Orange You Smart

Believe it or not, Orange You Smart was a TV ad campaign from the early 80’s promoting Florida citrus. I thought of it the other day while buying some very expensive orange juice, the kind that induces sudden sticker shock and 24-hour personal austerity programs. Why is OJ so expensive? Because it’s a commodity, and unlike equity, commodity prices and volatility can affect how much we pay for things we eat, burn, or construct. They also provide insight into the supply side drivers of inflation and the direction of the overall economy. As a well-informed investor, you should keep track of them.

Below are some of the more common commodity futures that you might want to consider and what their latest prices moves could mean for the broader economy.

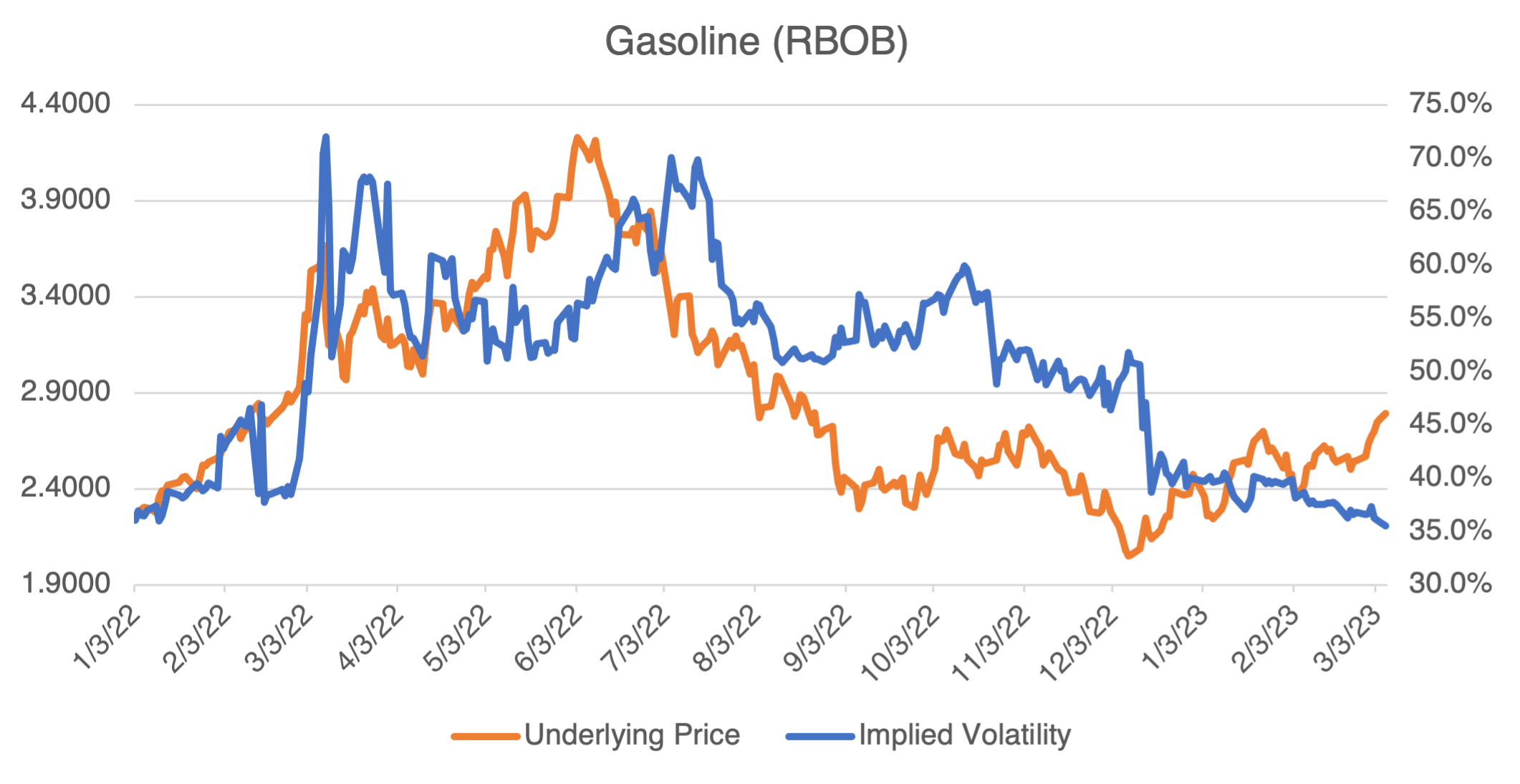

Everyone has a personal inflation indicator, and gasoline is usually first on their list. Last summer’s move to almost $4.25 wholesale (and over $5.00 retail in some locations) brought the Ukrainian war home to the US. Despite the hysterical predictions at the time of new gas lines (“it’s the 70’s all over again!”), none materialized as crude oil stabilized and adapted to the new wartime supply situation. It bottomed out close to $2.00 last December. However, as pump prices and futures indicate, it’s been rallying since. China’s post-Covid reopening (although in fits and starts) is playing a role here. Apparently, gasoline’s contribution to inflationary pressure has not ended.

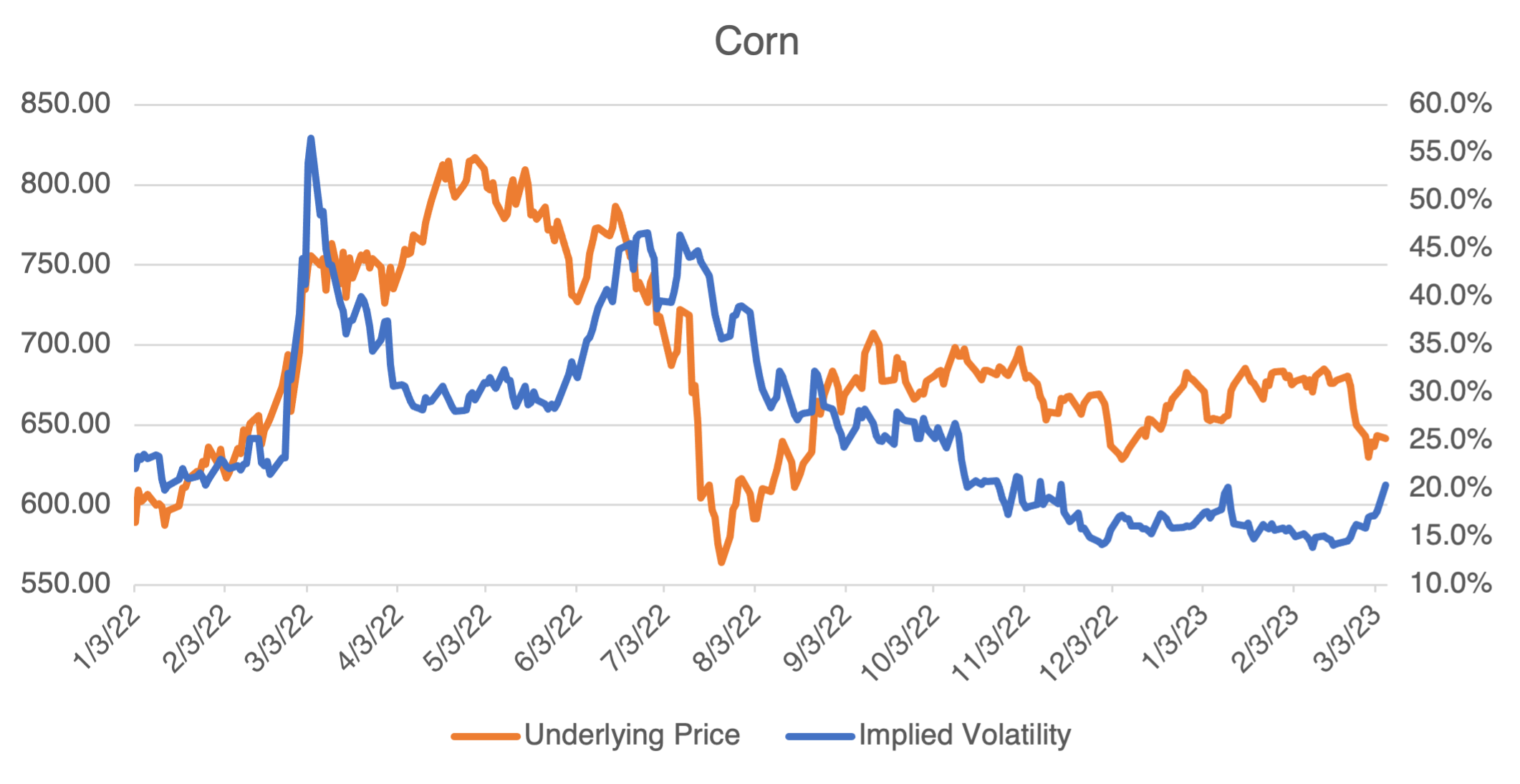

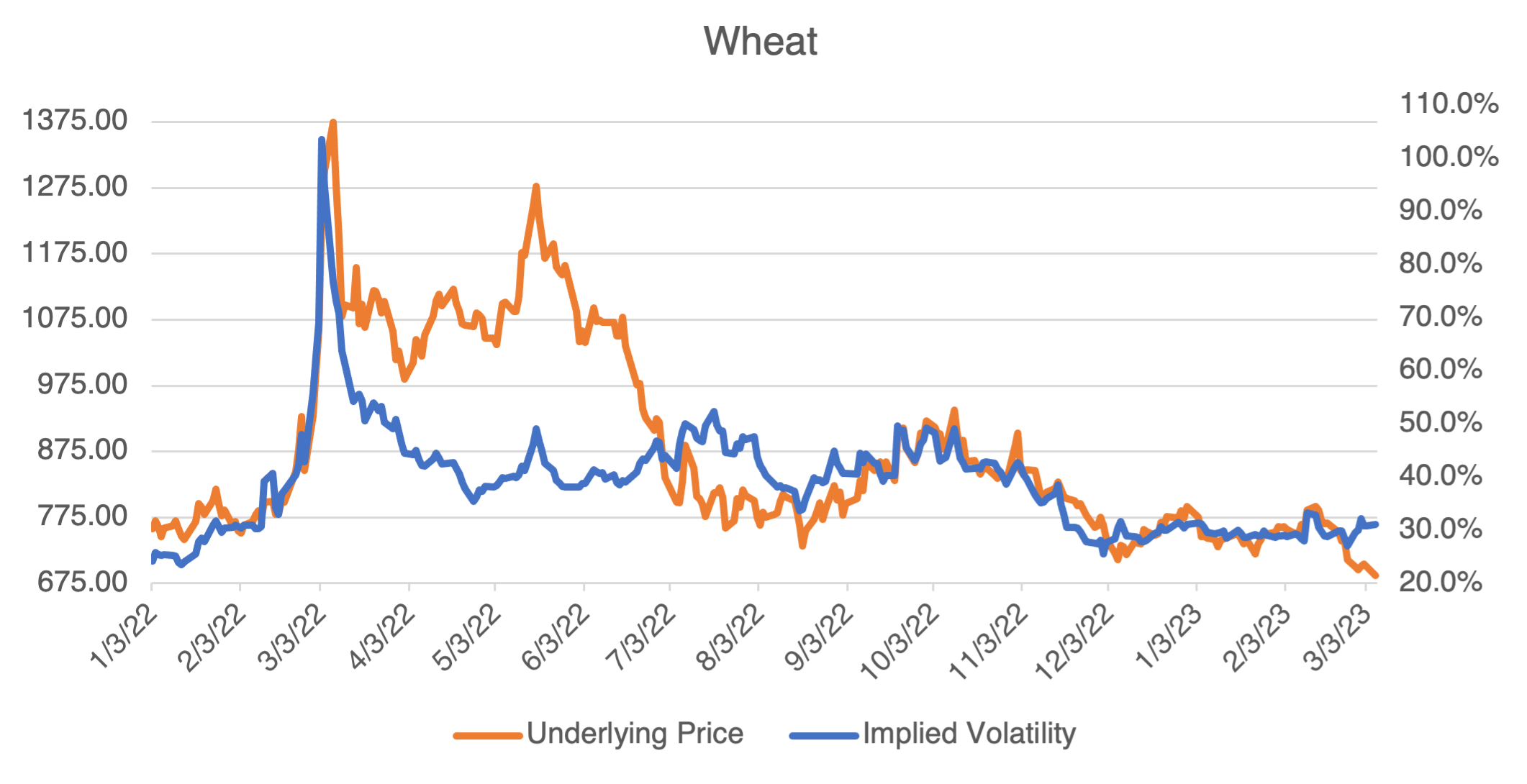

Agriculturals, in this case corn and wheat, were affected initially by the Ukrainian war (Ukraine supplies 10 and 15% of the world’s wheat and corn, respectively), but have since moderated considerably. As in energy, the supply balance adapted to the war. If current trends continue, they will not be contributing to inflationary pressures.

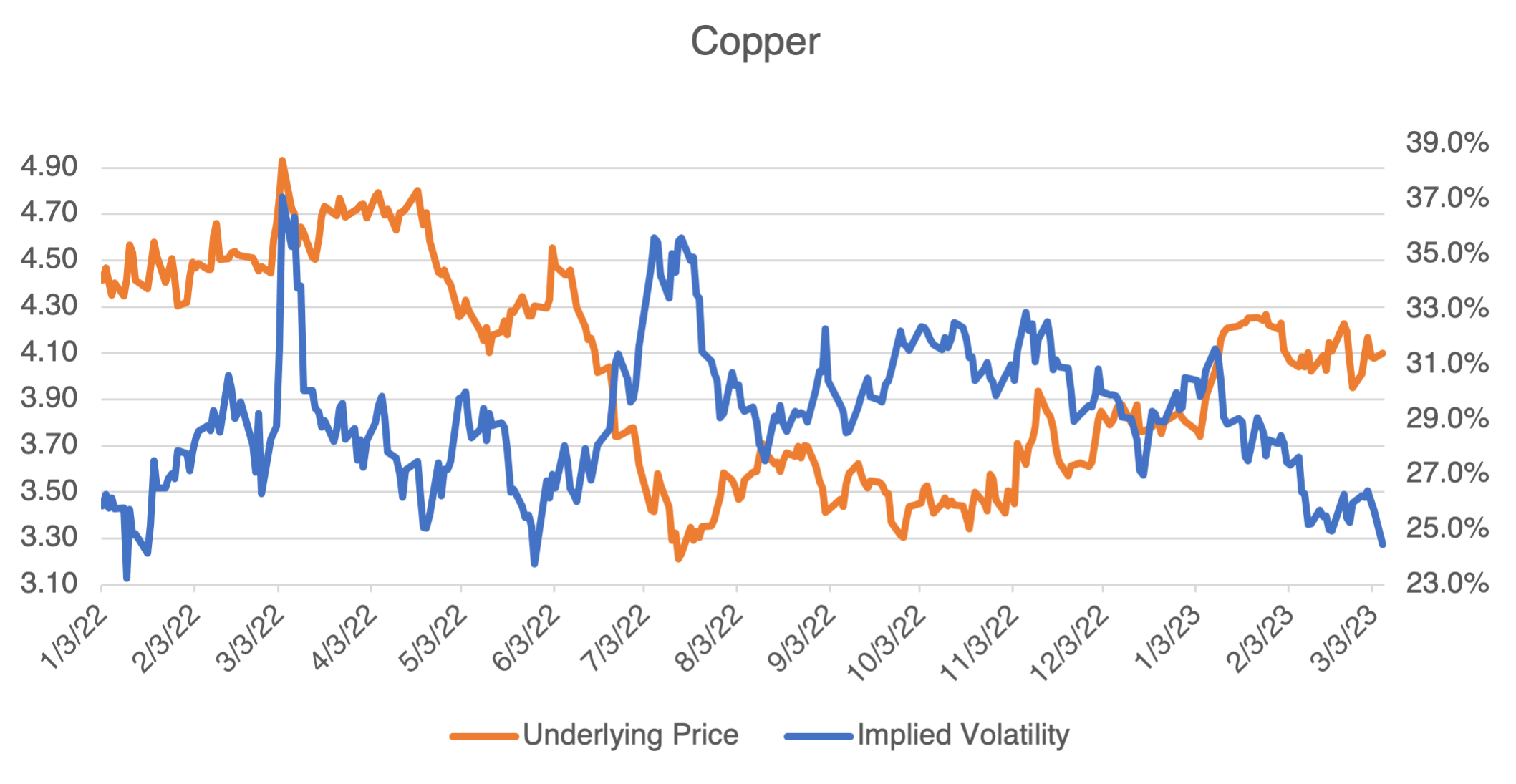

Finally, copper is sometimes used as an indicator for overall industrial demand and the global economy. Notice that after coming off hard last summer, it has stabilized and is currently hovering around $4.00/lb. It’s been rallying since last Fall, belying the imminent recession narrative commonly expressed.

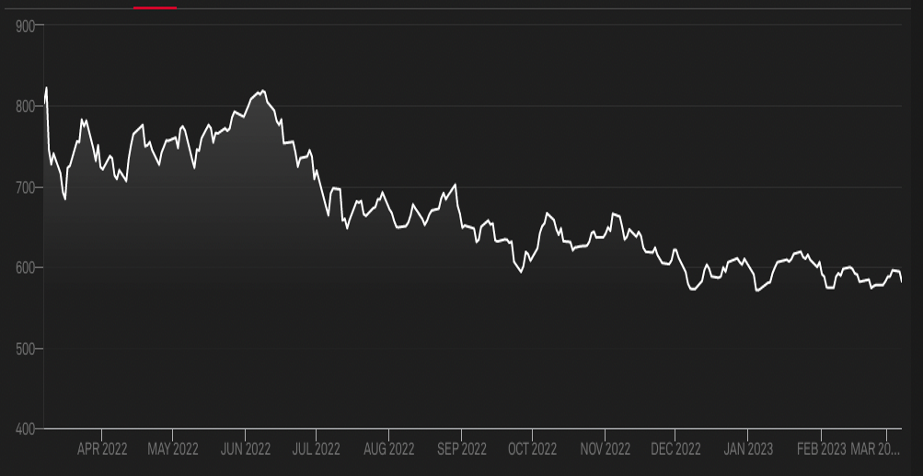

If you’re not interested in reviewing individual commodities, there are two commodity indexes that are worth looking at. The Bloomberg Commodity Index (BCOM) and the S&P GSCI (Goldman Sachs Commodity Index) provide a snapshot of commodity price action. Below is the GSCI. Notice that it has been in a downtrend since last Summer, suggesting that commodities have not been behind inflationary pressures.

Source: S&P Dow Jones

Time to Get Serious, Vol. II

Last week, I wrote about Salesforce and Beyond Meat as two companies that had seen the light and decided that making money, not changing the world, was in their best interest. This week’s born-again company is Sweetgreen (SG). You know, Sweetgreen, the kind-of-fast-food salad place. When it went IPO in late 2021, it had all the right startup street cred: three guys who met in college, hundreds of millions in VC funding, an obsession with growth, and all the right new-agey jargon. “Connecting people to real food,” “Shifting the paradigm,” “Building a more equitable society” — and all through salad! It’s that simple!

Well, that was then, and this is now, and the usual tech spiel, especially coming from a non-tech dining company, rings very yesterday. The result: since the IPO, the stock has been in a consistent bear market and is currently off about 84%. If that’s not enough, profits have proven elusive (or not even a goal, in the first place). Now shift to 2023. “Disciplined, capital-efficient growth” is their new mantra. As many post-funding startups have found, running a successful business is very different from starting a business, and requires vastly different skillsets. In the case of SG, however, don’t look for an easy change of day-to-day management — the three founders hold supervoting B shares that deny most investors the right to vote. During the go-go years of Silicon Valley, that was the fashion, something that I think will be more difficult for founders to pull off in the current environment. Good riddance.

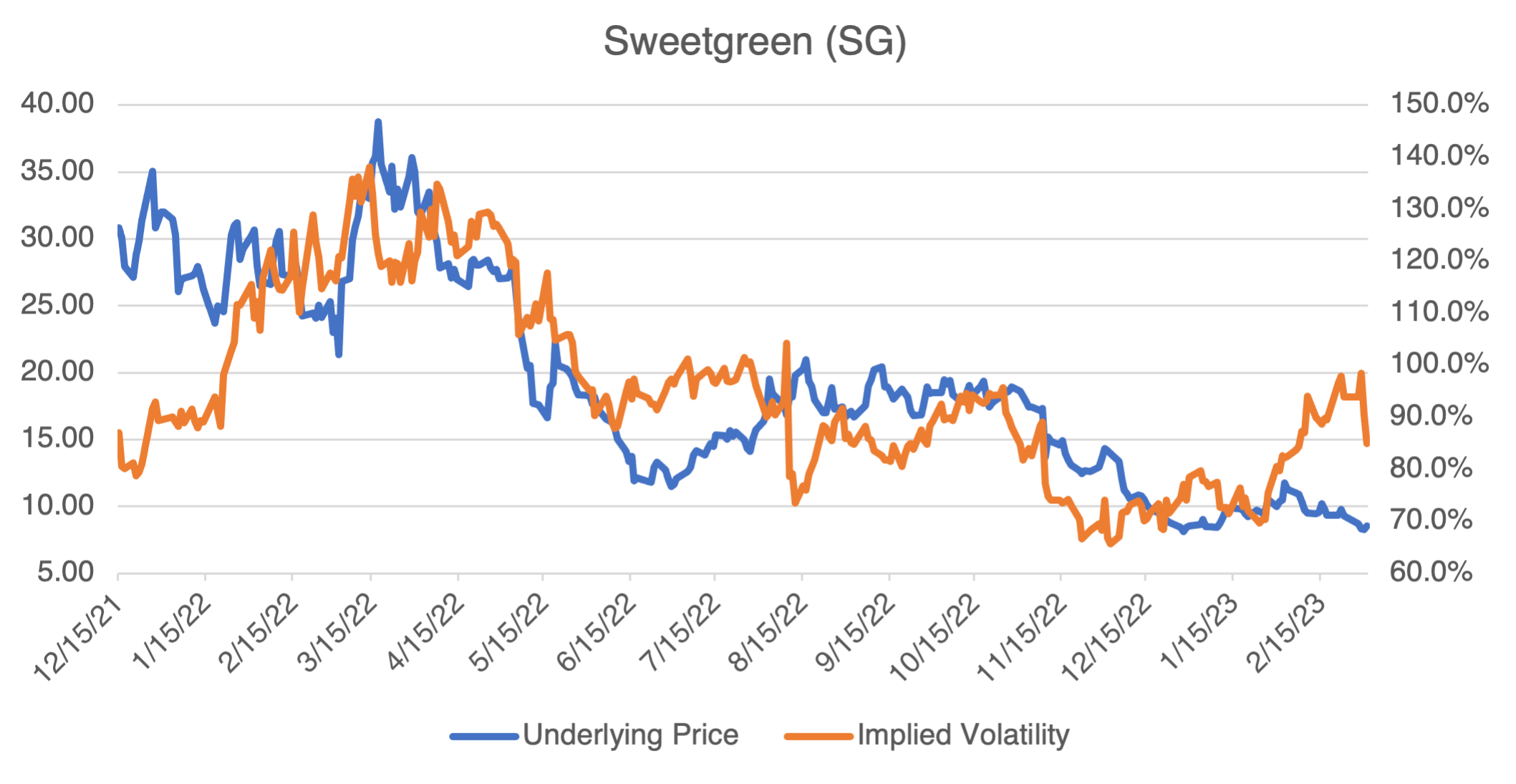

If you’re looking for a long-term turnaround trade, Sweetgreen might be your ticket. As in many such cases, however, SG options are no bargain, with implied volatility trading in the mid 80% region. Caveat emptor. You may want to consider paper trading a strategy that has low or even negative vega (meaning it will increase in value when IV drops, as opposed to your typical long call or put) You can utilize our options profit calculator tool to do that. (For example, with this bear put spread).