OptionStrat Features

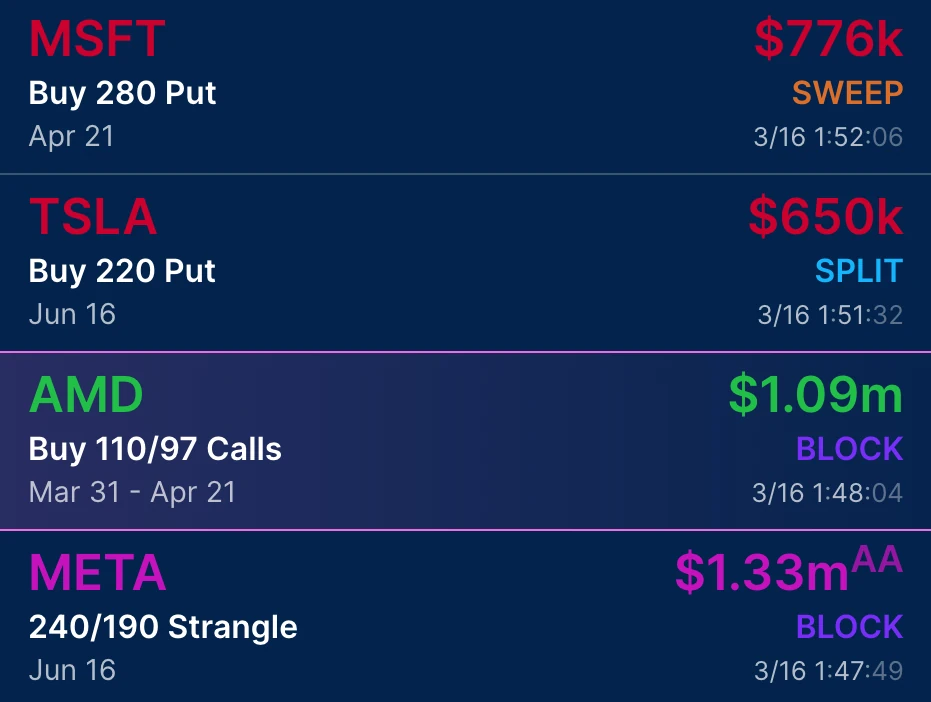

Track unusual options flow like never before:

Enhanced Options Flow

OptionStrat Flow scans the market to uncover large and unusual trades as they happen, giving you insight into trades by institutions and other smart money.

Not only do we show large call or put purchases, but we detect if the transaction showed urgency or aggression from the buyer or seller to show you both sides of the market.

OptionStrat Flow detects spreads, condors, and other advanced strategies and categorizes them as bearish, bullish, neutral, or directional.

Advanced Details & Tracking

Click on any flow to get more details such as the volume, open interest, spot price, and more.

Trades can also be opened in the options builder, allowing you to dive deeper into the trade.

We chart and track the performance of each alert, giving you an up-to-date view of the current profit or loss, and the maximum profit or maximum loss seen so far.

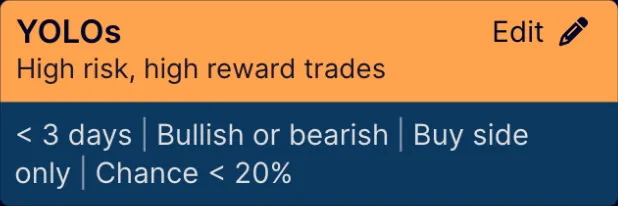

Custom Filters & Alerts

Easily filter the flow by specific criteria to narrow down your search. Filter configurations can be saved for later use, or to enable highlighting of matching rows.

Enable alerts for a filter to get web or mobile notifications when any matching trades are made.

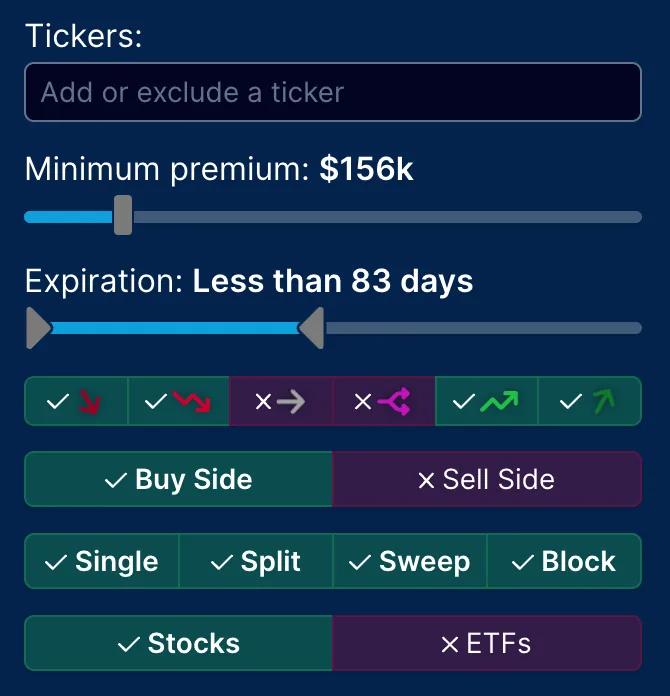

Visualize option strategies:

Options Profit Calculator

Build option strategies in real-time with our strategy builder. No more scrolling through lengthy option chains, just select a stock, expiration date, and strike(s) to see stats about your trade including:

- The cost of the trade (or the credit received)

- Maximum potential profit and loss

- Breakeven prices

- Estimated profit/loss in table or graph view

Everything in OptionStrat updates immediately, simply drag the strikes to reposition your trade, or adjust the IV to see how it affects the trade. You'll gain deeper insight into how options work as you adjust the trade and see how the risk and reward changes.

Members also get the following:

- Real-time, auto-updating data

- Chance of profit

- Combined (net) greeks

- Future greeks in the table & chart

- Commission calculations

- Historical IV charts

Market Events

OptionStrat keeps you informed by showing market events that might affect your trade.

Any stock with a significant price change will show the breaking news causing the price movement. The profit & loss table will also show upcoming events including:

- Earning dates and times

- Ex-dividend dates

Volume Overlay

See the most active strikes for calls and puts so that you can find the options with highest liquidity.

Share and Track Saved Trades

Click the share button to save your trade (and generate a unique link that you can share).

Saved trades are automatically tracked, giving you easy access to important stats:

- The total return

- Today's return

You can even close out saved trades, allowing you to practice paper trading options by entering and existing trades. We track both your realized and unrealized gain or loss throughout the lifetime of the trade.

With a premium membership, you can also track:

- The highest return and largest lost reached so far

- A historical chart showing the strategy's performance

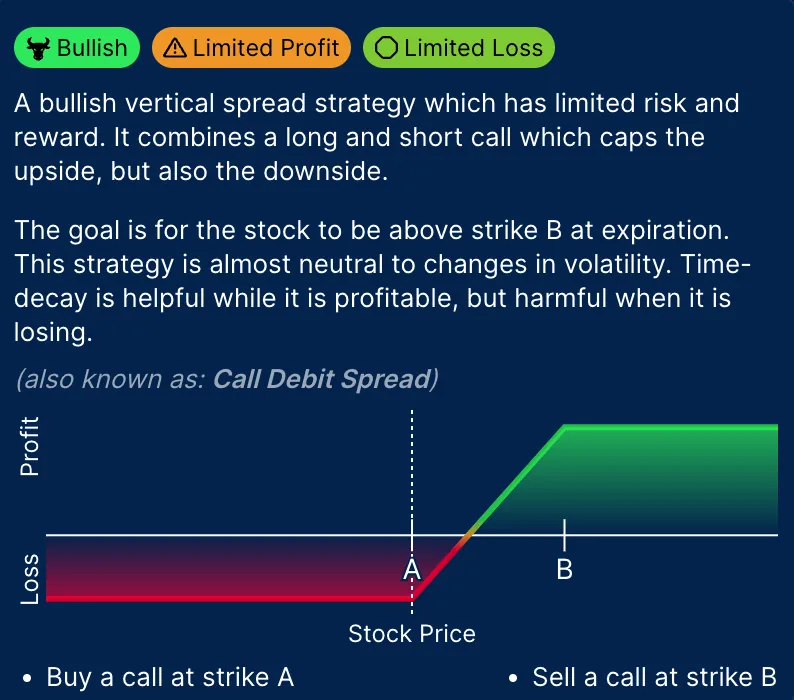

Pre-Made and Custom Strategies

Nearly any strategy can be created, including strategies with underlying stocks like covered calls, or multiple expirations such as double diagonals.

Over 50 strategy templates are available to choose from, each with a handy setup chart and description.

Use the menu at the top of this page to view all of our pre-made strategies.

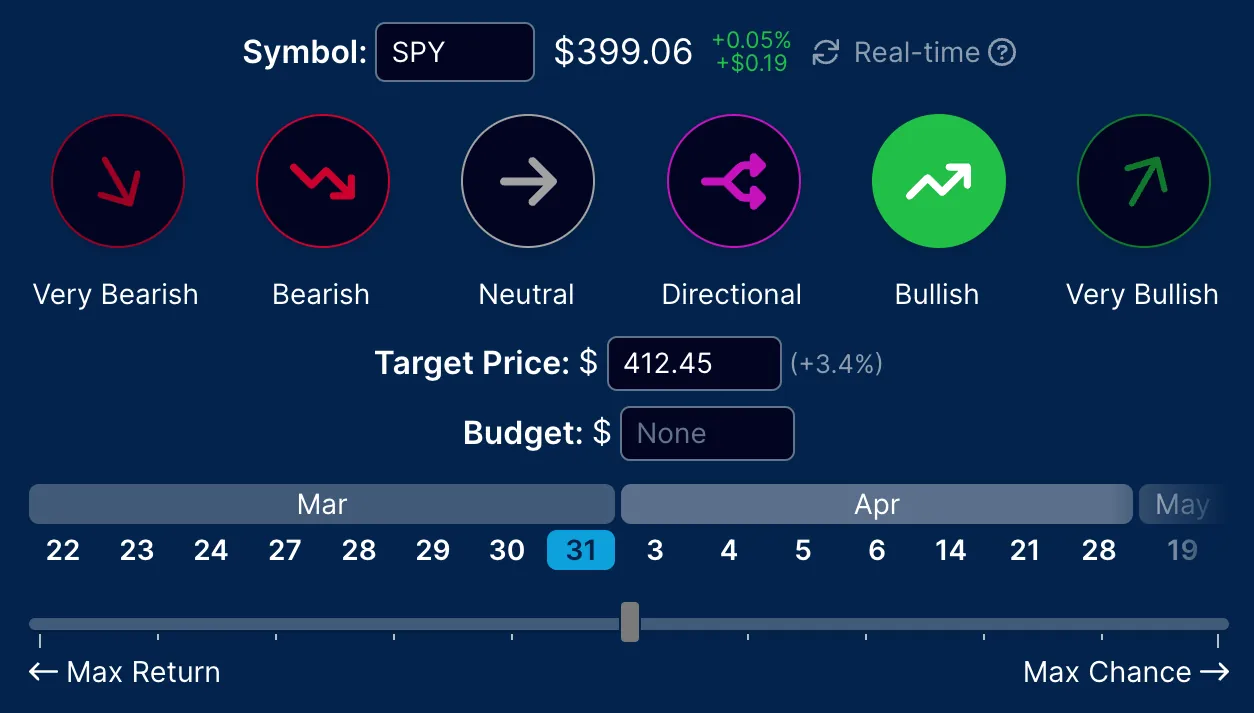

Instantly optimize a trade:

Find trades automatically by choosing:

- A sentiment (bearish, bullish, etc), or a target price

- A target expiration date

- Your risk tolerance (in the form of optimizing for max return or max chance)

The options optimizer then searches through thousands of potential trades to find which strategies maximize returns or chance of profit (or somewhere in between).