Tesla’s Robo Bet

Robotaxis and self-driving cars are new technologies that always seem to be five years away. A few years back, with the introduction of Tesla’s self-driving mode, it seemed like they were finally here and that driving would be safer, faster, and wouldn’t require any real participation. Imagine just telling your vehicle where you want to go and then just sitting there, doing whatever you want, while your car drives there. Pretty cool.

But then, news and videos of some spectacular auto-driving crashes led regulators and consumers to rethink whether the technology was really ready for primetime. Regardless, the technology and benefits are too compelling, and the potential profits too large, for those involved to just give up. Waymo (a sub of Alphabet), Tesla, Zoox (a sub of Amazon), and Pony AI, amongst others, have started rolling out autonomous vehicles in test ride-share markets in San Francisco, Phoenix, LA, and Austin. This serves two purposes. First, it allows them to refine their technology, and second, it gets people comfortable with the reality of being in a moving vehicle without a driver (or, in the case of Zoox, more of a pod than a car).

Given the improving technology and growing acceptance, the market is expected to grow to almost $50 billion by 2035. Skeptics point out that adoption may be primarily in ridesharing, and that consumers will be hesitant to adopt the technology in their personal vehicles. Although that might be true, it’s clear that the combination of AI with autonomous vehicles can still lead to massive changes in personal mobility — and investment opportunities.

Waymo and Tesla (TSLA) are well known in the AV space, but there is also Pony.ai (PONY), a Chinese and US based company that produces AI-assisted driving systems applicable to multiple vehicles. Waymo has gotten a head start in rideshare, with its CEO claiming 10 million trips so far, doubling in the last 5 months, and more than 250,000 per week. Having started in 2020, they have had over 5 years to methodically refine their AV system and operations.

Tesla has reported that it will be starting a pilot of its rideshare service in Austin next month..Much anticipated, the stakes are high given the company’s flat to declining revenue and Elon Musk’s damaged reputation. Tesla’s obvious advantage is that it already has mass production capabilities and reportedly has much lower AV system costs than Waymo.

Tesla better get it right — it’s up almost 60% since its lows of mid-April, and a good part of its current valuation (apart from SpaceX and the rumored basic model), may be based on the potential of its robotaxi initiative and the success of the pilot program. Reportedly, Elon Musk is now devoting his full efforts back to Tesla. Failure, such as AV accidents or operational difficulties, could lead to significant troubles for TSLA.

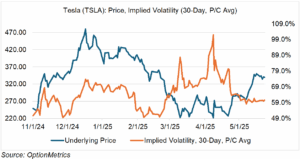

As you can see in the chart below, Tesla has been on a wild ride since the election in terms of both price and implied volatility. Since July, 2010, it’s implied volatility has averaged 54.7%; currently, it’s trading in the low- to mid-60s. I suspect if there is no new news over the next several weeks, TSLA implied volatility will drift lower. However, a shock, e.g. problems with the robotaxi rollout or some other unexpected setback to the business in general, may cause volatility to shoot back up.

The New Acronym

From the WSJ comes the latest acronym:

“TACO—for Trump Always Chickens Out and comes after Trump backed away from Friday’s threat to ramp up tariffs on imports from the European Union over the long Memorial Day weekend.”

But I Didn’t Understand!

Every financial panic has a lot of losers and very few winners, but sometimes the losers try to turn into winners. How do they do that? Simple — they go to court, or at least threaten to go to court! And what do they claim? Usually, it’s some variant of “I was tricked,” or “I didn’t understand the complex product you sold me.” In Wall Street parlance, they are alleging that the product wasn’t “suitable,” i.e., it wasn’t appropriate for the investors risk tolerance, experience, goals, or financial situation. It’s a pretty broad term, and the stuff that expensive lawsuits are made of (and I hasten to add, that is not legal advice).

Although this seems like a defense only for widows, orphans, newbies, or the naive, it’s not. High net worth individuals and corporate clients also use it, and do. But it’s kind of a poison pill: admitting that you were tricked or didn’t understand the product can be an embarrassing defense, especially for so-called “sophisticated” investors. But with enough money on the line, most will swallow their pride.

Last week, UBS revealed that it is in talks with clients over FX derivative losses stemming from the tariff panic last April. Since the customers were reportedly super high net worth individuals with enough money and lawyers to threaten credibly, UBS is trying to make them happy.

According to reports, the clients bought “conditional target redemption forwards” that went very bad after the President imposed the first round of tariffs. Now, if you don’t know what those are, join the club. Most simply, they are directional currency bets in which you buy currency or dollars at a discounted rate at the beginning of the trade. For example, say you want to buy dollars against another currency. If the dollar goes up, you got a great deal due to the discount. But, here’s the catch: if the dollar goes down, then you will be forced to buy additional dollars at certain lower thresholds. You would then be adding to an already losing position as the market declines, intensifying your losses.

As the dollar plunged after the first round of tariffs was announced, apparently the downside scenario became reality for some of UBS’ clients. 50% losses have been reported. Some clients are understandably upset.

The moral of the story: when you’re dealing with non-standard trades, read the fine print carefully and understand the payout profiles. If you get a discount, question why. I know that sounds very obvious, and I know the presentations can be as exciting as reading the Apple Service Agreement, but understanding them can save you endless time and trouble.