The Dollar, Again

The Dollar

As I wrote last week, the dollar continues to be the king of the FX forest and has soared to roughly 20-year highs against the Euro and Japanese Yen. Less heralded is the British Pound, which is also under pressure and threatening to take out its low of 1.1650 from last March, the lowest it’s been since 1985 — 38 years ago! I venture to say that most FX traders today weren’t even alive 38 years ago.

Parity with the dollar is always enticing for FX traders because the trade opportunity doesn’t come along that often. Both the Euro, and to an extent the British Pound, are both candidates for this. The best trades, and especially the best options trades, profit from sharp, violent price moves caused by the unexpected or ahistorical. Every now and then, the “it can’t happen” happens, and that’s when deep-out-of-the-money options and their implied volatilities go to town.

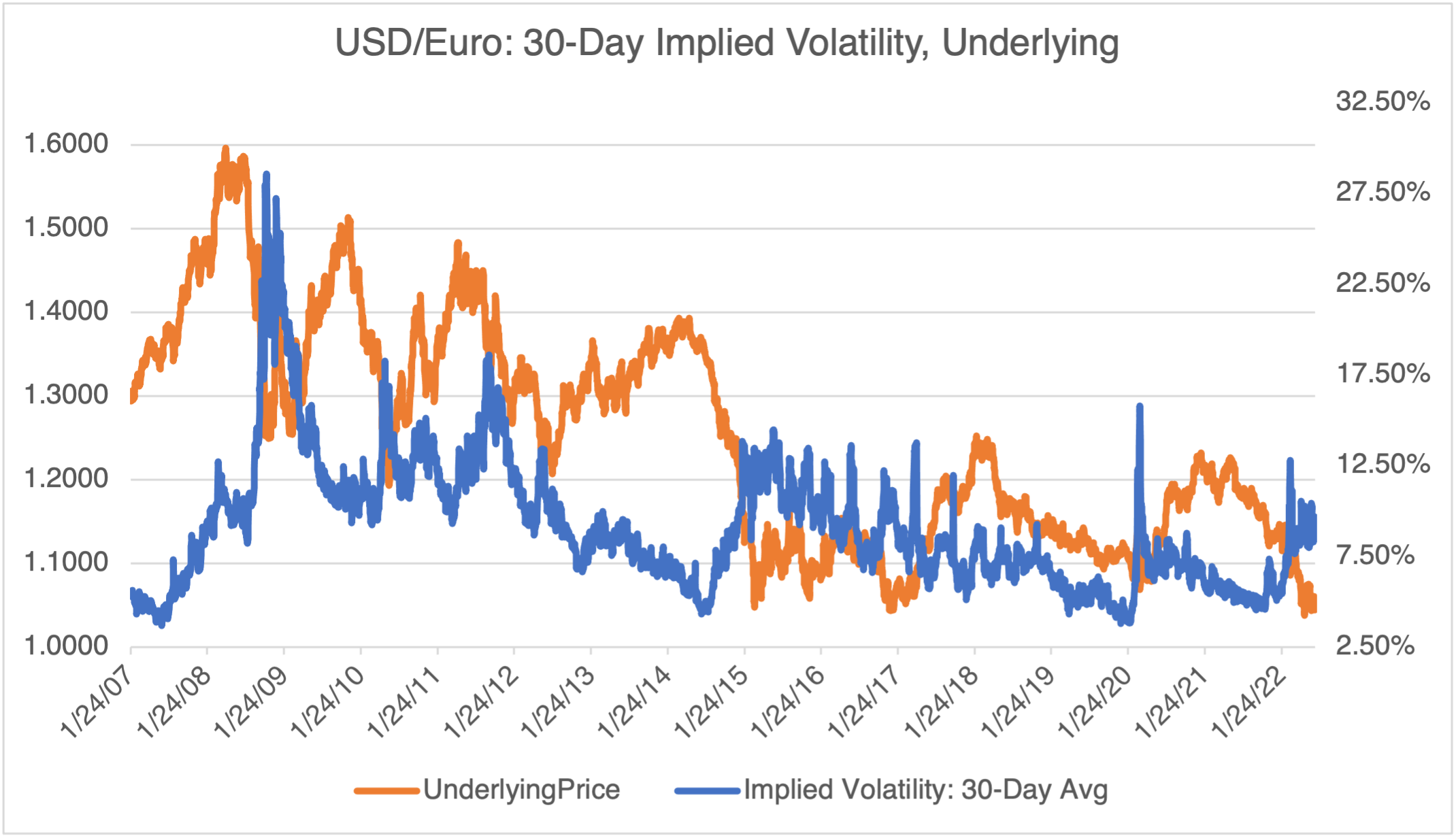

Consider the long-term chart of USD/Euro below. The Euro hasn’t been below 1.0, parity, since January 2000, 22 years ago:

USD/Euro

(Source: Macrotrends)

Notice the price action as it approached 1.0 in late 1999 (below). The Euro approached parity and then backed off a few times before finally piercing the barrier for the next 12 months. Think of it like trying to kick a door down; the first few attempts are usually unsuccessful. If this occurs again (and notice that the Euro failed to reach parity in 2015 despite repeated attempts), puts at 1.0 or below will profit not only from the underlying price movement but from a commensurate increase in implied volatility. The latter should not be ignored and could easily surge from the current 9% level to the high teens, almost doubling.

USD/Euro

(Source: Macrotrends)

(Source: OptionMetrics)

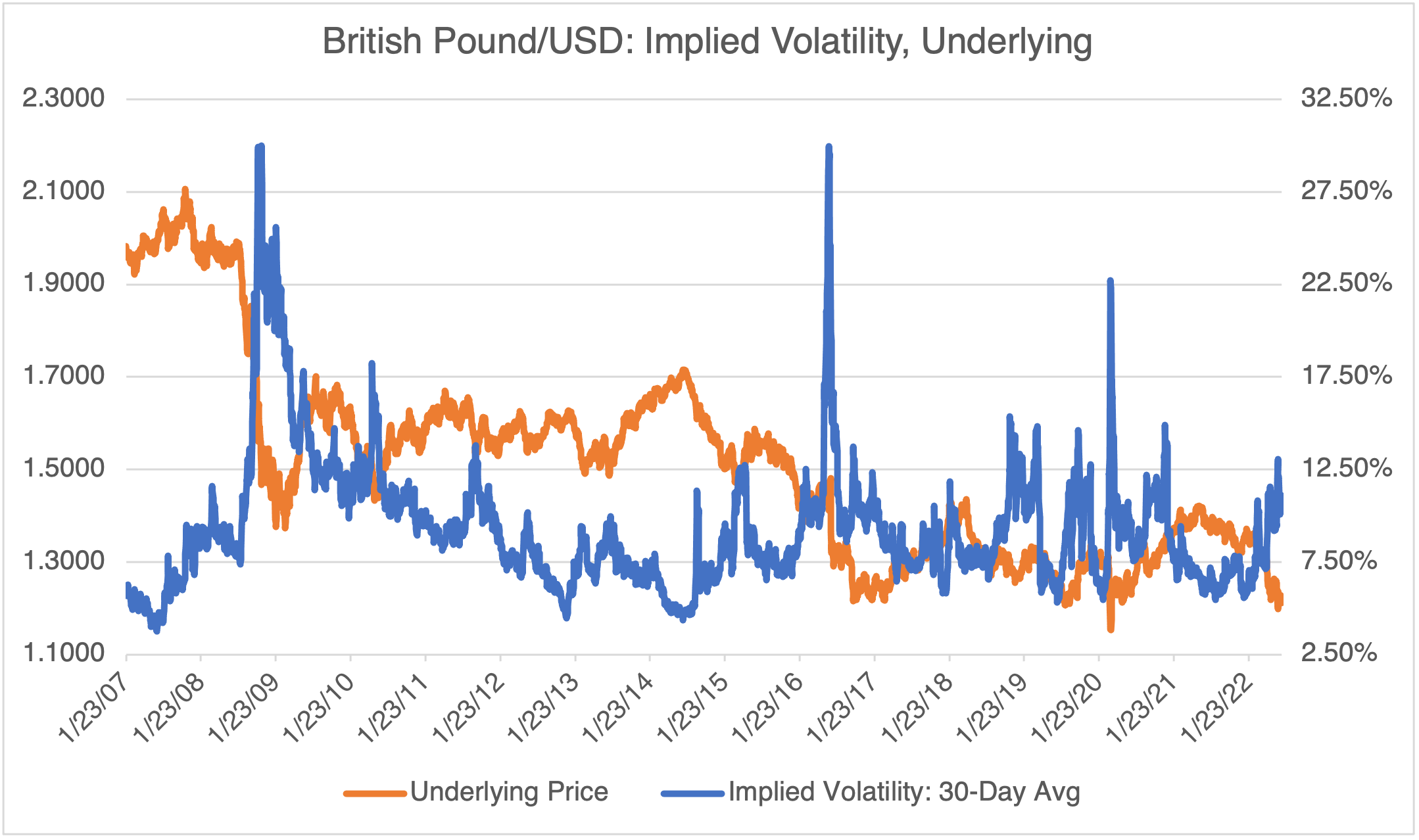

A similar setup can be found in the British Pound, albeit not as developed but a lot more shocking if it actually took place. As you can see below, the last time the pound approached parity was in 1985, reaching 1.05 before rallying sharply. Like the Euro, there aren’t that many traders still around that remember that move and how it turned on a dime at the last minute.

Regardless, if the current market goes below its March 2020 low of about 1.16, there’s nothing between that level and the 1985 lows, at which point a run on parity might suddenly be in the cards. I hasten to add that a move below parity has never happened and is therefore extremely unlikely. But, on the other hand, that’s what makes the pound/dollar parity trade so tantalizing — the opportunity to profit from a full-blown currency crisis only comes around a few times in one’s career. As is the case with the Euro, the strategy would profit from both a sharp move in the underlying and a sharp increase in implied volatility.

British Pound/USD

(Source: Macrotrends)

(Source: Macrotrends)

YES Means NO

If you follow financial news, you are probably familiar with UBS and the YES affair. In short, UBS paid $25 million to settle fraud charges related to selling an options strategy cleverly referred to as YES (Yield Enhancement Strategy). UBS’ financial advisors sold the strategy to approximately 600 investors and guess what: the financial advisors didn’t really understand what they were selling and misrepresented the risk involved. $25 million isn’t even rounding error to UBS, but the details are telling for anyone considering a private banking relationship.

For those who understand trading and have been on the receiving end of such pitches (as I have), there were at least two “tells” that would have given it away as a skanky scam.

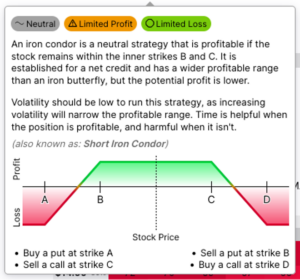

Tell #1: In Options Land, “yield enhancement” or “income producing” almost always means selling options and short volatility. Sure enough, the strategy UBS was pitching was nothing more than a standard options strategy, an iron condor on the S & P 500 index, only with a pithier name (the snappy acronym was also a tell!). From OptionStrat, here’s the 4-legged strategy:

The SEC characterized the strategy as complex but it’s really not for anyone who’s familiar with options. An iron condor involves selling out-of-the money puts and calls and then buying even more out-of-the money puts and calls to protect them should the market move. It’s a short volatility position that will profit if the market stays within a range, at expiration. It also assumes that the puts and calls are all struck at an equal distance to at-the-money options, i.e., one side isn’t more sensitive to market moves than the other. Invariably, a repacked options strategy isn’t exactly like standard issue but altered as market conditions change. In this case, it is alleged that the strikes were not symmetrical and the strategy has an upside bias. As a result, during bearish periods, such as Q1 2018, YES lost a lot more than what was originally represented. The result: investors that got in as a low risk trade lawyered up.

In all fairness to UBS, they did what most Wall St. firms do with their HNW (high net worth) clients: they took standard exchange traded products, marked them up, renamed them, and sold them via a fancy pitch book. That’s ok, as long as the sales people understand the strategy and don’t oversell it. Regardless, the pitch worked: after starting in 2015, YES holdings reached $6 billion by 2018.

Tell #2: The fancier the pitch book, the better the acronym, or the more analogies to insulating your portfolio from perfect storms, hurricanes, earthquakes, downdrafts, firestorms, and the like, the higher the probability that the bank is putting lipstick on a pig. Caveat emptor, big time.

Crypto Warnings

I’ve been pretty clear in past blogs that I’m not a fan of cryptocurrency, at least in their current guise. Over the last few months, most of the dire predictions from even the most consistent naysayers have come to pass. At this point, even the most ardent believers have been shaken to their core.

I think everybody can agree at this point that the new exchanges and deposit institutions that grew up during crypto’s golden age ignored, by design, many of the lessons that banks and trading houses learned the hard way during the start of the Great Depression, 95 years ago! Although it’s kind of boring and old fashioned, FDIC deposit insurance exists to preserve the public’s faith in banks. Before then, and especially for small rural agricultural banks, failure was a common occurrence, with local farmers and families losing their savings. Similarly, SIPC insurance was mandated for brokerage firms for the same reason. Exchanges that cannot guarantee the value of your deposits or securities, and hide that fact in small print, are ticking time bombs, regardless of their double-digit returns and celebrity backers.

Is crypto over? I doubt it — there are just too many true believers out there and it was too profitable in the past for traders to totally give up on it. But it’s definitely going through a very bad and self-inflicted winter, that’s for sure, and there’s probably more where that came from.

With all that in mind, and considering the most recent problems at Celsius, Coinbase, Terraform, Voyager, Three Arrows, et al, the timing of FTX’s proposal before the CFTX to introduce crypto derivatives could not have been worse. Of course, traditional exchanges such as the CME are firmly against it as it threatens to upend their whole business model. FTX’s proposal goes beyond just offering crypto derivatives — that’s nothing new — but aims to eliminate brokers from the trading process entirely. Rather, traders would post margin directly to FTX and then be subject to instant 24 X 7 auto-liquidation should their account fall short of FTX designated margin requirements. In the traditional system, margin calls must be met within 24 hours and credit is often extended to customers by their brokers to meet the call. This tends to cushion the impact. As a backstop, FTX is proposing to set up a $250mm guarantee fund to contain losses should their auto-liquidation feature cause a sudden wave of margin defaults, a “flash crash” if you will.

I can make arguments for and against this, but I think FTX is swimming upstream given the current environment and public perception of crypto. The CFTC is naturally risk averse, especially when it comes to giving approval to something that flies in the face of procedures going all the way back to the 19th century. As such, and regardless of the merits of their proposal, I wouldn’t be surprised if FTX is denied approval.