Pay Attention to Nickel!

Imagine that one day you’re trading away in a pretty quiet stock and all of sudden it goes up 66% one day and then doubles the next over the course of 18 minutes. Also imagine that you happened to be long and were already shopping for a Ferrari. Now imagine how you would feel if the exchange then stepped in and called one of the biggest do-overs in history, invalidating all the trades from the previous day, the day where it doubled, and you made all your money, to bail out their largest customer. You would be pissed, right? Well, this actually happened last week in the previously sleepy and genteel world of nickel trading and it’s something that every trader on any exchange should know about. It’s a genuinely wild story.

I know, nickel is a relatively obscure commodity traded in London by English guys in very nice, The Kingsman-looking suits. It trades on the London Metal Exchange (LME), one of the last exchanges that still maintains physical rings where brokers can trade (but there are seats and its complicated – this is England, after all). Nickel is used in stainless steel, wire, and most prominently lately, EV batteries. For about the last decade, it was about $10,000 to $20,000 per ton. It’s a specialized niche product that usually doesn’t attract much attention outside of commodity nerd circles.

That is, until the Ukrainian war broke out. You see, Russia is the third-largest producer of nickel and the largest exported or the refined version. Although nickel has not been sanctioned – yet – the market was susceptible to hijinks due to the actions of its largest customer, Xiang Guangda, founder of Tsingshan Holdings, the world’s largest producer. Xiang is known as “Big Shot” among Chinese commodity types and doesn’t think small. He’s a shooter and had been amassing a large short position due to his plans to swamp the market with a 40% increase in production this year for EV batteries. On the other side were various hedge and commodity traders (reportedly, Glencore) trying to capitalize on electric vehicles with large stocks of nickel in LME warehouses.

As nickel started increasing as a result of the war, it set the stage for a classic GameStop like short squeeze. The difference is that this one didn’t uncork over the course of weeks or months, but hours. On Friday, March 4, nickel settled at $28,919. Then on the following Monday, as blood spread in the water, it accelerated to $48,078.

Anyone caught short a meme stock knows full well what happened next: margin calls. On top of the pile was Tsingshan with reported calls of about $3 billion. They paid part, but not all, of the call. Next up were some LME member brokers and banks, i.e., the ones that acted as intermediaries for Tshingshan, facing huge losses and, in the case of some of the smaller brokers, possible failure. Even further downhill were other traders, producers, and end-users that were short. Needless to say, none of them were prepared for the level or timing of the calls. Despite all this, and despite the fact that nickel had gone up by 66% the previous session, the exchange allowed the market to trade the following day without any special rules.

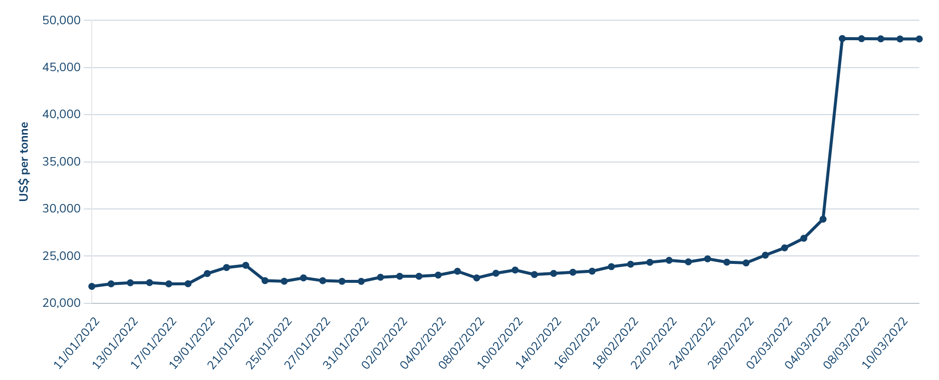

You can guess what happened — things got really crazy. Punching into hyperspace at around 5:30 AM the next morning, prices started going vertical, eventually topping out at $101,363 about half an hour later. At that point, and with the turmoil bleeding into other metals listed on the exchange, the LME suspended trading with the price at a frozen $80,000. Exchange officials said they would reopen after sorting out the mess — the ultimate exchange nightmare. Needless to say, the nickel price chart since the beginning of the year looks pretty dramatic, sort of like a plane taking off:

Nickel closing prices graph (Source: LME)

But their nightmare isn’t operational or confined to maintaining orderly markets. It’s one of survival. If a client can’t secure financing for the margin calls, the position and the related losses are then the brokers to keep. If the brokers then can’t handle it, the loss goes to other exchange members, or a special fund used for the purpose. And if that’s insufficient, the exchange itself goes down, completing the daisy chain of death.

Understandably, exchanges don’t want to go bankrupt and will do anything to maintain the integrity of the exchange. During times of war or economic calamity, they might shut the exchange for a few days to let things cool off. Alternatively, they may institute a liquidation-only market in which traders are only allowed to liquidate existing positions and not allowed to add any new ones. There is certainly ample precedent for both.

But here’s where the story departs from the usual. In one of the greatest “do-overs” in financial history, the LME decided to cancel all trades that took place on Tuesday morning, the entire session, about 9,000 trades, and act like it never happened. The previous day’s settlement, $48,078, was then the last prevailing price until the market reopens. Needless to say, the traders, brokers, and hedge funds that traded on Tuesday morning and made money were more than a little unhappy, and rightly so. These include Goldman Sachs, AQR Capital, and other well capitalized traders, not individual investors that the exchange could easily ignore. As is usually the case in such circumstances, time for everyone to lawyer up. A quote from the movie Chinatown is apropos: “I don’t get tough with anyone, Mr. Gittes. My lawyer does.”

Regardless, since exchanges can usually do whatever they need to do to ensure their financial integrity, the LME may escape liability. Although their actions were certainly unprecedented, they weren’t necessarily outside of the exchange charter. In any case, the LME’s reputation as an exchange will certainly suffer. Personally, I would love to ask LME management how they allowed one client to amass a position that was possibly exchange threatening. Exchanges and brokers maintain and enforce position limits for a reason.

One more wrinkle here. The LME is a wholly owned subsidiary of Hong Kong Exchanges and Clearing, of which the Hong Kong Government is the largest shareholder. One needn’t have much of an imagination to understand why the LME bent over backwards to help Tsingshan. Needless to say, conspiracy theorists are all over this and they might actually have a point.

The LME has scheduled March 16 for the reopening and has instituted 15% price limits across all metals until further notice. As the LME put it, “market participants have raised concern regarding the risk of sudden, extreme moves in other metals, particularly given the geopolitical backdrop.” A bit of classic English understatement there. Xiang Guangda of Tsingshan has indicated that he wants to keep his giant short position. Since the market closed, he and the banks that acted as his intermediaries (JP Morgan, Standard Chartered, BNP Paribas) have reportedly arranged a standstill agreement in which Tsingshan will be spared further margins calls or a forced liquidation. In other words, rather than let the company default, they agreed to give it more time to reduce its position and come up with some cash.

The banks’ motivation to come to the rescue is easy to discern. As Keynes famously put it, “If you owe your bank a hundred pounds, you have a problem. But if you owe a million, it has.” And for retail clients that don’t take giant positions that they can’t afford and trade rationally, I would quote George Costanza: “We live in a Society!!”

The lesson for retail investors?

- Your trades are only as good as the exchange in which they are executed.

- Exchanges are a business, not a public service, and will act in their members’ interest every time, regardless of reputation.

- Trading on an exchange is not exactly a free market (but close). As a trader, you are subject to the exchange’s rules and regulations, agree with them not — it’s their ballpark.

- The chance of exchange intervention during market disruptions, for any reason, are high; they can, and will, do anything to maintain an orderly market and, ultimately, their financial integrity and survival. Short-term considerations will prevail; they will deal with the long-term later. Retail traders can get hurt in the crossfire.