NVDA: Scary Stuff

After a few months of going sideways, and the market’s attention elsewhere, Nvidia took off again in late May after announcing yet another quarter of fantastic results. As of last Wednesday, Nvidia briefly become the most valuable company in the world, topping Microsoft at a mind bending $3.34 trillion. To put that number into perspective, a) it’s twice Nvidia’s valuation from just early February, and 2) it’s larger than the GDP of Russia, and approaching that of France. We’re talking just one company here! [Another interesting fact: the market cap of the top 5 tech companies — Microsoft, Apple, Nvidia, Google, and Amazon — is slightly larger than the GDP of Germany, France, Italy, and the UK, combined.]

I’m not going to opine on whether Nvidia is fairly valued or not. Other commentators and seemingly half the internet have an opinion on that.

But…history rhymes, and I’ve heard most of the justifications for the Nvidia bull case before, only in relation to other stocks and during the height of the dot.com bubble. As it eventually turned out, most of the scenarios and predictions didn’t even come close to reality. In fact, for those at the time that had been through similar frenzies, a giant, 1000 font “Caution! Proceed At Your Own Risk” sign was flashing. Some of the current commentary on Nvidia and AI harkens back to that era and should give pause to the most diehard bulls. A few sample quotes from a June 19th article in the WSJ:

- “The implications in terms of the size of the market opportunity [for AI] is that of the internet and cloud computing combined…The speed of change is different, the size of the market is different, the stage when the most valuable company was reached is different” — John Chambers, ex-chief executive, Cisco, venture investor

- “Nvidia will be the most important company to our civilization over the next decade…The chips Nvidia pioneered will be the most important invention of this century” — CFRA Research analyst Angelo Zino

Most important of this century? We’re only 24 years in! When I read stuff like this, I get transported back to the halcyon days of the dot.com boom, just before it went bust, when anything with “.com” attached to it, no matter how nuts, got breathless attention and funding. Hyperbole has always been part of the market, but it seems that its use has accelerated due to social media and the quest to get noticed in a sea of content.

Apart from the most hyperbolic claims, there’s no denying that Nvidia’s real world results have been spectacular, vindicating the wildest dreams of its most optimistic fans — it’s not just hopes ‘n dreams, as was the case with many of the dot.com superstars. Regardless, whether Nvidia’s success will attract competition (yes), or whether the promise of AI is overstated (probably), remains to be seen.

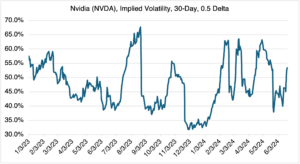

In the meantime, Nvidia’s implied volatility is not flashing “bubble ahead!” but is following its usual pattern of increasing before earnings announcements and then crashing afterwards (“vol crush”). NVDA’s skew, or the IV of 0.5 delta strikes – the IV of 0.2 strikes, expands and contracts similarly. That is not to say that this will cycle will repeat ad infinitum; it is predicated on the fact that each earnings announcement has been overwhelmingly positive. If they disappoint, which must occur eventually, then the reaction could be violent, with price coming off sharply and implied volatility increasing.

Source: OptionMetrics

Source: OptionMetrics

The VIX: Ho Hum?

You might have noticed that the VIX has been boring (there’s no better word) and has been declining, slowly, since roughly 2023. Geopolitical tensions, surprising economic indicators, new highs, AI — nothing seems to get the vol index all that excited:

Source: OptionMetrics

Even when VIX rallies do occur, they are short-lived and unimpressive, especially when viewed on a long term basis:

Source: OptionMetrics

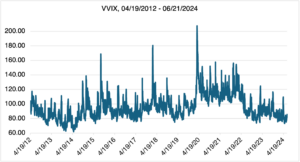

The VVIX, or the index that measures the volatility of the VIX (i.e., the vol of vol), has also been trending lower:

Source: OptionMetrics

By any metric, the VIX is one sleepy market! Is there any reason to suspect that it might be getting ready to wake up?

Maybe, and believe it or not, Nvidia, and its tech cousins, may be the reason why. More on this next week!