More Teslas?

This week, I’m going to concentrate on electric vehicle manufacturers other than Tesla. Rivian, Lucid, Fisker, Nikola, and Lordstown, if not exactly household names, have all been hard at work trying to carve out a niche for themselves in the fast-growing EV market. Electric vehicles have become mainstream, demand is red hot in urban areas, and they seem to be on the right side of history, so they have a pretty good tailwind.

Initial post-IPO valuations supported all of this. Rivian came on the market via an IPO in late 2021 with a valuation a little over $100 billion, making it larger than both GM and Ford, and hailed as the next Tesla. Needless to say, it was pre-revenue at the time.

But that was then, and this is now. Somewhere along the line, the market figured out that bringing a car to market and into full production from just the prototype stage is one of the trickiest high wire acts in manufacturing and can pose an existential threat to all but the most well-capitalized companies. Tesla came near bankruptcy during the launch of the Model 3. There is ample historical precedent. During the birth of the automobile industry, 485 car US companies were started. By 1908, 253 remained; by 1927, that number was down to only 44 and 80% of the output was concentrated in just Ford, GM, and Chrysler. WW2 wiped out most of the remaining independents in the US and only the Big Three remained.

Second, and despite all the hype, building EVs right now is expensive. Their batteries require nickel, lithium, and cobalt, commodities that have all exploded in price since the beginning of Covid. EV raw material prices have roughly doubled since March 2020. Adding to the pressure are continued supply chain woes, chip shortages, and new regulations that makes it more difficult to qualify for EV tax credits. The net result is that actual product is a fraction of what was projected in 2021.

Let’s put that into perspective in the real world. Rivian, perhaps the most successful of the EV startups, has produced about 5,000 cars, significantly less than projected. Let’s compare that against another pickup, the Ford F-150, which sells about 900,000 units/year, or about 2,500 per day. That’s over 100 per hour, or a little under 2 *per minute,* or about 180 times greater than Rivian’s current production. You can hope and dream all you want, but getting to numbers even approaching that would be impressive even for an established automaker.

Finally, higher interest rates, the tech selloff, and increased investor skepticism (you mean we have to show real profits now?) have made raising additional capital more challenging, to say the least. The success or failure of the EV startups featured below will hinge on their ability to manage their cash balances and attract new capital while production is ramping up and revenue isn’t coming in.

In short, it’s not surprising that the super high valuations from 2021 are a thing of the past. However, it’s not all bad news for those looking to invest in EVs: their valuations and stock prices are a fraction of what they were in the heady days of 2021. It’s a bargain hunters dream.

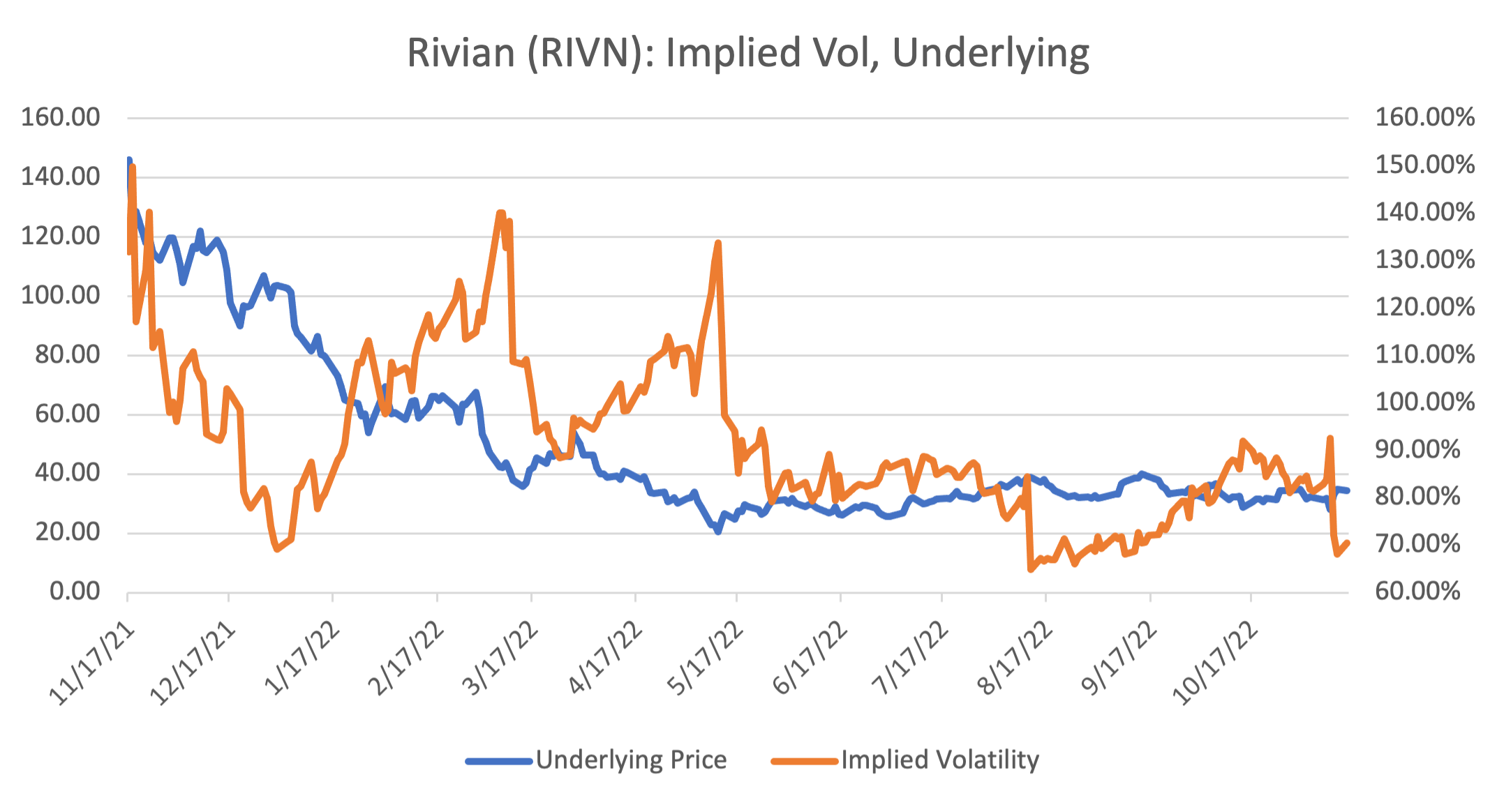

First up is Rivian (RIVN). Like its rivals, Rivian has had production problems that have limited the roll out of their pickup and SUV. However, with over $15 billion in cash as of the end of last June, they can afford delays. RIVN options are relatively inexpensive, as its implied volatility is trading near the lows of its historical range,

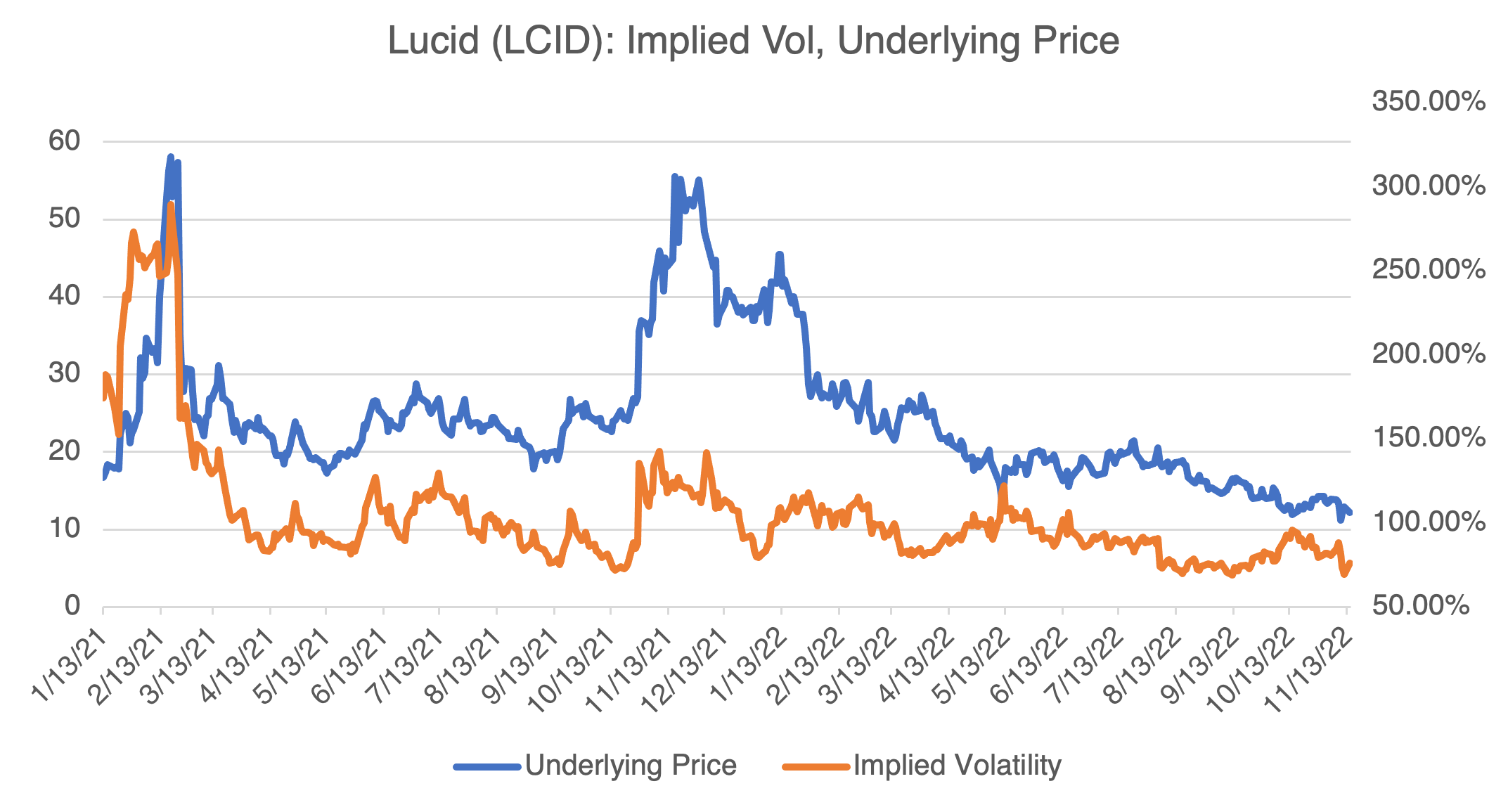

Lucid (LCID) has a lot less cash ($4.6 billion) than Rivian but has deep-pocketed investors in Saudi Arabia (61% ownership) that will probably step in if cash runs short. Like Rivian, LCID options are trading near the historical implied volatility lows.

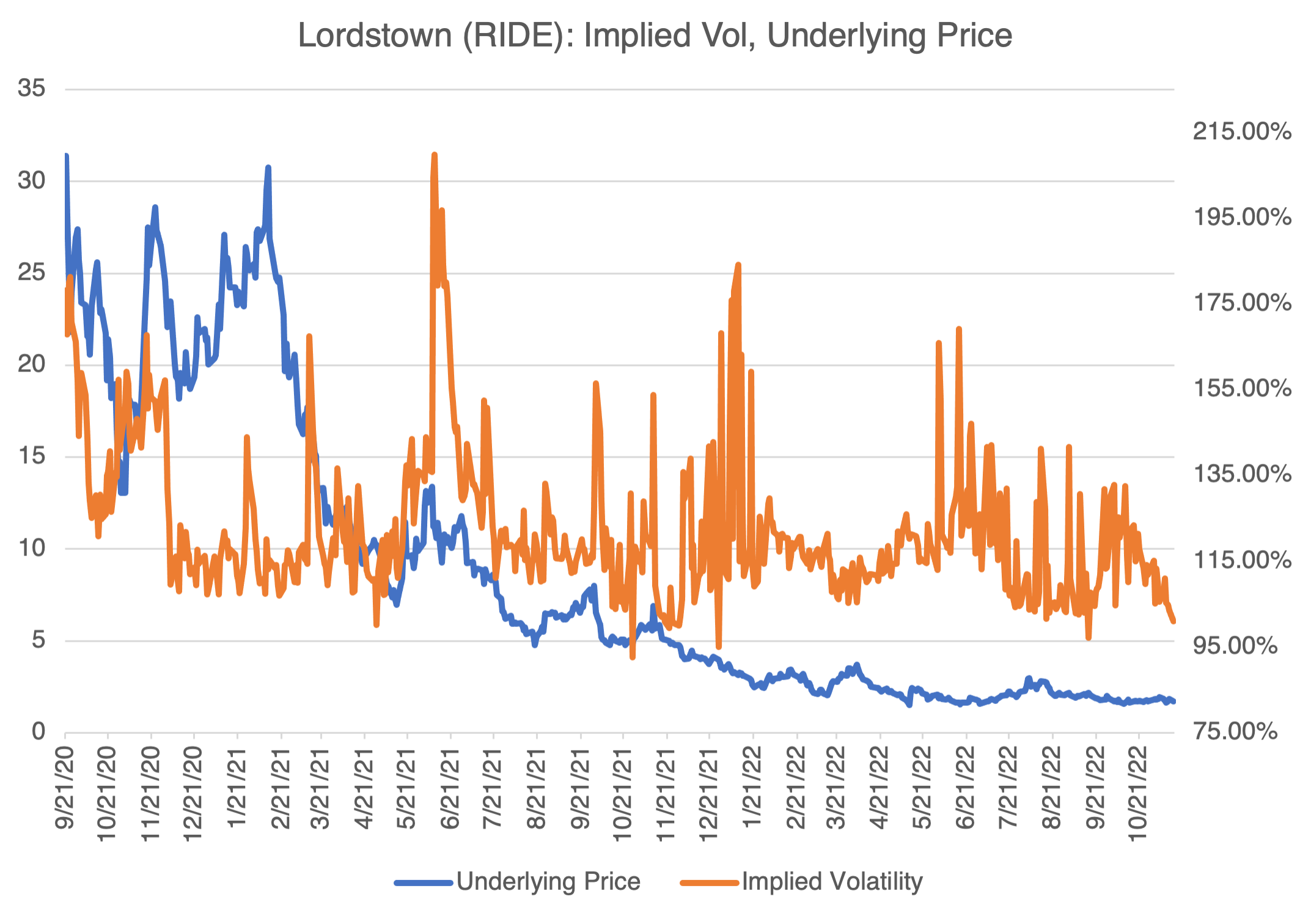

Lordstown is in a different league than Rivian and Lucid. Its cash balances as of the end of June were just $236 million and the stock price was destroyed after the founder was accused of fraud after allegedly misleading investors. In a bid to survive, RIDE sold its Ohio plant and is now outsourcing production to the buyer, Foxconn, the Taiwanese manufacturer best known for putting together iPhones. Obvious question: has a car company ever succeeded in the long-term by using a production outsourcing model? Between lack of funding and production woes, Lordstown is facing a steep uphill battle. A word of caution to bargain hunters thinking of using options to bet on recovery: RIDE’s implied volatility, although trading near the low of its range, is still no bargain at over 100%. Buyer beware.

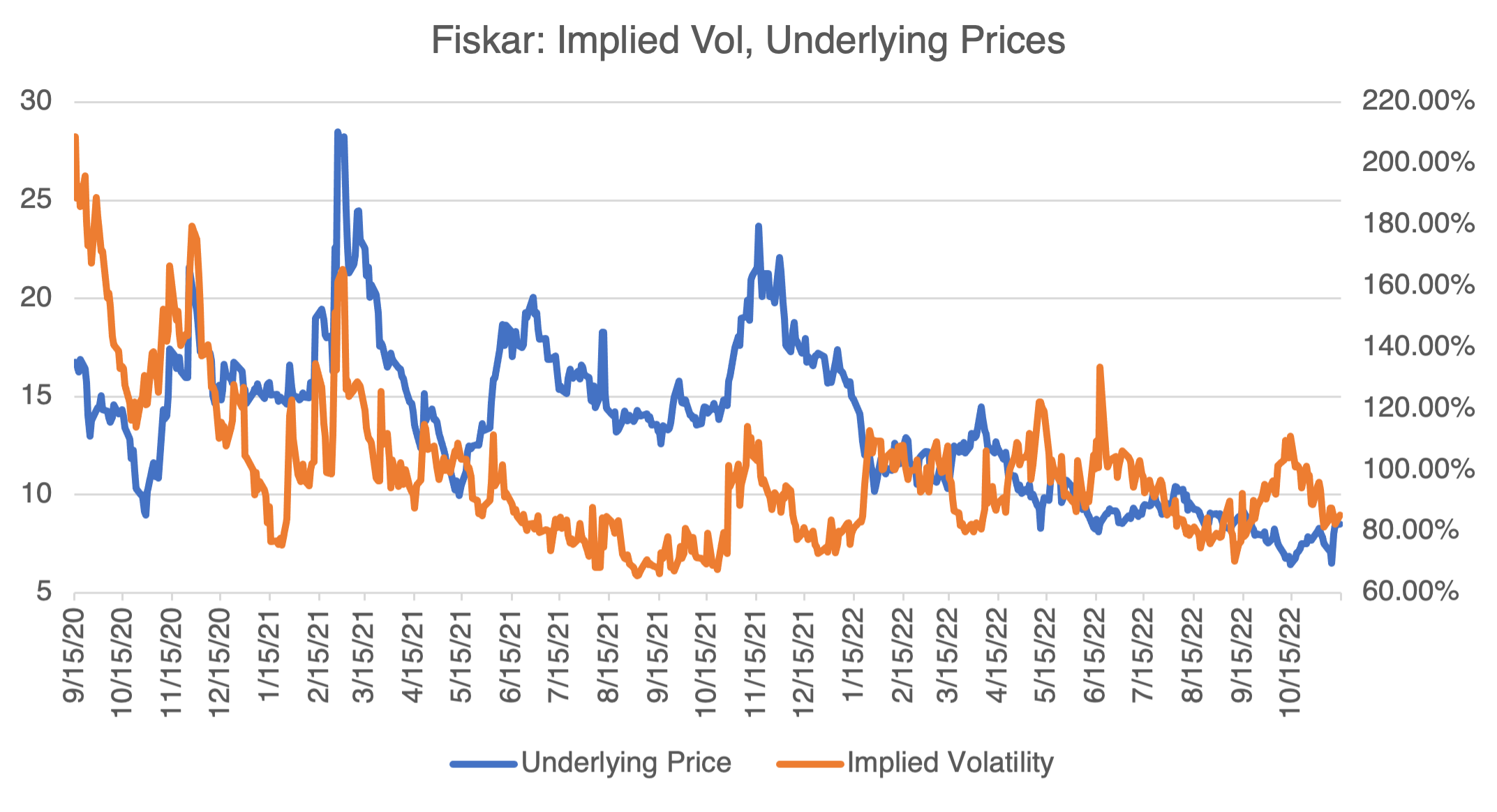

Finally, we have Fisker. Fisker is also following a production outsourcing model with Foxconn and auto parts supplier Magna International. Although this business model frees up production development costs in the short-term, it also reduces profitability once production begins. The overall question with Fisker is whether the outsourcing model will work. Regardless, design and initial prototypes will eat up cash in any scenario. Fisker had about $850mm in cash as of the end of June.

I Told You So Double Header!

If you’ve been reading my articles over the last few months (Here and Here), you know I thought that crypto and inflation were both seriously hyped and bound to reverse. I can now immodestly point out that I was exactly right on both.

Crypto: unless you’ve been on a desert island over the last few weeks, you should be familiar with the saga of Sam Brinkman-Fried (SBF to the cool kids) and his now defunct crypto exchange, FTX. No need for me to go over the gory details. Suffice it to say that this is yet another tale of greed, arrogance, ignorance, and lack of good old common sense. From what we are learning, it seems that FTX was run by amateurs with little appreciation of the details on how to run an exchange, correctly, and like adults. Still…no matter how new they were to the game, everyone in finance knows that misusing customer funds, as FTX allegedly did, is totally verboten, and something that you can do real jail time for. Animals tend to do crazy stuff when cornered, and SBF proved to be no exception. The whole incident does bring up an interesting question: is crypto dead? I will address that in my next blog (after Thanksgiving!). You can probably guess what I think.

Inflation: the market was unprepared (and a little shocked) by reports on November 10 that inflation might be ebbing for the time being. As I’ve written several times, commodity prices peaked last June and would take a few months to lower inflation. Interestingly, this is no longer the case. Commodity prices have been moving roughly sideways to up since they bottomed out in early July and are no longer supportive of lower inflation.