Presidential Volatility?

As of last Monday, we now have a new chief executive, and some have wondered whether the radical changes that the current administration has promised, as well as President Trump’s penchant for off-the-cuff or out of the blue remarks, will lead to increased volatility in the markets. Since he is a two term (non-consecutive) President, and assuming he behaves similarly in his second term, we can examine the VIX to find out.

Below is the historical performance of the VIX and SPX during each administration since 1996:

As you can see, for all of the administrations since Clinton, volatility (as represented by the VIX) during Trump’s first term was actually lower than in all but one. Two important caveats: 1) outside events that affect market return are not necessarily related to an administration’s policies. That is, it is difficult to assign higher or lower volatility directly to a specific administration or its policies, and 2) the sample size is too small to come to any definitive conclusions. Still, the data does point out, albeit tentatively, that there was nothing special during Trump’s first term, at least in terms of volatility.

Bitcoin is Back – But Not Its Implied Volatility

After coming off in December and earlier in the year, the start of a new crypto friendly administration has pumped new life into bitcoin. On inauguration day, enthusiastic traders briefly pushed BTC to new all-time highs over $109K, before it settled back down to just under $101K. News of a potential strategic crypto reserve, similar to the US oil reserve, have led to predictions of a new “golden age of crypto” and fantastic upside targets. For all the bullishness, however, there have been no new fundamentals supporting it since election day last year. That’s not to say that bitcoin is going to suddenly turn bearish, but that assets with meme stock characteristics require a steady stream of new news to keep going.

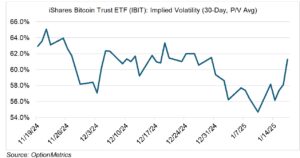

Interestingly, and despite the inauguration inspired frenzy, bitcoin implied volatilty has not increased (see chart below) appreciably. This has been true since the latest rally began around election day. If a bubble were forming (as some suggest), that would not be the case – implied volatilty would be increasing significantly. For now, bitcoin, at least on a volatilty basis, is remarkably controlled.