With Enough Money

The War Won’t Stop

It seems that most people have forgotten that there’s still a war in the Ukraine and it continues to influence energy prices. As Americans, we’re far removed from the fighting and largely insulated from the specter of bankruptcy-inducing energy price spikes facing Europe. Imagine your power and heating bills going up 5 to 10 times from normal, and you get the idea. For the time being, mild winter weather in Europe and retail subsidies have kept things under control and off the front pages. What remains is uncertainty and the potential for rocketing energy prices that may spill over into the US.

Obviously, the long-term driver behind all this is the interminable Ukrainian war. It’s been going on long enough now (10 months) and without a clear resolution that most people have stopped following it closely. Just how this war will wind down remains as unclear now as it did at the beginning of the conflict. As in most conflicts since WW2, this is really a proxy war, in this case between the US and Europe against Russia and its allies. As such, Ukraine is dependent on the West, specifically the US, for arms, financial, and diplomatic support. Without the US and Europe, the war is lost for them. So, in some sense, the outcome of the war is dependent on how long the US is willing to support Ukraine without just walking away or forcing them to settle. To the extent that our support bogs down one of our main geopolitical rivals in a war that they can’t afford and can’t win, the answer is a very long time. The US is a very rich nation, and the expense of the war (depending on the source, about $90 billion to date) is relatively minor when you consider it against this country’s GDP ($23 trillion), defense budget ($1.6 trillion), or overall spending ($6.3 trillion). So, we can wait as the Russians blow through their blood and treasure.

And now the options tie in. As long at the war rages on, the supply/demand balance in Europe will remain tight. And even after the war ends, the lesson is clear: don’t rely upon unstable, aggressive, undemocratic regimes run by autocrats to supply your crucial energy needs (frankly, I thought this was pretty clear before the war). Russia’s reputation as a dependable energy supplier has taken a hit, to say the least.

Part of Europe’s solution is to import LNG, liquified natural gas, from the rest of the world (mostly Qatar and the US). Before they do this, however, they will have to build out their LNG port facilities (more on that below). The largest LNG producer in the US and the second largest producer in the world is Cheniere Energy (LNG). I’ve written about them before as they are the obvious company to bet on if you buy into the long-term LNG story.

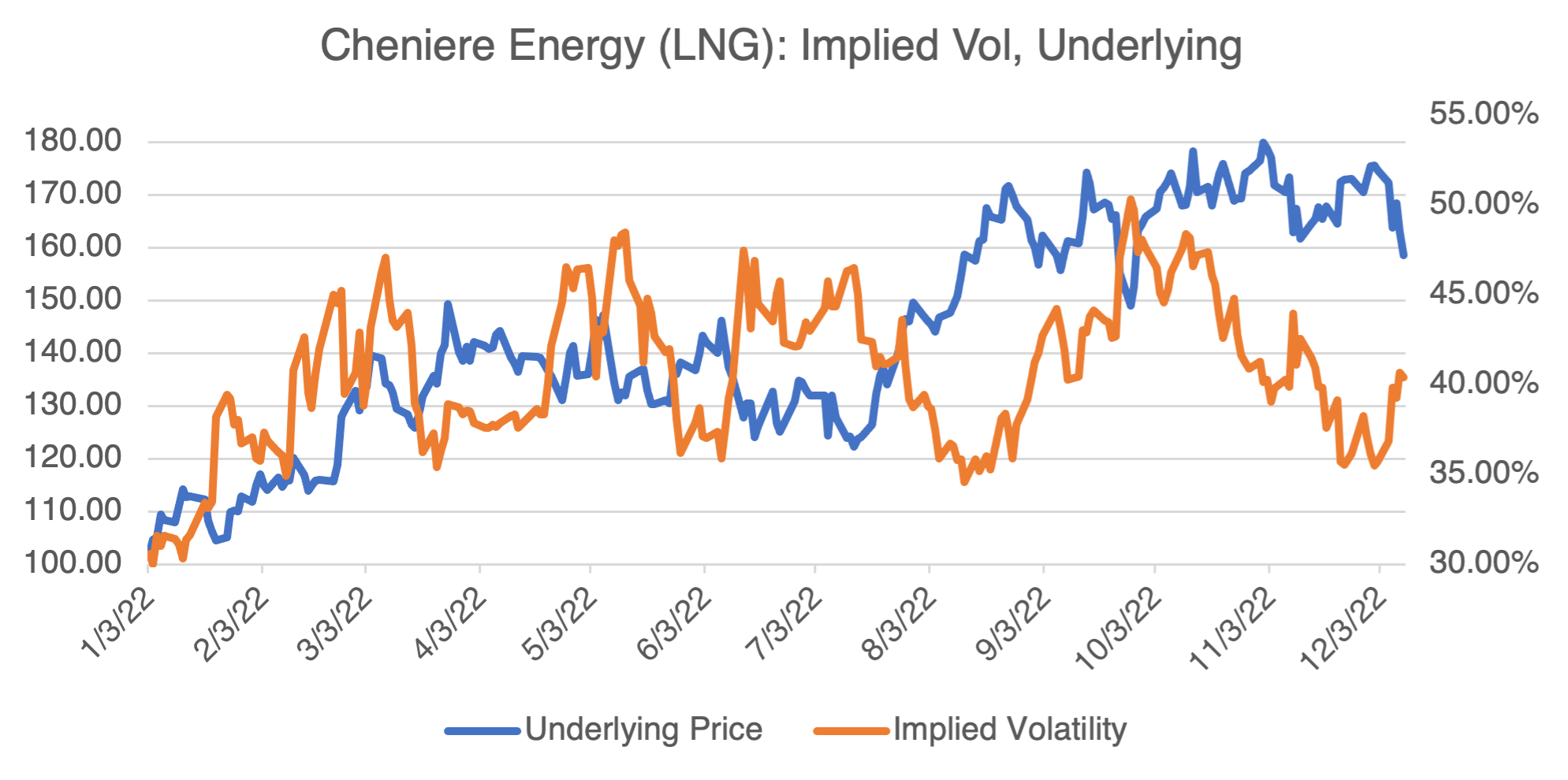

Cheniere rallied from about $123 to $172 last July when Europe was cut off from Russian natural gas and has been trading between roughly $150 and $180 since. Implied volatility has been trading between 35% and 45% and won’t be a strategic factor unless the stock manages to break out of its trading range. In the short term, Cheniere has been responding to developments in the European energy situation and recent events have not buoyed the stock. Against all odds, Europe managed to fill their natural gas stocks to over 90% by November and the continent has had a mild winter (so far). However, those are short term factors. In the long term, LNG is now a viable and established energy source for Europe and is here to stay. If you believe this, then Cheniere is a direct way to express the long-term investment thesis.

With Enough Money…

LNG is great, but it requires extensive infrastructure, such as port facilities to unload carrier ships as well as regassification and storage facilities connected to distribution pipelines. New European facilities are required to meet their expansion plans. Under normal conditions, these can take as much as five years to build. Facing the prospect of rationing and blackouts, one such project in Wilhelmshaven, Germany is on course to complete their terminal a mere 10 months after they started last March.

It’s amazing what can be accomplished when enough money, resources, and willpower are brought to bear. The Pentagon was built in 16 months at the beginning of WW2 and partially occupied after six; the Empire State Building was built at the depths of the Great Depression in 13; and the Manhattan Project designed and produced the atomic bomb from scratch in 36. Incredible.

SBF’s Parents (No Kidding), Etc.

Now that SBF has been arrested and will soon be extradited to the US, I can’t continue living without commenting on his proud parents. An article in the WSJ (Sam Brinkman-Fried’s Parents Were There for FTX’s Rise, and Now It’s Fall, December 12) provides some color on SBF’s upbringing and his parents’ alleged role at FTX. I will allow you to draw your own conclusions.

Both Stanford law professors (his father is also a clinical psychologist), it seems that Joe and Barbara “often spoke to their young sons as if they were adults and encouraged others to do the same…While many of the other children would leave the table at the Sunday dinner parties to watch TV in another room, Sam and his younger brother, Gabe, usually stayed with the adults.” In addition, it was reported that his father “…abhors conflict. When discussions at the Bankman-Fried’s Sunday dinner parties turned contentious, Mr. Bankman, on occasion, would step out of the room, friends said. “Joe likes people and wants people to be comfortable.” I doubt that will be the case over the next few months.

In other “Serves You Right News!,” various celebrity influencers and deep thinkers have been sued by investors for promoting Bored Ape NFTs after signing lucrative endorsement deals. Despite their love for their fans, I haven’t read about any of them voluntarily offering to give the money back or compensating investors after the crash. Not one.