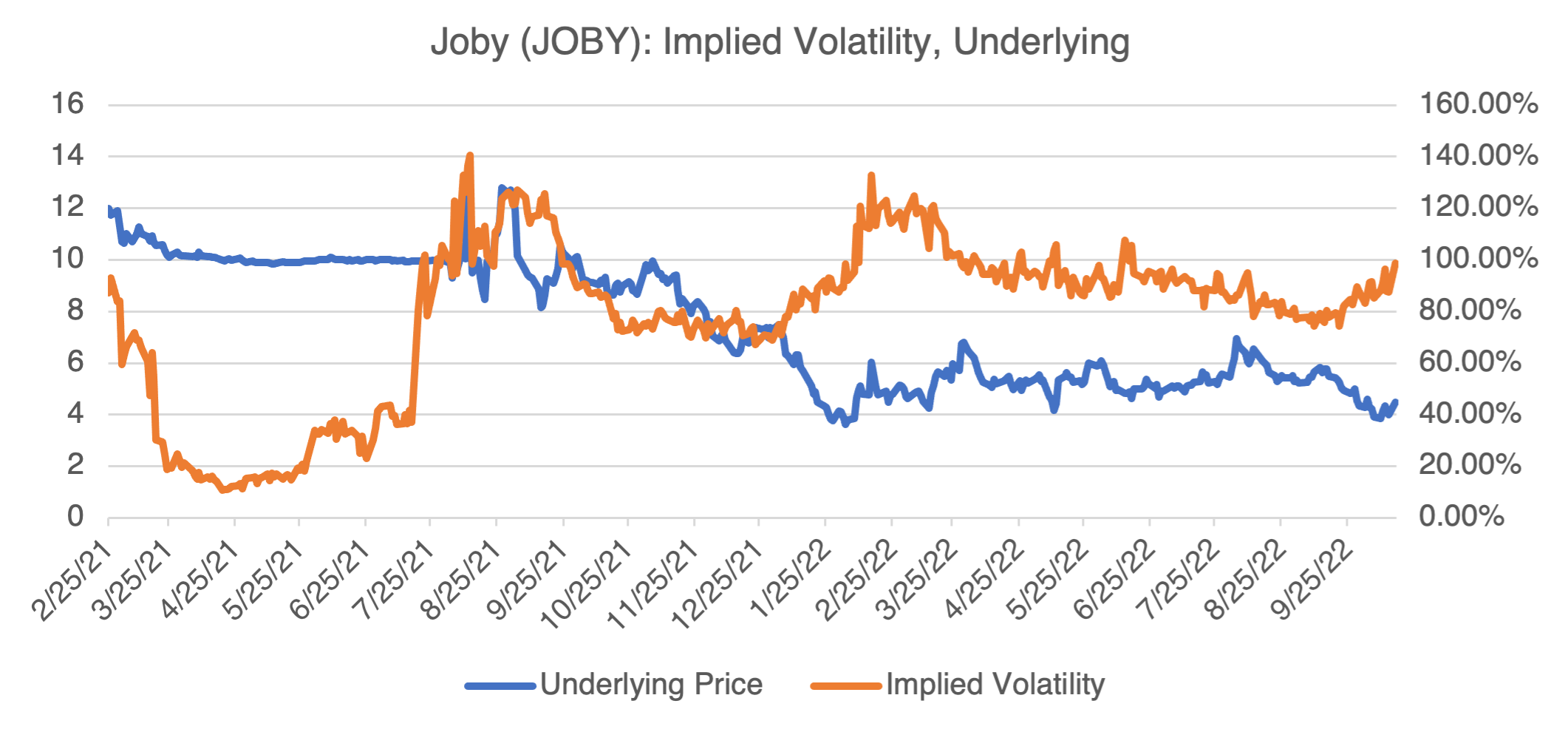

All this will result in a bumpy ride and the stock will be subject to sudden bouts of severe volatility. It will also be affected by developments in the broader markets — bear markets tend to make investors dump the highly speculative. Therefore, it’s not surprising that JOBY is down about 41% YTD. JOBY’s implied volatility reflects the uncertainty surrounding the stock and is trading almost 100%. This could be an instance in which the stock itself is a better investment than its options.

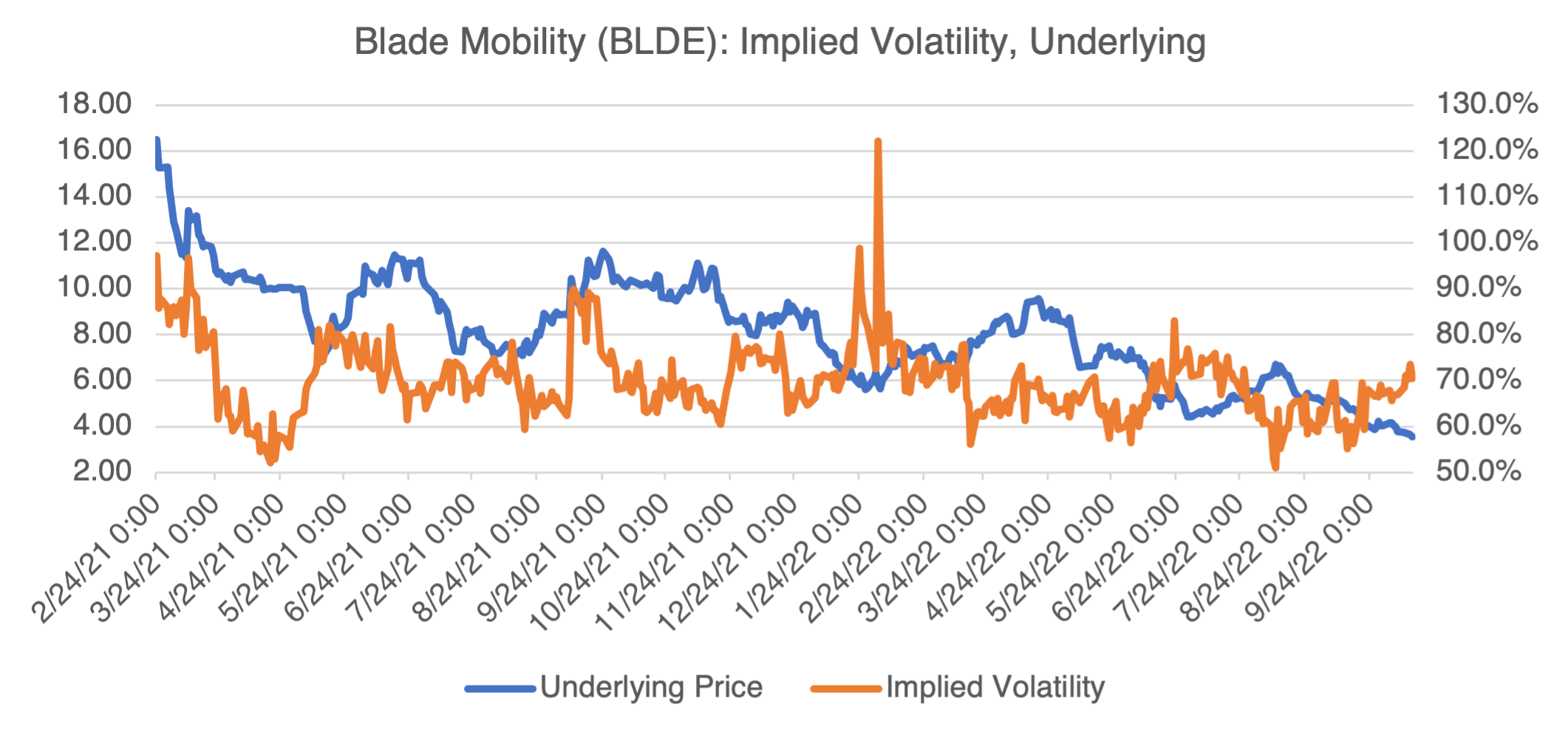

If you think that it is too early to invest directly in eVTOL producers, but like the air taxi business, Blade Mobility (BLDE) offers an alternative. If you’ve ever tried to get to JFK on a busy afternoon, you will appreciate Blade’s product. The company offers helicopter and seaplane services to airports primarily in the congested northeast. Although Blade hates the comparison, it’s commonly called “The Uber of the Sky,” because it doesn’t own any aircraft, but has a network of 29 operators that do. Blade makes money with annual fees, per-ride ticket prices, and takes a % of sales from its operators. Interestingly, its passenger terminals have been designed around eVTOL aircraft when they become available. Like JOBY, the stock is down sharply this year (-59%), partially due to the broader bear market, but could represent a solid long-term play if you want to invest in the space but don’t have the stomach for a pure eVTOL producer.

LNG, Now and Forever?

And now, back to the real world. The scary energy situation this winter in both the US and (mostly) Europe continues to provide some investment opportunities (if you’re going to be cold, you might as well make some money!).

Unless you’ve been very off the grid for the last few months, you should know by now that Europe has been undergoing a full-fledged energy crisis since the beginning of the Ukrainian War and the disruptions of Russian gas supply. Europeans are facing sharply higher natural gas and power prices, and although they have come off from the peaks seen a few months ago, the situation is still perilous — a cold winter could be enough to tip the situation into rolling blackouts and rationing. If you’re thinking of going to Europe this winter, bring a good coat!

Up until now, this has been a European problem and hasn’t affected us in the US (or at least not as much, and if you ignore the effect of the situation on US gasoline prices). But now comes a report from ISO New England, the region’s power grid operator, warning that a cold NE winter and a shortage of natural gas may result in rolling blackouts in the region. Admittedly, such reports from grid operators usually paint a grim picture and are an exercise in “plan for the worst, hope for the best.” But in this case, they may have a point. Historically, New England has always suffered from a lack of natural gas pipeline capacity and storage and relies upon imports of liquified natural gas (LNG) to meet demand. Sound familiar? Europe is in the same situation and has consequently spiked worldwide demand for LNG.

Which stocks could benefit from this? I’ve written about Cheniere Energy (LNG) before, and it continues to provide an intriguing opportunity. LNG is the second largest producer of LNG in the world (confusingly, Cheniere’s stock ticker and its product are the same) and seems to be in the right place at the right time. The stock has been flirting with new highs for some time now, but its implied volatility has remained stubbornly in the mid-40% region. In the event of actual shortages in New England, both its price and implied volatility should increase, providing a double kick to any bullish options strategy.