Something Real to Worry About, No Kidding!

Last February, I wrote about the debt ceiling in Something to Worry About. In it, I noted that “…as we get closer to June or financial insolvency, the greater the effect will be. A high impact/low probability event…” At the time, Janet Yellin was forecasting that the US wouldn’t be able to pay its bills by very early June. Well, here we are 3 1/2 months later, and with just a few weeks to go, and not much has changed. I suspect that the regional banking crisis has kept it from being at the top of everyone’s worry wheel.

Yesterday’s meeting between President Biden and lawmakers brought the debt ceiling back into the news. As expected, not much happened, and both sides more or less just reiterated their positions. Obviously, and just like in the movies in which the hero is trying to defuse a bomb, a solution will be found with just two seconds to go. After all, we’ve been down this road before, most seriously in 2011, but a compromise or extension has always been reached. Shockingly, the debt ceiling has been modified 102 times since WW2. And after much posturing, partisan division, and brinksmanship, that will probably happen again this time — the key word being probably. But what happens if they don’t reach an agreement, or if it gets too close to the wire?

Default is one of those events that institutional risk managers classify as low probability/high impact, something to keep in mind, review every now and then, but not necessarily do anything about. Hedging against these type of events is usually very expensive and not worth it given the probabilities involved — it’s like insuring your house against getting hit by a meteorite. In this case, however, that might not be the case, and the market may be underestimating the probability of this turning into a full-blown, Defcon 1 crisis. Granted, we are drifting into the next presidential election cycle and it’s in neither side’s interest to precipitate default. However, today’s political divisions are so deep, and both sides so entrenched, that it’s hard to predict with any degree of certainty that they will behave like adults.

This being primarily a political affair, a very short term solution might be found, such as clawing back unspent funds, temporarily suspending the limit, or litigation. As the probability of a solution changes, I believe the market will react asymmetrically, i.e., more to the downside due to disappointment and fear than to the upside due to relief. That’s due to the possibly cataclysmic nature of default. The US has never defaulted on its debt and to do so, especially after a long period of failed negotiations, would be financially and politically cataclysmic, possibly on a world-wide basis. US Treasuries as the benchmark for the world financial system will be called into question and the concept of US full faith and credit will be mortally wounded, perhaps for good. Interest rates will spike, equity and commodity markets will crash, and the dollar will…well, you get the idea. Economic damage will be widespread, and unemployment will spike. It will also provide proof that the US is no longer capable of effectively managing its political and economic affairs, further calling into question the status of the US dollar as the world’s reserve currency.

Some dispute that default will be as bad as forecast and that after the initial shock, things will return to normal. Personally, I’m not willing to test that theory and it’s not surprising that some on the fringes believe it. What is surprising is the market’s seeming complacency that a solution will somehow be found and the apocalypse averted, just like it always has. Although we are just a few weeks away from zero hour, inflation, recession, rate hikes, and the regional banking crisis are still taking center stage; the debt crisis, not so much. Nothing to see here, move on!

As you know from reading my blogs, I’m not a financial hysteric and am very hesitant to get swept up in every incident that sends the market into a tizzy. Risks that are known and that traders have lots of time to adapt to just don’t carry the punch of the truly unknown or unexpected. On the other hand, crises that the market discounts or is in denial about produce the biggest bang, and this might just be one of them. Along with this may come investment opportunities that could produce extreme, outsized profits, trades that could make your year in a very short period. But don’t go Ferrari shopping just yet. Real Black Swans, or even Gray Swans, are very rare, and betting on them usually fizzles. As I said, a solution to the debt ceiling to avoid default will probably be found, albeit after a bumpy ride.

But what if it’s not? Let’s review one way to trade this if you believe the debt ceiling issue could possibly metastasize into something very scary. Next week, I will review others. Keep in mind that we will be playing the potential of default as well as actual default. In other words, the crisis need not actually happen in order to profit from these trades, just for the market to become convinced that it might happen.

If you come to believe that actual default will indeed occur, however long the odds, then there is no need to be subtle or clever in selecting your trade or strategy; a large and brutal move will result, probably accompanied by limited liquidity in all but the most common stocks and instruments. During crises, liquidity can become an issue, so it’s important to keep the number of legs in any trade or strategy to a minimum. A lot will be going on, some predictable and some not. So keep it simple.

First up, and the most obvious: buy the VIX. Currently, the VIX is happily trading below 20, seemingly oblivious to all that’s going on, or could go on. If the prospect of default becomes very real, it could shoot to stratospheric levels. It was reported during the regional bank crisis that VIX 60 calls were experiencing heavy volume. Even if the regional bank crisis turned into a full-blown rush for the exits, it would still be a parlor game compared to a US default. However, it does show how investors might act, crowding into out-of-the-money strikes in a frantic rush for safety.

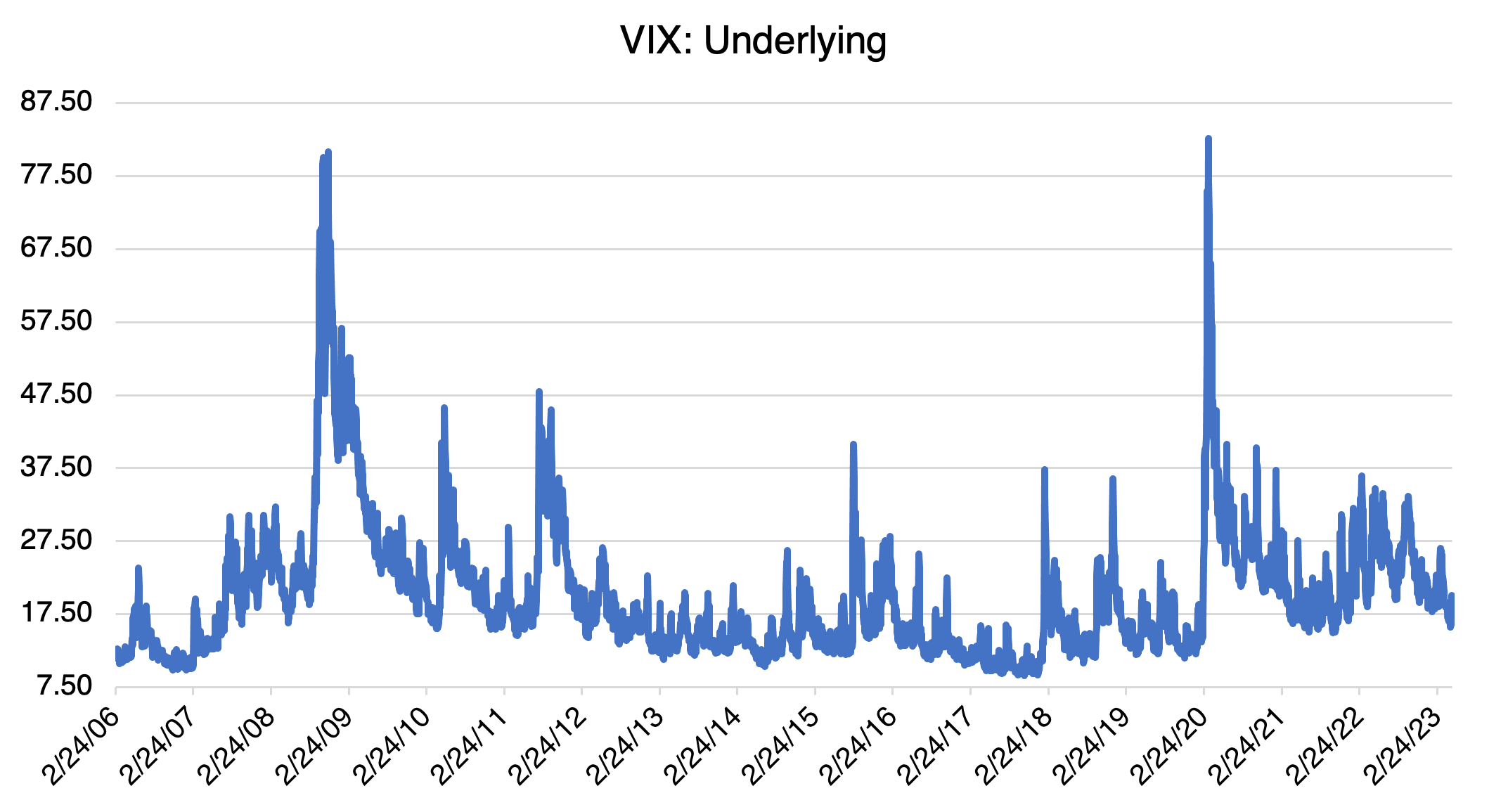

Consider the VIX’s historical price action:

(Source: OptionMetrics)

As you can see above, although the VIX certainly has a history of spiking, attempts at the highs made during the 2008 financial crisis or at the beginning of Covid will require a serious shock. Otherwise, VIX rallies tend to sputter when the index extends into about the 35 to 37.5 region. However, the chart also points out that if the VIX can somehow get above that, it’s probability to spike to new highs increases.

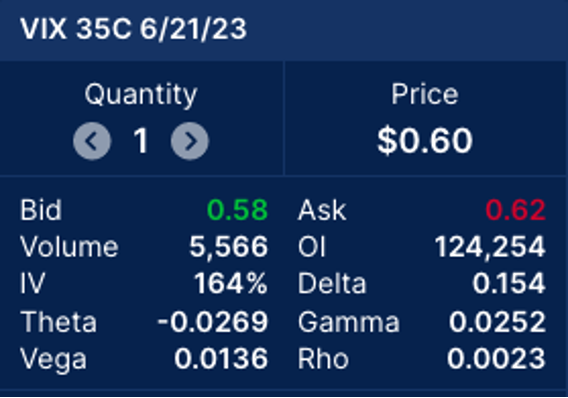

Let’s look at a simple long call position, nothing fancy, courtesy of OptionStrat’s options profit calculator:

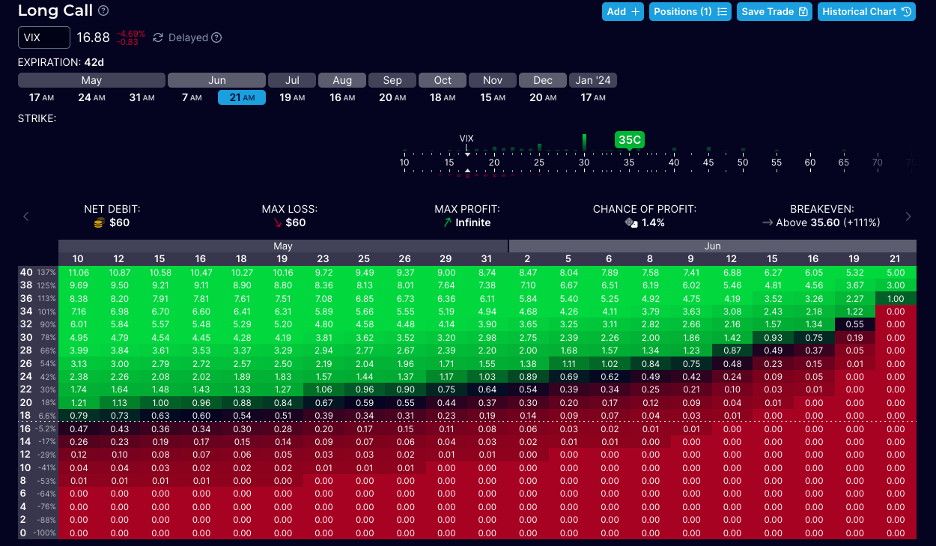

Like all out-of-the-money option positions, it will react best to sudden and extreme market shocks. The real prospect (not necessarily the reality) of default is one of them. The table below (also courtesy of OptionStrat) displaying contract values for the June 35 VIX call, displays its explosive upside potential:

Since June 1 is projected as the date when default becomes much more probable, concentrate on the simulations before then. Holding implied volatility constant, a VIX move up to 40 will result in mid to high teen multiple gains of the premium paid ($0.60).

Again, the strategy is simple and designed for extreme gains since it is meant for extreme circumstances. As I wrote, the odds of it working out are low. However, keep in mind that between now and June 1, you might have ample opportunities to get out at a profit or small loss as the crisis ebbs and flows. You may even get the chance, if the market rallies on bad news, to sell a higher strike call (i.e., > 35 strike) to produce a low cost bull call spread. In other words, the 35 call need not necessarily go in-the-money, or the debt crisis result in actual default, to make money.