NVDA: Vol Crush, Again & Again

I’ve written about vol crush a few times and how it’s one of the most consistent and reliable options trades around. For those of you unfamiliar with the term, vol crush is the tendency of implied volatility to spike before earnings announcements and then crash after they occur. Essentially, it’s the volatility version of buy the rumor, sell the news.

Nvidia is a great example of this (I wrote about this previously here and here). Vol crush has been firmly entrenched for some time. Since 2020, there have been 20 quarterly earnings announcements. Of those, 19 have displayed sharply lower implied volatility the day after the announcement. You can see this pattern in the chart below. After Nvidia’s latest announcement on 11/20, NVDA’s implied volatility plummeted from 55.9% to 43%, a drop of 13 percentage points. The average drop for all 20 announcements was 7.9 percentage points; five of them were over 10. Last August’s announcement saw a 16.8 percentage point decline, the largest since 2020. To get such large moves — all in one day and time after time — is a gift that should not be ignored.

‘

‘

Of course, eventually a future Nvidia quarterly announcement will be significantly different than expectations, or will contain something out of left field that will shock the market profoundly. In that case, the usual pattern of vol crush could fail spectacularly as everyone tries to head for the exits at the same time. That hasn’t happened yet, but eventually it will.

The VIX: DOA

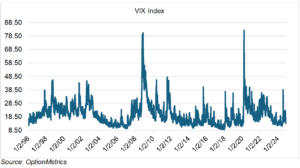

The post-election volatility hangover continued into last week, with the VIX falling below 14 to close at 13.51 last Friday. Yes, VIX bulls, there is some scary stuff going on – at least two major hot wars, potential tariffs, the specter of renewed inflation, uncertainties surrounding the new administration, etc., etc. But, all of this has been in the news for some time and are firmly in the “What Else Is New?” Jeopardy category. Something truly new and unexpected has to come along for the VIX to show any real life, and not just a minor increase for a few days. More of the same just won’t cut it. Until that time, and as long as the SPX continues to increase (the VIX is roughly inversely proportional to the SPX), the VIX will probably descend to its lowest quintile (below 13.6, 1996 – current).

Costco Treasure Hunt

I live in Utah, home to the largest Costco (COST) in the world. At 235,000 sq. ft., it’s big, really big, and has everything from a full side of beef to giant blocks of cheese to barrels of soy sauce to a 12 pack of scissors (with a little sharpener!). Cruising the endless aisles, everyone seems excited at the prospect of finding something they didn’t know they needed. It’s like a giant treasure hunt, and shoppers are lined up and eager to play. As an example of how to excite and retain customers, you can’t do much better than Costco.

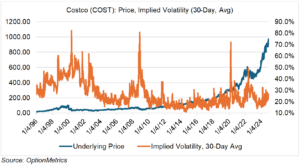

In FY 2024, Costco generated almost $250 billion in revenue, which is the eleventh largest in the U.S. Apparently, investors have noticed Costco’s allure: COST is up 49.4% year-to-date and 157.9% since 12/31/2020. Compare that to SPY at 27.5% and 61.1%, respectively, and you get the idea.

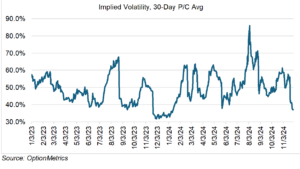

What is Costco doing in an options blog? Because not all options-related investments have to be super-exciting high flyers. Some can be companies with dependable earnings, loyal customers, and great execution, quarter after quarter. Costco checks all these boxes, as well as having implied volatility that has stayed relatively low and consistent despite the stock’s inexorable rise since 2023. Given COST’s overall bullish trend, its return/volatility ratio seems very favorable.