Ark, Again

I wrote about Cathy Wood’s ARK Innovation Fund earlier in the month (2023). Coincidentally, a long-time friend of mine, Richard Gluck, author of the Market Cyclist Substack blog (The Market Cyclist), mentioned it as well (The Year the Fever Broke). Rich is an astute observer of markets and trends from an historical standpoint and one of the better financial writers out there. Not sure why we both thought of ARK at the same time, but we came to the same conclusions, albeit from different directions.

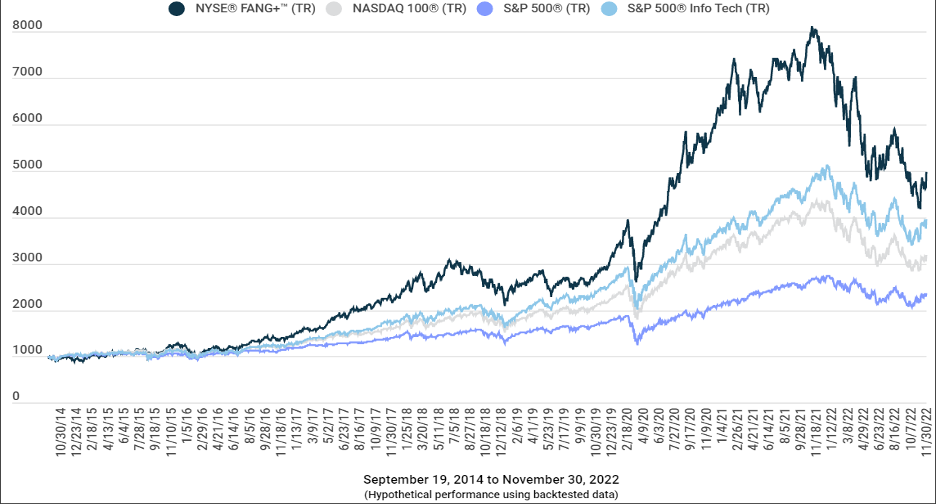

Rich puts ARK in the context of a larger trend: the concentration of US equity returns in growth stocks. Consider the chart below of various growth stock indexes since 2014:

(Source: NYSE)

Obviously, they were all serious bull markets until the beginning of last year. And then, the concept of drawdowns, near and dear to everyone who works for a hedge fund, suddenly became very important. If you’re not familiar, drawdowns are simply the amount an asset falls from peak to trough. It’s usually accompanied by time to recovery. Taken together, they can give you a sense of how bad, and for how long, things can get.

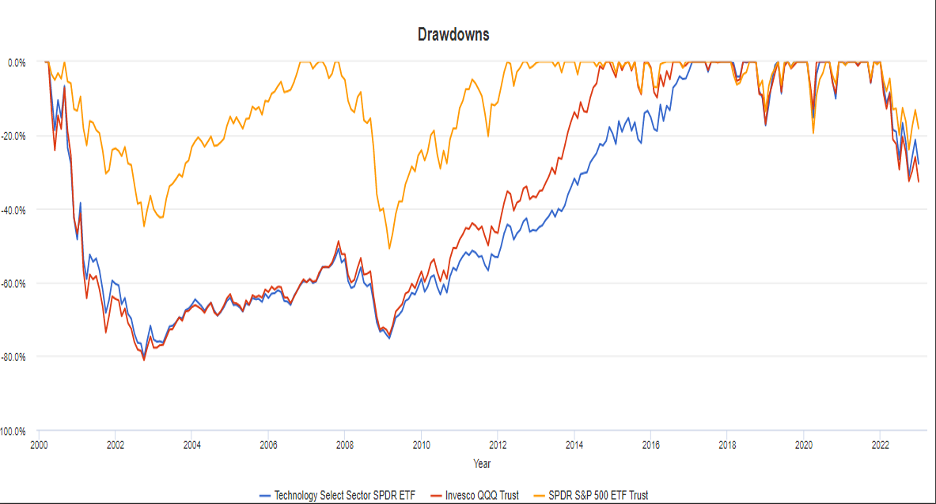

If you look at XLK, a tech ETF, then the answer is not good. The chart below compares its drawdown performance to that of the SPDR S&P 500 ETF.

(Source: NYSE)

After the tech crash of 2000, XLK did not recover until December 2016, a full 16 years later! Compare that to the S&P, which recovered by 2006, 10 years earlier. For those hoping for a tech recovery, that’s sobering news, to say the least.

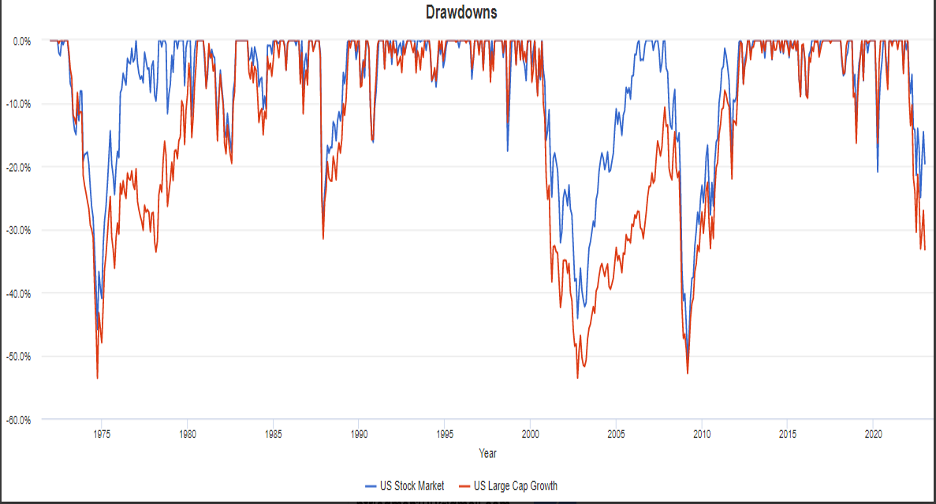

And to drive the point home, this has been going on for a very long time: growth stocks have taken longer to recover than the broad market for the last 50 years!

(Source: NYSE)

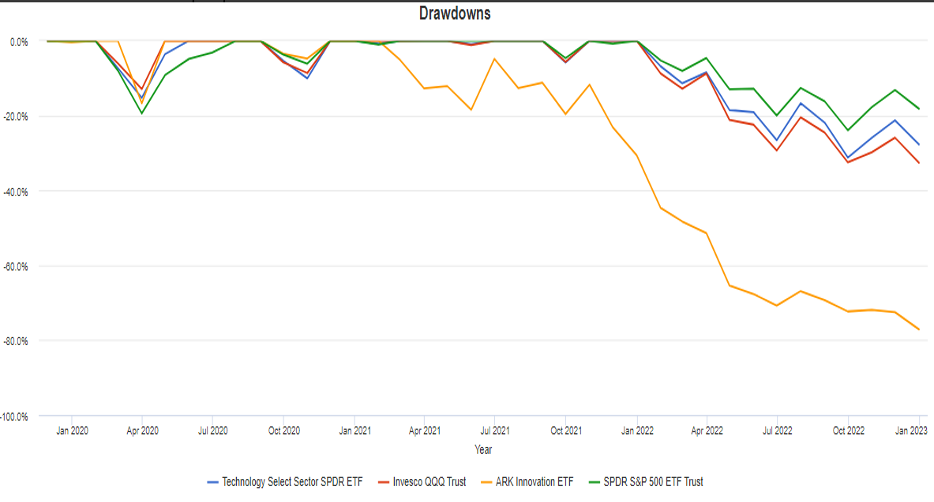

And where does all this leave ARKK? In addition to the fact that history suggests a very long recovery in growth stocks, its drawdown performance is even worse than its growth stock competitors, such as XLK and QQQ. If you’re thinking of holding on, bring food and a good book because it’s going to be a very long wait!

(Source: NYSE)

I mention ARK again because its history demonstrates an important lesson that’s worth repeating if you’re going to be a successful, long-term trader, namely, the importance of being flexible. Nothing lasts forever. As Rich Gluck put it, “Waiting for recovery in the same asset class/sector/industry/stocks that you were invested in when the market broke down can be a fool’s errand.”

Surprise! Crypto Might Be Back!

As usual, the end of the year brought a lot of articles reviewing what happened in 2022 and what may occur in 2023. For most of them, what was usually dictates what will be. That’s ok: current events and market forces don’t recognize December 31 as anything special; life goes on, much as it did before.

Surprises and events out of left field cause the most worry for risk managers. Last year, it was the war in Ukraine and the consequent energy crisis in Europe; in 2020, it was the pandemic. These were outliers and beyond most risk managers’ expectations, true Black Swans (an overused term — to qualify as one, the event must be extremely improbable and have great impact).

Note that the Crypto Crash ’22 does not qualify as such. Many market pundits, including myself, were calling for a major shakeout well before the FTX meltdown last November. In addition, its impact was confined to crypto and never managed to infect other asset classes.

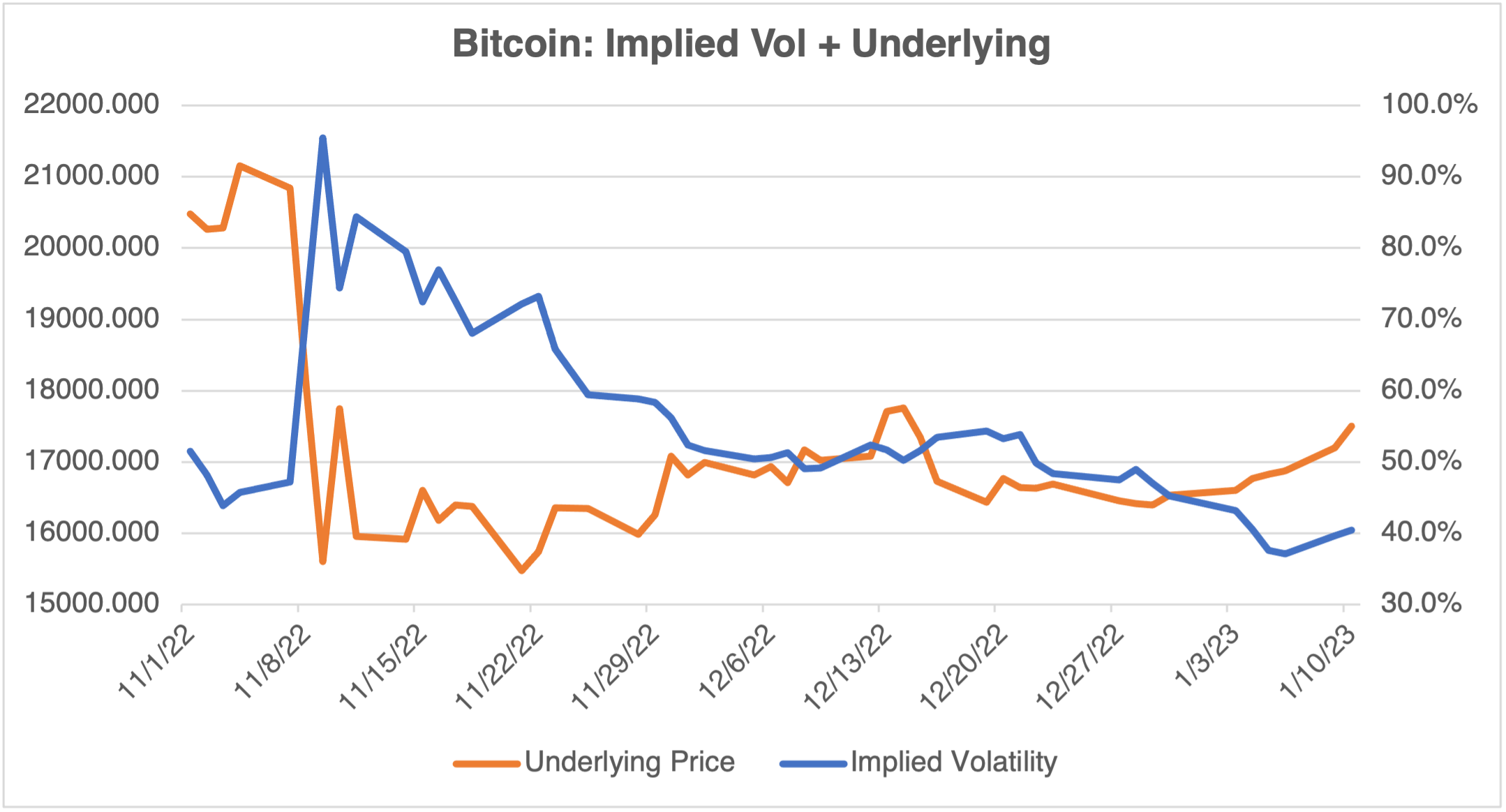

Whether it was a Black Swan or not (a distinction usually confined to risk manager nerd circles), crypto might be showing some signs of life. Without much fanfare, it’s rallied 11.6% from its low of last November 21. At the same time, its implied volatility has remained relatively low at a little over 40%, 30 vol points lower than its long-term average of 70.4% with a standard deviation of 17.7. I’m scared to write it, but bitcoin options look cheap!

(Source: OptionMetrics)

See real trades as they happen with our unusual options activity tool. Our options flow contains complex orders that you won’t find anywhere else. Combine it with our options profit calculator for the ultimate options research platform.