Shocking!

Last weekend, a horse aptly named Rich Strike won the Kentucky Derby. Believe it or not, he was an 80-1 long shot. I don’t know much about horse racing (actually, nothing), but I do know those are pretty long odds. Needless to say, the payoff was spectacular for those that bet on him. If they knew they existed or how they worked, I suspect the same bettors would be right at home buying deep-out-of-the money options.

If you are familiar with the concept of survivorship bias, you know what’s going on here: in placing their bet, they were focusing on previous bets that were successful, while ignoring all the rest. Related to this is the inability (or refusal) to accurately estimate probabilities. In risk management, we call this “irrational risk preference.” At some point, everybody is guilty of it to some extent. Traders who consistently buy deep OTM options because one of them once went in the money are a great example of this (of course, they never brag about the thousands of times they expired worthless). Hope springs eternal, but that’s not much of an investment strategy.

All this is not to say that OTM options should be avoided. Rather, they can be very useful in certain, limited circumstances, such as the effects from a sudden shock, something out of left field that wasn’t expected or is contrary to prevailing sentiment. OTM options, if structured correctly, can be very profitable in such scenarios. When the shock does occur, both the underlying and implied volatility will move significantly and in a sudden jolt. As always, however, it’s important to understand which direction implied volatility should move in such circumstances – it’s not necessarily higher. Below are two different shock situations that could benefit from an OTM strategy.

1) Ukraine Ceasefire

The best example I can think of currently is a sudden and unexpected ceasefire in Ukraine. Although it seems to be a low probability event now, keep in mind that most wars since WW2 have lasted less than six months (but, unfortunately, the longer they go on, the longer in total duration they tend to be). Also keep in mind that the first few attempts at a general ceasefire in Ukraine will most likely fail and be subject to question. For example, does a ceasefire mean that the sanctions will be lifted? And if so, which, and when? For this purpose, none of that really matters — the market will perceive that the war and associated sanctions are winding up, producing a short-term, knee-jerk reaction to the upside as all the mega-bears are caught the wrong way. Since one of the factors that had been weighing on the market will then be removed, uncertainty should decrease. Usually, that would result in a decrease in implied volatility, but in this case, the upside shock will probably be so great that implied volatility will either remain stable or even increase in the short term. Like all option trades based on unexpected shocks, the effect will be short term. Eventually, and if past conflicts are any guide, the economy’s underlying fundamentals will reassert themselves and the original, pre-shock trend will reassert itself.

Options strategies designed to take advantage of an unexpected ceasefire should therefore be designed to take advantage of a short term runup in prices accompanied by stable to increasing implied volatility. In other words, simple and liquid near date OTM calls.

2) Peloton

I’ve written about Peloton before, but I can’t resist wading in again because it’s so emblematic of a company that got carried away by Covid and thought that everybody would be stuck in the house forever, baking bread, painting by numbers, and working out in the empty kid’s room. As it turned out, these were blips, not trends — people are social animals and don’t like being cooped up 24 X 7. Obviously, that’s not good news for Peloton, no matter what its price or new strategy, and it was sheer arrogance to believe otherwise. You can throw ZOOM, Netflix, DoorDash, DocuSign, and all the other “pandemic darlings” into this leaky boat as well.

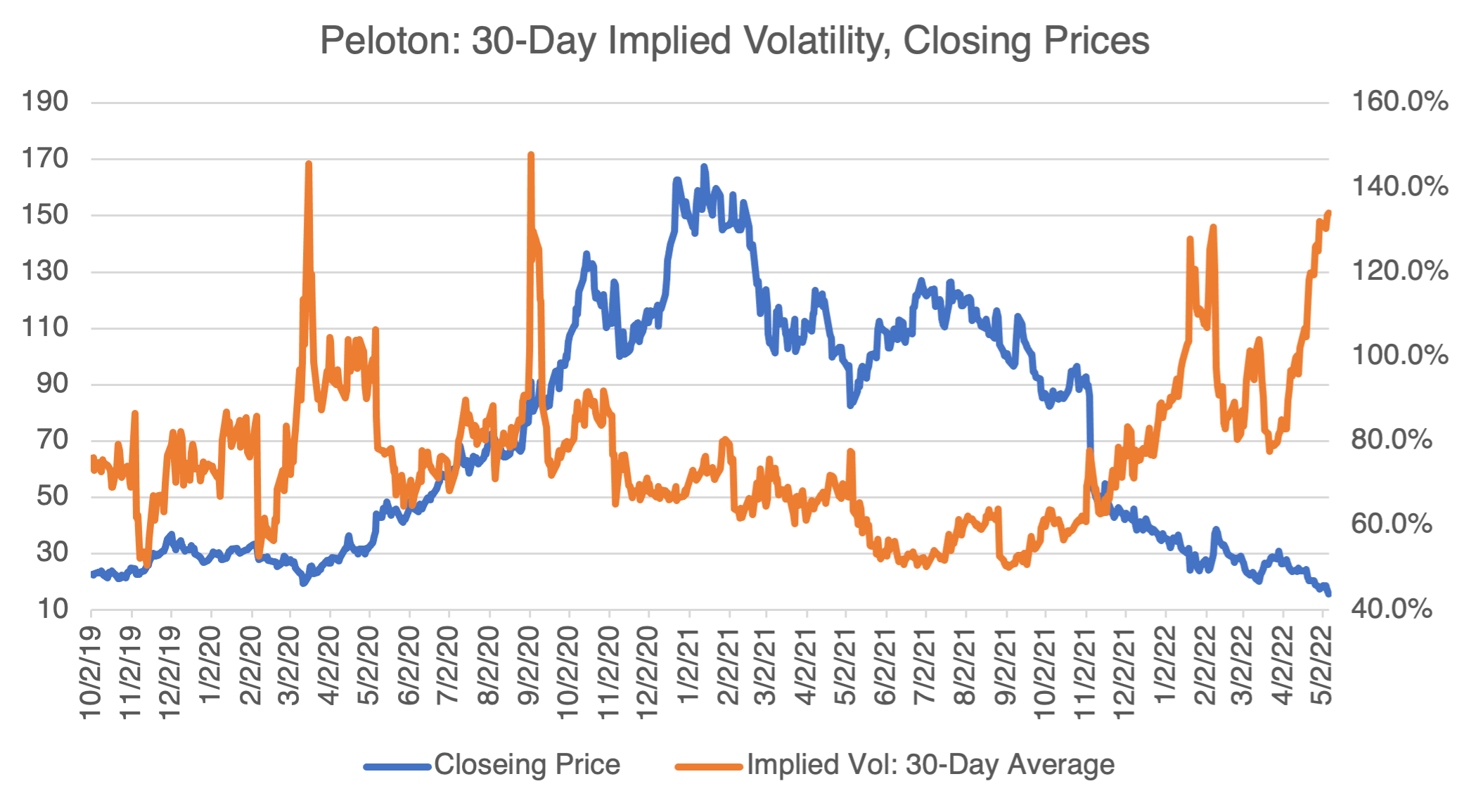

As I wrote in mid-April, “At this point, it’s unclear whether the company will stabilize or face a fire sale. In either case, Peloton options are subject to considerable uncertainty that tends to underpin its implied volatility.” I wrote that when PTON was trading about $24; currently, and after a dismal quarterly earnings report, it’s about $12 and change, a new all-time low (keep in mind that it was trading almost $163 at the end of 2020). Implied volatility is now a hefty 134%, up from 83% at the beginning of April.

Last week, the WSJ reported the totally unshocking news that the company may have to attract outside capital in exchange for 15-20% of the company. Even if they do attract investors, it will be at a deep discount and there’s no guarantee that the company will recover after that.

Needless to say, there aren’t too many Peloton bulls out there. That presents a perfect setup for an options strategy that would benefit from an improbable shock to the upside. However, and unlike the Ukraine example above, the shock will result in a different effect on PTON’s implied volatility. If the company is able to attract outside capital, then its future uncertainty will decrease markedly. This should decrease its implied volatility, which might move back down to the 80% region. If you are trying to structure an OTM options strategy to capitalize on an unexpected reversal in Peloton’s fortunes, keep that in mind. A 50-point negative move in implied volatility will provide a very serious headwind (to say the least) to any strategy with a long volatility component, including OTM options.

(Source: OptionMetrics)

3) Crypto — Nothing New Here, Keep Walking!

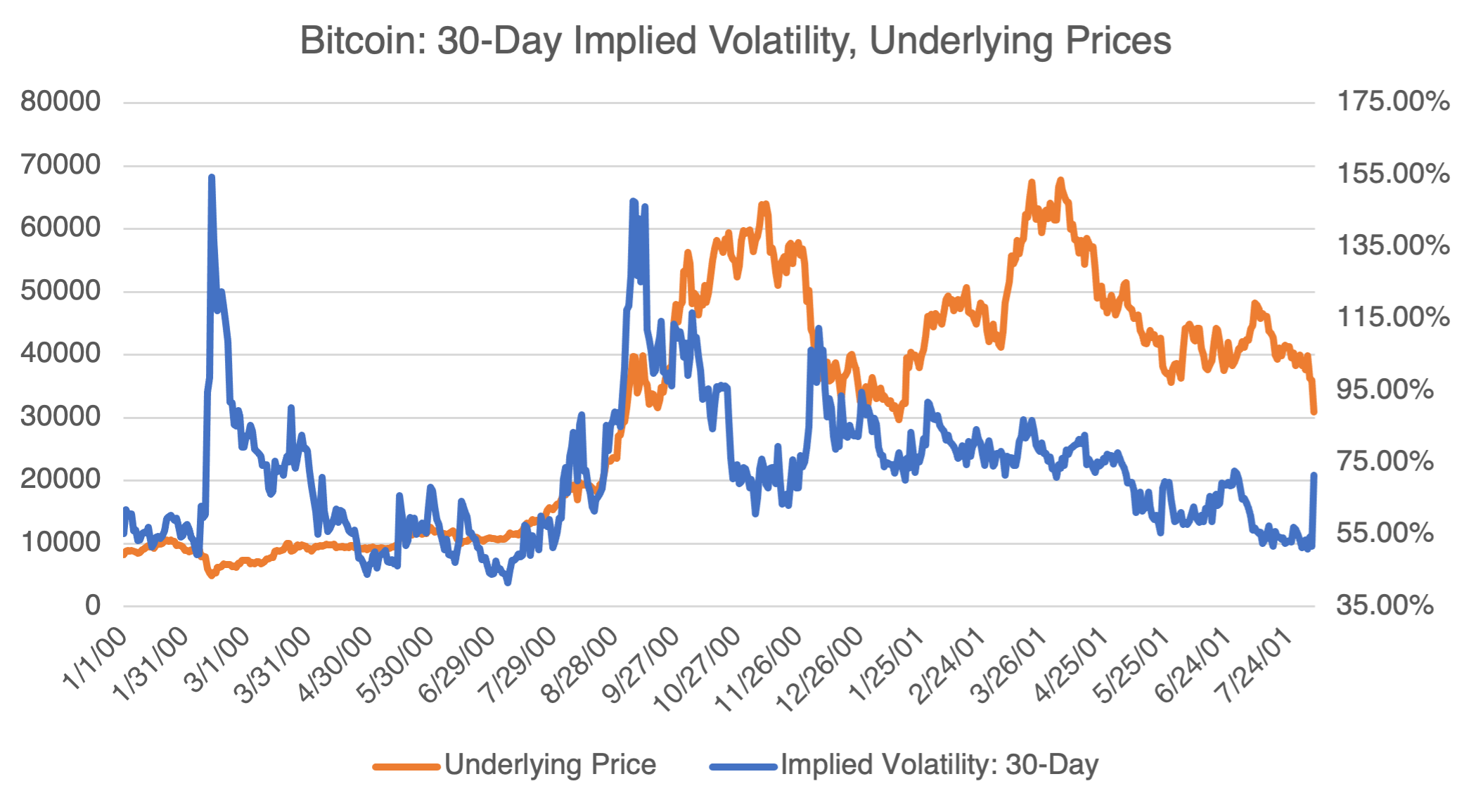

A few weeks back, I went on a crypto analysis kick and concluded that it was not acting as expected nor as promoted, not even close. Sanctions, war, inflation, currency devaluation – we’ve had it all over the last few months. This should be the perfect time for crypto to shine. Well, not exactly. Bitcoin and all its cousins continue to drop, right in line with the S & P and tech indexes. Apparently, it’s a just spec vehicle, just like all the regular old boring stuff that’s been around since the 19th century (and before), and not the first wave of an alternative asset class. Too bad. It’s kind of like finding out that your super-alt friend in college became an orthodontist.

(Source: OptionMetrics)