Gold, Again

Most investors don’t know this: commodities have been in a slow speed bear market since last June. The Bloomberg Commodity Index (BCOM) fell under 100 on July 15th and has been headed down since. The Goldman Sachs Commodity Index (GSCI), the other popular index, has been displaying a similar pattern, down 8.5% since just July 3rd. Projections of slower economic growth in the US and China are mostly behind the broad based declines.

In that bearish commodity environment, gold stands apart. The shiny metal made new all-time highs on July 16th, even after BCOM fell below 100 the day before.

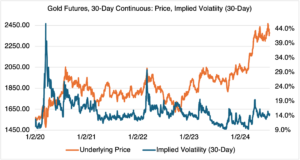

Source: OptionMetrics

Gold continues to receive a lot of attention from retail investors, preppers, gold salesmen, and more sober commodity industry types. Gold is in — they even sell it at Costco! (who reportedly can’t keep it in stock).

Why? It’s pretty simple. Investors have always viewed gold as a safe haven from geopolitical uncertainty, economic distress, and general anxiety about the future. One need only look at the political events in the US over the last month, as well as the long-term trends that seem to be reaching an inflection point, to understand why most people are uneasy.

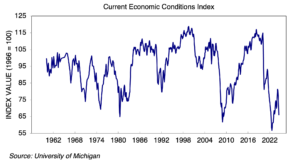

Consider the chart below from the University of Michigan, the Current Economic Conditions Index, which measures how US consumers assess current economic conditions:

As you can see, consumers’ views about the economy are almost as bearish as they were at the bottom of the Great Recession in early 2009! Add political and social anxiety, and a real feeling of unease results, justified or not. Of course, central bank purchases, inflation, and interest rates also factor into the price of gold, but they are currently taking a back seat. Simply, uneasy and anxious people buy gold. The runup to the presidential election in November will most likely only amplify their feelings.

How do you buy gold? Physical metal (i.e., gold bars) or gold futures are the most direct methods. The first involves storage and insurance…and gold is very heavy. The 400 troy ounce gold bar featured in most heist movies weighs 27.4 pounds. But don’t worry, you probably won’t have to pick it up; at current prices, each one is worth $981,600. Bars come in smaller 1000 oz and 100 oz sizes as well. And for those impulse shoppers at Costco, there’s also their 1 oz. version. Keep in mind that you will pay a premium over spot gold to buy them and a serious discount when and if you sell them (if you can find a buyer). If you’re thinking about using them as currency or barter during some sort of economic Armageddon, keep in mind that that you will have to lug them around with you and will have to divide them up every time you use them (cut off a chunk and then weigh it to determine its value?). There’s a reason paper money exists!

If you aren’t worried about dire scenarios in which you can’t use paper dollars, investing in gold mining stocks or ETFs is another.

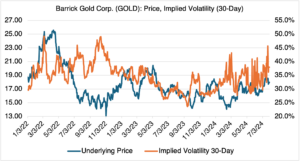

Source: OptionMetrics

For more broad-based exposure, a gold mining ETF is also an option:

Source: OptionMetrics

Source: OptionMetrics

Notice that the implied volatility of GDX has not increased with the underlying. That’s also true of gold futures. Both volatilities seem to be indicating that the market is comfortable with increasing prices.